When will my Medicare Bill arrive?

Medicare bills usually arrive on or around the 10th day of the month. The bill will list the dates for which a person is paying, which is usually a 1-month period for Part A and Part D but a 3-month period for Part B. Medicare must receive payment by the 25th day of the month.

How long does it take to get a Medicare premium Bill?

The bill will list the dates for which a person is paying, which is usually a 1-month period for Part A and Part D but a 3-month period for Part B. Medicare must receive payment by the 25th day of the month. A Medicare premium bill tells a person how much to pay for parts A, B, and D, or for all three.

How long do you have to sign up for Medicare?

You also have 8 months to sign up after you or your spouse (or your family member if you’re disabled) stop working or you lose group health plan coverage (whichever happens first). Temporary coverage available in certain situations if you lose job-based coverage. or other coverage that’s not Medicare.

How long do I have to submit my medical bills to insurance?

This varies by insurance company (and often from policy to policy) but is often set at 365 days from time of service. I’m other words, if you went to the doctor on June 1st. This means you have 365 days in order to submit the charges to your insurance company for processing.

Can Medicare be billed retroactively?

The new rules from the Centers for Medicare and Medicaid Services (CMS), effective April 1, cut from 27 months to 30 days the window in which physicians can back-bill for services after successful enrollment or re-enrollment in Medicare.

What is the timely filing limit for Medicare secondary claims?

12 monthsQuestion: What is the filing limit for Medicare Secondary Payer (MSP) claims? Answer: The timely filing requirement for primary or secondary claims is one calendar year (12 months) from the date of service.

What date does Medicare consider date of service?

The date of service for the Certification is the date the physician completes and signs the plan of care. The date of the Recertification is the date the physician completes the review. For more information, see the Medicare Claims Processing Manual, Chapter 12, Section 180.1.

What is timely filing limit?

In medical billing, a timely filing limit is the timeframe within which a claim must be submitted to a payer. Different payers will have different timely filing limits; some payers allow 90 days for a claim to be filed, while others will allow as much as a year.

How do I bill Medicare Secondary?

When Medicare is the secondary payer, submit the claim first to the primary insurer. The primary insurer must process the claim in accordance with the coverage provisions of its contract.

How do I submit Medicare secondary payer claims?

Medicare Secondary Payer (MSP) claims can be submitted electronically to Novitas Solutions via your billing service/clearinghouse, directly through a Secure File Transfer Protocol (SFTP) connection, or via Novitasphere portal's batch claim submission.

What is retroactive Medicare entitlement?

(3) Retroactive Medicare entitlement involving State Medicaid Agencies, where a State Medicaid Agency recoups payment from a provider or supplier 6 months or more after the date the service was furnished to a dually eligible beneficiary.

Does insurance pay based on date of service?

It is recorded for billing purposes and as an item in a patient's medical record. It also matters for insurance purposes, since health insurers base their reimbursement or payment on the date of service, along with other billing factors.

What does the date of service mean?

Date of Service means the date on which the client receives medical services or items, unless otherwise specified in the appropriate provider rules.

What is the timely filing limit for United healthcare claims?

within 90 daysYou must file the claim in a format that contains all of the information we require, as described below. You should submit a request for payment of Benefits within 90 days after the date of service.

What is COB in medical billing?

Insurance Term - Coordination of Benefits (COB) This is a provision in the contract that applies when a person is covered under more than one health insurance plan. It requires that payment of benefits be coordinated by all health insurance plans to eliminate over-insurance or duplication of benefits.

What is the time limit to submit claims bill to TPA insurer?

What is the time frame for submitting the reimbursement claim documents from the date of discharge from the hospital? Claimant is required to submit reimbursement claim documents within 7 to 15 days from the date of discharge.

How long do you have to sign up for a health insurance plan?

You also have 8 months to sign up after you or your spouse (or your family member if you’re disabled) stop working or you lose group health plan coverage (whichever happens first).

When does insurance start?

Generally, coverage starts the month after you sign up.

When does Part A coverage start?

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65. (If your birthday is on the first of the month, coverage starts the month before you turn 65.)

What is a health plan?

In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How often does Medicare bill come?

A Medicare bill will tell a person if their payments are late. There are usually three billing attempts: First bill: This bill comes every month if a person is paying on time (or every 3 months for those who just pay for Part B). Medicare must receive payment on or before the due date. Second bill: If Medicare does not receive payment from ...

When does Medicare bill arrive?

Medicare bills usually arrive on or around the 10th day of the month. The bill will list the dates for which a person is paying, which is usually a 1-month period for Part A and Part D but a 3-month period for Part B. Medicare must receive payment by the 25th day of the month. A Medicare premium bill tells a person how much to pay for parts A, B, ...

What does Medicare premium bill tell you?

A Medicare premium bill tells a person how much to pay for parts A, B, and D, or for all three.

What happens if Medicare does not pay the first bill?

Second bill: If Medicare does not receive payment from the first bill, a person will receive a second bill to pay in full by the specified due date.

How long does it take for Medicare to process a debit card payment?

When payments come from checking or savings accounts, it can take up to 5 business days to process them.

How long does it take to get a Medicare statement?

A person should mail their completed form to the Medicare Premium Collection Center. Completion of the sign-up process takes about 6–8 weeks. After a person has successfully registered for Medicare Easy Pay, they will receive a Medicare statement that includes the text, “This is not a bill.”.

What happens after a person completes a Medicare payment?

After a person has completed their payment, they will receive a reference number for their records, and the credit card, debit card, or bank statement will show a transaction to “CMS Medicare.”

How long does it take for Medicare to process a claim?

The MAC evaluates (or adjudicates) each claim sent to Medicare, and processes the claim. This process usually takes around 30 days .

What information does Medicare use for billing?

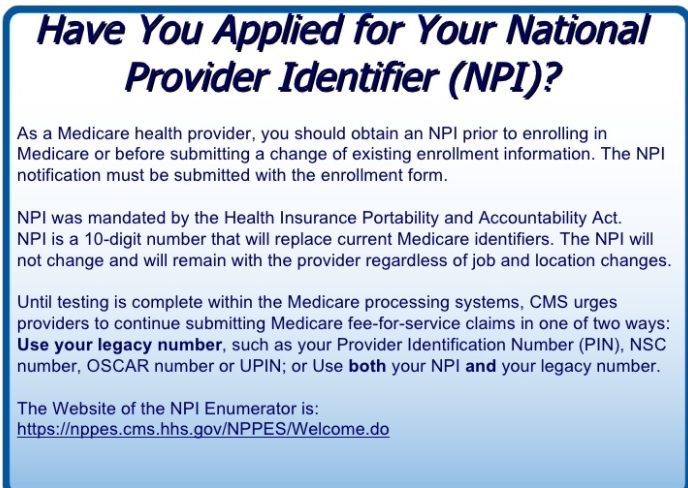

When billing for traditional Medicare (Parts A and B), billers will follow the same protocol as for private, third-party payers, and input patient information, NPI numbers, procedure codes, diagnosis codes, price, and Place of Service codes. We can get almost all of this information from the superbill, which comes from the medical coder.

What is 3.06 Medicare?

3.06: Medicare, Medicaid and Billing. Like billing to a private third-party payer, billers must send claims to Medicare and Medicaid. These claims are very similar to the claims you’d send to a private third-party payer, with a few notable exceptions.

What form do you need to bill Medicare?

If a biller has to use manual forms to bill Medicare, a few complications can arise. For instance, billing for Part A requires a UB-04 form (which is also known as a CMS-1450). Part B, on the other hand, requires a CMS-1500. For the most part, however, billers will enter the proper information into a software program and then use ...

What is a medical biller?

In general, the medical biller creates claims like they would for Part A or B of Medicare or for a private, third-party payer. The claim must contain the proper information about the place of service, the NPI, the procedures performed and the diagnoses listed. The claim must also, of course, list the price of the procedures.

Is it harder to bill for medicaid or Medicare?

Billing for Medicaid. Creating claims for Medicaid can be even more difficult than creating claims for Medicare. Because Medicaid varies state-by-state, so do its regulations and billing requirements. As such, the claim forms and formats the biller must use will change by state. It’s up to the biller to check with their state’s Medicaid program ...

Can you bill Medicare for a patient with Part C?

Because Part C is actually a private insurance plan paid for, in part, by the federal government, billers are not allowed to bill Medicare for services delivered to a patient who has Part C coverage. Only those providers who are licensed to bill for Part D may bill Medicare for vaccines or prescription drugs provided under Part D.

How long can a hospitalist back bill Medicare?

The new rules from the Centers for Medicare and Medicaid Services (CMS), effective April 1, cut from 27 months to 30 days the window in which physicians can back-bill for services after successful enrollment or re-enrollment in Medicare. Most HM groups routinely allow new hospitalists to work prior to payor credentialing, ...

How long do you have to notify Medicare of changes?

Another provision of the rules states that practices must alert contractors of any changes in practice locations within 30 days, or risk expulsion from Medicare for as much as two years.

How long does Medicare benefit last after discharge?

Then, when you haven’t been in the hospital or a skilled nursing facility for at least 60 days after being discharged, the benefit period ends. Keep reading to learn more about Medicare benefit periods and how they affect the amount you’ll pay for inpatient care. Share on Pinterest.

What is Medicare benefit period?

Medicare benefit periods mostly pertain to Part A , which is the part of original Medicare that covers hospital and skilled nursing facility care. Medicare defines benefit periods to help you identify your portion of the costs. This amount is based on the length of your stay.

How much coinsurance do you pay for inpatient care?

Days 1 through 60. For the first 60 days that you’re an inpatient, you’ll pay $0 coinsurance during this benefit period. Days 61 through 90. During this period, you’ll pay a $371 daily coinsurance cost for your care. Day 91 and up. After 90 days, you’ll start to use your lifetime reserve days.

What facilities does Medicare Part A cover?

Some of the facilities that Medicare Part A benefits apply to include: hospital. acute care or inpatient rehabilitation facility. skilled nursing facility. hospice. If you have Medicare Advantage (Part C) instead of original Medicare, your benefit periods may differ from those in Medicare Part A.

How much is Medicare deductible for 2021?

Here’s what you’ll pay in 2021: Initial deductible. Your deductible during each benefit period is $1,484. After you pay this amount, Medicare starts covering the costs. Days 1 through 60.

How long does Medicare Advantage last?

Takeaway. Medicare benefit periods usually involve Part A (hospital care). A period begins with an inpatient stay and ends after you’ve been out of the facility for at least 60 days.

How long can you be out of an inpatient facility?

When you’ve been out of an inpatient facility for at least 60 days , you’ll start a new benefit period. An unlimited number of benefit periods can occur within a year and within your lifetime. Medicare Advantage policies have different rules entirely for their benefit periods and costs.

How to release information from Medicare?

Medicare does not release information from a beneficiary’s records without appropriate authorization. If you have an attorney or other representative , he or she must send the BCRC documentation that authorizes them to release information. Your attorney or other representative will receive a copy of the RAR letter and other letters from the BCRC as long as he or she has submitted a Consent to Release form. A Consent to Release (CTR) authorizes an individual or entity to receive certain information from the BCRC for a limited period of time. With that form on file, your attorney or other representative will also be sent a copy of the Conditional Payment Letter (CPL) and demand letter. If your attorney or other representative wants to enter into additional discussions with any of Medicare’s entities, you will need to submit a Proof of Representation document. A Proof of Representation (POR) authorizes an individual or entity (including an attorney) to act on your behalf. Note: In some special circumstances, the potential third-party payer can submit Proof of Representation giving the third-party payer permission to enter into discussions with Medicare’s entities. If potential third-party payers submit a Consent to Release form, executed by the beneficiary, they too will receive CPLs and the demand letter. It is in the best interest of both sides to have the most accurate information available regarding the amount owed to the BCRC. Please see the following documents in the Downloads section at the bottom of this page for additional information: POR vs. CTR, Proof of Representation Model Language and Consent to Release Model Language.

What happens if a BCRC determines that another insurance is primary to Medicare?

If the BCRC determines that the other insurance is primary to Medicare, they will create an MSP occurrence and post it to Medicare’s records. If the MSP occurrence is related to an NGHP, the BCRC uses that information as well as information from CMS’ systems to identify and recover Medicare payments that should have been paid by another entity as primary payer.

How to remove CPL from Medicare?

If you or your attorney or other representative believe that any claims included on CPL/PSF or CPN should be removed from Medicare's interim conditional payment amount, documentation supporting that position must be sent to the BCRC. This process can be handled via mail, fax, or the MSPRP. Click the MSPRP link for details on how to access the MSPRP. The BCRC will adjust the conditional payment amount to account for any claims it agrees are not related to the case.

How long does it take for a BCRC to send a CPL?

Within 65 days of the issuance of the RAR Letter, the BCRC will send the CPL and Payment Summary Form (PSF). The PSF lists all items or services that Medicare has paid conditionally which the BCRC has identified as being related to the pending case.

What is conditional payment in Medicare?

A conditional payment is a payment Medicare makes for services another payer may be responsible for.

Why is Medicare conditional?

Medicare makes this conditional payment so you will not have to use your own money to pay the bill. The payment is "conditional" because it must be repaid to Medicare when a settlement, judgment, award, or other payment is made.

What is a POR in Medicare?

A Proof of Representation (POR) authorizes an individual or entity (including an attorney) to act on your behalf. Note: In some special circumstances, the potential third-party payer can submit Proof of Representation giving the third-party payer permission to enter into discussions with Medicare’s entities.

When do hospitals report Medicare Part A retirement?

When a beneficiary cannot recall his/her retirement date, but knows it occurred prior to his/her Medicare entitlement dates, as shown on his/her Medicare card, hospitals report his/her Medicare Part A entitlement date as the date of retirement. If the beneficiary is a dependent under his/her spouse's group health insurance and the spouse retired prior to the beneficiary's Medicare Part A entitlement date, hospitals report the beneficiary's Medicare entitlement date as his/her retirement date. If the beneficiary worked beyond his/her Medicare Part A entitlement date, had coverage under a group health plan during that time, and cannot recall his/her precise date of retirement but the hospital determines it has been at least five years since the beneficiary retired, the hospital enters the retirement date as five years retrospective to the date of admission. (Example: Hospitals report the retirement date as January 4, 1998, if the date of admission is January 4, 2003)

How to determine primary payer for Medicare?

The CMS Questionnaire should be used to determine the primary payer of the beneficiary’s claims. This questionnaire consists of six parts and lists questions to ask Medicare beneficiaries. For institutional providers, ask these questions during each inpatient or outpatient admission, with the exception of policies regarding Hospital Reference Lab Services, Recurring Outpatient Services, and Medicare+Choice Organization members. (Further information regarding these policies can be found in Chapter 3 of the MSP Online Manual.) Use this questionnaire as a guide to help identify other payers that may be primary to Medicare. Beginning with Part 1, ask the patient each question in sequence. Comply with all instructions that follow an answer. If the instructions direct you to go to another part, have the patient answer, in sequence, each question under the new part. Note: There may be situations where more than one insurer is primary to Medicare (e.g., Black Lung Program and Group Health Plan). Be sure to identify all possible insurers.

Why did CMS develop an operational policy?

CMS developed an operational policy to help alleviate a major concern that hospitals have had regarding completion of the CMS Questionnaire.

Does Medicare pay for black lung?

Federal Black Lung Benefits - Medicare does not pay for services covered under the Federal Black Lung Program. However, if a Medicare-eligible patient has an illness or injury not related to black lung, the patient may submit a claim to Medicare. For further information, contact the Federal Black Lung Program at 1-800-638-7072.

Does Medicare pay for the same services as the VA?

Veteran’s Administration (VA) Benefits - Medicare does not pay for the same services covered by VA benefits.

Does no fault insurance cover medical expenses?

Treated for an illness or injury caused by an accident, and liability and/or no-fault insurance will cover the medical expenses as the primary payer.

Is Medicare a primary or secondary payer?

Providers must determine if Medicare is the primary or secondary payer; therefore, the beneficiary must be queried about other possible coverage that may be primary to Medicare. Failure to maintain a system of identifying other payers is viewed as a violation of the provider agreement with Medicare.