How long do you have to report Medicare overpayments?

The Centers for Medicare & Medicaid Services (CMS) has published a final rule that requires Medicare Parts A and B health care providers and suppliers to report and return overpayments by the later of the date that is 60 days after the date an overpayment was identified, or the due date of any corresponding cost report, if applicable.

What happens if Medicare overpays you?

Overpayment Definition A Medicare overpayment exceeds regulation and statute properly payable amounts. When Medicare identifies an overpayment, the amount becomes a debt you owe the federal government. Federal law requires we recover all identified overpayments. Medicare overpayments happen because of:

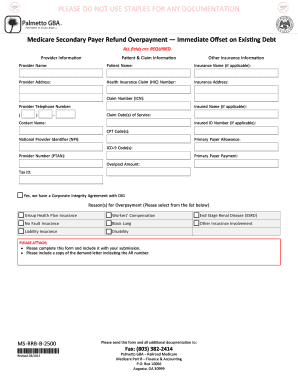

How do I send an overpayment to Medicare?

There are multiple ways to send an overpayment. The immediate recoupment process is for providers who have received an overpayment demand letter from Medicare. Immediate recoupment is not an alternative for sending a voluntary refund to Medicare.

How long does it take to get a refund for overpayment?

The debtor has 30 days from the date of the demand letter to refund the contractor. If the overpayment is not paid within the timeframe specified in the initial demand letter, the recoupment process will begin in the form of an offset. Current and future payments will be offset until the overpayment is completely recouped.

How do I notify Medicare of overpayment?

If you believe that an overpayment has been made, you can notify Medicare by: Medicare redetermination and clerical error reopening request form (Part A) (Part B): Do not include a check when sending redetermination and clerical error reopening request form.

What should you do if Medicare overpays you for patient treatment?

If You Find the Overpayment If you or your staff detects an overpayment from Medicare, you can report it either electronically, through the eRefunds or Overpayment Claim Adjustment (OCA) features in the WPS-GHA portal, or by mail, using the Overpayment Notification/Refund Form.

What happens if you owe Medicare money?

If your second bill remains unpaid by its due date, you'll receive a delinquency notice from Medicare. At that point, you'll need to send in the total overdue amount by the 25th of the following month to avoid losing coverage. In our example, that would put you at May 25.

What is the Medicare 60 day rule?

The 60-day rule requires anyone who has received an overpayment from Medicare or Medicaid to report and return the overpayment within the latter of (1) 60 days after the date on which the overpayment was identified and (2) the due date of a corresponding cost report (if any).

What is the time limit on returning an identified overpayment?

within six yearsUnder this final rule, overpayments must be reported and returned only if a person identifies the overpayment within six years of the date the overpayment was received.

How long does Medicare have to request a refund?

What is the timeframe in which Medicare may request return of an overpayment? For Medicare overpayments, the federal government and its carriers and intermediaries have 3 calendar years from the date of issuance of payment to recoup overpayment.

Is there a grace period for Medicare premium payments?

Under rules issued by the Centers for Medicare and Medicaid Services (CMS), consumers will get a 90-day grace period to pay their outstanding premiums before insurers are permitted to drop their coverage.

Can you negotiate Medicare liens?

This means that if you get a settlement, you will have to pay back Medicare before anything else gets taken out. While you can get the lien reduced, paying back Medicare after a settlement is not optional. The only path around a Medicare lien is to negotiate the lien to zero.

How can I reduce my Medicare lien?

You can challenge the Medicare lien by showing that certain medical expenses paid by Medicare were unrelated to the injuries that you sustained in your lawsuit.How do you challenge Medicare expenses unrelated to the injuries sustained in your case? ... Eliminating Unrelated Charges is the Key!More items...

How long is a Part A benefit period?

Medicare Part A covers an unlimited number of benefit periods, and it helps pay for up to 90 days of care for each one. After 90 days, it's possible to tap into lifetime reserve days.

Is there a cap on Medicare?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

Do Medicare days reset every year?

Does Medicare Run on a Calendar Year? Yes, Medicare's deductible resets every calendar year on January 1st. There's a possibility your Part A and/or Part B deductible will increase each year. The government determines if Medicare deductibles will either rise or stay the same annually.

How long does it take for Medicare to report overpayments?

The Centers for Medicare & Medicaid Services (CMS) has published a final rule that requires Medicare Parts A and B health care providers and suppliers to report and return overpayments by the later of the date that is 60 days after the date an overpayment was identified, or the due date of any corresponding cost report, if applicable.

When is an overpayment identified?

This final rule states that a person has identified an overpayment when the person has or should have, through the exercise of reasonable diligence, determined that the person has received an overpayment and quantified the amount of the overpayment.

What is CMS 1128J?

CMS published a proposed rule to implement the provisions of section 1128J (d) of the Act for Medicare Parts A and B providers and suppliers. The major provisions of this final rule include clarifications around: the meaning of overpayment identification; the required lookback period for overpayment identification;

What is Medicare overpayment?

An “overpayment” is any funds received under Title XVIII (Medicare) or XIX (Medicaid), to which , after applicable reconciliation, the provider is not entitled (under these titles). The deadline for these two actions is the later of the date that any corresponding cost report is due or 60 days after the overpayment is identified.

How long do you have to report overpayments?

The 60-day deadline for reporting and returning overpayments begins on one of two dates.

How to determine overpayment amount?

The CMS final rule establishes that a quantification of the overpayment amount may be determined using extrapolation methodologies, statistical sampling, or other appropriate methodologies (such as random selections of claims from a population or extrapolation only from within the time period covered by the population emanating from the relevant sample). Notably, if a provider calculates the overpayment amount pursuant to one particular methodology, the report must contain a description of that methodology’s statistically valid sampling/extrapolation. Importantly, providers should not return only a subset of claims identified for overpayment without extrapolating the overpayment’s full amount. Indeed, until the full overpayment amount is determined, the provider should not report and return overpayment on any individual claims (re the “prove sample”). The idea behind this is that if a provider finds a single overpaid claim, it would then be appropriate to perform further inquiry so as to determine if that provider has more overpayments before that provider reports and returns the singularly identified overpaid claim.

What is overpayment in CMS?

An overpayment is defined as the difference between the amount that CMS actually paid to the provider and the amount that the provider should have been paid, noting that there is no de minimis exception to overpayment’s definition .

Can you forward an overpayment report to an inappropriate agency?

Providers must remember that forwarding the overpayment report and refund to an inappropriate agency will not satisfy their obligations with regard to any applicable process. The provider must correctly identify the relevant Medicare contractor or other recipient.

Is an overpayment retained under the False Claims Act?

Importantly, any overpayment retained is an obligation under the Federal False Claims Act. Second, in February 2016, CMS published its final rule requiring that Medicare Parts A and B healthcare providers and suppliers report and refund overpayments. An overpayment is defined as the difference between the amount that CMS actually paid to ...

Who must report overpayments under the ACA?

First, under the ACA (42 U.S.C. 1320a-7k (d)), a provider who has received an overpayment must report and return it. The provider must send the overpayment to the correct recipient (the Secretary, the State, an intermediary, a carrier, or a contractor) and include, in writing, the reason for the overpayment.

How long does it take for Medicare to pay overpayments?

A request for immediate recoupment must be received by Medicare in writing no later than 16 days from the date ...

What happens if Medicare overpayment is not returned?

If the overpayment is not returned within the appropriate timeframe (see below) after the initial notice of overpayment, Medicare will automatically withhold funds from a future payment (s) to satisfy the overpayment and any interest that has accrued.

How long does it take for Medicare to respond to a request for immediate recoupment?

A request for immediate recoupment must be received by Medicare in writing no later than 16 days from the date of the overpayment demand letter . A request for immediate recoupment must be in writing and submitted via: When submitting an immediate offset you must specify whether you are submitting either:

What is a Medicare overpayment letter?

Medicare’s notice of overpayment is also known as a "refund" or "demand" letter. You may receive a notice of overpayment as the result of a beneficiary, provider, primary insurer inquiry or internal identification of a payment error. When claims are adjusted due to an overpayment, a Solicited Demand letter will be issued to you.

How long does it take for a CMS refund to be assessed?

Assessment of interest, as mandated by CMS, occurs on an overpayment balance that is not satisfied within 30 days of the refund letter (the calculated 30 days includes the date of the refund letter). Interest accrual is based on a 30-day period. Periods of less than 30 days will not be counted.

How long does interest accrue on a 36 day overpayment?

Example. If the overpayment is satisfied on the 36th day, 1 month of interest will be accrued (1 for the first 30 days and none for the 31st through the 36th day because it is not a full 30 day period).

Is immediate recoupment a voluntary payment?

By signing the form you are acknowledging that you understand that going through the immediate recoupment process is considered to be a payment arrangement that constitutes a voluntary payment and will not be subject to 935 (f) (2) interest pursuant to 1893 (f) (2). The exception to this is when your appeal at the Administrative Law Judge (ALJ) prevails, any money recouped 30 calendar days after the reconsideration decision will be subject to 935 interest.

How to offset Medicare overpayment?

If you would like to have the overpayment immediately offset the overpayment from your next check from Medicare, simply complete the Immediate Offset Request Form. The request may be submitted via regular mail or fax, and the request must include documentation on the overpayment to be offset.

What to do if you overpay Medicare?

Submit an Overpayment Refund Form to explain the reason for the overpayment (if you know the amount Medicare overpaid, you may also submit a check made payable to "Medicare"), or

How many ICNs can you refund?

We recommend that you refund no more than 20 Internal Claim Numbers (ICNs, also called CCNs) per request.

How Long Do I Have to Refund an Overpayment?

When CGS determines that a provider/supplier has been overpaid, a refund request will be sent to the debtor in the form of an overpay ment demand letter. This demand letter will include a Document Control Number (DCN) that must be referenced in any communication with the contractor. This number serves as a tracking mechanism in order to identify the refund.

What happens if you don't pay your overpayment?

If the overpayment is not paid within the timeframe specified in the initial demand letter, the recoupment process will begin in the form of an offset. Current and future payments will be offset until the overpayment is completely recouped.

When a provider/supplier believes that an overpayment has been received and makes an unsolicited voluntary refund,?

When a provider/supplier believes that an overpayment has been received and makes an unsolicited voluntary refund, it is accepted by the contractor regardless of the amount. The DME MAC Jurisdiction C Overpayment Voluntary Refund Form, or a similar document containing all of the required information, should accompany every voluntary refund so that the receipt of check is properly recorded and applied. If the specific Patient/HICN or MBI/Claim number is not provided, no appeal rights shall be afforded.

How long does it take to recover overpayments?

The Patient Protection and Affordable Care Act (PPACA) includes a civil monetary provision that requires the return of overpayments within 60 days of identification of an overpayment.

Why do Medicare providers have to report credit balances?

Credit balances may occur due to duplicate payments, misplaced allowances, up front collections from patients, or full primary and secondary insurance payments. All participating providers who bill for Medicare beneficiaries on a regular basis are required to submit a quarterly Medicare Credit Balance Report ( CMS-838 form ).

What does time limit mean in billing?

Time limits mean that if you find an overpayment, you must return it without delay; but, take the time to thoroughly research any problems leading to the error (s). Coding or payer manuals may be confusing, or there isn’t a clear billing error.

Do you need a cover letter for an overpayment?

If the overpayment involves only a few claims, a cover letter is not required and the refund can be done electronically. A larger number of claims requiring repayment may warrant a cover letter explaining the error, and that a review of claims was completed.

Does Medicare return overpayments?

The Medicare program includes program manual instructions on overpayments. In most cases, overpayments are returned to the MAC.

About Oberheiden, P.C.

Duty to Investigate

Documenting The Investigation

Sampling and The Medicare Regulation

Co-Payment and Deductibles?

- Providers are required to refund overpayments of co-payments and deductibles pursuant to Medicare regulations. Specifically, providers must promptly refund to the beneficiary any incorrect collections and notify the MAC of the refund. Failure to refund the overpayment within 60 days results in a requirement that the provider set aside an amount equ...

Enforcement and Penalties

Compliance Considerations For Providers