How much does Medicare pay for a nursing home stay?

How Long Will Medicare pay for you to be in a nursing home? Medicare pays up to 100 days of skilled nursing facility (SNF) care each benefit period in a skilled nursing facility. If you require skilled nursing facility care for more than 100 days within a benefit period, you will be required to pay out of pocket.

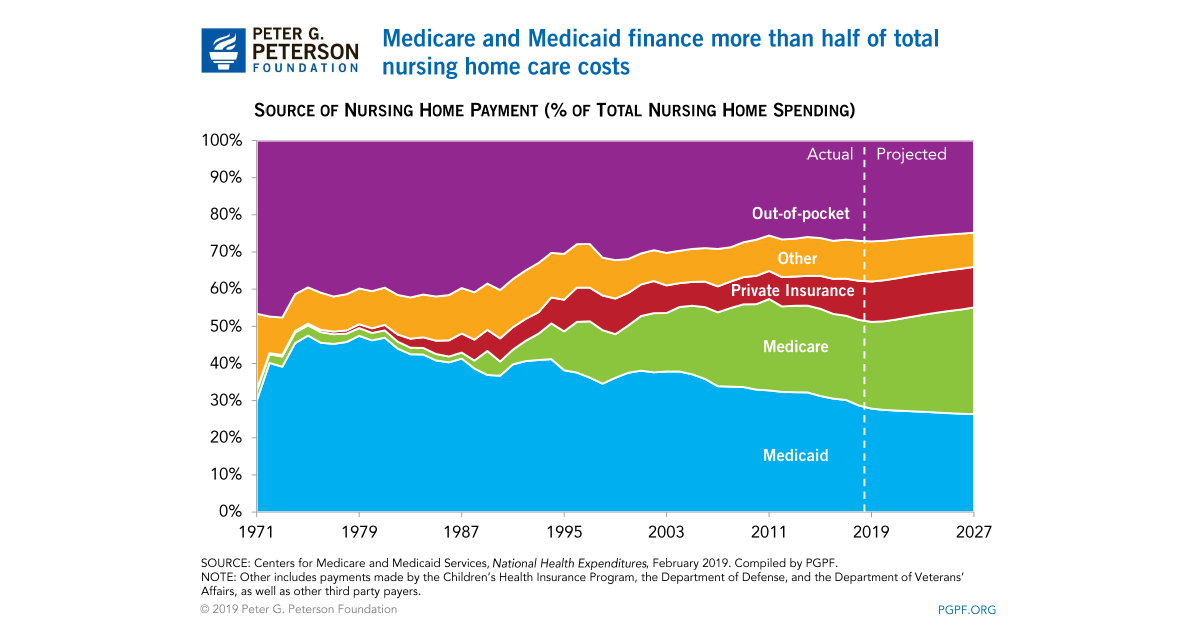

Does Medicaid pay for nursing home care?

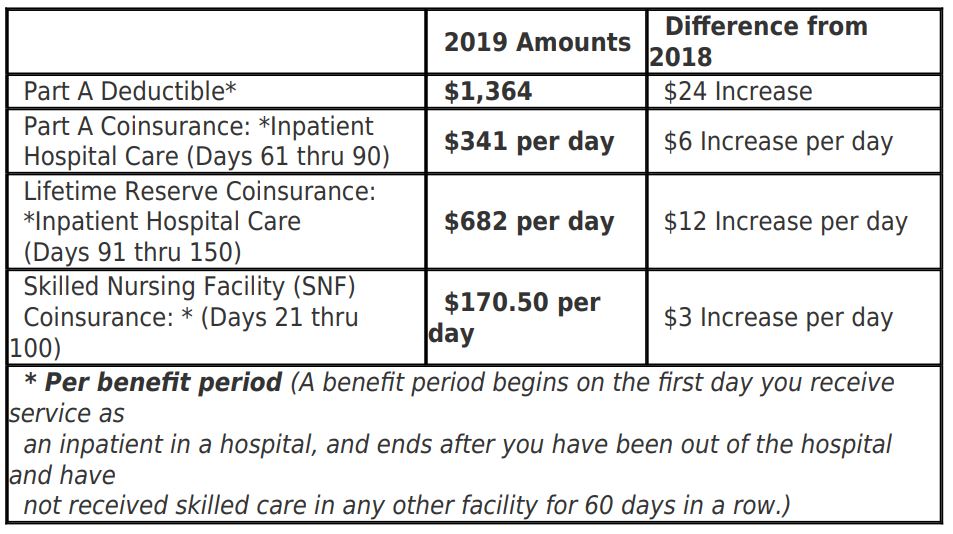

Jun 12, 2019 · There are costs for a covered stay in a skilled nursing facility (nursing home). In 2019, you pay no coinsurance for days 1 through 20, $170.50 per day for days 21 through 100, and all nursing home costs for your care after the 100th day. Medicare does not, however, pay any nursing home costs for long-term care or custodial care.

Does Medicare cover skilled nursing home care?

Apr 05, 2021 · Medicare Part A and Part B cover skilled nursing facility stays of up to 100 days for older people who require care from people with medical skills, such as sterile bandage changes. Medicare does...

How long can you stay in a nursing home on Medicaid?

6 Section 1: The Basics How much is covered by Original Medicare? For days 1–20, Medicare pays the full cost for covered services. You pay nothing. For days 21–100, Medicare pays all but a daily coinsurance for covered services. You pay a daily coinsurance. For days beyond 100, Medicare pays nothing.

What happens when you run out of Medicare days?

Medicare will stop paying for your inpatient-related hospital costs (such as room and board) if you run out of days during your benefit period. To be eligible for a new benefit period, and additional days of inpatient coverage, you must remain out of the hospital or SNF for 60 days in a row.

How Long Will Medicare pay for confinement in a skilled nursing facility?

100 daysMedicare covers care in a SNF up to 100 days in a benefit period if you continue to meet Medicare's requirements.

Do Medicare SNF days reset?

Your benefits will reset 60 days after not using facility-based coverage. This question is basically pertaining to nursing care in a skilled nursing facility. Medicare will only cover up to 100 days in a nursing home, but there are certain criteria's that needs to be met first.

How many days of rehab does Medicare cover?

100 daysMedicare will pay for inpatient rehab for up to 100 days in each benefit period, as long as you have been in a hospital for at least three days prior. A benefit period starts when you go into the hospital and ends when you have not received any hospital care or skilled nursing care for 60 days.Sep 13, 2018

Can Medicare lifetime reserve days be used for SNF?

The lifetime reserve days do not apply to stays at skilled nursing facilities and stays at psychiatric hospitals.Jul 22, 2020

Do Medicare days reset every year?

Yes, Medicare's deductible resets every calendar year on January 1st. There's a possibility your Part A and/or Part B deductible will increase each year. The government determines if Medicare deductibles will either rise or stay the same annually.

What is the difference between skilled nursing and long term care?

Once they are deemed strong enough and stable, most patients leave a skilled nursing facility to go home or into assisted living. Long-term care facilities are often part of a skilled facility. They are for patients that require hands on care and supervision 24 hours a day but may not require skilled care.Apr 22, 2018

Does Medicare start over each year?

By definition, these are the only reserve days Medicare will give you in your lifetime. They are not renewed each year. After you exhaust your lifetime reserve days, you will pay all out-of-pocket costs.Nov 22, 2021

What Nursing Home Care Does Medicare Cover?

Nursing home care can be broken into two broad categories: Custodial care and skilled nursing care.Custodial careCustodial care is help with daily...

What Nursing Home Care Expenses Will Original Medicare Cover?

If you qualify, then Original Medicare may cover expenses related to your nursing home care in a skilled nursing facility for the first 100 days as...

How Can Medicare Supplement Insurance Plans Help With Nursing Home Care Expenses?

A Medicare Supplement Insurance policy offered by a private company may help you pay for certain Medicare out-of-pocket costs, such as copayments,...

How Can Medicare Advantage Plans Help With Nursing Home Care Expenses?

Some people choose to get their Medicare benefits through Medicare Advantage plans, an alternative way to receive Original Medicare (Part A and Par...

Where Can I Get Help With Nursing Home Care Expenses?

If you need long-term nursing home care after Medicare coverage expires, your state may be able to help you through the Medicaid program. To see if...

How long does Medicare cover nursing home care?

What parts of nursing home care does Medicare cover? Medicare covers up to 100 days at a skilled nursing facility. Medicare Part A and Part B cover skilled nursing facility stays of up to 100 days for older people who require care from people with medical skills, such as sterile bandage changes.

What is covered by Medicare Advantage?

Some of the specific things covered by Medicare include: A semiprivate room. Meals. Skilled nursing care. Physical and occupational therapy. Medical social services. Medications. Medical supplies and equipment. However, if you have a Medicare Advantage Plan, it’s possible that the plan covers nursing home care.

What is hospital related condition?

A hospital-related condition treated during your inpatient stay, even if it wasn’t the reason you were first admitted. A condition that started while you were already getting care in a skilled nursing facility for a hospital-related condition.

How many days do you have to be in hospital to qualify for Medicare?

Having days left in your benefit period. Having a qualifying hospital stay of three inpatient days. Your doctor determining that you need daily skilled care.

How much does a nursing home cost?

On average, annual costs for nursing homes fall between $90,000 and $110,000, depending on whether you have a private or semi-private room. This can burn through your personal funds surprisingly quickly. It’s best to pair your personal funds with other financial aid to help you afford nursing home care.

How long does functional mobility insurance last?

Most policies will also require you to pay out of pocket for a predetermined amount of time, usually between 30 and 90 days, before coverage kicks in.

Is nursing home care a guarantee?

Even though needing nursing home care is not a guarantee, it’s important to plan for, just in case. While Medicare doesn’t offer a lot of support for long-term stays in nursing facilities, other options are available, depending on your history, financial situation and other qualifications.

Does Type A Medicare Cover The Cost Of A Nursing Home?

Part A of Medicare covers acute care in an SNF for up to 100 days for most people in an SNF. the individual is well cared for every day while recovering.

Does Medicare Ever Pay For In Home Care?

A healthcare provider certified by Medicare must be in order to provide the services covered, and one of the over 11,000 agencies certified by Medicare covering the area is essential for offering the services. This means the Medicare program can pay for home health care at a rate up to 60 days in advance.

Does Medicare Cover Full Time Nursing Care?

The cost of long-term care isn’t covered by Medicare or most health insurance plans. Stays at an assisted living facility. The hospital, doctor services, and medical supplies you need at your nursing home will need Medicare regardless of whether or not there is Medicare coverage for your care.

How Much Does Medicare Pay For Nursing Care?

During the first 20 days, Medicare will cover most of the cost associated with dining, nursing care, room, and other expenses – including meals. There are copays for 7 days, then another copay for 7 days, then another copay on the 21 days you go through. There will be 50 in 2019.

What Type Of Long-Term Care Bill Will Medicare Pay For?

While living in a skilled nursing home after a three-day hospital stay, Medicare can be paid for. After 20 days, Medicare will pick up the total costs of skilled nursing, bringing you $185 per month. Coinsurance will be 50 coinsurance per day in 2021. The Medicare program will no longer cover Medicare after 100 days.

What Does Type A Medicare Cover?

Part A of Medicare is what it sounds like. Hospital insurance is covered by Medicare Part A. Providers of inpatient hospital services, skilled nursing care, hospice care, and limited home health care services are provided through Part A. Paying a deductible and coinsurance participate copays and/or copayments is how insurance plans usually operate.

Does Medicare Cover The First 100 Days In A Nursing Home?

When Medicare satisfies the requirements, its coverage for care in a SNF up to 100 days includes a benefit period.

What type of insurance covers long term care?

Long-term care insurance. This type of insurance policy can help pay for many types of long-term care, including both skilled and non-skilled care. Long -term care insurance can vary widely. Some policies may cover only nursing home care, while others may include coverage for a range of services, like adult day care, assisted living, ...

How to find out if you have long term care insurance?

If you have long-term care insurance, check your policy or call the insurance company to find out if the care you need is covered. If you're shopping for long-term care insurance, find out which types of long-term care services and facilities the different policies cover.

Does Medicare cover nursing home care?

Medicare generally doesn't cover Long-term care stays in a nursing home. Even if Medicare doesn’t cover your nursing home care, you’ll still need Medicare for hospital care, doctor services, and medical supplies while you’re in the nursing home.

Do nursing homes accept Medicaid?

Most, but not all, nursing homes accept Medicaid payment. Even if you pay out-of-pocket or with long-term care insurance, you may eventually "spend down" your assets while you’re at the nursing home, so it’s good to know if the nursing home you chose will accept Medicaid. Medicaid programs vary from state to state.

Can federal employees buy long term care insurance?

Federal employees, members of the uniformed services, retirees, their spouses, and other qualified relatives may be able to buy long-term care insurance at discounted group rates. Get more information about long-term care insurance for federal employees.

How much does nursing home care cost?

Nursing home care can cost tens of thousands of dollars per year for basic care, but some nursing homes that provide intensive care can easily cost over $100,000 per year or more. How Much Does Medicare Pay for Nursing Home Care?

How long does Medicare cover you?

If you have Original Medicare, you are fully covered for a stay up to 20 days. After the 20th day, you will be responsible for a co-insurance payment for each day at a rate of $176 per day. Once you have reached 100 days, the cost of care for each day after is your responsibility and Medicare provides no coverage.

Can Medicare recipients get discounts on at home care?

At-Home Care as an Alternative. Some Medicare recipients may also qualify for discounts on at-home care provided by a nursing service. These providers often allow seniors to stay in their own homes while still receiving routine monitoring and basic care from a nurse who visits on a schedule.

Do skilled nursing facilities have to be approved by Medicare?

In order to qualify for coverage in a skilled nursing facility, the stay must be medically necessary and ordered by a doctor. The facility will also need to be a qualified Medicare provider that has been approved by the program.

Do you have to have Medicare to be a skilled nursing facility?

In addition, you must have Medicare Part A coverage to receive care in a residential medical facility. The facility must qualify as a skilled nursing facility, meaning once again that traditional residential nursing homes are not covered.

Is Medicare good or bad for seniors?

For seniors and qualifying individuals with Medicare benefits, there’s some good news and some bad news. While Medicare benefits do help recipients with the cost of routine doctor visits, hospital bills and prescription drugs, the program is limited in its coverage of nursing home care.

How long does Medicare cover SNF?

After day 100 of an inpatient SNF stay, you are responsible for all costs. Medicare Part A will also cover 90 days of inpatient hospital rehab with some coinsurance costs after you meet your Part A deductible. Beginning on day 91, you will begin to tap into your “lifetime reserve days.".

How long does rehab last in a skilled nursing facility?

When you enter a skilled nursing facility, your stay (including any rehab services) will typically be covered in full for the first 20 days of each benefit period (after you meet your Medicare Part A deductible). Days 21 to 100 of your stay will require a coinsurance ...

How much is Medicare Part A deductible for 2021?

In 2021, the Medicare Part A deductible is $1,484 per benefit period. A benefit period begins the day you are admitted to the hospital. Once you have reached the deductible, Medicare will then cover your stay in full for the first 60 days. You could potentially experience more than one benefit period in a year.

How much is coinsurance for inpatient care in 2021?

If you continue receiving inpatient care after 60 days, you will be responsible for a coinsurance payment of $371 per day (in 2021) until day 90. Beginning on day 91, you will begin to tap into your “lifetime reserve days,” for which a daily coinsurance of $742 is required in 2021. You have a total of 60 lifetime reserve days.

What day do you get your lifetime reserve days?

Beginning on day 91 , you will begin to tap into your “lifetime reserve days.". You may have to undergo some rehab in a hospital after a surgery, injury, stroke or other medical event. The rehab may take place in a designated section of a hospital or in a stand-alone rehabilitation facility. Medicare Part A provides coverage for inpatient care ...

How long do you have to be out of the hospital to get a deductible?

When you have been out of the hospital for 60 days in a row, your benefit period ends and your Part A deductible will reset the next time you are admitted.

Does Medicare cover rehab?

Learn how inpatient and outpatient rehab and therapy can be covered by Medicare. Medicare Part A (inpatient hospital insurance) and Part B (medical insurance) may both cover certain rehabilitation services in different ways.

How to apply for medicaid for nursing home?

First, the applicant applies for Medicaid, which they can do online or at any state Medicaid office.

How many states have Medicaid eligibility for nursing home care?

Medicaid Eligibility for Nursing Home Care. To be eligible for nursing home care, all 50 states have financial eligibility criteria and level of care criteria. The financial eligibility criteria consist of income limits and countable assets limits. These limits change annually, change with marital status, and change depending on one’s state ...

Why do nursing homes prefer private pay?

The reason for this is because private pay residents pay approximately 25% more for nursing home care than Medicaid pays.

How much will Medicaid pay in 2021?

In 2021, the nationwide average private payer pays $255 per day for nursing home care while Medicaid pays approximately $206 per day. Being Medicaid eligible and finding a Medicaid nursing home is often not enough to move a loved one in. Read about how to get into a nursing home .

What is a short term nursing home?

Short-term nursing homes are commonly called convalescent homes and these are meant for rehabilitation not long term care. Be aware that different states may use different names for their Medicaid programs. In California, it is called Medi-Cal. Other examples include Tennessee (TennCare), Massachusetts (MassHealth), and Connecticut (HUSKY Health).

What is a trustee in Medicaid?

A trustee is named to manage the account and funds can only be used for very specific purposes, such as contributing towards the cost of nursing home care. Assets. In all states, persons can “spend down” their assets that are over Medicaid’s limit. However, one needs to exercise caution when doing so.

Can a married couple get Medicaid for nursing home?

Note for Married Couples – While a single nursing home Medicaid beneficiary must give Medicaid almost all their income for nursing home care, this is not always the case for married couples in which only one spouse needs Medicaid-funded nursing home care.