Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, paying an additional 1.45% on your behalf, for a total of 2.9%. Medicare as Part of the Self-Employment Tax

Will I owe more Medicare tax than my employer withheld?

· The additional tax (0.9% in 2022) is the sole responsibility of the employee and is not split between the employee and employer. Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. 2. The self-employed tax consists of two parts: 12.4% for Social Security; 2.9% for Medicare You can deduct the employer-equivalent portion of …

What is the employee share of Social Security and Medicare taxes?

· 2022 Medicare Tax Rates In 2022, the Medicare tax rate is 2.9%, which is split evenly between employers and employees. W-2 employees pay 1.45%, and their employer covers the remaining 1.45%....

What is the Medicare tax rate for employers?

· An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period until the end of the calendar year. There's no …

How do I pay additional Medicare tax withheld from employee pay?

· The total cost of the Medicare tax is split between you and your employer. If you’re self-employed, you’ll pay Medicare tax as part of your self-employment tax. Why Do You Pay Medicare Tax? The Medicare tax is used to fund approximately 88% of Medicare Part A services for seniors and people with disabilities. These funds are used to pay for current services and …

Is Medicare split between employer and employee?

The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Are Medicare taxes paid by both employee and employer?

FICA (Federal Insurance Contributions Act) taxes are social security and Medicare taxes that both employers and employees pay. Employers must withhold FICA taxes from employees' wages, pay employer FICA taxes and report both the employee and employer shares to the IRS.

Do employers pay half of Social Security and Medicare?

Social Security and Medicare Tax Rates The total social security rate is 12.4%. Therefore, the employer/employee each pay 6.2%.. The employer/employee each pay 50% of the total Medicare rate. The total Medicare rate is 2.9%.

How is employer portion of Medicare calculated?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay. 2

Why are my Medicare wages higher than my regular wages?

Medicare wages include any deferred compensation, retirement contributions, or other fringe benefits that are normally excluded from the regular income tax. In other words, the amount in Box 5 typically represents your entire compensation from your job.

How do you calculate Medicare taxable wages?

These wages are taxed at 1.45% and there is no limit on the taxable amount of wages. The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction.

Why is Medicare taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

Does the employer or employee pay Social Security tax and Medicare tax quizlet?

Employee marital status and number of withholding allowances. Does the employer or employee pay social security tax and Medicare tax? Both the employee and the employer pay.

Does the employer portion of Social Security cap?

Note: For employed wage earners, their Social Security portion is 6.2% on earnings up to the taxable maximum. Their Medicare portion is 1.45% on all earnings....2022 Wage Cap Jumps to $147,000 for Social Security Payroll Taxes.Payroll Taxes: Cap on Maximum EarningsType of Payroll Tax2022 Maximum Earnings2021 Maximum EarningsMedicareNo limitNo limit2 more rows•Oct 13, 2021

How much Medicare tax is withheld from my paycheck?

1.45%Medicare tax: 1.45%. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000.

How do you calculate FICA and Medicare tax 2020?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

What is employee Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee's paycheck or paid as a self-employment tax.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

Who is responsible for Medicare taxes?

Self-employed individuals are responsible for both portions of Medicare tax but only on 92.35% of business earnings.

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

What is the Medicare contribution surtax?

The net investment income tax, also known as the “unearned income Medicare contribution surtax,” is an additional 3.8% tax applied to net investment income as of 2021. Like the additional Medicare tax, there is no employer-paid portion. 9

Is Medicare surtax withheld from paycheck?

Like the initial Medicare tax, the surtax is withheld from an employee’s paycheck or paid with self-employment taxes. However, there is no employer-paid portion of the additional Medicare tax. The employee is responsible for paying the full 0.9%. 8.

What is the Medicare tax rate for a person earning $225,000 a year?

However, the additional 0.9% only applies to the income above the taxpayer’s threshold limit. 8 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45% and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

Is Medicare a surtax?

In 2013, the Affordable Care Act (ACA) introduced two Medicare surtaxes to fund Medicare expansion: the additional Medicare tax and the net investment income tax. Both surtaxes apply to high earners and are specific to different types of income. It is possible for a taxpayer to be subject to both Medicare surtaxes.

Is there a limit on Medicare income?

Unlike Social Security tax, there is no income limit to which Medicare tax is applied. 7. An individual’s Medicare wages are subject to Medicare tax. This generally includes earned income such as wages, tips, vacation allowances, bonuses, commissions, and other taxable benefits up to $200,000.

What is Medicare tax?

Medicare tax is a payroll tax that funds the Medicare Hospital Insurance program. Employers and employees each pay Medicare tax at a rate of 1.45% with... Menu burger. Close thin.

How is Medicare funded?

Like Social Security benefits, Medicare’s Hospital Insurance program is funded largely by employment taxes. If you work “under the table” you won’t pay into these systems. That’s why payroll tax withholding, although it takes a chunk out of your take-home pay, is actually providing you with something in return for those lost dollars in your paychecks.

What is the Social Security tax for 2017?

As of 2017, the employee share of Social Security and Medicare taxes is 7.65%. If you make over $200,000, remember to account for the Additional Medicare Tax. It may seem like a lot of trouble now, but all this tax withholding is designed to give you a safety net when you reach retirement.

What is the Medicare surtax rate?

It is not split between the employer and the employee. If your income means you’re subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000.

What is the current Social Security tax rate?

The current Social Security tax is 12.4% with employees and employers each paying 6.2%. Today, the Medicaretax rate is 2.9%. Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes.

How to get help with Medicare taxes?

If you need help with medicare taxes or any other financial issue, consider working with a financial advisor, who will walk you through everything you need to know. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool connects you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors, get started now.

Is Medicare tax the same as NIIT?

According to the IRS, a taxpayer may be subject to both the Additional Medicare Tax and the NIIT, but not necessarily on the same types of income. That’s because the 0.9 percent Additional Medicare Tax applies to wages, compensation and self-employment income over the $200,000 limit, but it does not apply to net investment income.

Who is responsible for Medicare tax?

The Additional Medicare Tax is owed by higher-income employees, and employers are responsible for withholding this tax and paying it to the Internal Revenue Service (IRS). Learn how to withhold, report, and pay this employment tax.

When do employers have to withhold Medicare tax?

Employers must begin withholding the Additional Medicare tax Rate from an employee's pay beginning with the pay period when the individual's total pay for the year reaches $200,000 and continue withholding this tax from the employee's pay until the end of the year.

What happens if an employee's withholding is miscalculated?

If an employee's withholding is miscalculated and they are owed a refund, the employee must request the refund directly from the IRS. Don't attempt to give the employee a refund or adjust the employee's withholding on a miscalculation of federal income tax or FICA tax.

Is fringe benefit taxable?

Some wages and fringe benefits are taxable to the employee for income tax purposes , but some wages may not be taxable to the employee for Social Security and Medicare taxes, including the Additional Medicare Tax. You must exclude the wages not subject to Social Security and Medicare taxes when you calculate the wages subject to ...

Is there regular withholding for self employment?

There is no regular withholding for self-employment tax, so if you expect that your income might be above the levels above, you may need to increase your estimated tax payments to account for the additional Medicare tax. 2.

Does Medicare tax self employed?

The new Medicare tax also affects self-employed individuals who earn over a specific amount. If you are both an employee and self-employed, all sources of earned income (as opposed to investment income) are combined to reach the levels where the Additional Medicare Tax is applicable.

Do you have to keep records of Medicare taxes?

You must keep records of amounts of the additional Medicare tax withheld from employee pay and that you owe to the IRS as an employer. These amounts must be paid along with all other payroll tax payments.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

Is there a wage base limit for Medicare?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.

What if an employer does not deduct Medicare?

An employer that does not deduct and withhold Additional Medicare Tax as required is liable for the tax unless the tax that it failed to withhold from the employee’s wages is paid by the employee. An employer is not relieved of its liability for payment of any Additional Medicare Tax required to be withheld unless it can show that the tax has been paid by filing Forms 4669 and 4670. Even if not liable for the tax, an employer that does not meet its withholding, deposit, reporting, and payment responsibilities for Additional Medicare Tax may be subject to all applicable penalties.

How to calculate Medicare tax?

Step 1. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2. Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

When is Medicare tax withheld?

An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee.

Does Medicare match employer?

No. There is no employer match for Additional Medicare Tax.

Can RDPs make joint estimated tax payments?

By contrast, each RDP takes full credit for the estimated tax payments that he or she made. RDPs cannot make joint estimated tax payments.

How much is F liable for Medicare?

F is liable to pay Additional Medicare Tax on $50,000 of his wages ($175,000 minus the $125,000 threshold for married persons who file separate).

Can you use estimated Medicare tax for additional taxes?

No. An individual cannot designate any estimated payments specifically for Additional Medicare Tax. Any estimated tax payments that an individual makes will apply to any and all tax liabilities on the individual income tax return (Form 1040 or 1040-SR), including any Additional Medicare Tax liability.

How much is Medicare tax?

Medicare tax. The Medicare portion of the FICA tax is 2.9% of gross wages, and it’s applied to every dollar your employee earns. So for this tax, it’s 1.45% that you pay, and 1.45% that your employee pays.

How much Medicare tax do you have to pay if you make more than 200 000?

If your employee makes more than $200,000, they are also subject to the Additional Medicare Tax. As the employer, you must withhold 0.9% of wages beyond $200,000.

Where to find payroll tax breakdown?

Employees can typically find a breakdown of their payroll taxes in the Deductions section ( example above) or the Taxes section of their pay stub . This breakdown will include the amount of money withheld for taxes from that pay period plus the amount that has been withheld for the year to date.

How often do companies deposit taxes?

Companies must deposit these withholdings plus their own tax contributions to the IRS on a monthly or semi-weekly basis. Although the schedule you follow will depend on the kind of business you have, you can find out your deposit schedule with IRS Publication 15.

Which states don't have income tax?

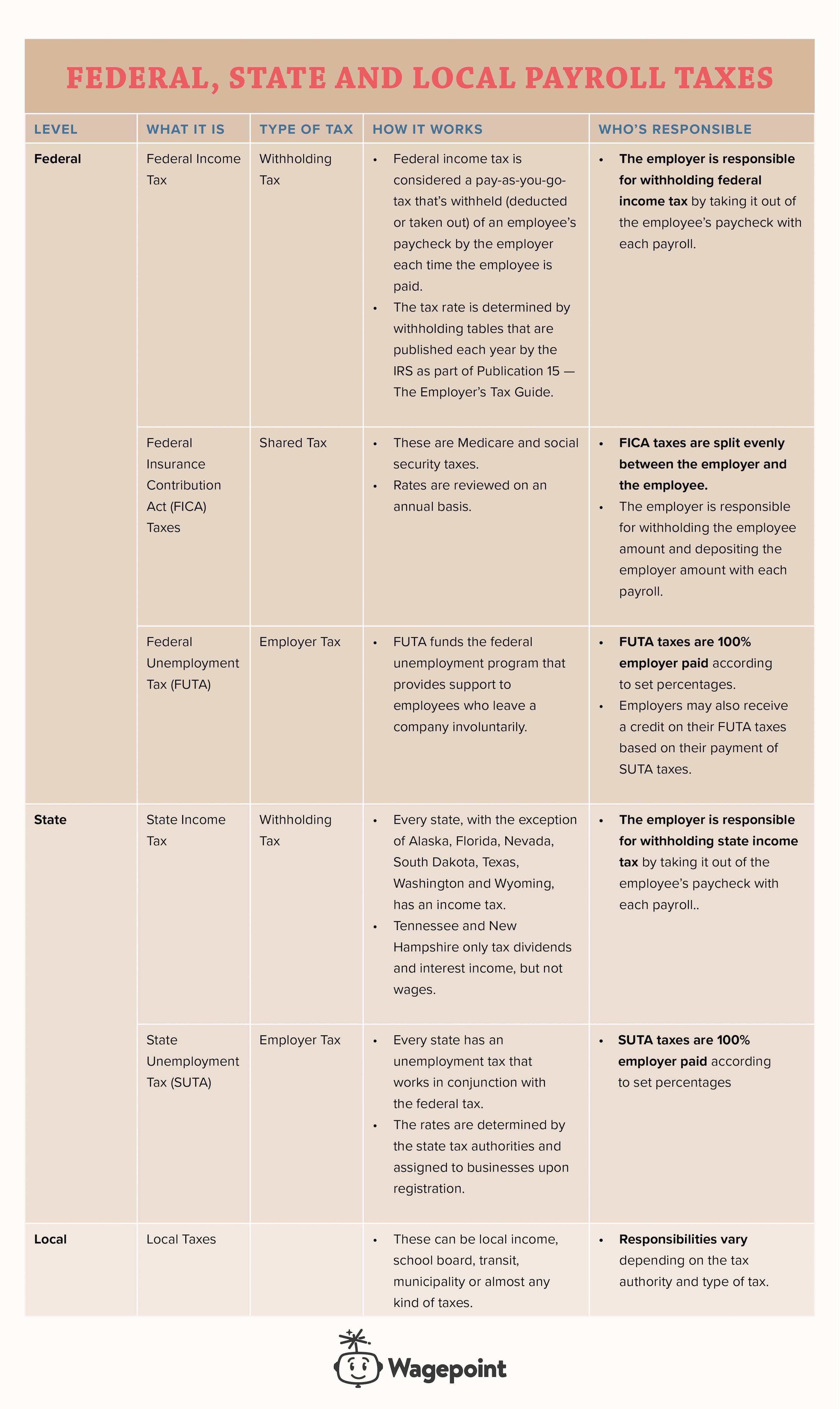

On the other end of the spectrum, Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t have a personal income tax on wages. (Note: Tennessee does tax interest and dividend income.)

What is the federal unemployment tax credit?

The Federal Unemployment Tax Act, or FUTA for short, is there to provide a buffer for people who have recently lost their jobs. Employers have to pay 6% toward FUTA, though companies who pay their state unemployment taxes on time can receive a credit up to 5.4% towards their FUTA tax rate.

What is the Social Security tax rate for 2021?

The 2021 Social Security tax is 12.4%. That’s 6.2% for employers and 6.2% employees. This rate is applied to the first $142,800 your employee earns, so if your employee makes more than that amount in a year, there won’t be any Social Security taxes withheld once they hit that limit.

How much is payroll tax for Social Security?

So, how much is the employer cost of payroll taxes? Employer payroll tax rates are 6.2% for Social Security and 1.45% for Medicare.

What are payroll taxes?

Payroll tax includes two specific taxes: Social Security and Medicare taxes. Both taxes fall under the Federal Insurance Contributions Act (FICA), and employers and employees pay these taxes.

What is the wage base for Social Security in 2021?

Social Security taxes have a wage base. In 2021, this wage base is $142,800. The wage base means that you stop withholding and contributing Social Security taxes when an employee earns more than $142,800.

How much is the federal unemployment tax?

Federal unemployment tax is 6.0% on the first $7,000 in employee wages. However, most states and businesses receive a tax credit of 5.4% and only pay 0.6% to FUTA. So, the maximum amount most employers pay into FUTA each year per employee is $42 ($7,000 X 0.6%). If a business or state does not receive the tax credit, the maximum amount per employee is $420 ($7,000 X 6%).

Can you multiply gross wage by FICA?

You can also multiply your gross wage by the entirety of the FICA tax:

Do employers pay Medicare tax?

Do employers pay the additional Medicare tax? No, employers only pay 1.45%, even if an employee earns more than $200,000. Additional Medicare tax only applies to employees.

Do you have to pay 0.9% of Medicare?

Because you do not hit the wage base for Medicare, do not pay the additional 0.9%. However, you must pay the full 2.9% of Medicare: