Disabled people who are approved for Social Security disability insurance (SSDI) benefits will receive Medicare, and those who are approved for Supplemental Security Income (SSI) will receive Medicaid. However, SSDI recipients aren't eligible to receive Medicare benefits until two years after their date of entitlement.

Full Answer

Does Social Security disability affect Medicare or Medicaid?

Generally, if you are approved for Social Security disability insurance (SSDI) benefits, you will receive Medicare, and if you are approved for Supplemental Security Income (SSI), you will receive Medicaid. However, this isn't true in all states.

Which type of health coverage do I receive on Social Security disability?

Which type of health coverage you receive depends on the Social Security disability program: Social Security Disability Income (SSDI) or Supplemental Security Income (SSI). If you receive approval for SSDI, you will not receive Medicaid along with your disability benefits, but you will obtain Medicare after an applicable waiting period.

How do I get Medicare vs Medicaid coverage for disability?

Getting Medicare vs Medicaid coverage depends on which government assistance program provides your monthly disability checks. If you’re getting SSI benefits, you’re also automatically enrolled in the Medicaid program unless you live in:

How does Social Security disability pay for Medicare?

Money from that trust fund then pays all eligible bills incurred by people covered under the Medicare program. The program doesn’t have any income limits, but your monthly Medicare premiums are often automatically deducted from your SSDI checks.

What disabilities qualify for Medicaid in Georgia?

ABD MEDICAID IN GEORGIA: ABD Medicaid in Georgia serves persons who are 65 years of age or older, legally blind and/or totally disabled. There are 19 different coverage categories, known as classes of assistance (COA), for the ABD population (see below for the primary categories.)

What is the maximum income to qualify for Medicaid in GA?

Not be eligible for any other Medicaid program or managed care program. Meet family gross income requirements of no more than 211 percent of the federal poverty level (FPL)....Eligibility.Family SizeMaximum Monthly IncomeMaximum Yearly Income1$2,135$25,6162$2,895$34,7313$3,654$43,8464$4,114$51,961

What is the monthly amount for Social Security disability?

SSDI payments range on average between $800 and $1,800 per month. The maximum benefit you could receive in 2020 is $3,011 per month. The SSA has an online benefits calculator that you can use to obtain an estimate of your monthly benefits.

Can you get disability and Medicare at the same time?

Will a beneficiary get Medicare coverage? Everyone eligible for Social Security Disability Insurance (SSDI) benefits is also eligible for Medicare after a 24-month qualifying period. The first 24 months of disability benefit entitlement is the waiting period for Medicare coverage.

What's the income limit for food stamps in GA?

Who is eligible for Georgia Food Stamps?Household Size*Maximum Income Level (Per Year)1$17,6672$23,8033$29,9394$36,0754 more rows

How long does it take to get approved for Medicaid in GA?

How long does it take? You will find out whether or not you are eligible for Medicaid within 45-60 days after you apply. Any Special Circumstances? If you are pregnant and eligible, you can get a Medicaid certification form on the same day that you apply.

Does disability pay more than Social Security?

In general, SSDI pays more than SSI. Based on data from 2020: The average SSDI payment is $1,258 per month. The average SSI payment is $575 per month.

How can I get more money from Social Security disability?

You may get more if you live in a state that adds money to the federal SSI payment. You may get less if you have other income such as wages, pensions, or Social Security benefits. You may also get less if someone pays your household expenses or if you live with a spouse and he or she has income.

What is the highest paying state for disability?

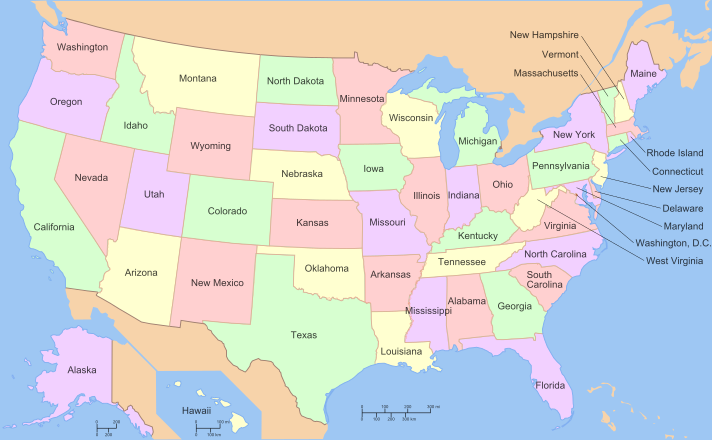

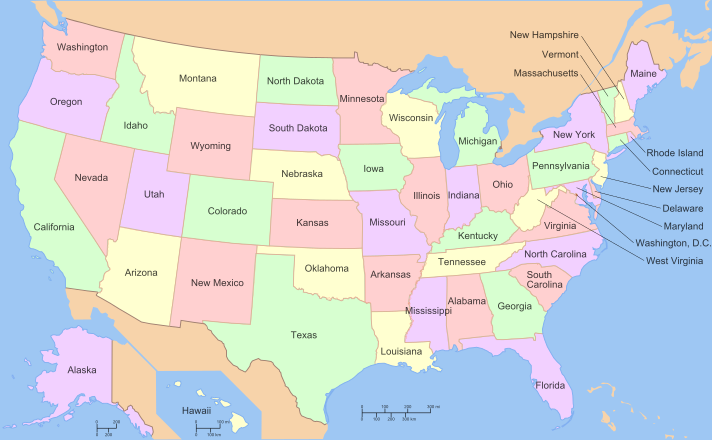

The highest paying states for SSI benefits as of 2022 are New Jersey, Connecticut, Delaware, New Hampshire and Maryland....The breakout for those states are as followed:New Jersey: $1,689 per month.Connecticut: $1,685 per month.Delaware: $1,659 per month.New Hampshire: $1,644 per month.Maryland: $1,624 per month.

What happens if I get approved for both SSI and SSDI?

Yes, you can receive Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) at the same time. Social Security uses the term “concurrent” when you qualify for both disability benefits it administers. However, drawing SSDI benefits can reduce your SSI payment, or make you ineligible for one.

How much money can I have in the bank on SSDI?

The SSDI program does not limit the amount of cash, assets, or resources an applicant owns. An SSDI applicant can own two houses, five cars, and have $1,000,000 in the bank. And the SSDI program doesn't have a limit to the amount of unearned income someone can bring in; for instance, dividends from investments.

Do Social Security disability benefits end at 65?

To put it in the simplest terms, Social Security Disability benefits can remain in effect for as long as you are disabled or until you reach the age of 65. Once you reach the age of 65, Social Security Disability benefits stop and retirement benefits kick in.

When Doesmedicare Or Medicaid Start?

SSDI recipients aren't eligible to receive Medicare benefitsuntil two years after their date of entitlement to SSDI (this is the date theirdisabili...

in Which Statesis Medicaid Enrollment Automatic?

The Social Security Administration handles Medicaid enrollmentfor the many states in which Medicaid eligibility is automatic for SSIrecipients. You...

Which Statesmake Medicaid Decisions Based on SSI Standards?

Some states use the same eligibility standards as the federalSSI program but insist on making their own Medicaid decisions. In these states,enrollm...

Which Statesuse Their Own Criteria For Granting Medicaid?

Theremaining states do not automatically grant Medicaid to persons withdisabilities who qualify for SSI because they use their own criteria fordete...

What If Iwas Approved For SSI but Denied Medicaid?

If you receive SSI but were denied Medicaid benefits in a 209(b)state – or any state for that matter, you should appeal the decision to yourstate’s...

How long do you have to be on Medicare to receive Social Security?

You’ll be eligible and automatically enrolled in Medicare Part A and Medicare Part B once you’ve been receiving Social Security Disability benefits, or disability benefits from the Railroad Retirement Board, for 24 months .

How old do you have to be to qualify for Medicare and Social Security?

You may qualify for Social Security Disability Insurance if you’re at least 18 years old, and can’t work for 12 months or longer.

How long do you have to wait to get Medicare if you have ALS?

If you have Lou Gehrig’s disease (ALS) or ESRD, you don’t have to wait through the 24-month period before you’re eligible for Medicare. If you have ALS, your Medicare coverage starts when you begin collecting disability benefits.

What is Medicare Advantage?

Medicare Advantage plans are a form of private insurance, and are primary instead of Original Medicare. While the claims-paying process and doctor networks may be different, they’re required to offer benefits that are considered at least equal to Medicare. Some Advantage plans include prescription drug coverage.

Is Medicare free for Social Security?

Medicare isn’t free for most people on Social Security Disability Insurance. Unless you qualify for another form of income-based help, you’ll most likely need to pay the Medicare Part B premium, which for most people in 2021 is $148.50. It’s unlikely that you’ll have to pay for Part A.

Does Medicare pay for DME?

Clinical research. DME (durable medical equipment) It’s important to note that in most cases, Original Medicare only pays up to 80% of these costs, after deductibles and copays. These out-of-pocket costs can be difficult to manage, and don’t include prescription medications.

Does Medicare Supplement cover prescriptions?

Unfortunately, the premiums for Medicare Supplement plans for people under 65 on disability can be expensive, and they don’t cover prescription medications .

When did Medicare expand to cover disabled people?

When Congress expanded Medicare to cover seriously disabled Americans in 1972, the law also mandated that SSDI two-year waiting period. For this reason, the Social Security Administration (SSA) isn’t likely to change that requirement anytime soon.

How does Medicare work?

Medicare provides coverage for Americans who: Here’s how Medicare payments work: Essentially, your Social Security taxes go into a trust fund that grows throughout your working years. Money from that trust fund then pays all eligible bills incurred by people covered under the Medicare program.

How long does it take to get a disability after you have Lou Gehrig's disease?

While that two-year waiting period sounds like a long time, it’s calculated using your original SSDI entitlement date. For most people, that means five months after the date when your disability began.

What is Medicaid insurance?

Medicaid is a need-based joint federal and state insurance program that covers low-income individuals and families. That said, Medicaid coverage can vary significantly from state to state. That’s because the federal government covers up to 50% of each state’s Medicaid program costs.

How long do you have to wait to apply for SSDI?

(Those five months cover the waiting period before you became eligible to apply for SSDI benefits.) But if your disability started long before you applied for SSDI, that time counts toward your mandatory two-year waiting period.

What is Medicare Part B?

Medical: Medicare Part B works like most private insurance policies and covers doctor’s visits, lab work, and visits to the emergency room. Prescription Drugs: Medicare Part D helps cover prescribed medication costs. Medicare Part A and B participants are eligible for Part D (or you can purchase it as a standalone plan).

Is there a waiting period for Medicare vs Medicaid?

If you’re getting SSI benefits, you’re also automatically enrolled in the Medicaid program unless you live in: If you reside in an automatic-enrollment state, there’s no waiting period for Medicaid coverage.

How long does it take to get Medicare after SSDI?

SSDI recipients aren't eligible to receive Medicare benefits until two years after their date of entitlement to SSDI (this is the date their disability began, up to a year before their application date). Because it often takes a year or two to be approved for disability benefits, however, SSDI recipients often become eligible for Medicare soon ...

How long does it take for SSI to get medicaid?

Because it often takes a year or two to be approved for disability benefits, however, SSDI recipients often become eligible for Medicare soon after they get their award letter from Social Security. In the states where Medicaid eligibility is automatic for SSI recipients, there is no waiting period for SSI recipients to receive Medicaid.

What to do if denied SSI?

If you receive SSI but were denied Medicaid benefits in a 209 (b) state – or any state for that matter, you should appeal the decision to your state's Medicaid agency. Your state has to follow certain federal Medicaid rules in notifying you of the denial and holding a hearing.

Is there a higher asset limit for Medicaid than for SSI?

And many of them use the same resource (asset) limit as SSI program, although several have a lower asset limit than SSI (preventing some people who qualify for SSI from qualifying for Medicaid), and a couple states have a higher asset limit (allowing more people to qualify for Medicaid than for SSI).

Does Medicaid work in all states?

However, this isn't true in all states. Medicaid is operated by the states, and the states are allowed to set eligibility criteria that are different than SSI's criteria. As a result, whether getting approved for SSI gets you Medicaid depends on your state, as we'll discuss below.

Is Indiana a 209b state?

Note that Indiana ceased being a 209 (b) state in 2014. Even though some 209 (b) states have lower income limits than the SSI program, these states have to let Medicaid applicants deduct their medical expenses from their income when their eligibility for Medicaid is being determined. This is called "spending-down.".

Which states require a separate application for Medicaid?

These states, called "SSI criteria states," are: Alaska. Idaho. Kansas.

What is SSI disability?

Supplemental Security Income (SSI) Disability & Medicaid coverage. Waiting for a disability status decision and don’t have health insurance. No disability benefits, no health coverage. The Marketplace application and disabilities. More information about health care for people with disabilities.

Do you have to fill out a Medicaid application if you have SSI?

In many states, SSI recipients automatically qualify for Medicaid and don’t have to fill out a Medicaid application. In other states, your SSI guarantees you Medicaid eligibility, but you have to sign up for it. In a few states, SSI doesn’t guarantee Medicaid eligibility. But most people who get SSI are still eligible.

Can I apply for medicaid if I don't have SSI?

If you have SSI Disability and don’t have Medicaid, you can apply for Medicaid coverage 2 ways: Select your state from the menu on this Medicaid page for contact information. Create an account or log in to complete an application. Answer “yes” when asked if you have a disability, and we’ll send your application to your state Medicaid office.

Do you have to apply for medicaid if you have SSI?

If you have Supplemental Security Income (SSI) Disability, you may get Medicaid coverage automatically or you may have to apply.

Which states have the same eligibility for Medicaid as SSI?

The following jurisdictions use the same rules to decide eligibility for Medicaid as SSA uses for SSI, but require the filing of a separate application: Alaska, Idaho, Kansas, Nebraska, Nevada, Oregon, Utah, Northern Mariana Islands.

How long do you have to be disabled to qualify for SSI?

To qualify a recipient must: Have been eligible for an SSI cash payment for at least one month; Still be disabled; Still meet all other eligibility rules, including the resources test; Need Medicaid in order to work; and.

Which states have separate Medicaid applications?

In these States a separate application for Medicaid must be filed: Connecticut, Hawaii, Illinois, Minnesota, Missouri, New Hampshire, North Dakota, Oklahoma, Virginia.

Who is eligible for Medicaid?

It covers children, the aged, blind, and/or disabled and other people who are eligible to receive federally assisted income maintenance payments. Thirty-five states and the District of Columbia provide Medicaid eligibility to people eligible for Supplement al Security Income (SSI ) benefits.

Can you continue to get medicaid if you are on SSI?

If a recipient`s State provides Medicaid to people on SSI, the recipient will continue to be eligible for Medicaid. Please refer to the general Work Incentives section for more information about SSI work incentives. Medicaid coverage can continue even it a recipient`s earnings along with other income become too high for a SSI cash payment.

How long do you have to wait to receive medicare if you have SSDI?

For more information on calculating how this is calculated, see our article on when you'll receive Medicare benefits. There is no waiting period for SSI recipients to receive Medicaid.

Which states have a lower income limit for Medicaid?

There are a few states, including Illinois and Ohio, that are exceptions to this rule. These states may have a lower income or asset limit for the Medicaid program than the SSI program, so they make their own Medicaid determinations.

Do you get medicaid if you are approved for SSI?

Do you get Medicare coverage if you were approved for SSI? Claimants who are approved for SSI only typically receive Medicaid coverage in most states. And like SSI, Medicaid is subject to income and asset limitations. Medicaid is a needs-based, state- and county-administered program that provides for a number of doctor visits and prescriptions each month, as well as nursing home care under certain conditions.#N#Can you ever get Medicare if you get SSI? Medicare coverage for SSI recipients does not occur until an individual reaches the age of 65 if they were only entitled to receive monthly SSI disability benefits. At the age of 65, these individuals are able to file an "uninsured Medicare claim," which saves the state they reside in the cost of Medicaid coverage. Basically, the state pays the medical premiums for an uninsured individual to be in Medicare so that their costs in health coverage provided through Medicaid goes down.

Do you get medicaid if you are on SSDI?

If you're approved for disability benefits, you'll also get Medicare or Medicaid, depending on whether you receive SSDI or SSI benefits. Disabled people who are approved for Social Security disability insurance (SSDI) benefits will receive Medicare, and those who are approved for Supplemental Security Income (SSI) will receive Medicaid.

Can I get concurrent disability from both SSI and SSDI?

Some disability recipients will be approved for concurrent benefits; that is, they will draw disability money from both SSDI and SSI. In such instances, the issue of whether a claimant will get Medicare or Medicaid is not so cut and dry. Claimants who are approved for concurrent disability benefits should consult their local Social Security office ...

What is SSDI for Social Security?

SSDI is a government-run disability insurance program. It caters to people who have worked and paid a certain amount into the Social Security system. As you work and have payroll taxes deducted from your paychecks, you rack up work credits, and once you accumulate a certain number of these credits, you are eligible to file for SSDI if you become disabled. If you do not have enough work credits, either because you have not worked long enough or have not earned enough, you do not qualify for SSDI.

Which states have lower income limits than SSI?

In only a few states — namely, Illinois and Ohio — the income and asset limits for Medicaid are lower than for SSI. It is thus possible in those states to fall into the in-between zone where you qualify for SSI but earn too much money for Medicaid.

Why can't I get SSI if I make too much money?

In fact, if you make too much money from work or have too high of a network, you will be denied SSI benefits due to lack of financial need. Because SSI is a government welfare program, it aligns with Medicaid, a health benefits program also for those with financial need.

When will Medicare start?

You begin receiving benefits, plus you collect back pay for the period from July to December 2016. But your Medicare benefits do not begin until July 1, 2018 — two years after your entitlement date.

Can I get medicaid if I get SSDI?

If you receive approval for SSDI, you will not receive Medicaid along with your disability benefits, but you will obtain Medicare after an applicable waiting period. Upon approval for SSI, you will generally receive Medicaid at the same time, though a few states do not grant automatic Medicaid benefits for SSI recipients.

Does Social Security Disability come with Medicare?

In the majority of cases, Social Security disability comes with either Medicaid or Medicare benefits. Which type of health coverage you receive depends on the Social Security disability program: Social Security Disability Income (SSDI) or Supplemental Security Income (SSI). If you receive approval for SSDI, you will not receive Medicaid along ...

Do I have to wait to get Medicare if I have Social Security?

But if your Social Security benefits come from SSDI, you might have to wait to receive Medicare. The length of your wait depends on a couple of factors. One, your eligibility date; two, how long you have already waited since your eligibility date to get your SSDI approval.

Which states make their own Medicaid eligibility decisions?

A few states make their own Medicaid eligibility decisions using the same income, resource, and disability criteria that Social Security uses for the SSI program. Alaska, Idaho, Kansas, Nebraska, Nevada, Oregon, Utah, and the Northern Mariana Islands all make their own Medicaid eligibility decisions using SSI criteria.

How many states have Medicaid eligibility criteria?

Eleven states have elected to use eligibility criteria for Medicaid that are more restrictive than SSI's. In most of those states, SSI recipients will find that the rules about income and resources or the definition of disability are more restrictive for Medicaid than they are for SSI. Still, the federal government has imposed rules ...

What is medicaid for low income?

Medicaid is a health insurance program for low-income individuals that is operated by the states according to guidelines established by the federal government. The federal government requires the states to offer Medicaid coverage to some groups of people and allows the states to cover certain additional groups. One group required to be covered by Medicaid is disabled individuals with low incomes. But states are allowed to have different eligibility requirements than the SSI disability program. Whether SSI recipients are automatically eligible for and enrolled in Medicaid depends on the state that the recipient lives in.

Why is Indiana a 209b state?

Social Security calls these ten states the "209 (b) states" because it was section 209 (b) of the Social Security Amendments of 1972 that gave states the option of using their own criteria for Medicaid. Note that Indiana ceased being a 209 (b) state in 2014.

Does Medicaid automatically grant SSI?

Where Medicaid Eligibility Is Automatic. Most states automatically grant Medicaid when you get approved for SSI based on disability. In fact, most states let the Social Security Administration handle Medicaid enrollment for SSI recipients when they are approved for SSI.