How long do you have to pay Medicare Part a deductible?

Mar 07, 2022 · How much money can you have in the bank to qualify for Medicare? Specified Low-Income Medicare Beneficiary (SLMB) Program A single person can qualify in 2021 with an income up to $1,308 per month. A couple can qualify with a combined income of $1,762 per month. The asset limits are $7,970 for an individual and $11,960 for a couple.

Does Medicare cover long-term care?

Dec 01, 2019 · Medicare, as a rule, does not cover long-term care settings. So, Medicare in general presents no challenge to your clear home title. Most people in care settings pay for care themselves. After a while, some deplete their liquid assets and qualify for Medicaid assistance. ... Many baby boomers find senior condo properties or co-op initiatives ...

How does Medicare cover hospital stays?

Can Medicare Be Taken Away? Common Questions. Losing Your Medicare Coverage. There are different rules about how you can lose Medicare coverage, depending on what type of plan you have. ... as long as you have not recovered from your initial qualifying disability. Contact your local SSA office to find out more information regarding your ...

What happens to my Medicare insurance when I move?

Mar 01, 2022 · Can Medicare Take A Property? Posted at 08:22h in Properties by Carolyn 0 Comments. 0 Likes. Long-term care settings are not covered by Medicare as a general rule. With Medicare, you cannot be challenged for your clear title of your residence in most cases. The state generally cannot take your home if there’s a possibility that you’ll ...

How do I avoid MassHealth estate recovery?

Can medical take your house?

How do I avoid Medicaid estate recovery in Ohio?

What is the 60 day rule for Medicare?

Can Medi-Cal take your inheritance?

Can Medicaid Take your home after death?

Can Ohio Medicaid take your house?

How long does Medicaid have to file a claim against an estate in Ohio?

How do I protect my assets from Medicaid in Ohio?

A common strategy to protect your assets from spend down is to use an Irrevocable Medicaid Trust. This is a special type of trust where a trustee of your choosing will hold your title to your assets in this trust, and you remain the income beneficiary of the trust.Apr 23, 2020

What happens when you run out of Medicare days?

What is the maximum number of days of inpatient care that Medicare will pay for?

Does Medicare cover ICU costs?

What happens if you let someone else use your Medicare card?

If you let someone else use your Medicare card in order to obtain services, or if you attempt to defraud Medicare in any other way, your coverage would likely be taken away from you.

Does moving affect Medicare?

Because Medicare Part A and Part B (Original Medicare) do not have provider networks or service areas within the United States, moving should not affect your enrollment in either. Original Medicare is accepted by any medical provider who accepts Medicare. If you lose your Medicare coverage because you relocate, ...

Is Medicare Advantage a private insurance?

Medicare Advantage plans (Part C), Medicare Part D prescription drug plans and Medicare Supplement Insurance plans (Medigap) are provided by private insurance companies. They are not provided by the federal government like Medicare Part A and Part B (Original Medicare). The eligibility rules for private plans can be different than ...

What happens if you don't pay Medicare?

If you do not pay by the deadline indicated on the Second Notice, you will receive a Delinquent Notice.

What is disruptive behavior?

The definition of disruptive behavior could vary depending on your plan provider, but it generally means engaging in any type of behavior that impairs the insurers ability to arrange for or provide care for you or other plan members.

Can Medicaid take my home?

A Simple Answer: As long as either the Medicaid beneficiary or his / her spouse lives in the home, Medicaid cannot take the home or force a sale. However, there are many complexities and nuances.

Does estate recovery apply to Medicaid?

To be very clear, estate recovery does not apply when a Medicaid recipient is still living. It only applies when he/she passes away and is unmarried. Said another way, if a Medicaid applicant dies and still has a living spouse, Medicaid cannot attempt to recover long-term care costs.

What is MERP in Medicaid?

All 50 states and the District of Columbia have Medicaid Estate Recovery Programs (abbreviated as MERP or MER). These programs used to be optional, but became mandatory with the passing of the Omnibus Budget Reconciliation Act of 1993. Following the death of a Medicaid recipient, MERPs attempt to be reimbursed the funds in which the state paid for long-term care for that individual. (This can be for in-home care, community based care, such as adult day care and assisted living services, or nursing home care. Please note that with the exception of nursing home care, if the deceased Medicaid recipient was not 55+ years old, he/she is exempt from MERP. Being exempt means the state will not attempt to recover funds paid for long-term care Medicaid.)

Can Medicaid be recovered after death?

After the death of a Medicaid recipient, the state will try to recover the cost of long-term care for which it paid through a home sale. However, the state cannot do this if the deceased has a child that is disabled, blind, or under 21 years of age.

Can a spouse move into a nursing home?

Married and one spouse moving to a nursing home. When your spouse moves into a Medicaid funded nursing home, you are considered the community spouse, and as such, you are entitled to keep your home. This holds true regardless of the equity value in your home.

What is long term care partnership?

Long Term Care Partnership Programs help protect all, or a portion, of a Medicaid applicant’s assets from Medicaid’s asset limit, as well as from Medicaid estate recovery. Partnership Programs are a collaboration between a private insurance company that sells long term care partnership policies and a state’s Medicaid program. Essentially, the same dollar amount that a long term care insurance policy pays out for the policyholder’s long term care is “protected” from Medicaid’s asset limit and from estate recovery.

Can you transfer a home to an adult child?

In most cases, the home cannot be transferred to an adult child without jeopardizing one’s eligibility for Medicaid. (Medicaid has a look back period that if one is found to have violated by gifting assets or selling them for less than they are worth, a period of Medicaid ineligibility will result). However, there is one exception known as the caregiver child exemption or caretaker child exception. This rule allows a parent to transfer his/her home to his/her adult child under the following circumstances without violating the look back period. First, the adult child must have lived with his/her parent at least two years prior to the parent moving to a nursing home or assisted living facility paid for by Medicaid. (Please note that it is care services Medicaid pays for in assisted living, not room and board). Second, the adult child must have provided care that delayed the necessity of the parent moving out of the home and into a nursing home.

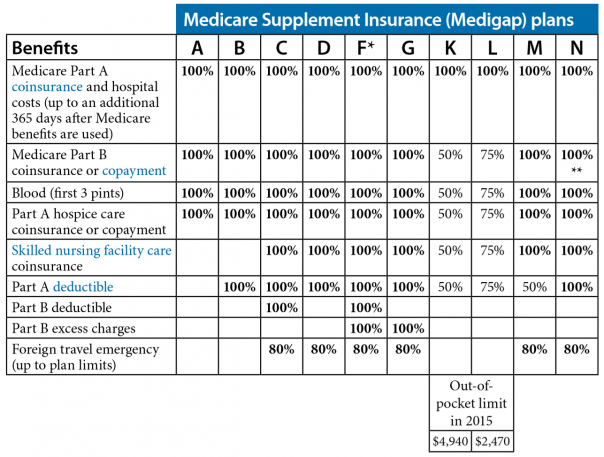

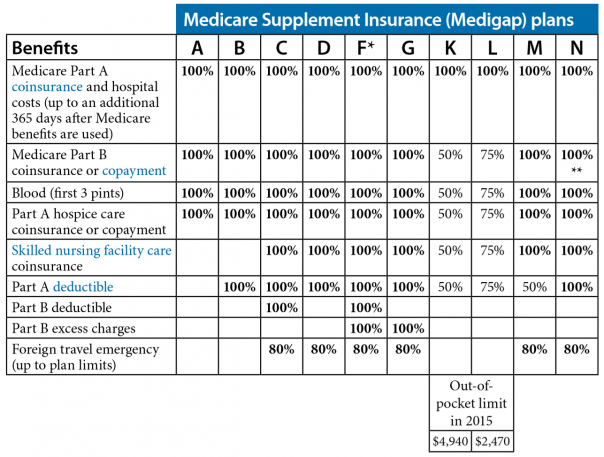

How many Medicare Supplement plans are there?

In most states, there are up to 10 different Medicare Supplement plans, standardized with lettered names (Plan A through Plan N). All Medicare Supplement plans A-N may cover your hospital stay for an additional 365 days after your Medicare benefits are used up.

Does Medicare cover hospital stays?

When it comes to hospital stays, Medicare Part A (hospital insurance) generally covers much of the care you receive: You generally have to pay the Part A deductible before Medicare starts covering your hospital stay. Some insurance plans have yearly deductibles – that means once you pay the annual deductible, your health plan may cover your medical ...

What is Medicare Part A?

When it comes to hospital stays, Medicare Part A (hospital insurance) generally covers much of the care you receive: 1 As a hospital inpatient 2 In a skilled nursing facility (SNF)

Do you have to pay a deductible for Medicare?

You generally have to pay the Part A deductible before Medicare starts covering your hospital stay. Some insurance plans have yearly deductibles – that means once you pay the annual deductible, your health plan may cover your medical services for the rest of the year. But under Medicare Part A, you need to pay the deductible once per benefit period.

How long is a benefit period?

A benefit period is a timespan that starts the day you’re admitted as an inpatient in a hospital or skilled nursing facility. It ends when you haven’t been an inpatient in either type of facility for 60 straight days. Here’s an example of how Medicare Part A might cover hospital stays and skilled nursing facility ...

Does Medicare cover SNF?

Generally, Medicare Part A may cover SNF care if you were a hospital inpatient for at least three days in a row before being moved to an SNF. Please note that just because you’re in a hospital doesn’t always mean you’re an inpatient – you need to be formally admitted.

Can you give away assets to qualify for medicaid?

Many people try to give away their assets to relatives in order to qualify for Medicaid. But when an applicant gives away property within five years of applying for Medicaid coverage of long-term care, Medicaid presumes that the gifts was made to qualify for Medicaid. This will trigger a period of ineligibility for Medicaid long-term care benefits ...

Does Medicaid pay for long term care?

While Medicaid finances most long-term care in this country, Medicaid is supposed to be "the payer of last resort" when it comes to long-term care. Medicaid pays for long-term care only for those who are poor or who have become poor after paying for medical expenses or nursing homes. Many people try to give away their assets to relatives in order ...

What are some examples of assets that can be used for Medicaid?

Some examples include household goods and personal effects, one automobile (depending upon state laws and the marital status of the applicant), certain pre-paid funeral plans, and property used for self-support, such as income-producing property or property used in a business. If all of the conditions contained in state and federal laws are met, these assets do not have to be liquidated to pay for the Medicaid applicant's long term care. For that reason, federal and state laws generally allow for the gifting of those assets to others for little or no compensation.

Is a home exempt from Medicaid?

As a general rule, a home is exempt (that is, it doesn't count toward Medicaid's asset limit and Medicaid does not require it to be sold to pay for long-term care) if all of the following conditions are met: ...

Can you gift a house to someone without penalty?

However, in most cases, the house cannot be gifted to someone without penalty (since the home exemption requires the applicant or the applicant's spouse to live in and own the house). But there are exceptions to this rule. Under federal law, when title to the applicant's home is transferred to another, this will trigger a period ...

What is a sibling in a home?

a child of the applicant who is blind or permanently and totally disabled. the sibling of the applicant who has an equity interest in the home and who has been residing in the home for a period of at least one year immediately before the date the applicant becomes institutionalized, or.

Does Medicaid pay for transfers to spouse?

Transfers to a spouse are not penalized by Medicaid because assets held in the name of either spouse are included when determining an applicant's eligibility. In other words, Medicaid does not care which spouse owns the asset. Federal law provides that there is no transfer penalty if:

Does Medicare cover nursing home care?

But Medicare provides only limited nursing home benefits and only to people who need skilled care. And most other health insurance policies (except for special “long term care” insurance) have no coverage whatsoever for nursing home care. So, if you go into a nursing home, you will need to find some way to pay for the cost of your care.

Can a nursing home be taken off Medicaid?

This means that, in most cases, a nursing home resident can keep their residence and still qualify for Medicaid to pay their nursing home expenses. The nursing home doesn’t (and cannot) take the home. Note that special rules apply if the Medicaid applicant owns a home in which he has equity of more than $536,000 (in 2013).

Can a nursing home go after a person's home?

A nursing home can’t “go after” a person’s home or other assets. The way it works is that when a person goes into a nursing home they have to find a way to pay for the cost of their care. Most seniors have Medicare. But Medicare provides only limited nursing home benefits and only to people who need skilled care.

How much does a nursing home cost in Pennsylvania?

In Pennsylvania, nursing home costs currently average around $100,000 a year. Most people in nursing homes eventually qualify for assistance from the Government Medi caid program to help pay for the care they need. Unlike Medicare, Medicaid will cover a long term stay in a nursing home. But Medicaid requires that a person only have limited income ...