What is the Medicare supplement enrollment period?

] Medicare Supplement Insurance plans can be used to pay for some of Medicare's cost-sharing requirements and sometimes services traditional Medicare doesn't cover. The Medigap enrollment period is different than the other parts of Medicare. It's a six-month period that begins when you are 65 or older and enrolled in Medicare Part B.

Is there a best time to enroll in a Medicare supplement plan?

Q: Is there a best time to enroll in a Medicare supplement plan? A: Yes. The best time to enroll is during your Medigap open enrollment period, a six-month window of time that begins on the first day of the month that you are at least 65 years old and are enrolled in Medicare Parts A and B.

What is the Medigap enrollment period?

Medicare Supplement Insurance plans can be used to pay for some of Medicare's cost-sharing requirements and sometimes services traditional Medicare doesn't cover. The Medigap enrollment period is different than the other parts of Medicare. It's a six-month period that begins when you are 65 or older and enrolled in Medicare Part B.

Can I Change my Medicare supplement plan outside of open enrollment?

Guaranteed Issue Rights You may be able to buy or change your Medicare Supplement Plan outside of your six-month Medigap Open Enrollment Period, if you have a “guaranteed issue right” – meaning an insurance company can’t refuse to sell you a Medigap policy – in the following situations:

Can Medicare Supplement be purchased anytime of the year?

If you're in good health and comfortable answering medical questions, you can apply to change Medigap plans at any time of the year. Medicare Advantage plans and Medicare Part D prescription drug plans can only be changed during certain times of year, but Medicare supplements are different.

Is it too late to get supplemental insurance?

You can apply for a Medicare Supplemental Insurance (Medigap) plan at any time during the year. If you're within the six-month open enrollment window that begins as soon as you're at least 65 and enrolled in Medicare Part B, the coverage is guaranteed issue.

Can I add Medigap later?

If you have had at least 6 months of continuous prior creditable coverage, the Medigap insurance company can't make you wait before it covers your pre-existing condition.

What is the minimum guaranteed issue period for a Medicare Supplement insurance policy?

People eligible for Medicare on or after January 1, 2020 have the right to buy Plans D and G instead of Plans C and F. You can/must apply for a Medigap policy: No later than 63 calendar days from the date your coverage ends. There may be times when more than one of the situations above applies to you.

Can I change my Medicare Supplement plan at any time?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

When can you switch from Medicare Advantage to a Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

Can you switch Medigap plans without underwriting?

During your Medigap Open Enrollment Period, you can sign up for or change Medigap plans without going through medical underwriting. This means that insurance companies cannot deny you coverage or charge you more for a policy based on your health or pre-existing conditions.

Do Medicare Supplement plans cover pre-existing conditions?

The pre-existing condition waiting period “ This means that you may have to pay all your own out-of-pocket costs for your pre-existing condition for up to six months. After the waiting period, the Medicare Supplement insurance plan may cover Medicare out-of-pocket costs relating to the pre-existing condition.

Can you change Medicare Supplement plans during the year?

Can I Change Medicare Supplement Plans During Annual Open Enrollment? Changing Medicare supplement plans often requires you to go through medical underwriting. You can change Medicare supplement plans at any time of year – but in most states you will have to pass medical underwriting to do so.

What provision allows a person to return a Medicare Supplement policy within 30 days for a full premium refund?

The free-look provision starts from the day the policy is delivered. A Medicare Supplement policy issued or delivered in Florida must contain a provision which allows the insured to return the policy or certificate within 30 days and receive a full refund.

What enrollment periods will a client not have to go through underwriting when purchasing a supplement?

Each beneficiary has a Medigap Open Enrollment Period when turning 65 and first activate their Part B. After Medigap research, you'll learn the 6-month enrollment window allows you to apply for a supplement without underwriting.

Can you have 2 Medicare Supplement plans?

Retirees can't have more than one Medicare supplement plan or one at the same time as a Medicare Advantage plan. To cut costs on health care, start by calculating whether a supplement or an Advantage plan will save you the most money.

Why is it not a good idea to have supplemental insurance?

For example, it may not cover all the expenses you expected; it may impose waiting periods before payments start; or it may contain limits based on how much you paid and for how long. It is important to understand that supplemental insurance is not regulated by the Affordable Care Act.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Who might benefit from supplemental insurance and why?

Supplemental health insurance can be an added layer of protection used to cover what a traditional health insurance plan does not. It can also help pay for nonmedical expenses that can go with illness or injury, such as lost income or childcare.

Do Medicare Supplement plans cover pre-existing conditions?

The pre-existing condition waiting period “ This means that you may have to pay all your own out-of-pocket costs for your pre-existing condition for up to six months. After the waiting period, the Medicare Supplement insurance plan may cover Medicare out-of-pocket costs relating to the pre-existing condition.

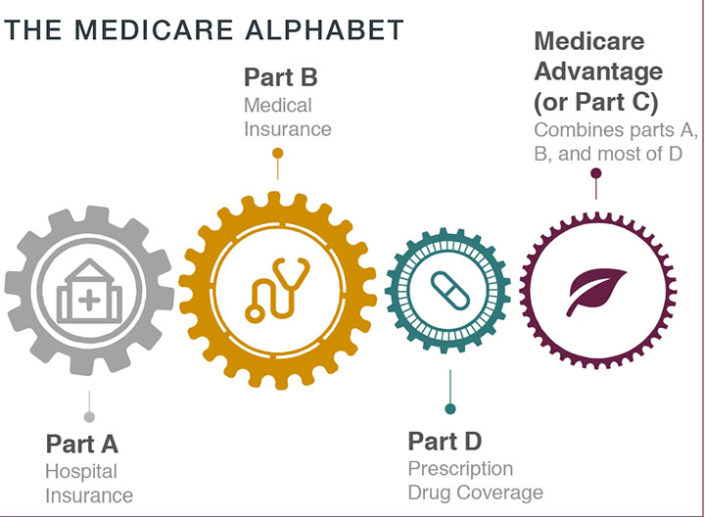

What is Medicare Supplement Plan?

A Medicare Supplement plan (also known as Medigap) is used for exactly what the name suggests — it supplements the gaps in your original Medicare coverage. This means you must have Medicare Parts A and B in order to get a Medigap plan.

How long is the Medigap enrollment period?

Medicare Supplements are no different. There is a 6-month Medigap enrollment period, during which you can enroll at any time.

How long does it take to apply for Medicare Supplement?

When to apply for a Medicare Supplement plan. Here's the quick answer: Most people should apply for a Medigap plan within six months of signing up for Part B. Medigap open enrollment begins when you sign up for Medicare Part B (at age 65) and lasts for six months. If you defer Part B coverage past age 65 because of health coverage ...

Is eligibility.com a Medicare provider?

Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.

Does Medigap guarantee issue rights?

As you can see, Medigap guaranteed issue rights are incredibly valuable. Outside your open enrollment period, there are a few other scenarios where you have these rights as well. Typically these situations apply to you when you lose your existing coverage or after you try out Medicare Advantage.

Can you keep Medicare and Medigap together?

Be sure to keep your Medicare and Medigap cards together in a safe place. Your Medigap plan will be guaranteed renewable if you apply within your window of guaranteed issue rights. Guaranteed renewable means that as long as you continue to pay your premiums, you’ll keep your plan for as long as you’d like.

When is the best time to enroll in Medicare Supplement?

The best time to enroll is during your Medigap open enrollment period, a six-month window of time that begins on the first day of the month that you are at least 65 years old and are enrolled in Medicare Parts A and B. During this period, a private insurance company ...

How long can you have continuous coverage before enrolling in Medigap?

So if you had continuous coverage for six or more months before enrolling in Medigap, you won’t have a pre-existing condition waiting period. The rules can be confusing, so don’t hesitate to talk to a representative of the Medigap insurance company for clarification.

How long does it take for Medigap to pay out of pocket?

Even if you enroll during your initial enrollment period, a private Medigap insurer may refuse (for up to six months) to pay your out-of-pocket expenses if you have a pre-existing health issue. If your pre-existing condition was diagnosed or treated within six months prior to the date your Medigap supplemental coverage was to begin, ...

What does it mean to lose a Medicare group?

Losing a group or retiree plan that has been paying secondary to Medicare. The Medigap or Medicare Advantage plan you’re on leaves Medicare or stops offering coverage in your area, or you leave the plan because they didn’t follow Medicare’s rules. You enrolled in a Medicare Advantage plan when you first became eligible for Medicare, ...

How long does it take to switch to Medicare Advantage?

You enrolled in a Medicare Advantage plan when you first became eligible for Medicare, and are utilizing your “trial right” to switch to Original Medicare within 12 months of purchasing the Medicare Advantage plan (this only applies the first time you join Medicare Advantage).

Can you be declined for Medigap after six months?

After your six-month open enrollment window, Medigap plans are medically underwritten in nearly every state, meaning that if you apply for coverage outside of your open enrollment window, you can be declined or charged more based on your medical history. (States with exceptions to this rule are discussed below).

Can a private insurance company refuse to sell a Medigap policy?

During this period, a private insurance company that offers Medigap coverage can not: refuse to sell you any Medigap policy it offers. make you wait for your coverage to take effect (except under certain circumstances); or. charge you additional fees for your coverage because of your medical history.

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

What is a select Medicare policy?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. . If you buy a Medicare SELECT policy, you have rights to change your mind within 12 months and switch to a standard Medigap policy.

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

Can you shorten the waiting period for a pre-existing condition?

It's possible to avoid or shorten waiting periods for a. pre-existing condition. A health problem you had before the date that new health coverage starts. if you buy a Medigap policy during your Medigap open enrollment period to replace ".

Can you get Medicare if you are 65?

Some states provide these rights to all people with Medicare under 65. Other states provide these rights only to people eligible for Medicare because of disability or only to people with ESRD. Check with your State Insurance Department about what rights you might have under state law.

Can you charge more for a Medigap policy?

Charge you more for a Medigap policy. In some cases, an insurance company must sell you a Medigap policy, even if you have health problems. You're guaranteed the right to buy a Medigap policy: When you're in your Medigap open enrollment period. If you have a guaranteed issue right.

How long do you have to apply for a guaranteed issue in Michigan?

You're eligible for a guaranteed issue right in a Blue Cross Blue Shield of Michigan Medicare Supplement Plan A, Plan C, Plan D, Plan F or Plan HD-F if you apply within 63 days of your employer canceling your employer group health plan. This situation does not apply to Medicare supplement Plan N, G or HD-G.

How long does it take to cancel Medicare Advantage?

The organization offering your Medicare Advantage coverage lost certification to sell the plan. You canceled your Medicare Advantage plan within 12 months of enrolling in Medicare Part A. For the following situations, you're only eligible for special enrollment for Medicare ...

Why did Medicare cancel my plan?

You canceled your Medicare Advantage plan because it violated its contract with you. You canceled your enrollment in a Medicare supplement plan and enrolled in a Medicare Advantage plan for the first time. Then, you canceled the Medicare Advantage plan within the first 12 months (applies to Plan N as well).

What is the Medicare deductible?

The Medicare deductibles, coinsurance and copays listed are based on the 2019 numbers approved by the Centers for Medicare and Medicaid Services. You can go to any hospital, doctor or other health care provider in the U.S. or its territories that accepts Medicare.

When can I enroll in Medicare Advantage Plan A?

You're automatically eligible for Plan A if you’re 65 or older. If you’re under age 65, you are eligible for Plan A if you’ve lost coverage under a group policy after becoming eligible for Medicare. You can also enroll if you had Plan A, then enrolled in a Medicare Advantage plan, and now would like to return to Plan A.

Is Blue Cross Medicare endorsed by the government?

This is a solicitation of insurance. We may contact you about buying insurance. Blue Cross Medicare Supplement plans aren't connected with or endorsed by the U.S. government or the federal Medicare program. If you're currently enrolled in Plan A or Plan C, you can stay with your plan as long as you pay your premium.

Do Medicare Supplement Plans have annual enrollment periods?

Medicare supplement plans don't have annual enrollment periods, so when you apply is very important. If you're new to Medicare or you're losing your current coverage, you may qualify for a guaranteed issue right. It's the best time for you to apply because it guarantees you'll get coverage and you may get a better price.

How to enroll in Medicare Supplement?

The Medicare enrollment period is: 1 You can initially enroll in Medicare during the seven-month period that begins three months before you turn age 65. 2 If you continue to work past age 65, sign up for Medicare within eight months of leaving the job or group health plan to avoid penalties. 3 The six-month Medicare Supplement Insurance enrollment period begins when you are 65 or older and enrolled in Medicare Part B. 4 You can make changes to your Medicare coverage during the annual open enrollment period, from Oct. 15 to Dec. 7. 5 Medicare Advantage Plan participants can switch plans from Jan. 1 to March 31 each year.

When is the Medicare Advantage open enrollment deadline?

Medicare Advantage Plan participants can switch to another Medicare Advantage Plan or drop their Medicare Advantage Plan and return to original Medicare, including purchasing a Medicare Part D plan, from Jan. 1 to March 31 each year.

How long does Medicare Part D coverage last?

Medicare Part D prescription drug coverage has the same initial enrollment period of the seven months around your 65th birthday as Medicare parts A and B, but the penalty is different. The late enrollment penalty is applied if you go 63 or more days without credible prescription drug coverage after becoming eligible for Medicare. The penalty is calculated by multiplying 1% of the "national base beneficiary premium" ($32.74 in 2020) by the number of months you didn't have prescription drug coverage after Medicare eligibility and rounding to the nearest 10 cents. This amount is added to the Medicare Part D plan you select each year. And as the national base beneficiary premium increases, your penalty also grows.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans can be used to pay for some of Medicare's cost-sharing requirements and sometimes services traditional Medicare doesn't cover. The Medicare Supplement Insurance plans' enrollment period is different than the other parts of Medicare. It's a six-month period that begins when you are 65 or older and enrolled in Medicare Part B. During this open enrollment period, private health insurance companies are required by the government to sell you a Medicare Supplement Insurance plan regardless of health conditions.

How much is the late enrollment penalty for Medicare?

The late enrollment penalty is applied if you go 63 or more days without credible prescription drug coverage after becoming eligible for Medicare. The penalty is calculated by multiplying 1% of the "national base beneficiary premium" ($32.74 in 2020) by the number of months you didn't have prescription drug coverage after Medicare eligibility ...

What happens if you don't sign up for Medicare?

If you don't sign up for Medicare during this initial enrollment period, you could be charged a late enrollment penalty for as long as you have Medicare. The Medicare enrollment period is: You can initially enroll in Medicare during the seven-month period that begins three months before you turn age 65. If you continue to work past age 65, sign up ...

How long does it take to get Medicare if you are 65?

If you continue to work past age 65, sign up for Medicare within eight months of leaving the job or group health plan to avoid penalties. The six-month Medicare Supplement Insurance enrollment period begins when you are 65 or older and enrolled in Medicare Part B. You can make changes to your Medicare coverage during the annual open enrollment ...

How long do you have to sign up for Medicare Supplement?

To receive a Medicare Supplement plan, you must apply with one of these insurers. You’ll have a six-month period around your 65th birthday when you can sign up, and your Medigap insurance company will not be able to use medical underwriting to turn you down because of health conditions.

How to get Medicare Supplement insurance?

There are three common methods: Call Social Security at 1-800-772-1213 ( Monday through Friday, 7 am to 7 pm) Visit your closest Social Security office in person. Once you are enrolled in Original Medicare, then you are eligible to enroll in a Medigap plan, which is also commonly known as Medicare Supplement insurance.

How long does it take to enroll in Medicare Part B?

The day after you turn age 65 and are enrolled in Medicare Part B, your six-month Open Enrollment Period will begin. During this period, federal law states that insurance companies cannot reject your application for any Medigap plan due to pre-existing conditions or disability; this is known as having guaranteed issue rights.

When do you enroll in Medigap?

The first step to enrolling in a Medigap plan is to register for Original Medicare, Medicare Part A, and Medicare Part B. You will be eligible for the Medicare program when you turn 65, and your coverage will begin on the first day of the month of your 65th birthday.

How long do you have to sign up for Medigap?

You don’t have to sign up during this Medigap Open Enrollment Period, but it’s the best time to do so. You are legally entitled to 30 days to review any new Medigap policy that you enroll in. If you cancel your plan within that time, then you will receive a full refund.

Does Medicare Part D include prescriptions?

Medicare Part D Prescription drug coverage will not be included in your Medigap plan. You will need to sign up for a separate Part D prescription drug plan. If you choose a Medicare Advantage plan, on the other hand, prescription drug coverage might be included. If so, it will be required to be creditable coverage.

How long is the open enrollment period for Medicare?

The Medigap Open Enrollment Period covers six months. It starts the month you are 65 or older and are enrolled in Medicare Part B. In this period, no insurer offering supplemental insurance in your state can deny you coverage or raise the premium because of medical conditions.

What is Medicare Supplement Insurance?

Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation. Combine this with the fixed income that so many seniors find themselves on, ...

How much does Medicare Supplement cover?

Choosing Medicare Supplement insurance can help. It can cover up to 100% of out-of-pocket costs, depending on the plan. One out of every three Original Medicare beneficiaries — over 13 million seniors — have chosen to do so. 1.

How many separate insurance plans are there?

Premiums for the same policy can vary between insurance companies. But, only the quoted price and the reputation of the insurer will vary. There are ten separate plans, labeled A through N. Two plans, C and F, are no longer offered to newly eligible beneficiaries.

Does Medicare Supplement cover all costs?

Original Medicare does not cover all costs. Medicare Supplement insurance, or Medigap, can cover what Medicare does not. Private insurance companies – vetted by the federal government – offer it to help manage out-of-pocket expenses. These policies do not add coverage.

Can you renew a Medigap policy?

You can renew your Medigap policy as long as you pay the premium. The insurer cannot use your health problems to cancel your policy or raise your premium.

Does Medicare Part C have a referral requirement?

Original Medicare allows you to see any doctor in the U.S. who accepts Medicare. It provides excellent flexibility: it has no networks or referral requirements. Medicare Part C (or Medicare Advantage) bundles hospital, doctor and drug coverage.