How big is the Medicare trust fund?

The Medicare Program is the second-largest social insurance program in the U.S., with 62.6 million beneficiaries and total expenditures of $926 billion in 2020.

What happens when Medicare trust fund runs out?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

How is the Medicare trust fund funded?

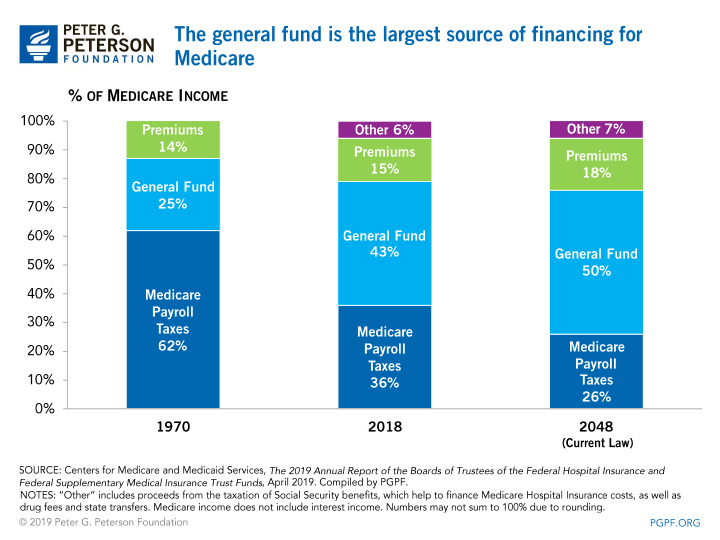

The Medicare trust fund finances health services for beneficiaries of Medicare, a government insurance program for the elderly, the disabled, and people with qualifying health conditions specified by Congress. The trust fund is financed by payroll taxes, general tax revenue, and the premiums enrollees pay.

What does the Medicare trust fund invest in?

Hospital Insurance (HI) Trust Fund Income taxes paid on Social Security benefits. Interest earned on the trust fund investments. Medicare Part A premiums from people who aren't eligible for premium-free Part A.

How long will the Medicare trust fund last?

In the 2022 Medicare Trustees report, the trustees projected that assets in the Part A trust fund will be depleted in 2028, six years from now. This is a modest improvement from the projection in the 2021 Medicare Trustees report, when the depletion date was projected to be 2026.

Which president started borrowing from Social Security?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19648.LETTER TO THE NATION'S FIRST SOCIAL SECURITY BENEFICIARY INFORMING HER OF INCREASED BENEFITS--SEPTEMBER 6, 196515 more rows

Can Medicare run out?

A report from Medicare's trustees in April 2020 estimated that the program's Part A trust fund, which subsidizes hospital and other inpatient care, would begin to run out of money in 2026.

Does Medicare take money from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare underfunded?

Politicians promised you benefits, but never funded them.

How much money is in the Social Security trust fund?

Summary: Actuarial Status of the Social Security Trust Funds2021 report2022 reportTrust fund reservesAmount at beginning of report year (in billions)$2,908$2,852Amount at beginning of report year (as a percentage of report year outgo)253%230%Projected year of peak trust fund reserves c2021202227 more rows

Does a trust fund affect Social Security benefits?

Money paid directly to you from the trust reduces your SSI benefit. Money paid directly to someone to provide you with food or shelter reduces your SSI benefit but only up to a certain limit.

Is Social Security a trust fund?

There are two separate Social Security trust funds, the Old-Age and Survivors Insurance (OASI) Trust Fund pays retirement and survivors benefits, and the Disability Insurance (DI) Trust Fund pays disability benefits.

How many people did Medicare cover in 2017?

programs offered by each state. In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds.

What is the CMS?

The Centers for Medicare & Medicaid Services ( CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the. Department Of Health And Human Services (Hhs) The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, ...

What is Medicare Part B?

Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. and. Medicare Drug Coverage (Part D) Optional benefits for prescription drugs available to all people with Medicare for an additional charge.

What is covered by Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

Does Medicare cover home health?

Medicare only covers home health care on a limited basis as ordered by your doctor. , and. hospice. A special way of caring for people who are terminally ill. Hospice care involves a team-oriented approach that addresses the medical, physical, social, emotional, and spiritual needs of the patient.

How much will the HI trust fund be in 2025?

By 2025, assets in the trust fund at the beginning of the year will have decreased to $73 billion, and with $50 billion more in spending than in revenues that year, assets will drop to $23 billion by the end of 2025. And by 2026, the $23 billion in assets in the HI trust fund at the start of the year is projected to be insufficient to cover ...

How much of the federal budget is Medicare?

Medicare spending often plays a major role in federal health policy and budget discussions, since it accounts for 21% of national health care spending and 12% of the federal budget. Recent attention has focused on one specific measure of Medicare’s financial condition – the solvency of the Medicare Hospital Insurance (HI) trust fund, ...

How much would Medicare increase over 75 years?

Over a longer 75-year timeframe, the Medicare Trustees estimated that it would take an increase of 0.76% of taxable payroll over the 75-year period, or a 16% reduction in benefits each year over the next 75 years, to bring the HI trust fund into balance.

How much of Medicare will be covered in 2026?

Based on data from Medicare’s actuaries, in 2026, Medicare will be able to cover 94% of Part A benefits spending with revenues plus the small amount of assets remaining at the beginning of the year, and just under 90% with revenues alone in 2027 through 2029.

Where does Medicare get its money from?

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest. The different parts of Medicare are funded in varying ways.

How many years has the HI trust fund been depleted?

In the 30 years prior to 2021, the HI trust fund has come within five years of depletion only twice – in 1996 and again in 1997 (Figure 4). At that time, Congress enacted legislation to reduce Medicare spending obligations to improve the fiscal outlook of the trust fund.

How many people are covered by Medicare?

Medicare, the federal health insurance program for more than 60 million people ages 65 and over and younger people with long-term disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. Medicare spending often plays a major role in federal health policy and budget discussions, ...

Find out what you should know about one source of financial support for Medicare

Retirees count on a combination of retirement benefits from Social Security and healthcare benefits from Medicare to give them the peace of mind they need to live well in their older years.

2 trust funds for Medicare

Medicare has two different trust funds that offer financial support for various Medicare benefits. The Hospital Insurance Trust Fund, or HI Trust Fund for short, goes toward paying the hospital and inpatient care expenses that Medicare Part A typically covers.

Where do the Medicare trust funds get their money?

The two programs get funded in very different ways. The 1.45% in Medicare taxes that get withheld from your paycheck, along with your employer's matching 1.45% tax, go into the HI Trust Fund.

Should you worry about the Medicare Trust Funds?

This year's report from Medicare's trustees raised new alarm bells about the financial sustainability of the program. With just $202 billion in the HI Trust Fund, the trustees estimate that money will be gone by 2026, three years sooner than it expected in the 2017 report.

What is the hospital insurance trust fund?

As we discussed, The Hospital Insurance Trust Fund funds Medicare Part A. The Hospital Insurance Trust Fund is the particular fund that is expected to lose its money by the year 2026.

What are the parts of Medicare?

Medicare Part A covers hospital expenses, like inpatient stays and hospice care. Medicare Part B covers medical expenses, like doctors’ visits and medical supplies. Medicare Part D covers prescription drugs which include any medications you may pick up at your pharmacy.

How is Medicare Part D funded?

Like Medicare Part B, Medicare Part D is funded by monthly premiums and government expenditures. As with Medicare Part B, there will be increases in medical expenses over time. This increase in expenses will lead to the need for an increase in spending by Medicare trust funds. The financial issues will lead to an increase in ...

What is Medicare for 65?

Surprisingly, a lot of people don’t know what this governmental service is and what its purpose was upon creation. Medicare is a kind of federal health insurance in the United States that is meant for those who are 65 and older. However, some young people with certain disabilities can also apply for the benefits.

Will the Hospital Insurance Trust Fund become insolvent?

This is not the first time that The Hosptial Insurance Trust Fund has been projected to become insolvent. Medicare will still be able to cover some of the financial loss if the Hospital Insurance Trust Fund does become insolvent. This will decrease over time, but we will still be able to cover the majority of Medicare costs.

Is Medicare a financial projection?

However, the financial projection of the Medicare program is not as simple as that. There is much more that goes into the projection of future finances and the stability of the future of the program. Let’s discuss some of the major issues surrounding the Medicare Trust Fund and how exactly you should interpreting their financial struggles.

Is Medicare taking in enough money?

Because of all of the income streams that we covered before, Medicare is still bringing in enough money to cover its overall costs. Although Medicare did spend billions of dollars caring for millions of people, it’s revenue still remained more than its loss.