Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Full Answer

How much can you make to qualify for Medicare?

Feb 15, 2022 · Medicare Part B premiums are calculated based on your income. More specifically, they’re based on the modified adjusted gross income (MAGI) reported on your taxes from two years prior. This means your 2022 Medicare Part B premium may be calculated using the income you reported on your 2020 taxes.

How much does Medicare cost at age 65?

Jan 22, 2020 · $252 per month for those who paid Medicare taxes for 30-39 quarters. Medicare Part B premium. While zero-premium liability is typical for Part A, the standard for Medicare Part B is a premium that changes annually, determined by modified adjusted gross income and tax filing status. For 2020, the standard monthly rate is $144.60.

How to find out how much Medicare costs?

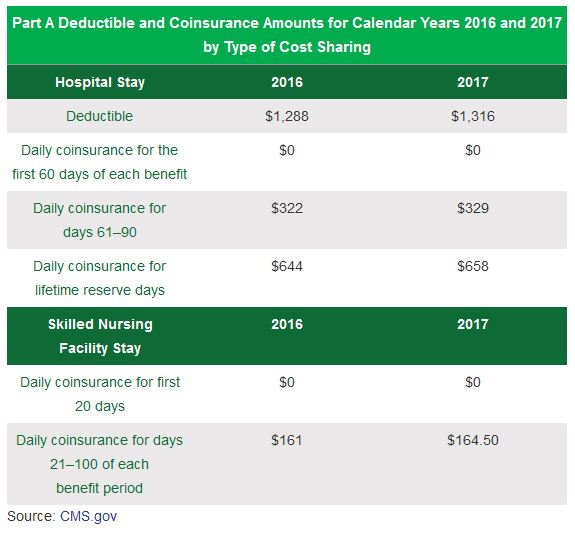

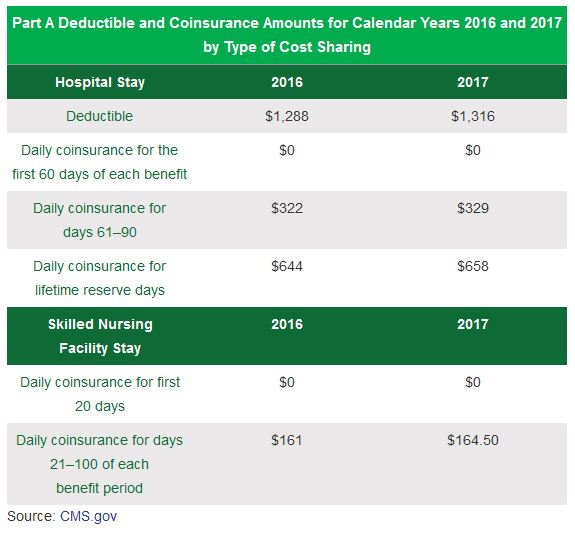

Medicare then covers the entire cost of up to 60 days of a hospital stay, but after that there are coinsurance rates to pay. If you stay in an inpatient facility longer than 61 days, then you'll ...

What is the average cost of Medicare per month?

Get an estimate of when you're eligible for Medicare and your premium amount. If you don't see your situation, contact Social Security (or the Railroad Retirement Board if you get railroad benefits) to learn more about your specific eligibility or premium.

How are Medicare costs determined?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What income is used to calculate Medicare premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Does Medicare Part B premium change every year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

How do I get my Medicare premium reduced?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

Is Pension considered income for Medicare?

While Social Security benefits are subject to income taxes after retirement, pension payments, annuities, and the interest or dividends you receive from your savings or investments are not subject to Medicare or FICA taxes.Mar 29, 2021

How much does Medicare take out of Social Security?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.Apr 6, 2022

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

How long do you have to be on Medicare to receive Part A?

People under age 65 may receive Part A with no liability for premiums under the following circumstances: Have received Social Security or Railroad Retirement Board disability benefits for two years.

What is the Medicare premium for 2020?

For 2020, the standard monthly rate is $144.60. However, it will be more if you reported above a certain level of modified adjusted gross income on your federal tax return two years ago. Any additional amount charged to you is known as IRMAA, which stands for income-related monthly adjustment amount. Visit Medicare.gov, point to “Your Medicare Costs,” and then click “Part B costs” to see a matrix of premiums corresponding to income ranges across different tax filing statuses.

How many years of work do you need to be eligible for Medicare?

Four is the maximum number of credits a person can earn per year, so it takes at least 10 years or 40 quarters of employment to be eligible for Medicare.

Is Medicare the same for everyone?

Medicare is a federal program that mandates standardization of services nationwide, so many people may assume the premiums would be the same for everyone. In reality, there are variations in the premiums people pay, if they pay any at all.

Can Medicare be charged at 65?

For Part A, most Medicare recipients are not charged any premium at all. Seniors at age 65 are eligible for premium-free Part A if they meet the following criteria: Currently collect retirement benefits from Social Security or the Railroad Retirement Board. Qualify for Social Security or Railroad benefits not yet claimed.

How much does Medicare cover for hospital stays?

Medicare then covers the entire cost of up to 60 days of a hospital stay, but after that there are coinsurance rates to pay.

What is the number to call Medicare?

For details on what a specific item will cost, you can also visit MyMedicare.gov, or if you'd rather talk to someone on the phone, give Medicare a call at 1-800-MEDICARE (633-4227) . Brian Feroldi has no position in any stocks mentioned. The Motley Fool recommends UnitedHealth Group.

How much does Part B cost?

While the majority of Part B recipients pay $104.90 each month, that number can jump to as high as $389.80 per month if your income is high enough. Beyond the monthly premiums, Part B coverage also charges a deductible, and most services or tests require coinsurance payments.

How much is coinsurance for 90 days?

After 90 days a different set of rules kick in, as the coinsurance rate doubles to $644 per day and you'll start using up your lifetime reserve of up to 60 days of additional care.

What is Medicare Part B?

Medicare Part B -- medical insurance. Medicare Part B is used to cover the costs of services and supplies needed to diagnose and treat diseases. Most commonly, Part B is used to pay for things such as doctor visits and medical diagnostic tests, but it also covers a variety ...

Where does Medicare Part C come from?

Unlike Parts A and B, Part C comes not through the government but from private health insurers, such as Humana or UnitedHealth Group, that receive fixed payments from Medicare for each participant who signs up to be a part of the network.

Can I use Medicare Advantage to add drug coverage?

If you're signed up for a Medicare Advantage plan that offers prescription drug coverage, you'll need to go through that insurer to access your Part D benefits, but if you use regular Medicare and want to add drug coverage, you can do so by just signing up for Part D.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is Medicare premium?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. A deductible is the amount you pay out of pocket before your insurance company covers its ...

How does Medicare Part B work?

How it Works Premiums & Deductibles Coverage & Enrollment FAQs. Medicare Part B provides the medical portion of your Medicare coverage . Part B has costs, including a premium, deductible and coinsurance. Together, they make up the overall cost of Medicare Part B. But the costs aren’t the same for everyone.

What is coinsurance on medical insurance?

Coinsurance is the percentage of your medical costs that you pay after you meet your deductible. The remaining amount is paid by your insurance company.

What is premium insurance?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. and annual deductible. A deductible is the amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs ...

Does Medicare Supplement Insurance cover Part B?

Medicare Supplement Insurance (Medigap) has several policies that will help cover your Part B costs, including premiums, deductibles and out-of-pocket costs.

Is Medicare Part B based on income?

Unlike the Part B premium, this amount isn’t based on income. Everyone enrolled in Original Medicare pays the same Part B deductible. That means no matter how high your income is, you’ll pay the standard Medicare Part B deductible amount.

Is Medicare Part B the same as Medicare Advantage?

But Part B coverage isn’t exclusive to Original Medicare; you’ll receive at least the same benefits with Medicare Advantage (Part C).

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How Are Medicare Part D Premiums Calculated

Medicare Part D prescription drug plans are also sold by private insurance companies, so premiums will vary from one plan to the next.

Medicare Part B Part D Irmaa Premium Brackets

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors services and Medicare Part D that covers prescription drugs.

What Income Is Used To Determine Medicare Premiums

Did you know that not everyone pays the same amount for Medicare premiums? As you are planning for retirement or if you are already in retirement, it is important to understand the effects that your financial decisions can have on your Medicare premiums. It could be the difference of hundreds of dollars a month.

Medicare Part B Premium Appeals

OMHA handles appeals of the Medicare programs determination of a beneficiarys Income Related Monthly Adjustment Amount , which determines a Medicare beneficiarys total monthly Part B insurance premium.

How Record Social Security Cost

News that inflation rose to a historic high in November probably comes as no surprise to retirees.

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

How To Calculate Medicare Premiums

As you hit the retirement milestone, one of the items you’ll likely need to address is enrolling in Medicare. Medicare has many complexities and the calculation of premiums that you will pay is one of them. The questions and confusion can be endless.

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

Can you ask Social Security to adjust your premium?

You can ask Social Security to adjust your premium if a “life-changing event” caused significant income reduction or financial disruption in the intervening tax year — for example, if your marital status changed , or you lost a job , pension or income-producing property. You’ll find detailed information on the Social Security web page “Medicare ...

Do you pay Medicare Part B if you are a high income beneficiary?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don’t pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income ...