When did Medicare start in USA?

Medicare’s history: Key takeaways President Harry S Truman called for the creation of a national health insurance fund in 1945. President Lyndon B. Johnson signed Medicare into law in 1965. As of 2021, nearly 63.8 million Americans had coverage through Medicare. Medicare spending accounts for 21% of total health care spending in the U.S.

How did Medicare get started?

On July 30, 1965, President Lyndon B. Johnson signed into law legislation that established the Medicare and Medicaid programs. For 50 years, these programs have been protecting the health and well-being of millions of American families, saving …

What is the origin of Medicare?

Jul 30, 2015 · I t was 50 years ago Thursday, on July 30, 1965, that President Lyndon Johnson signed the Medicare bill, turning the national social security healthcare program for older Americans into law.

Who enacted Medicare and when?

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs. Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Under the program, drug benefits are provided by private insurance plans …

When did Medicare start and why?

The Medicare program was signed into law in 1965 to provide health coverage and increased financial security for older Americans who were not well served in an insurance market characterized by employment-linked group coverage.

What was the original Medicare age?

age 65 or olderBe age 65 or older; Be a U.S. resident; AND. Be either a U.S. citizen, OR. Be an alien who has been lawfully admitted for permanent residence and has been residing in the United States for 5 continuous years prior to the month of filing an application for Medicare.Dec 1, 2021

What year did Social Security start?

August 14, 1935, United StatesSocial Security Administration / FoundedThe Social Security Act was signed into law by President Roosevelt on August 14, 1935. In addition to several provisions for general welfare, the new Act created a social insurance program designed to pay retired workers age 65 or older a continuing income after retirement.

What President started Medicare?

President Lyndon JohnsonOn July 30, 1965, President Lyndon Johnson traveled to the Truman Library in Independence, Missouri, to sign Medicare into law.

How long has Medicare and Medicaid been around?

Medicare & Medicaid: keeping us healthy for 50 years. On July 30, 1965, President Lyndon B. Johnson signed into law legislation that established the Medicare and Medicaid programs. For 50 years, these programs have been protecting the health and well-being of millions of American families, saving lives, and improving the economic security ...

When did Medicare expand?

Over the years, Congress has made changes to Medicare: More people have become eligible. For example, in 1972 , Medicare was expanded to cover the disabled, people with end-stage renal disease (ESRD) requiring dialysis or kidney transplant, and people 65 or older that select Medicare coverage.

What is Medicare Part D?

Medicare Part D Prescription Drug benefit. The Medicare Prescription Drug Improvement and Modernization Act of 2003 (MMA) made the biggest changes to the Medicare in the program in 38 years. Under the MMA, private health plans approved by Medicare became known as Medicare Advantage Plans.

When was the Children's Health Insurance Program created?

The Children’s Health Insurance Program (CHIP) was created in 1997 to give health insurance and preventive care to nearly 11 million, or 1 in 7, uninsured American children. Many of these children came from uninsured working families that earned too much to be eligible for Medicaid.

What is the Affordable Care Act?

The 2010 Affordable Care Act (ACA) brought the Health Insurance Marketplace, a single place where consumers can apply for and enroll in private health insurance plans. It also made new ways for us to design and test how to pay for and deliver health care.

When did Medicare Part D go into effect?

Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Under the program, drug benefits are provided by private insurance plans that receive premiums from both enrollees and the government.

How many Medicare beneficiaries are enrolled in Part D?

Medicare beneficiaries who delay enrollment into Part D may be required to pay a late-enrollment penalty. In 2019, 47 million beneficiaries were enrolled in Part D, which represents three-quarters of Medicare beneficiaries.

What is Medicare Part D?

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs.

How much of Medicare is covered by Part D?

In 2019, about three-quarters of Medicare enrollees obtained drug coverage through Part D. Program expenditures were $102 billion, which accounted for 12% of Medicare spending. Through the Part D program, Medicare finances more than one-third of retail prescription drug spending in the United States.

What is Medicare Part D cost utilization?

Medicare Part D Cost Utilization Measures refer to limitations placed on medications covered in a specific insurer's formulary for a plan. Cost utilization consists of techniques that attempt to reduce insurer costs. The three main cost utilization measures are quantity limits, prior authorization and step therapy.

Does Medicare Part D reduce the number of people over 65?

A 2020 study found that Medicare Part D led to a sharp reduction in the number of people over the age of 65 who worked full-time. The authors say that this is evidence that before the change, people avoided retiring in order to maintain employer-based health insurance.

Do Part D plans have to pay for all covered drugs?

Part D plans are not required to pay for all covered Part D drugs. They establish their own formularies, or list of covered drugs for which they will make payment, as long as the formulary and benefit structure are not found by CMS to discourage enrollment by certain Medicare beneficiaries. Part D plans that follow the formulary classes and categories established by the United States Pharmacopoeia will pass the first discrimination test. Plans can change the drugs on their formulary during the course of the year with 60 days' notice to affected parties.

When did Medicare start offering capitated health plans?

In the 1970s, less than a decade after the beginning of fee for service (FFS) "Original Medicare," Medicare beneficiaries gained the option to receive their Medicare benefits through managed, capitated health plans, mainly HMOs, as an alternative.

When did Medicare+choice become part C?

But initially this choice was only available under temporary Medicare demonstration programs. The Balanced Budget Act of 1997 formalized the demonstration programs into Medicare Part C, and introduced the term Medicare+Choice as a pseudo-brand for this option.

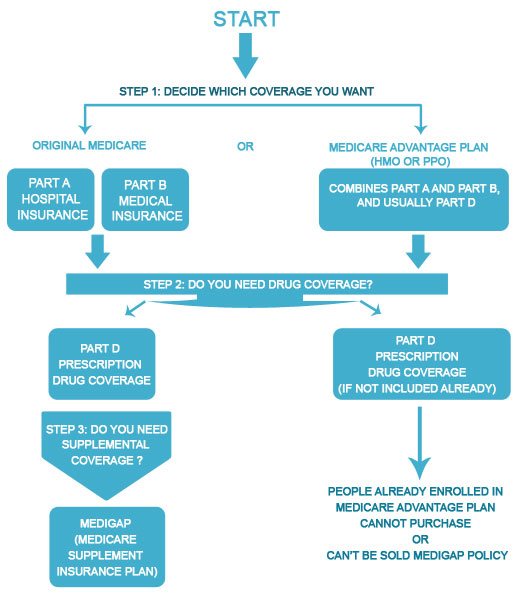

What is the difference between Medicare Advantage and Original Medicare?

From a beneficiary's point of view, there are several key differences between Medicare Advantage and Original Medicare. Most Medicare Advantage plans are managed care plans (e.g., PPOs or HMOs) with limited provider networks, whereas virtually every physician and hospital in the U.S. accepts Original Medicare.

What is Medicare Advantage?

Medicare Advantage (sometimes called Medicare Part C or MA) is a type of health insurance plan in the United States that provides Medicare benefits through a private-sector health insurer. In a Medicare Advantage plan, a Medicare beneficiary pays a monthly premium to a private insurance company ...

What happens if Medicare bid is lower than benchmark?

If the bid is lower than the benchmark, the plan and Medicare share the difference between the bid and the benchmark ; the plan's share of this amount is known as a "rebate," which must be used by the plan's sponsor to provide additional benefits or reduced costs to enrollees.

How does capitation work for Medicare Advantage?

For each person who chooses to enroll in a Part C Medicare Advantage or other Part C plan, Medicare pays the health plan sponsor a set amount every month ("capitation"). The capitated fee associated with a Medicare Advantage and other Part C plan is specific to each county in the United States and is primarily driven by a government-administered benchmark/framework/competitive-bidding process that uses that county's average per-beneficiary FFS costs from a previous year as a starting point to determine the benchmark. The fee is then adjusted up or down based on the beneficiary's personal health condition; the intent of this adjustment is that the payments be spending neutral (lower for relatively healthy plan members and higher for those who are not so healthy).

How many people will be on Medicare Advantage in 2020?

Enrollment in the public Part C health plan program, including plans called Medicare Advantage since the 2005 marketing period, grew from zero in 1997 (not counting the pre-Part C demonstration projects) to over 24 million projected in 2020. That 20,000,000-plus represents about 35%-40% of the people on Medicare.

When did Social Security pay retirement benefits?

Under the 1935 law, what we now think of as Social Security only paid retirement benefits to the primary worker. A 1939 change in the law added survivors benefits and benefits for the retiree's spouse and children. In 1956 disability benefits were added.

What was the first social security program?

The original 1935 law contained the first national unemployment compensation program , aid to the states for various health and welfare programs, and the Aid to Dependent Children program.

What is the life expectancy of a person born at 65?

Life expectancy at birth was less than 65, but this is a misleading measure. A more appropriate measure is life expectancy after attainment of adulthood, which shows that most Americans could expect to live to age 65 once they survived childhood. ( See more detailed explanation.)

What was the Social Security Act of 1935?

Originally, the Social Security Act of 1935 was named the Economic Security Act, but this title was changed during Congressional consideration of the bill. (The full story has been recounted by Professor Edwin Witte who was present at the event.)

When did the SSA add the legend to the bottom of the card?

Beginning with the sixth design version of the card, issued starting in 1946 , SSA added a legend to the bottom of the card reading "FOR SOCIAL SECURITY PURPOSES -- NOT FOR IDENTIFICATION.". This legend was removed as part of the design changes for the 18th version of the card, issued beginning in 1972.

Is it true that the age of 65 was chosen as the retirement age for Social Security?

Q6: Is is true that the age of 65 was chosen as the retirement age for Social Security because the Germans used 65 in their system, and the Germans used age 65 because their Chancellor, Otto von Bismarck, was 65 at the time they developed their system? A: No, it is not true.

Is Social Security a true program?

A: No, it is not true. All members of Congress, the President and Vice President, Federal judges, and most political appointees, were covered under the Social Security program starting in January 1984. They pay into the system just like everyone else.

When did Medicare start?

Managed care programs administered by private health insurers have been available to Medicare beneficiaries since the 1970s, but these programs have grown significantly since the Balanced Budget Act – signed into law by President Bill Clinton in 1997 – created the Medicare+Choice program.

When did Medicare change to Advantage?

The Medicare Modernization Act of 2003 changed the name to Medicare Advantage, but the concept is still the same: beneficiaries receive their Medicare benefits through a private health insurance plan, and the health insurance carrier receives payments from the Medicare program to cover beneficiaries’ medical costs.

What happens if a Medicare Advantage plan fails to meet the MLR requirements?

If a Medicare Advantage plan fails to meet the MLR requirement for three consecutive years, CMS will not allow that plan to continue to enroll new members. And if a plan fails to meet the MLR requirements for five consecutive years, the Medicare Advantage contract will be terminated altogether.

How many people will be enrolled in Medicare Advantage in 2021?

As of 2021, there were more than 26 million Americans enrolled in Medicare Advantage plans — about 42% of all Medicare beneficiaries. Enrollment in Medicare Advantage has been steadily growing since 2004, when only about 13% of Medicare beneficiaries were enrolled in Advantage plans.

How much of Medicare revenue is used for patient care?

That means 85% of their revenue must be used for patient care and quality improvements, and their administrative costs, including profits and salaries, can’t exceed 15% of their revenue (revenue for Medicare Advantage plans comes from the federal government and from enrollee premiums).

How much of Medicare premiums must be spent on medical?

Medicare Advantage plans must spend at least 85% of premiums on medical costs. The ACA added new medical loss ratio requirements for commercial insurers offering plans in the individual, small group, and large group markets.

What is the average Medicare premium for 2021?

But across all Medicare Advantage plans, the average premium is about $21/month for 2021. This average includes zero-premium plans and Medicare Advantage plans that don’t include Part D coverage — if we only look at plans that do have premiums and that do include Part D coverage, the average premium is higher.

What is Medicare Part A funded by?

Its Hospital Insurance Trust Fund pays for what's known as Medicare Part A: hospitals, nursing facilities, home health and hospice care and is primarily funded by payroll taxes. Employers and employees each kick in a 1.45% tax on earnings; the self-employed pay 2.9% and high-income workers pay an additional 0.9% tax.

When will Medicare become insolvent?

Medicare's Hospital Insurance Trust Fund is projected to become insolvent in 2024 or 2026 — just three to five years from now. Yet you probably haven't heard about that.

How much money did the Cares Act get from the Medicare Trust Fund?

And last year's Covid-19 relief CARES Act tapped $60 billion from the Medicare trust fund to help hospitals get through the pandemic. Meantime, Medicare rolls have been growing with the aging of the U.S. population. With the insolvency clock ticking, the Biden administration and Congress will need to act soon.

When his administration and Congress get around to staving off Medicare insolvency, should they address?

When his administration and Congress get around to staving off Medicare insolvency, some experts say, they ought to also address longer-term questions about how best to provide high-quality health care at an affordable price for older Americans.

Is Medicare insolvency a new issue?

Medicare Insolvency Issues Aren't New. The Medicare Hospital Insurance Trust Fund has actually confronted the risk of insolvency since Medicare began in 1965 because of its dependence on payroll taxes (much like Social Security).

How long will a 65 year old live on Medicare?

A Social Security Administration calculator notes a man who turned 65 on April 1, 2019 could expect to live, on average, until 84.0. A women who turned 65 on the same date could expect to live, on average, until 86.5.

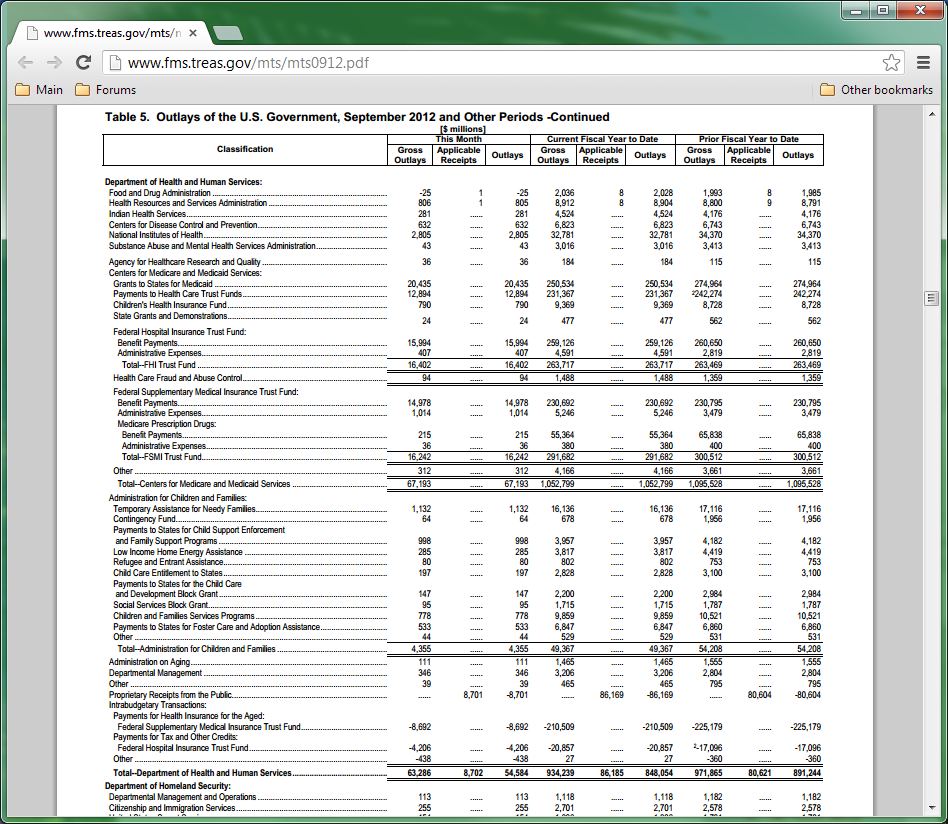

How much did Medicare spend in 2016?

In 2016, people on Original Medicare (Part A and Part B) spent 12% of their income on health care. People with five or more chronic conditions spent as much as 14%, significantly higher than those with none at 8%, showing their increased need for medical care. 9.

What is the source of Medicare trust funds?

The money collected in taxes and in premiums make up the bulk of the Medicare Trust Fund. Other sources of funding include income taxes paid on Social Security benefits and interest earned on trust fund investments.

What is the CMS?

As the number of chronic medical conditions goes up, the Centers for Medicare and Medicaid Services (CMS) reports higher utilization of medical resources, including emergency room visits, home health visits, inpatient hospitalizations, hospital readmissions, and post-acute care services like rehabilitation and physical therapy .

Why is the Department of Justice filing suit against Medicare?

The Department of Justice has filed law suits against some of these insurers for inflating Medicare risk adjustment scores to get more money from the government. Some healthcare companies and providers have also been involved in schemes to defraud money from Medicare.

How much is Medicare payroll tax?

Medicare payroll taxes account for the majority of dollars that finance the Medicare Trust Fund. Employees are taxed 2.9% on their earnings, 1.45% paid by themselves, 1.45% paid by their employers. People who are self-employed pay the full 2.9% tax.

Does Medicare cover hearing aids?

As it stands, many people argue that Medicare does not cover enough. For example, Medicare does not cover the cost of corrective lenses, dentures, or hearing aids even though the most common things that happen as we age are changes in vision, dental health, and hearing.

How long does it take to get Medicare for all?

After two years , every U.S. resident will eligible for and enrolled in the Medicare for All program.

What is Medicare for All?

Medicare for All expands the benefits package of Medicare to include all needed care. Dental, vision, and hearing, currently left uncovered by Medicare, are included in Medicare for All, making the program much more robust in its benefits.

Why is the Medicare for All Act written?

That is why the Medicare for All Act is written to ensure a just transition for workers who stand to be impacted by the change in our healthcare system.

How long does Medicare take to get a specialist?

Medicare as it exists now has some of the shortest wait times in the world for seniors, with only 21 percent of seniors ever having to wait four weeks to see a specialist. It’s perfectly possible to design a single payer system that avoids long wait times and guarantees everybody gets the care they need.

How much money does Medicare spend on advertising?

A major source of waste in our current healthcare system is the 30 billion dollars annually spent by insurers on advertising. Private insurance will have nothing to advertise under Medicare for All, saving billions a year in costs that do nothing to improve health.

What percentage of Americans support Medicare for All?

Medicare for All has the energy, the enthusiasm, and the public support needed to overcome big money opposition. 70 percent of Americans support Medicare for All, and the plan has continued to dominate any discussion of health care reform.

What is the hardest part of Medicare for All?

One of the hardest aspects of needing long-term care is the fear of losing the ability to live a healthy and independent lifestyle.