How long does it take to recoup from Medicaid?

MAC begins standard Part A overpayment recoupment not subject to Recoupment Limitations or in an excluded category. Day 30 Last day to pay in full to avoid interest accrual. Interest continues to accrue for each 30-day period until you pay the debt in full.

How long does it take to get a refund from Medicare?

The third and very important point to recognize is that the United States may only seek to recover conditional payments made during a 3-year period beginning on the date on which the item or service was furnished to the Medicare beneficiary. In many cases, liability, no-fault and workers’ compensation claims can go on for years.

How long does it take to collect Medicare overpayments?

Feb 17, 2010 · Answer: Under the statute of limitations (28 U.S.C. 2415), Medicare has six (6) years and three (3) months to recover Medicare’s claim. The statute of limitations begins at the time Medicare is made aware that the overpayment exists. Medicare’s overpayment does not come into existence until a judgment award or settlement offer is accepted.

Is there a statute of limitations on Medicare repaying?

July 19th, 2021. Federal law requires the state to attempt to recover the long-term care benefits from a Medicaid recipient's estate after the recipient's death. If steps aren't taken to protect the Medicaid recipient's house, it may need to be sold to settle the claim. For Medicaid recipients age 55 or older, states must seek recovery of payments from the individual's estate for nursing …

How many years back can Medicare recoup payments?

3 calendar yearsFor Medicare overpayments, the federal government and its carriers and intermediaries have 3 calendar years from the date of issuance of payment to recoup overpayment. This statute of limitations begins to run from the date the reimbursement payment was made, not the date the service was actually performed.Jan 4, 2017

Does Medicare recoup payments?

Federal law requires the Centers for Medicare & Medicaid Services (CMS) to recover all identified overpayments. When an overpayment is $25 or more, your Medicare Administrative Contractor (MAC) initiates overpayment recovery by sending a demand letter requesting repayment.

When Should Medicare overpayments be returned?

60 daysThe Centers for Medicare & Medicaid Services (CMS) has published a final rule that requires Medicare Parts A and B health care providers and suppliers to report and return overpayments by the later of the date that is 60 days after the date an overpayment was identified, or the due date of any corresponding cost report ...Feb 11, 2016

How far back can Medicare audit claims?

three yearsMedicare RACs perform audit and recovery activities on a postpayment basis, and claims are reviewable up to three years from the date the claim was filed.Nov 1, 2015

How do you get money back from Medicare?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.Jan 20, 2022

How do I get my money back from Medicare?

Submit a check with the Part A Voluntary Refund Form. When the claim(s) is adjusted, Medicare will apply the monies to the overpayment. Option 2: Submit the Part A Voluntary Refund Form without a check and when the claim(s) are adjusted, NGS will create an account receivable and generate a demand letter to you.

What are the most common reasons for overpayment?

The most common reasons for an overpayment are: You incorrectly reported your wages when certifying for benefits and were overpaid. Learn how to correctly report wages when certifying....Notice of OverpaymentThe total amount due.A summary for each week that you were overpaid.Information on how to appeal.Feb 17, 2022

What is overpayment recovery?

Staff News Writer. Print Page. When a payer sends an overpayment recovery request—a retroactive denial or reduced payment of a previously paid claim—you may lose significant time from patient care while handling the issue.Dec 3, 2014

What is recoup in medical billing?

A: A recoupment is a request for refund when we overpay an account. Some of the most common reasons for a recoupment are: We are not aware of a patient's other health insurance coverage. We paid the same charge more than once. We paid on a claim for an ineligible beneficiary.

What is a Medicare CERT audit?

Each year, the CERT program reviews a statistically valid stratified random sample of Medicare FFS claims to determine if they were paid properly under Medicare coverage, coding, and payment rules.Jan 5, 2022

What is a 935 overpayment?

The result of the original claim reversal and the 935 claim may either be an overpayment amount for the full amount of the claim payment or a partial amount. On the same RA, the resulting overpayment amount is then added back to the RA total net reimbursement in the Adjust to Balance field.Nov 1, 2012

What is a Medicare audit?

The Medicare Fee for Service (FFS) Recovery Audit Program's mission is to identify and correct Medicare improper payments through the efficient detection and collection of overpayments made on claims of health care services provided to Medicare beneficiaries, and the identification of underpayments to providers so that ...Dec 1, 2021

How long does interest accrue on a recovery letter?

Interest accrues from the date of the demand letter and, if the debt is not repaid or otherwise resolved within the time period specified in the recovery demand letter, is assessed for each 30 day period the debt remains unresolved. Payment is applied to interest first and principal second. Interest continues to accrue on the outstanding principal portion of the debt. If you request an appeal or a waiver, interest will continue to accrue. You may choose to pay the demand amount in order to avoid the accrual and assessment of interest. If the waiver/appeal is granted, you will receive a refund.

Why is Medicare conditional?

Medicare makes this conditional payment so you will not have to use your own money to pay the bill. The payment is "conditional" because it must be repaid to Medicare when a settlement, judgment, award, or other payment is made.

What is conditional payment in Medicare?

A conditional payment is a payment Medicare makes for services another payer may be responsible for.

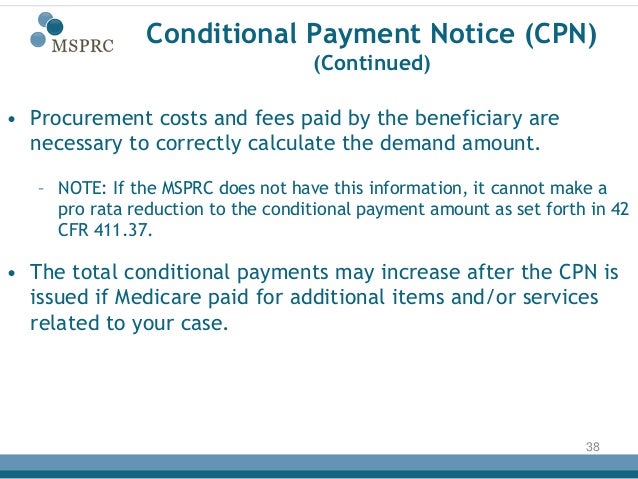

What information is sent to the BCRC?

The information sent to the BCRC must clearly identify: 1) the date of settlement, 2) the settlement amount, and 3) the amount of any attorney's fees and other procurement costs borne by the beneficiary (Medicare may only take beneficiary-borne costs into account).

What is a POR in Medicare?

A Proof of Representation (POR) authorizes an individual or entity (including an attorney) to act on your behalf. Note: In some special circumstances, the potential third-party payer can submit Proof of Representation giving the third-party payer permission to enter into discussions with Medicare’s entities.

Can you get Medicare demand amount prior to settlement?

Also, if you are settling a liability case, you may be eligible to obtain Medicare’s demand amount prior to settlement or you may be eligible to pay Medicare a flat percentage of the total settlement. Please see the Demand Calculation Options page to determine if your case meets the required guidelines. 7.

How long does Medicare have to pay back overpayments in Arizona?

Arizona Attorney. Answer: Under the statute of limitations (28 U.S.C. 2415), Medicare has six (6) years and three (3) months to recover Medicare’s claim. The statute of limitations begins at the time Medicare is made aware that the overpayment exists. Medicare’s overpayment does not come into existence until a judgment award or settlement offer is ...

When did Medicare claim come into existence?

1395Y (B) (2) (B) (I) when payment for medical expenses that Medicare conditionally paid for has been made by a third party payer. In your situation, the date of settlement was 2000, the clock started ticking on Medicare's SOL when you notified Medicare of the settlement.

Who does the MSPRC send a post settlement compromise request to?

All post-settlement compromise requests must be in writing and sent to the MSPRC Medicare Contractor), they will forward your request to the CMS Regional office. The MSPRC contractor does not have the authority to compromise. The authority to compromise a Medicare claim is reserved exclusively for the CMS home office or regional offices.

Is Medicare an overpayment?

Medicare’s overpayment does not come into existence until a judgment award or settlement offer is accepted. It is at the point of settlement that Medicare’s conditional payments are considered to be overpayments.

What is estate recovery?

Estate Recovery. State Medicaid programs must recover certain Medicaid benefits paid on behalf of a Medicaid enrollee. For individuals age 55 or older, states are required to seek recovery of payments from the individual's estate for nursing facility services, home and community-based services, and related hospital and prescription drug services. ...

Can you recover Medicaid from a deceased spouse?

States may not recover from the estate of a deceased Medicaid enrollee who is survived by a spouse, child under age 21, or blind or disabled child of any age. States are also required to establish procedures for waiving estate recovery when recovery would cause an undue hardship.