What is the Medicaid 5 year look back period?

Aug 31, 2018 · It is true that the Medicaid look-back period was initially three years in most states. The CMS reported on the new regulations, effective February 2006, after the passing of the Deficit Reduction Act of 2005. The DRA brought about several changes to …

How long does the Medicaid lookback period last?

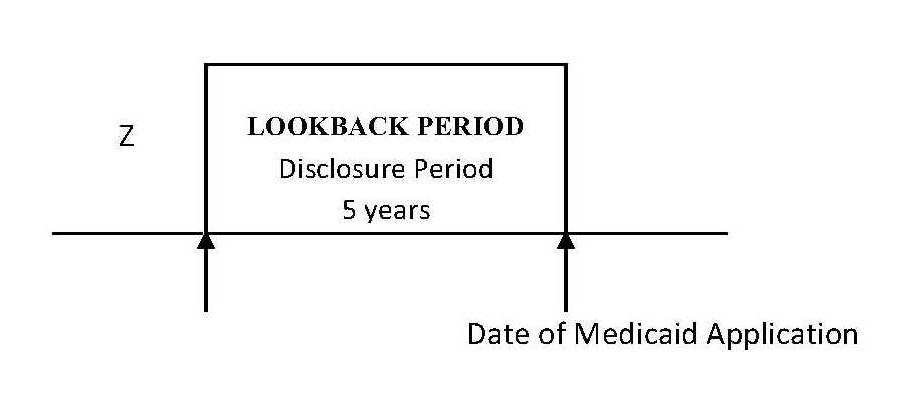

Sep 13, 2018 · The Medicaid Look Back Period begins the day someone applies for Medicaid and goes back 60 months (5 years) in all states but California. At this time, California only requires a 30-month Look Back Period.

What is the 5 year Medicaid lookback rule?

Oct 27, 2021 · The look-back period in most states is 60 months, or 5 years. The exceptions are New York and California, which both have look-back periods that are half as long, at 30 months or 2.5 years. (New York is complicated, as there is a community Medicaid program that’s different from other states’, and the 30-month limit is being phased in over time.)

How does the Medicaid look-back period work?

Dec 20, 2021 · Medicare coverage is retroactive for the six months preceding Medicare enrollment, but not before an enrollee's 65th birthday. Any time a person over age 65 who has been contributing to an HSA ...

What happens to your savings when you go into a nursing home?

The basic rule is that all your monthly income goes to the nursing home, and Medicaid then pays the nursing home the difference between your monthly income, and the amount that the nursing home is allowed under its Medicaid contract.

How long is a lookback period?

five-yearThe lookback period is the five-year period before the excess benefit transaction occurred. The lookback period is used to determine whether an organization is an applicable tax-exempt organization.Sep 23, 2021

What is a lookback rule?

The American Rescue Plan of 2021 has a “lookback” provision that allows you to use your 2019 earned income instead of your 2021 earned income to calculate the Earned Income Credit (EIC) or Additional Child Tax Credit (ACTC) on your 2021 tax return if doing so makes the credit larger.Feb 8, 2022

How do I protect my assets from Medicaid in Minnesota?

Protect Assets from Nursing Home and Long Term Care Costs in MinnesotaFor married couples, the most common option is the Family Pot Trust.For single individuals, the most common option is the Crow Wing Trust.Other trusts, both testamentary and inter vivos, may also be part of a Medicaid protection plan.

When does the look back period start for medicaid?

Now it begins 60 months prior to the date the person applies for Medicaid.

When did CMS change Medicaid?

The CMS reported on the new regulations, effective February 2006, after the passing of the Deficit Reduction Act of 2005. The DRA brought about several changes to the Medicaid look-back period.

What is the look back period for medicaid?

The Medicaid Look Back Period. To prevent people from giving away all their goods to family and friends, resources that could have been otherwise used to help pay for nursing home care, the Centers for Medicare and Medicaid Services has established the Medicaid Look Back Period. This is a period of time when all financial transactions made by ...

How long is the look back period for Medicaid in California?

At this time, California only requires a 30-month Look Back Period. 4 . Although there are gift and estate tax laws in place that allow certain transfers to remain tax-free, that does not mean they do not count toward the Medicaid Look Back Period.

How long does it take for Medicaid to look back?

The Medicaid Look Back Period begins the day someone applies for Medicaid and goes back 60 months (5 years) in all states but California.

What is Medicaid based on?

Traditionally, you became eligible for Medicaid based on how much money you earned and how many assets you owned. That changed with the passage of the Affordable Care Act, aka Obamacare, in 2010.

How long do you have to be ineligible for medicaid?

You will be ineligible for Medicaid for 10 months ($60,000 in violations divided by the $6,000 penalty divisor) from the time you apply. Example 3: The penalty divisor is $6,000. You sell your house to your daughter for $120,000 less than fair market value the year before you apply for Medicaid.

How long can you give away $60,000 for Medicaid?

You give away $60,000 during the Look Back Period. That means that you will be ineligible for Medicaid for 10 months ($60,000 in violations divided by the $6,000 penalty divisor) from the time of your application. Example 2: The penalty divisor is $6,000. You give $12,000 away to your niece each year over 10 years.

Does Medicare cover nursing home stays?

Without a qualifying hospitalization, it does not cover long-term stays in a nursing home at all. Ultimately, 62% of long-term nursing home stays are covered by Medicaid. 3 .

How long is the look back period for Medicaid?

In 49 of the 50 states, the length of the look-back period is 5 years (60 months). As of 2020, the one exception to this rule is California, which has a 2.5 year (30 month) look-back period. The look-back period begins the date that one applies for Medicaid.

What is look back penalty for Medicaid?

The penalty for violating the Medicaid look-back is a period of time that one is made ineligible for Medicaid. This period of ineligibility, called the penalty period, is determined based on the dollar amount of transferred assets divided by either the average monthly private patient rate or daily private patient rate of nursing home care in the state in which the elderly individual lives. (This is called the penalty divisor or private pay rate, which increases each year with the increase in the cost of nursing home care). Please note, there is no maximum penalty period.

How long is the Great Aunt's period of ineligibility for Medicaid?

This means the great aunt’s period of Medicaid ineligibility will be for 5 months ($35,000 / $7,000 = 5 months ). The penalty period begins on the date that one becomes eligible for Medicaid, not the date that the transfer or gift resulting in penalization was made.

How much can a spouse transfer to Medicaid?

An applicant is permitted to transfer up to $128,640 (in 2020) to their spouse, given their spouse is not also applying for long-term care Medicaid and will continue to live independently in the community. Phrased differently, a non-applicant spouse is permitted to retain up to $128,640 of the couple’s assets.

What is an annuity for medicaid?

Annuities, also referred to as Medicaid Annuities or Medicaid Compliant Annuities, are a common way to avoid violating the Medicaid look-back period. With an annuity, an individual pays a lump sum in cash.

What happens if you violate the look back period?

If a transaction is found to be in violation of the look-back period’s rules, the applicant will be assessed a penalty. Penalties come in the form of a period of time that the applicant is made ineligible for Medicaid.

How long is a gift of $60,000 for Medicaid?

This means you will be ineligible for Medicaid for 15 months. ($60,000 gifted divided by $4,000 average monthly cost = 15 months). Over the past five years, a grandmother gave her granddaughter $8,000 / year, which equals $40,000 in violation of the 5-year look-back period.

What happens if Medicare overpayment exceeds regulation?

Medicare overpayment exceeds regulation and statute properly payable amounts. When Medicare identifies an overpayment, the amount becomes a debt you owe the federal government. Federal law requires we recover all identified overpayments.

What is reasonable diligence in Medicare?

Through reasonable diligence, you or a staff member identify receipt of an overpayment and quantify the amount. According to SSA Section 1128J(d), you must report and return a self-identified overpayment to Medicare within:

What is SSA 1893(f)(2)(A)?

SSA Section 1893(f)(2)(A) outlines Medicare overpayment recoupment limitations. When CMS and MACs get a valid first- or second-level overpayment appeal , subject to certain limitations , we can’t recoup the overpayment until there’s an appeal decision. This affects recoupment timeframes. Get more information about which overpayments we subject to recoupment limitation at

How long does it take to submit a rebuttal to a MAC?

Rebuttal: Submit a rebuttal within 15 calendar days from the date you get your MAC’s demand letter. Explain or provide evidence why no recoupment should occur. The MAC promptly evaluates your rebuttal statement.

How long does it take to get an ITR letter?

If you fail to pay in full, you get an ITR letter 60–90 days after the initial demand letter. The ITR letter advises you to refund the overpayment or establish an ERS. If you don’t comply, your MAC refers the debt for collection.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

How long does it take to get a look back on medicaid?

Gone are the days when an applicant could simply transfer assets out of his/her name in anticipation of applying for Medicaid. Medi-Cal imposes a “look-back” period that prohibits doing so. The look-back period in most states is 60 months; however, in California, it remains 30 months for the time being. Medi-Cal will review your finances ...

Can you include Medi-Cal in your estate plan?

The best way to ensure that you do not run into a problem because of the look-back period, or with any of the other Medi-Cal eligibility guidelines, is to include Medi-Cal planning in your comprehensive estate plan well ahead of the need for long-term care.

Medicaid Eligibility Explained

Medicaid is a government program that’s administered by the states. This program provides medical care to qualifying individuals and families, including assistance with long-term care costs. Whether you qualify for Medicaid for long-term-care is based on:

How the Medicaid Look-Back Period Works

If you want to apply for long-term care Medicaid but your assets exceed the allowed limit for your state, you may have to spend them down to qualify. This can include using up those assets, i.e. spending down the money in your checking or savings account. But it can also include transferring assets so they’re excluded from your estate.

Medicaid Look-Back vs. Estate Recovery

While the Medicaid look-back period can prevent you from receiving full benefits to pay for nursing care during your lifetime, Medicaid estate recovery can pursue your assets after you pass away.

How to Avoid Medicaid Look-Back Period Penalties

Proper planning is key to avoid being penalized under Medicaid look-back rules. When you apply for Medicaid for nursing care you’re required to disclose any and all financial transactions involving the transfer of assets for your state’s look-back period.

The Bottom Line

The Medicaid look-back period can play an important part in determining your eligibility to receive help with long-term care. Understanding when this period begins in your state can help you plan ahead to ensure that you’re able to qualify for nursing care Medicaid, should the need for it arise.

Tips for Estate Planning

Consider talking to a financial advisor about what steps you should be taking to prepare for long-term care costs and how to avoid Medicaid look-back period penalties. If you don’t have a financial advisor yet, finding one doesn’t have to be complicated.