Who manages Medicare trust funds?

These funds can only be used for Medicare. Hospital Insurance (HI) Trust Fund How is it funded? Payroll taxes paid by most employees, employers, and people who are self-employed; Other sources, like these: Income taxes paid on Social Security benefits; Interest earned on the trust fund investments; Medicare Part A premiums from people who aren't eligible for premium …

What are the disadvantages of a Medicaid Trust?

Mar 07, 2022 · How is Medicare funded is a funny question because there are so many answers depending on who answers your question. Some will say it’s primarily funded through general revenue, payroll taxes, and beneficiary premiums. The Center for Medicare and Medicaid Services (CMS) says Medicare gets its funding from the Medicare Trust Fund.

Is Medicare funded by taxes?

Mar 02, 2021 · The Medicare Trust Funds. The way Medicare is funded is, in a large part, through taxes. Most of us know that much, but different taxes help pay for different parts of Medicare via trust funds. The United States Treasury holds two trust funds that directly fund the parts of Medicare. The taxes that have been placed in the trust funds can only be used to run and …

When was the Medicare trust fund established?

The Medicare Trust Fund is created by the government to help cover the cost of Medicare. The funding comes from premiums paid by people with Medicare and taxes on Social Security benefits. The information here explains what the Trust Fund is, how it’s funded, and what happens when it runs out of money.

Where does Medicare funding come from?

How is Medicare funded and administered?

Is Medicare federally funded or state funded?

Who administers funds for Medicare?

What are the two Medicare trust funds?

How Long Will Medicare be funded?

How is Medicare funded in Australia?

What is the current state of the Medicare trust fund?

Is Medicare paid out of Social Security?

What tax funds the Social Security and Medicare programs?

How is Medicare funded by paid taxes quizlet?

What services are paid by Medicare Part A?

- Inpatient care in a hospital.

- Skilled nursing facility care.

- Nursing home care (inpatient care in a skilled nursing facility that's not custodial or long-term care)

- Hospice care.

- Home health care.

How is Medicare funded?

Medicare is financed by multiple tax-funded trust funds, trust fund interest, beneficiary premiums, and additional money approved by Congress. This article will explore the various ways each part of Medicare is funded and the costs associated with enrolling in a Medicare plan. Share on Pinterest.

What is SMI trust fund?

Supplementary Medical Insurance (SMI) trust fund. Before we dive into how each of these trust funds pays for Medicare, we should first understand how they’re financed. In 1935, the Federal Insurance Contributions Act (FICA) was enacted.

How many beneficiaries did Medicare cover in 2017?

In 2017, Medicare covered over 58 million beneficiaries, and total expenditures for coverage exceeded $705 billion. Medicare expenditures are paid for primarily by two trust funds: Before we dive into how each of these trust funds pays for Medicare, we should first understand how they’re financed.

What percentage of your wages are withheld for Medicare?

In addition, 1.45 percent of your gross wages are withheld for Medicare. If you are employed by a company, your employer matches the 6.2 percent for Social Security and the 1.45 percent for Medicare, for a total of 7.65 percent. If you are self-employed, you will pay the additional 7.65 percent in taxes.

How much tax is paid on Medicare?

The 2.9 percent tax provision for Medicare goes directly into the two trust funds that provide coverage for Medicare expenditures. All individuals currently working in the United States contribute FICA taxes to fund the current Medicare program. Additional sources of Medicare funding include:

Where does Medicare Part D get its money from?

Although Medicare Part D receives some funding from the SMI trust fund , a portion of the funding for both Medicare Part D and Medicare Advantage (Part C) comes from beneficiary premiums. For Medicare Advantage plans in particular, any costs not covered by Medicare funding must be paid for with other funds.

What is Medicare premium?

A premium is the amount you pay to stay enrolled in Medicare. Parts A and B, which make up original Medicare, both have monthly premiums. Some Medicare Part C (Advantage) plans have a separate premium, in addition to the original Medicare costs. Part D plans and Medigap plans also charge a monthly premium. Deductibles.

What is a trust fund for hospital insurance?

Hospital insurance trust fund. Taxes paid by employers, employees, and self-employed people provide money for the HI trust fund, which was founded in 1965. The trust fund also garners the interest earned on its investments, income taxes from some Social Security benefits, and income from Medicare Part A premiums.

How does Medicare get money?

Medicare gets money from two trust funds : the hospital insurance (HI) trust fund and the supplementary medical insurance (SMI) trust fund. The trust funds get money from payroll taxes, as allowed by the Federal Insurance Contributions Act (FICA) enacted in 1935.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How much is Medicare spending in 2019?

According to the Centers for Medicare and Medicaid Services, Medicare expenditures in 2019 totaled $796.2 billion. This article looks at the ways in which Medicare is funded. It also discusses changes in Medicare costs.

What is a coinsurance for Medicare?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is Medicare for adults?

Medicare is the federal healthcare program for adults aged over 65, adults with disabilities, and people with end stage renal disease. The program provides coverage for inpatient and outpatient services, and prescription drugs. Medicare gets money from two trust funds: the hospital insurance (HI) trust fund and the supplementary medical insurance ...

Will Medicare increase in 2021?

Increases in 2021 involve Part A deductibles, and coinsurance, along with Part B premiums and the deductible. According to the 2020 Medicare Trustees Report, it is difficult to predict future Medicare costs because of the uncertainty of changes and advances in technology and medicine. Each Medicare part has different costs, ...

How is Medicare funded?

The way Medicare is funded is, in a large part, through taxes. Most of us know that much, but different taxes help pay for different parts of Medicare via trust funds. The United States Treasury holds two trust funds that directly fund the parts of Medicare. The taxes that have been placed in the trust funds can only be used to run ...

Does the HI trust fund get a boost from Medicare?

Finally, the HI trust fund receives a small boost from Medicare Part A premiums. This is a very small proportion since, as noted earlier, almost all Medicare Part A beneficiaries qualify to receive the coverage premium-free.

How many Medicare beneficiaries will receive premium free in 2020?

In fact, in 2020, 99 percent of Medicare Part A beneficiaries received their coverage premium-free. With the substantial amount that Medicare covers, how does the program stay solvent? While it’s easy to say “taxes” and move on, that doesn’t tell the whole story.

What can trust funds be used for?

The taxes that have been placed in the trust funds can only be used to run and support Medicare. Not only do they allow Medicare to run, the trust funds are authorized to help cover administrative costs like collecting Medicare taxes and combatting Medicare abuse and fraud.

What is covered by Part A?

In some circumstances, Part A will also cover things like home health care and hospice care, and many of the tangential parts that go along with inpatient care. This could include a semi-private room, prescription drugs taken as part of inpatient treatment, and meals.

What is Medicare in Simple Terms?

Medicare is the federal health insurance program for people turning 65 or older and certain younger people with disabilities. Also for people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called (ESRD). The president who started Medicare; we all know this is Lyndon B.

What are the 2 Medicare Trust Funds?

The Medicare trust fund is a two-tiered system, with funds drawn from the supplementary medical insurance trust and hospital insurance. Hospital Insurance Trusts Funds are responsible for Medicare Part A coverage. Here is a brief definition of the Hospital Insurance trust.

What is the Hospital Trust Fund?

It states, “HI (which stands for Hospital Insurance Trust Fund ), otherwise known as Medicare Part A, helps pay for inpatient hospital services, hospice care, and skilled nursing facility and home health services following hospital stays.

What is the Supplementary Medical Insurance Trust Fund?

SMI ( The Supplementary Medical Insurance Trust Fund) is for Medicare Part B needs. SMI consists of Medicare Part B and Medicare Part D. Medicare Part B helps pay for physicians, outpatient hospitals, and other services for individuals who have voluntarily enrolled.

How are PACE Programs Funded?

Medicare Advantage and Program of All-Inclusive Care for the Elderly (PACE) plans receive prospective, capitated payments for such beneficiaries from the HI and SMI Medicare trust fund accounts; the other plans are paid from the accounts based on their costs.

How Is Medicare Part A Paid For?

The Medicare revenue is distributed to the hospital insurance trust fund. The payment mainly consists of payroll taxes, which you can see in this chart from the report. Payroll taxes accounted for 285.1 billion dollars. I found this chart pretty interesting, detailing the income and expenditures.

How is the Medicare Part B Program Paid?

Medicare Part B is supplementary insurance that provides coverage for expenses not covered by Medicare Part A. It’s paid through the Supplementary Medical Insurance Trust Fund.

How is Medicare funded?

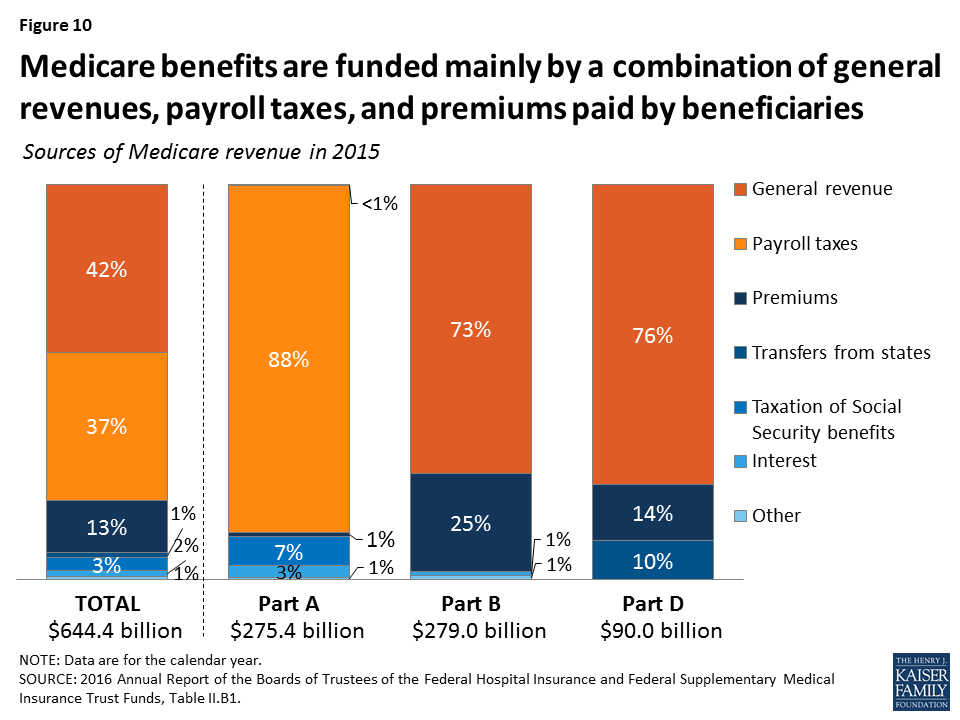

How is Medicare financed? Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1) . Other sources include taxes on Social Security benefits, payments from states, and interest.

Where does Medicare get its money from?

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest. The different parts of Medicare are funded in varying ways.

How many people are covered by Medicare?

Medicare, the federal health insurance program for more than 60 million people ages 65 and over and younger people with long-term disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. Medicare spending often plays a major role in federal health policy and budget discussions, ...

How much of the federal budget is Medicare?

Medicare spending often plays a major role in federal health policy and budget discussions, since it accounts for 21% of national health care spending and 12% of the federal budget. Recent attention has focused on one specific measure of Medicare’s financial condition – the solvency of the Medicare Hospital Insurance (HI) trust fund, ...

How much of Medicare will be covered in 2026?

Based on data from Medicare’s actuaries, in 2026, Medicare will be able to cover 94% of Part A benefits spending with revenues plus the small amount of assets remaining at the beginning of the year, and just under 90% with revenues alone in 2027 through 2029.

How much would Medicare increase over 75 years?

Over a longer 75-year timeframe, the Medicare Trustees estimated that it would take an increase of 0.76% of taxable payroll over the 75-year period, or a 16% reduction in benefits each year over the next 75 years, to bring the HI trust fund into balance.

How much will the HI trust fund be in 2025?

By 2025, assets in the trust fund at the beginning of the year will have decreased to $73 billion, and with $50 billion more in spending than in revenues that year, assets will drop to $23 billion by the end of 2025. And by 2026, the $23 billion in assets in the HI trust fund at the start of the year is projected to be insufficient to cover ...

What is the hospital insurance trust fund?

As we discussed, The Hospital Insurance Trust Fund funds Medicare Part A. The Hospital Insurance Trust Fund is the particular fund that is expected to lose its money by the year 2026.

How is Medicare Part D funded?

Like Medicare Part B, Medicare Part D is funded by monthly premiums and government expenditures. As with Medicare Part B, there will be increases in medical expenses over time. This increase in expenses will lead to the need for an increase in spending by Medicare trust funds. The financial issues will lead to an increase in ...

How many people are covered by Medicare?

However, some young people with certain disabilities can also apply for the benefits. Medicare has covered over 58 million people at $705.9 billion. There are three parts to Medicare: A, B, and D.

What are the parts of Medicare?

Medicare Part A covers hospital expenses, like inpatient stays and hospice care. Medicare Part B covers medical expenses, like doctors’ visits and medical supplies. Medicare Part D covers prescription drugs which include any medications you may pick up at your pharmacy.

What does Medicare Part A cover?

Medicare Part A covers hospital expenses, like inpatient stays and hospice care. Medicare Part B covers medical expenses, like doctors’ visits and medical supplies. Medicare Part D covers prescription drugs which include any medications you may pick up at your pharmacy.

Does Medicare cover resurge?

Supplements such as resurge are not covered under the plan. While Medicare covers many different kinds of health-care expenses, it doesn’t cover everything.

Is Medicare taking in enough money?

Because of all of the income streams that we covered before, Medicare is still bringing in enough money to cover its overall costs. Although Medicare did spend billions of dollars caring for millions of people, it’s revenue still remained more than its loss.