Full Answer

What is the extended period of eligibility for Medicare?

You will get at least 7 years and 9 months of continued Medicare coverage, as long as your disabling condition still meets our rules. I completed my Trial Work Period. I am now in my 36 month of Extended Period of Eligibility. Will this law apply to me? Yes, this will apply to you. Promptly report any changes in your work activity.

When will my ESRD Medicare coverage end?

Your ESRD Medicare coverage will end if: You no longer need dialysis. Your Medicare coverage will end 12 months after the month of your last dialysis treatment. You had a successful kidney transplant.

When does the Medicare benefit period end?

Then, when you haven’t been in the hospital or a skilled nursing facility for at least 60 days after being discharged, the benefit period ends. Keep reading to learn more about Medicare benefit periods and how they affect the amount you’ll pay for inpatient care. What are benefit periods in Medicare?

What happens when you use up your 60 days of Medicare?

Once you use up your 60 days, you’ll be responsible for all costs associated with inpatient stays that last longer than 90 days. An estimated 40 percent of people with Medicare require post-acute care after a hospital stay – for example, at a skilled nursing facility.

What happens when Medicare benefits run out?

These days are nonrenewable, meaning you will not get them back when you become eligible for another benefit period. Medicare will stop paying for your inpatient-related hospital costs (such as room and board) if you run out of days during your benefit period.

How long can you keep Medicare after going back to work?

Under this law, how long will I get to keep Medicare if I return to work? As long as your disabling condition still meets our rules, you can keep your Medicare coverage for at least 8 ½ years after you return to work. (The 8 ½ years includes your nine month trial work period.)

What does Medicare cover after a hospital stay?

Medicare covers the first 60 days of a hospital stay after the person has paid the deductible. The exact amount of coverage that Medicare provides depends on how long the person stays in the hospital or other eligible healthcare facility. A coinsurance cost applies after day 60 of the hospital stay.

Can Medicare benefits be exhausted?

The guarantee of payment provisions are not applicable until the individual has exhausted 60 lifetime reserve days of inpatient hospital services except where the beneficiary is deemed to have elected not to use lifetime reserve days. (See §10.2, below, and see §30, below.)

What happens to my Medicare if I go back to work?

If you're going back to work and can get employer health coverage that is considered acceptable as primary coverage, you are allowed to drop Medicare and re-enroll again without penalties. If you drop Medicare and don't have creditable employer coverage, you'll face penalties when getting Medicare back.

Can you continue working with Medicare?

You can get Medicare if you're still working and meet the Medicare eligibility requirements. You become eligible for Medicare once you turn 65 years old if you're a U.S. citizen or have been a permanent resident for the past 5 years. You can also enroll in Medicare even if you're covered by an employer medical plan.

What is the 3 day rule for Medicare?

The 3-day rule requires the patient have a medically necessary 3-consecutive-day inpatient hospital stay. The 3-consecutive-day count doesn't include the discharge day or pre-admission time spent in the Emergency Room (ER) or outpatient observation.

What is the 100 day rule for Medicare?

Medicare pays for post care for 100 days per hospital case (stay). You must be ADMITTED into the hospital and stay for three midnights to qualify for the 100 days of paid insurance. Medicare pays 100% of the bill for the first 20 days.

Does Medicare cover emergency room visits?

Private hospital emergency department services are claimable under Medicare from 1 March 2020. If you're an Overseas policy holder, please visit our Overseas webpage to confirm if you're eligible to claim a benefit for outpatient services under your level of cover.

How many lifetime days Does Medicare have?

60 daysMedicare gives you an extra 60 days of inpatient care you can use at any time during your life. These are called lifetime reserve days.

How long is Medicare benefit period?

60 daysA benefit period begins the day you're admitted as an inpatient in a hospital or SNF. The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins.

How many days is lifetime reserve for Medicare?

60 daysOriginal Medicare covers up to 90 days of inpatient hospital care each benefit period. You also have an additional 60 days of coverage, called lifetime reserve days. These 60 days can be used only once, and you will pay a coinsurance for each one ($778 per day in 2022).

How long will a 65 year old live on Medicare?

A Social Security Administration calculator notes a man who turned 65 on April 1, 2019 could expect to live, on average, until 84.0. A women who turned 65 on the same date could expect to live, on average, until 86.5.

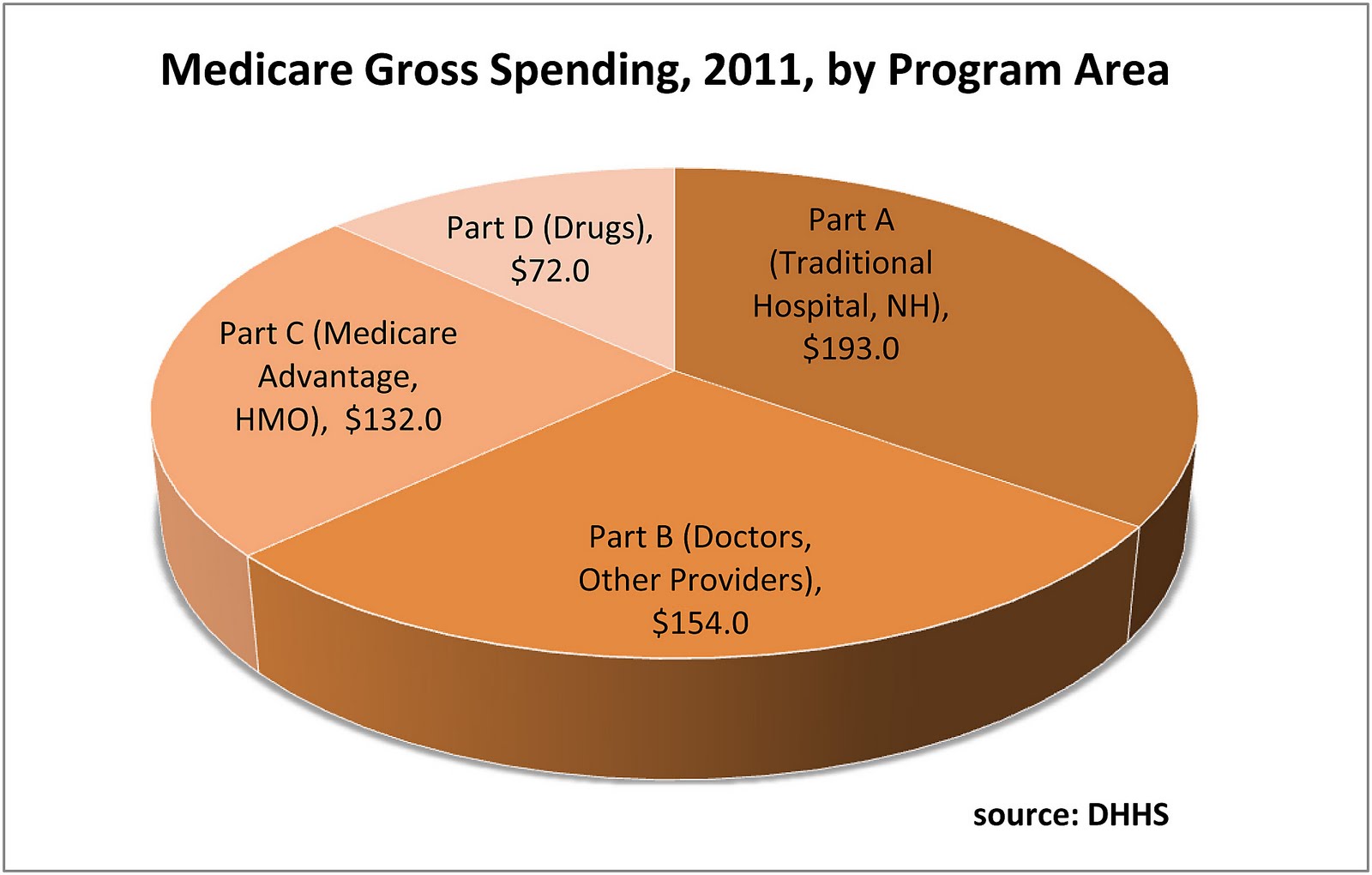

How much did Medicare spend in 2016?

In 2016, people on Original Medicare (Part A and Part B) spent 12% of their income on health care. People with five or more chronic conditions spent as much as 14%, significantly higher than those with none at 8%, showing their increased need for medical care. 9.

What is the source of Medicare trust funds?

The money collected in taxes and in premiums make up the bulk of the Medicare Trust Fund. Other sources of funding include income taxes paid on Social Security benefits and interest earned on trust fund investments.

What is the CMS?

As the number of chronic medical conditions goes up, the Centers for Medicare and Medicaid Services (CMS) reports higher utilization of medical resources, including emergency room visits, home health visits, inpatient hospitalizations, hospital readmissions, and post-acute care services like rehabilitation and physical therapy .

Why is the Department of Justice filing suit against Medicare?

The Department of Justice has filed law suits against some of these insurers for inflating Medicare risk adjustment scores to get more money from the government. Some healthcare companies and providers have also been involved in schemes to defraud money from Medicare.

How much is Medicare payroll tax?

Medicare payroll taxes account for the majority of dollars that finance the Medicare Trust Fund. Employees are taxed 2.9% on their earnings, 1.45% paid by themselves, 1.45% paid by their employers. People who are self-employed pay the full 2.9% tax.

Does Medicare cover hearing aids?

As it stands, many people argue that Medicare does not cover enough. For example, Medicare does not cover the cost of corrective lenses, dentures, or hearing aids even though the most common things that happen as we age are changes in vision, dental health, and hearing.

How long does Medicare cover dialysis?

You no longer need dialysis. Your Medicare coverage will end 12 months after the month of your last dialysis treatment. You had a successful kidney transplant. A transplant is considered successful if it lasts for 36 months without rejection.

When does Medicare resume dialysis?

Your Medicare coverage will either resume the first of the month that you start dialysis again or the first of the month you have a kidney transplant. There is also a separate 30-month coordination period each time you become eligible for ESRD Medicare.

Does Medicare cover immunosuppressants?

Note: If you receive a kidney transplant and want Part B to cover your immunosuppressant drug costs, you must have Medicare Part A at the time of your transplant. If you do not have Medicare when you receive a transplant, your immunosuppressant drugs will be covered by Part D after your transplant.

How long does Medicare Advantage last?

Takeaway. Medicare benefit periods usually involve Part A (hospital care). A period begins with an inpatient stay and ends after you’ve been out of the facility for at least 60 days.

How long does Medicare benefit last after discharge?

Then, when you haven’t been in the hospital or a skilled nursing facility for at least 60 days after being discharged, the benefit period ends. Keep reading to learn more about Medicare benefit periods and how they affect the amount you’ll pay for inpatient care. Share on Pinterest.

How much coinsurance do you pay for inpatient care?

Days 1 through 60. For the first 60 days that you’re an inpatient, you’ll pay $0 coinsurance during this benefit period. Days 61 through 90. During this period, you’ll pay a $371 daily coinsurance cost for your care. Day 91 and up. After 90 days, you’ll start to use your lifetime reserve days.

What facilities does Medicare Part A cover?

Some of the facilities that Medicare Part A benefits apply to include: hospital. acute care or inpatient rehabilitation facility. skilled nursing facility. hospice. If you have Medicare Advantage (Part C) instead of original Medicare, your benefit periods may differ from those in Medicare Part A.

What is Medicare benefit period?

Medicare benefit periods mostly pertain to Part A , which is the part of original Medicare that covers hospital and skilled nursing facility care. Medicare defines benefit periods to help you identify your portion of the costs. This amount is based on the length of your stay.

How much is Medicare deductible for 2021?

Here’s what you’ll pay in 2021: Initial deductible. Your deductible during each benefit period is $1,484. After you pay this amount, Medicare starts covering the costs. Days 1 through 60.

How long can you be out of an inpatient facility?

When you’ve been out of an inpatient facility for at least 60 days , you’ll start a new benefit period. An unlimited number of benefit periods can occur within a year and within your lifetime. Medicare Advantage policies have different rules entirely for their benefit periods and costs.

When did Medicare start covering advance care?

Starting January 1, 2016, Medicare began covering advance care planning as a separate service provided by physicians and other health professionals (such as nurse practitioners who bill Medicare using the physician fee schedule).

How many people died on Medicare in 2014?

About eight of 10 of the 2.6 million people who died in the US in 2014 were people on Medicare, making Medicare the largest insurer of health care provided during the last year of life. 1 In fact, roughly one-quarter of traditional Medicare spending for health care is for services provided to Medicare beneficiaries in their last year of life—a proportion that has remained steady for decades. 2 The high overall cost for health care received in the last year of life is not surprising given that many who die have multiple serious and complex conditions.

What percentage of Medicare beneficiaries died in 2014?

Of all Medicare beneficiaries who died in 2014, 46 percent used hospice—a rate that has more than doubled since 2000 (21 percent). 21 The rate of hospice use increases with age, with the highest rate existing among decedents ages 85 and over. Hospice use is also higher among women than men and among white beneficiaries than beneficiaries ...

How much did Medicare cost per beneficiary in 2014?

A: Among seniors in traditional Medicare who died in 2014, Medicare spending averaged $34,529 per beneficiary – almost four times higher than the average cost per capita for seniors who did not die during the year. 27 Other research shows over the past several decades, roughly one-quarter of traditional Medicare spending for health care is for services provided to beneficiaries ages 65 and older in their last year of life. 28

What are the most common causes of death for Medicare?

For people ages 65 and over, the most common causes of death include cancer, cardiovascular disease, and chronic respiratory diseases. 4 Medicare covers a comprehensive set of health care services that beneficiaries are eligible to receive up until their death. These services include care in hospitals and several other settings, home health care, ...

What are the services covered by Medicare?

These services include care in hospitals and several other settings, home health care, physician services, diagnostic tests, and prescription drug coverage through a separate Medicare benefit. Many of these Medicare-covered services may be used for either curative or palliative (symptom relief) purposes, or both.

Does Medicare cover hospice care?

A: Yes. For terminally ill Medicare beneficiaries who do not want to pursue curative treatment, Medicare offers a comprehensive hospice benefit covering an array of services, including nursing care, counseling, palliative medications, and up to five days of respite care to assist family caregivers. Hospice care is most often provided in patients’ homes. 19 Medicare patients who elect the hospice benefit have little to no cost-sharing liabilities for most hospice services. 20 In order to qualify for hospice coverage under Medicare, a physician must confirm that the patient is expected to die within six months if the illness runs a normal course. If the Medicare patient lives longer than six months, hospice coverage may continue if the physician and the hospice team re-certify the eligibility criteria.

When does Medicare coverage end?

If the beneficiary has Medicare only because of ESRD, Medicare coverage will end when one of the following conditions is met: 12 months after the month the beneficiary stops dialysis treatments, or. 36 months after the month the beneficiary had a kidney transplant.

How long is Medicare based on ESRD?

Medicare is the secondary payer to group health plans (GHPs) for individuals entitled to Medicare based on ESRD for a coordination period of 30 months regardless of the number of employees and whether the coverage is based on current employment status.

How long does Medicare cover a transplant?

Medicare coverage can start two months before the month of the transplant if the transplant is delayed more than two months after the beneficiary is admitted to the hospital for that transplant or for health care services that are needed before the transplant.

When does Medicare start covering dialysis?

2. Medicare coverage can start as early as the first month of dialysis if: The beneficiary takes part in a home dialysis training program in a Medicare-approved training facility to learn how to do self-dialysis treatment at home; The beneficiary begins home dialysis training before the third month of dialysis; and.

When does Medicare start?

2. Medicare coverage can start as early as the first month of dialysis if:

Is Medicare a secondary plan?

Medicare is secondary to GHP coverage provided through the Consolidated Omnibus Budget Reconciliation Act (COBRA), or a retirement plan. Medicare is secondary during the coordination period even if the employer policy or plan contains a provision stating that its benefits are secondary to Medicare.