Medicare's Limited Income NET Program, effective January 1, 2010, provides temporary Part D prescription drug coverage for low income Medicare beneficiaries not already in a Medicare drug plan including: Full Benefit Dual Eligible and SSI-Only beneficiaries on a retroactive basis, up to 36 months in the past; and

Full Answer

What are Medicare Part D prescription drug quantity limits?

Your Medicare Part D plan formulary will show any Quantity Limits for your medications and you can also see the Quantity Limits for all formulary medications by using our Drug Finder ( www.Q1Rx.com ). For example: "Q:6/28Days" meaning the quantity limit is a quantity of 6 pills per 28 days or "Q:90/365Days" meaning the Medicare Part D plan limits this drug to 90 pills for the entire year.

What is the Medicare Part D initial coverage limit (ICL)?

The Initial Coverage Limit (ICL) is a fixed dollar amount ( $4,430 in 2022) that acts as the "boundary" between the second part of your Medicare Part D plan or the Initial Coverage Phase (where you and your drug plan share the cost of your drug purchases) and the third part of your plan, the Coverage Gap (where you receive a 75% Donut Hole discount on all formulary drugs).

What companies offer Medicare Part D?

Top 10 Supplemental Medicare Insurance Companies in 2022

- Mutual of Omaha – Best Overall

- Aetna – High-Quality Nationwide Options

- Cigna – Superior Customer Care

- United American – Best Enrollment Experience

- GPM – Superior Coverage Options

- UnitedHealthcare – Wide Variety of Plan Options

- Manhattan Life – Best Website Experience

- Bankers Fidelity – Best Senior Expertise

- Blue Cross Blue Shield – Best Mobile App

What are the best Medicare Part D plans?

They include:

- Switching to generics or other lower-cost drugs;

- Choosing a plan (Part D) that offers additional coverage in the gap (donut hole);

- Pharmaceutical Assistance Programs;

- State Pharmaceutical Assistance Programs;

- Applying for Extra Help; and

- Exploring national and community-based charitable programs.

Is there a cap on Medicare Part D?

The Medicare Part D donut hole or coverage gap is the phase of Part D coverage after your initial coverage period. You enter the donut hole when your total drug costs—including what you and your plan have paid for your drugs—reaches a certain limit. In 2022, that limit is $4,430.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

What is the 2022 Part D initial coverage limit?

$4,430CMS has released the following 2022 parameters for the defined standard Medicare Part D prescription drug benefit: Deductible: $480 (up from $445 in 2021); Initial coverage limit: $4,430 (up from $4,130 in 2021); Out-of-pocket threshold: $7,050 (up from $6,550 in 2021);

Can Medicare Part D be denied?

If you were denied coverage for a prescription drug, you should ask your plan to reconsider its decision by filing an appeal. The appeal process is the same in stand-alone Part D plans and Medicare Advantage Plans with Part D coverage. Follow the steps below if your plan denied coverage for your prescription.

Why is Medicare Part D so expensive?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive. Read more about .

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

How do I avoid the Medicare Part D donut hole?

Here are some ideas:Buy Generic Prescriptions. ... Order your Medications by Mail and in Advance. ... Ask for Drug Manufacturer's Discounts. ... Consider Extra Help or State Assistance Programs. ... Shop Around for a New Prescription Drug Plan.

What will Medicare Part D cost 2022?

Highlights for 2022 The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.

What are the 4 phases of Part D coverage 2022?

If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

When did Medicare Part D become mandatory?

The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

What is true about Medicare Part D?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications.

Is Medicare Part D optional or mandatory?

Medicare drug coverage helps pay for prescription drugs you need. Even if you don't take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare.

How much of Medicare is covered by Part D?

In 2019, about three-quarters of Medicare enrollees obtained drug coverage through Part D. Program expenditures were $102 billion, which accounted for 12% of Medicare spending. Through the Part D program, Medicare finances more than one-third of retail prescription drug spending in the United States.

What is Medicare Part D?

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs.

What is Medicare Part D cost utilization?

Medicare Part D Cost Utilization Measures refer to limitations placed on medications covered in a specific insurer's formulary for a plan. Cost utilization consists of techniques that attempt to reduce insurer costs. The three main cost utilization measures are quantity limits, prior authorization and step therapy.

How many Medicare beneficiaries are enrolled in Part D?

Medicare beneficiaries who delay enrollment into Part D may be required to pay a late-enrollment penalty. In 2019, 47 million beneficiaries were enrolled in Part D, which represents three-quarters of Medicare beneficiaries.

What is excluded from Part D?

Excluded drugs. While CMS does not have an established formulary, Part D drug coverage excludes drugs not approved by the Food and Drug Administration, those prescribed for off-label use, drugs not available by prescription for purchase in the United States, and drugs for which payments would be available under Part B.

When did Medicare Part D go into effect?

Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Under the program, drug benefits are provided by private insurance plans that receive premiums from both enrollees and the government.

What is part D coverage?

Part D coverage excludes drugs or classes of drugs that may be excluded from Medicaid coverage. These may include: Drugs used for anorexia, weight loss, or weight gain. Drugs used to promote fertility. Drugs used for erectile dysfunction. Drugs used for cosmetic purposes (hair growth, etc.)

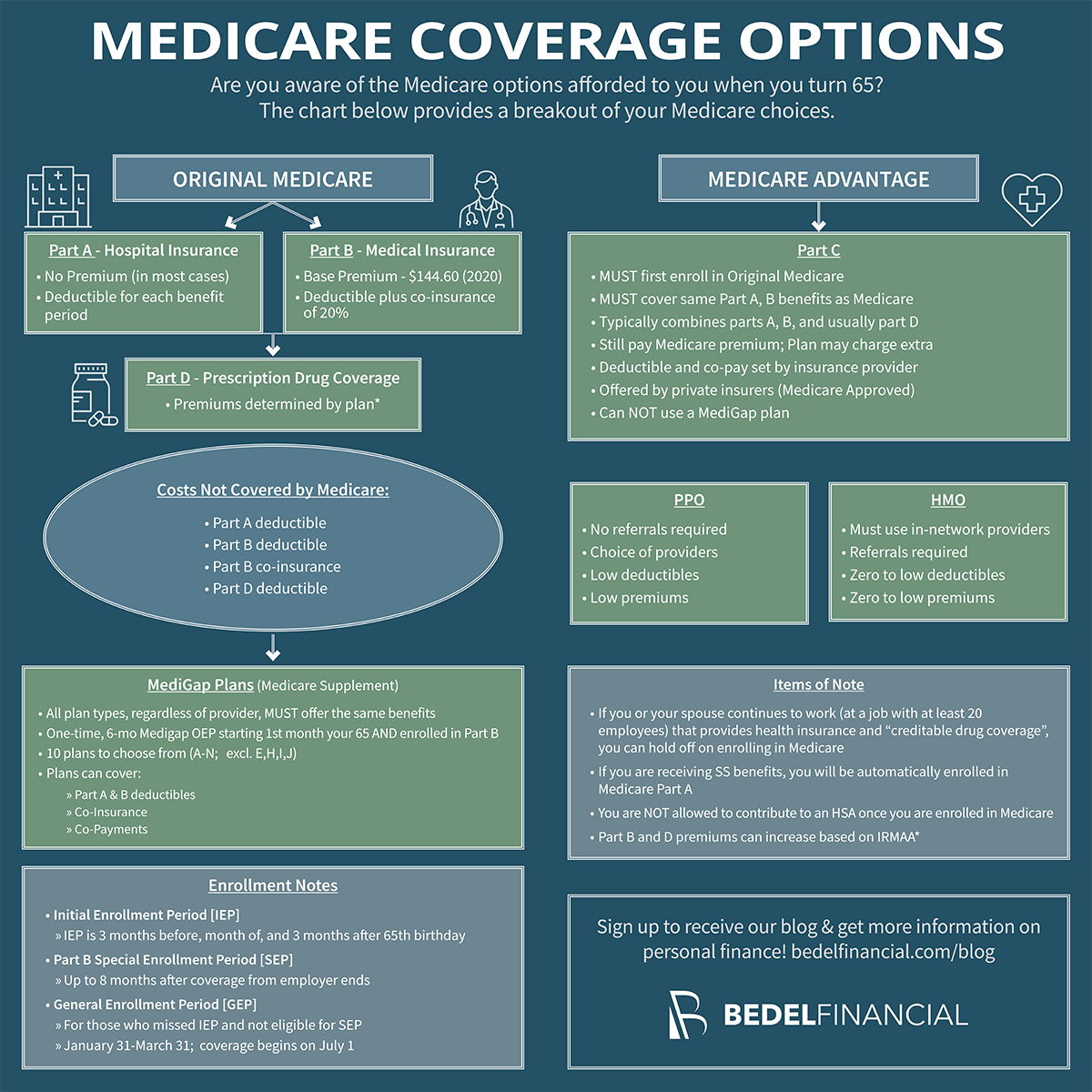

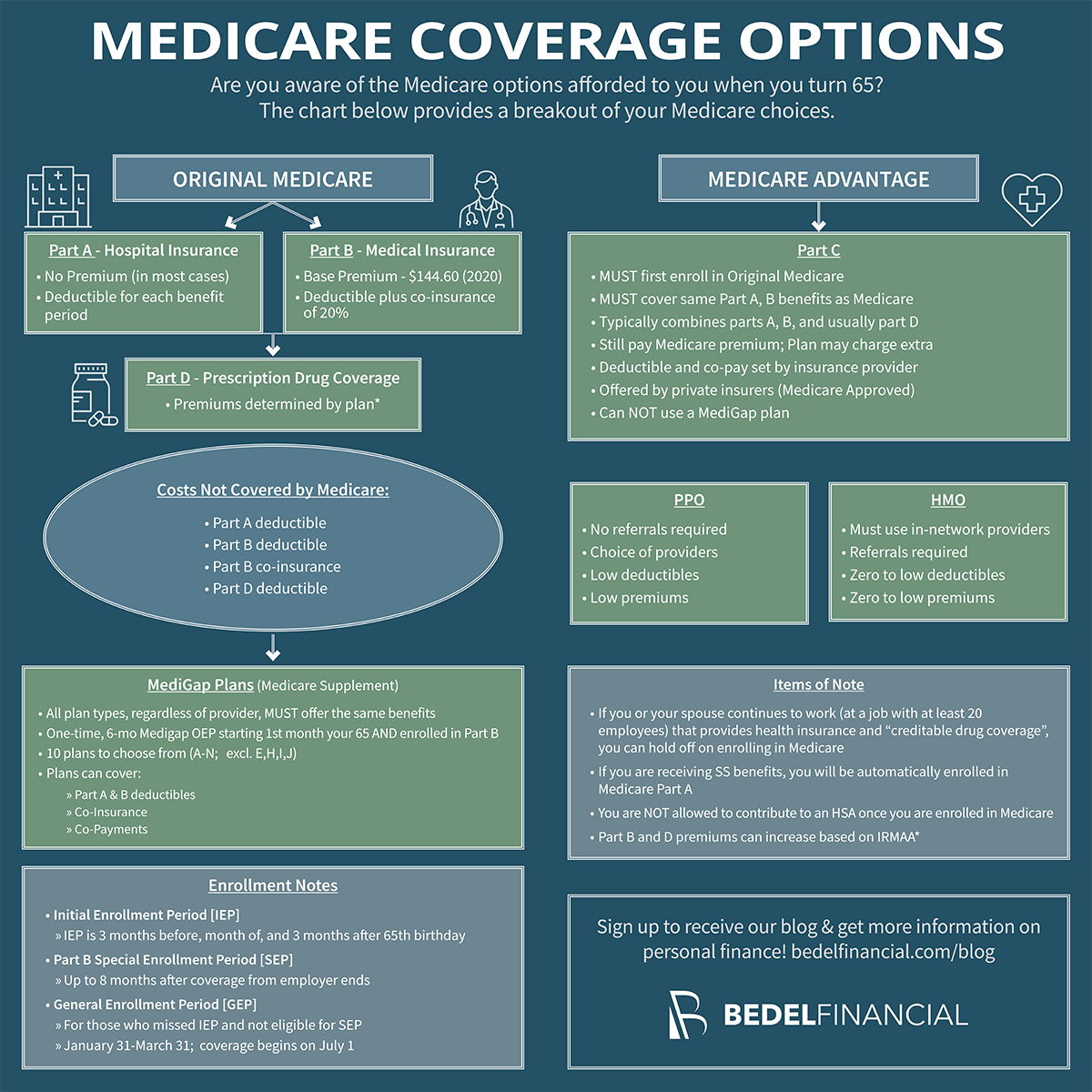

What is Medicare Part B and Part D?

Medicare Part B (medical insurance) and Part D have income limits that can affect how much you pay for your monthly Part B and/or Part D premium. Higher income earners pay an additional amount, called an IRMAA, or the Income-Related Monthly Adjusted Amount.

What is the Medicare Advantage spending limit?

Medicare Advantage (Medicare Part C) plans, however, do feature an annual out-of-pocket spending limit for covered Medicare expenses. While each Medicare Advantage plan carrier is free to set their own out-of-pocket spending limit, by law it must be no greater than $7,550 in 2021. Some plans may set lower maximum out-of-pocket (MOOP) limits.

What is the Medicare donut hole?

Medicare Part D prescription drug plans feature a temporary coverage gap, or “ donut hole .”. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs. Once you and your plan combine to spend $4,130 on covered drugs in 2021, you will enter the donut hole. Once you enter the donut hole in 2021, you ...

How much is Medicare Part A deductible in 2021?

You are responsible for paying your Part A deductible, however. In 2021, the Medicare Part A deductible is $1,484 per benefit period. During days 61-90, you must pay a $371 per day coinsurance cost (in 2021) after you meet your Part A deductible.

What happens if you spend $6,550 out of pocket in 2021?

After you spend $6,550 out-of-pocket on covered drugs in 2021, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

What is Medicare Advantage Plan?

When you enroll in a Medicare Advantage plan, it replaces your Original Medicare coverage and offers the same benefits that you get from Medicare Part A and Part B.

How long does Medicare cover hospital care?

Depending on how long your inpatient stay lasts, there is a limit to how long Medicare Part A will cover your hospital costs. For the first 60 days of ...

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

What is Medicare Part D?

1 The law created what we now know of as Medicare Part D, an optional part of Medicare that provides prescription drug coverage. Part D plans are run by private insurance companies, not the government.

What is a Part D premium?

Part D Premiums. A premium is the amount of money you spend every month to have access to a health plan. The government sets no formal restrictions on premium rates and prices may change every year. 3 Plans with extended coverage will cost more than basic-coverage plans.

What is the donut hole in Medicare?

In fact, it has a big hole in it. The so-called donut hole is a coverage gap that occurs after you and Medicare have spent a certain amount of money on your prescription medications.

What is the maximum deductible for 2021?

A deductible is the amount of money you spend out-of-pocket before your prescription drug benefits begin. Your plan may or may not have a deductible. The maximum deductible a plan can charge for 2021 is set at $445, 2 an increase of $10 from 2020.

How much does a generic cost for Part D?

For a generic drug, you will pay $25 and your Part D plan will pay $75. In all Part D plans in 2020, after you've paid $6,550 in out-of-pocket costs for covered medications, you leave the donut hole and reach catastrophic coverage, where you will pay only $3.70 for generic drugs and $9.20 for brand-name medications each month or 5% the cost ...

What is NBBP in Medicare?

The NBBP is a value used to calculate how much you owe in Part D penalties if you sign up late for benefits. Your best bet is to avoid Part D penalties altogether, so be sure to use this handy Medicare calendar to enroll on time.

How much will a generic drug cost in 2020?

The remaining costs will be paid by the pharmaceutical manufacturer and your Part D plan. 6 . For example, if a brand-name drug costs $100, you will pay $25, the manufacturer $50, and your drug plan $25. For a generic drug, you will pay $25 and your Part D plan will pay $75. In all Part D plans in 2020, after you've paid $6,550 in out-of-pocket ...

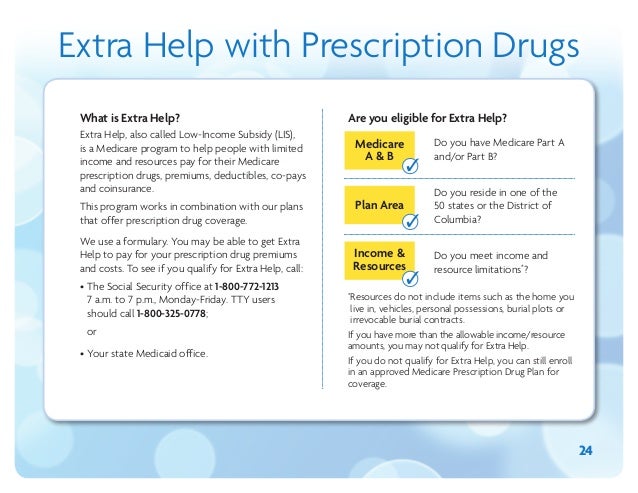

What are some examples of documents you can send to Medicare?

Examples of documents you can send your plan include: A purple notice from Medicare that says you automatically qualify for Extra Help. A yellow or green automatic enrollment notice from Medicare. An Extra Help "Notice of Award" from Social Security. An orange notice from Medicare that says your copayment amount will change next year.

How long does Medicaid pay for stay?

Or, a copy of a state document showing Medicaid paid for your stay for at least a month. A print-out from your state’s Medicaid system showing you lived in the institution for at least a month. A document from your state that shows you have Medicaid and are getting home- and community-based services.

How much does a prescription cost for 2021?

Make sure you pay no more than the LIS drug coverage cost limit. In 2021, prescription costs are no more than $3.70 for each generic/$9.20 for each brand-name covered drug for those enrolled in the program. Contact Medicare so we can get confirmation that you qualify, if it's available.

What is an orange notice from Medicare?

An orange notice from Medicare that says your copayment amount will change next year. If you have. Supplemental Security Income (Ssi) A monthly benefit paid by Social Security to people with limited income and resources who are disabled, blind, or age 65 or older.