How long can I Use my Medicare supplement insurance plan?

Dec 09, 2020 · Open enrollment, as it pertains to Medicare Supplement plans, is a 6 month period that begins the first day of the month that you are both 65 or older and enrolled in Medicare Part B (see page 14 of the “Choosing a Medigap” booklet ). Now, some states do have additional open enrollment periods for people on Medicare.

How many Medicare supplement plans are there?

May 06, 2021 · In most states, there are up to 10 different Medicare Supplement plans, standardized with lettered names (Plan A through Plan N). All Medicare Supplement plans A-N may cover your hospital stay for an additional 365 days after your Medicare benefits are used up. (Massachusetts, Minnesota, and Wisconsin have different standardized plans.)

What is Medicare supplement insurance?

Mar 24, 2022 · Medicare Supplement Insurance helps you manage out-of-pocket costs for covered services. Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020.

How long does Medicare coverage last?

It provides an additional 365 days in the hospital after your Medicare benefits run out, and it covers your skilled nursing facility co-insurance, too. Medigap G covers all but the first $233 in expenses for outpatient care, which is the Part B deductible. You will pay that the first time you have outpatient care for that year.

Do I need to renew my Medicare Supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.May 16, 2018

Do Medicare supplements have a lifetime limit?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

Does my Medicare supplemental plan automatically renew?

All Medicare Supplement insurance plans are guaranteed renewable, even if you develop health conditions while you have your plan. Renewal is based on your regular payment of the plan's premium.

Do Medicare supplements go up with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What happens when you run out of Medicare days?

Medicare will stop paying for your inpatient-related hospital costs (such as room and board) if you run out of days during your benefit period. To be eligible for a new benefit period, and additional days of inpatient coverage, you must remain out of the hospital or SNF for 60 days in a row.

What is the Part A deductible for 2021?

$1,484Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Are Medigap policies guaranteed renewable?

Any standardized Medigap policy is guaranteed renewable even if you have health problems. This means the insurance company can't cancel your Medigap policy as long as you pay the premium.

Does Medicare Part expire?

As long as you continue paying the required premiums, your Medicare coverage (and your Medicare card) should automatically renew every year. But there are some exceptions, so it's always a good idea to review your coverage every year to make sure it still meets your needs.

Do you have to enroll in Medicare Part B every year?

For Original Medicare (Parts A and B), there are no renewal requirements once enrolled. Medigap plans ― also known as Medicare Supplement plans ― auto renew annually unless you make a change.Apr 5, 2022

What state has the cheapest Medicare supplement plans?

Meanwhile, the cheapest state in the Union for Medigap plans is sun-soaked Hawaii, where policies are only $1,310 annually — $109.16 on a monthly basis.Jul 31, 2018

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How Does Medicare Cover Hospital Stays?

When it comes to hospital stays, Medicare Part A (hospital insurance) generally covers much of the care you receive: 1. As a hospital inpatient 2....

What’S A Benefit Period For A Hospital Stay Or SNF Stay?

A benefit period is a timespan that starts the day you’re admitted as an inpatient in a hospital or skilled nursing facility. It ends when you have...

What’S A Qualifying Hospital Stay?

A qualifying hospital stay is a requirement you have to meet before Medicare covers your stay in a skilled nursing facility (SNF), in most cases. G...

How Might A Medicare Supplement Plan Help With The Costs of My Hospital Stay?

Medicare Supplement insurance is available from private insurance companies. In most states, there are up to 10 different Medicare Supplement plans...

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

How many Medicare Supplement plans are there?

In most states, there are up to 10 different Medicare Supplement plans, standardized with lettered names (Plan A through Plan N). All Medicare Supplement plans A-N may cover your hospital stay for an additional 365 days after your Medicare benefits are used up.

How long is a benefit period?

A benefit period is a timespan that starts the day you’re admitted as an inpatient in a hospital or skilled nursing facility. It ends when you haven’t been an inpatient in either type of facility for 60 straight days. Here’s an example of how Medicare Part A might cover hospital stays and skilled nursing facility ...

What is Medicare Part A?

When it comes to hospital stays, Medicare Part A (hospital insurance) generally covers much of the care you receive: 1 As a hospital inpatient 2 In a skilled nursing facility (SNF)

Does Medicare cover SNF?

Generally, Medicare Part A may cover SNF care if you were a hospital inpatient for at least three days in a row before being moved to an SNF. Please note that just because you’re in a hospital doesn’t always mean you’re an inpatient – you need to be formally admitted.

Does Medicare cover hospital stays?

When it comes to hospital stays, Medicare Part A (hospital insurance) generally covers much of the care you receive: You generally have to pay the Part A deductible before Medicare starts covering your hospital stay. Some insurance plans have yearly deductibles – that means once you pay the annual deductible, your health plan may cover your medical ...

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

How long is open enrollment for Medicare?

Open Enrollment is the principal time you will be able to enroll in Medicare Supplement Insurance. This open enrollment period runs for six months, starting on the month when you are first covered by Medicare Part B.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

Does Medicare pay for prescription drugs?

Medicare Part D helps you pay for prescription drugs. Depending on your plan, you may have to shop at preferred pharmacies to get the best price. You may also have to pay an out-of-pocket deductible before the insurance begins paying. Part D drug plans carry a premium which you must pay in addition to the Plan B premium.

What is Plan F?

Plan F. Plan F is the most extensive Medicare Supplement Insurance plan available. It covers everything the other plans cover, in addition to 100% of Medicare Part B excess charges. Plan F also covers 80% of medical emergency expenses when you travel outside of the country.

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

What is Medicare Plan G?

Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, we can probably help you on premiums by looking ...

What is Plan G?

After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

Does Frank have a medicare plan?

Frank is a diabetic who has Medicare Supplement Plan G. He sees his primary care doctor once per year, but visits his endocrinologist several times a year to renew his prescriptions. In January, he goes to his first doctor visit for the year. The specialist bills Medicare, which pays 80% share of the bill except for the $203 outpatient deductible, which is billed to Frank.

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

Which is better, Plan F or Plan G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more than Plan G since it picks up the annual Part B deductible. COMPARE PLANS AND PRICING.

Does Medicare pay for inpatient hospital?

So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, durable medical equipment, x-rays, ambulance, surgeries and much more. Medicare pays first, then Plan G pays all the rest after you pay ...

What is the difference between Medicare Advantage and Supplemental?

With Medicare Advantage, you pay most of the costs when you use services. With a Medigap plan, you pay most costs in advance. This causes great confusion for many people and it gets them in trouble.

How much does Medicare cover?

A serious illness or accident can spin up hospital and doctor bills very quickly. Medicare only covers about 80 percent of a beneficiary’s major medical costs. The other 20 percent is paid by the beneficiary, via deductibles.

What is Medicare Advantage enrollment?

With Medicare Advantage, enrollment and dis-enrollment are only available during certain enrollment periods. The most common of these is the annual open enrollment. In health insurance, open enrollment is a period during which a person may enroll in or change their selection of health plan benefits.

Does Medicare Advantage cover the same benefits as Original Medicare?

Your health now and in the future is a serious factor in choosing the best Medicare insurance. Sure, both Original Medicare and Medicare Advantage cover the same core major medical benefits. But, did you know that Medicare Advantage plans#N#Medicare Advantage (MA), also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare (Medicare Part A and Medicare Part B)....#N#are not required to cover your Medicare Part A and Medicare Part B benefits in the same way as Original Medicare?

What age do you have to be to get medicare?

Medicare is a federal health insurance program for people ages 65 and older and people with certain disabilities.... , and most states, only require insurance companies to issue a Medigap policy, without restrictions, for a very limited time. That time is when you first turn age 65 and have a guaranteed issue right.

Is Medicare Advantage expensive?

In other words, if you are not a healthy person, Medicare Advantage can get very expensive. Private insurance companies are in business to make money, and the monthly premiums on their top insurance plans and the copayment they attach to various healthcare services reflect this.

Do you have to pay Medicare Part B premiums?

NOTE: No matter which Medicare insurance option you choose, you must continue to pay your monthly Medicare Part B premium for outpatient coverage. MA plan premiums and Medigap premiums do not replace what you owe for your Part B coverage. In other words, there’s no such thing as a free Medicare Advantage plan.

What happens if you cancel your insurance?

When you terminate your policy, in most cases it continues through the month that you have already paid. Some insurance companies offer a refund of unused funds if applicable.

Does Medigap cover coinsurance?

Medigap plans cover some of your out of pocket expenses like copayments, coinsurances, and some deductibles not included in Original Medicare benefits. There are currently several types of Medigap policies available to purchase in most states.

How long does Medicare enrollment last?

This date marks the beginning of your Initial Enrollment Period. This period lasts for a total of seven months, and you must apply for Medicare coverage during this period to avoid having to pay late enrollment penalties. The seven months encompass the three months prior to your birthday, your birth month, and the three months following your birth ...

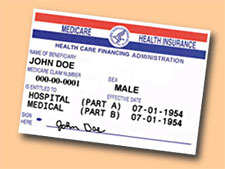

How long does it take to get a Medicare card?

After you apply for Medicare insurance and are accepted into the program, you will generally receive your Medicare card within about three weeks. If you are already receiving Social Security and are automatically enrolled, you should receive your Medicare card about two months prior to your 65th birthday.

What happens after you enroll in Medicare?

After enrolling in Medicare, you will receive your Medicare identification card so that you can use it to receive healthcare coverage at a variety of different facilities across the United States. Since Medicare is a government-run entity, applications for insurance coverage are handled by the Social Security Administration.

Does Medicare cover prescription drugs?

Original Medicare encompasses both Part A and Part B. At the time you apply for Original Medicare, you also have the ability to sign up for Medicare Part D coverage, which covers prescription drugs.

Does Medicare increase over time?

ALL standardized Medigap plans will increase in price over time. There are several driving factors that affect the rates. Your Medicare supplement rate can increase with your age, inflation, the insurance companies internal reasons (claims, cost of doing business, etc), or a combination of all three. See our full explanation on how policies are ...

Who is Alex Wender?

Alex Wender. Alex Wender is the founder and CEO of Bluewave Insurance. He has been blogging about Medicare-related topics since 2010. Since then, he and his agency have helped thousands of people across the country choose the right Medicare to fit their needs.