What happens to my Medicare if my taxable income changes?

Phil Moeller: Regardless of changes in your future taxable income, nothing would happen to your Medicare benefit. However, it could be another matter when it comes to how much you pay for that benefit.

How do Medicare premiums affect Social Security benefits?

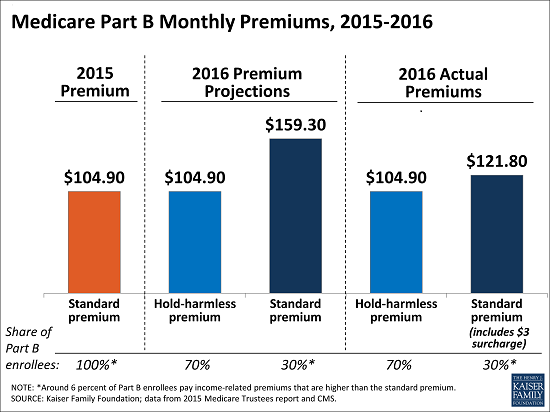

You’ll find detailed information on the Social Security web page “Medicare Premiums: Rules for Higher-Income Beneficiaries.” If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up.

Will my tax return affect my Medicare premiums in 2016?

But if it did, it would not show up until your 2016 tax return, meaning it would not affect your Medicare premiums until 2018. But as I said, it doesn’t look like your taxable income would jump enough to trigger the surcharges for even a single year.

How much do health insurance premiums increase with income?

At higher incomes, premiums rise, to a maximum of $504.90 a month if your MAGI exceeded $500,000 for an individual, $750,000 for a couple.

Does long term capital gains affect Medicare premiums?

Income from your assets whether through IRA withdrawals or by dividends, interest and capital gains from non-IRA assets can make your social security taxable or increase your Medicare premiums.

Do capital gains count for Medicare?

The Medicare surtax applies to the following gross investment income types: Interest. Dividends. Capital gains.

Do long term capital gains count towards Irmaa?

Some examples of what counts as income towards IRMAA are: Wages, Social Security benefits, Pension/Rental income, Interest, Dividends, distributions from any tax-deferred investment like a Traditional 401(k) or IRA and, again, Capital Gains.

What type of income affects Medicare premiums?

modified adjusted gross incomeMedicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Are capital gains considered earned income for Social Security?

'Social Security excludes government benefits and investments as earned income. Interest, capital gains, pensions and annuities do not count as earned income.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

Does long term capital gains count as income?

Capital gains and losses are classified as long term if the asset was held for more than one year, and short term if held for a year or less. Short-term capital gains are taxed as ordinary income at rates up to 37 percent; long-term gains are taxed at lower rates, up to 20 percent.

How do capital gains affect Irmaa?

IRMAA could potentially add to that cost since capital gains are included in calculating your modified adjusted gross income. On top of that, IRMAA is a so-called cliff penalty, meaning that—if you breach an IRMAA income threshold by $1—you have to pay the full surcharge for that income bracket.

How do I avoid Medicare Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).

What year income is used to determine Medicare premiums?

To determine your 2022 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2021 for tax year 2020. Sometimes, the IRS only provides information from a return filed in 2020 for tax year 2019.

What tax year is Medicare premiums based on?

The Social Security Administration bases the IRMAA determination on federal tax return information received from the IRS. The adjustment is calculated using your modified adjusted gross income (MAGI) from two years ago. In 2022, that means the income tax return that you filed in 2021 for tax year 2020.

Do 401k distributions affect Medicare premiums?

Money coming out of a 401(k) is subject to income tax rates, which top out at 37%. To tailor your taxes in retirement, you'll need a combination of taxable, tax-deferred and tax-free savings. Manage your withdrawals from these accounts to keep your Medicare premiums down.

What is Medicare tax?

The Medicare tax is also known as the Medicare surtax or net investment income tax (NIIT). It is part of IRC Section 1411 (c). The tax became effective in 2013 and is part of the Affordable Care Act of 2010. While it is a tax on investment income, funds from the tax are used for Medicare expansion. Hence the word Medicare in some of the tax’s terminology.

How to offset Medicare surtax?

One is called tax-loss harvesting. Tax-loss harvesting is performed on equity portfolios and is generally automated.

What is the tax rate for short term capital gains?

Long-term capital gain taxes are more favorable and are taxed at less than the ordinary income tax rate. The 2020 long-term capital gains tax rates are broken down into three different rates — 0%, 15%, 20%.

Does Medicare surtax apply to estates?

It applies to individuals, estates, and trusts. Of course, like other taxes, the Medicare surtax only applies after any losses/expenses have been factored in. For example, if an investor had $180k in income from investments and MAGI, the investor would not incur Medicare surtax.

Does Medicare apply to capital gains?

Does Medicare Tax Apply To Capital Gains? Posted by David Funes on Dec 14, 2020. Capital gains taxes are something every investor must contend with. But these taxes aren’t limited to just short and long-term gains. There’s another tax called the Medicare tax that can also get thrown in.

Is Medicare tax thrown in?

There’s another tax called the Medicare tax that can also get thrown in. It doesn’t happen to everyone, though. In this article, we’ll look at who the Medicare tax effects.

Do you have to be a high income to get Medicare?

You don’t have to be a high-income earner to be hit with the Medicare surtax. Through a windfall, the middle class can be affected as well. Don’t confuse the Medicare surtax with the Medicare payroll tax, which is also called the Additional Medicare Tax (AMT), Obamacare tax, and even the Medicare surtax.

What are the life changing events that can be appealed to Social Security?

You can appeal to Social Security for any of the following life-changing events: the death of a spouse. marriage, divorce, or annulment. retirement, reduced work income, or loss of job for one or both spouses. loss of income-producing property due to event beyond your control. loss or decrease in a pension.

What is Medicare Part B based on?

Your Medicare Part B premium amount (and the Part D premium) is based on the Modified Adjusted Gross Income ( MAGI) on your tax return from two years ago — the most recent federal tax return the IRS provides to Social Security.

When did Ostrom retire?

Ostrom retired from the Air Force in 2000 and joined the MOAA team in 2006. His responsibilities include researching and answering member inquiries regarding military benefits, health care, survivor issues, and financial concerns.

Can you appeal Medicare premium?

Besides the shock of Part B premiums to Medicare newcomers, the jump in your Part B premium after a one-time financial transaction can also cause distress. You can appeal your increased Medicare premium if you experienced a life-changing event that caused your income to decrease.

When should I file for my survivor benefit?

If they are less than your own retirement benefits would be at age 70, you should file for them right away. If your husband made a lot of money and your survivor benefit will be larger than your own retirement benefit, I would advise you to wait to file for it until it reaches its maximum value when you turn 66.

Can you get penalized for claiming a tax deduction in 2016?

While you could face an IRS penalty for improperly claiming the tax benefits in the first place, my experience is that if you take care of this within a tax year and have no improper tax deductions on your 2016 tax return, you will escape a penalty.

Does Medicare have a surcharge?

Phil Moeller: Regardless of changes in your future taxable income, nothing would happen to your Medicare benefit. However, it could be another matter when it comes to how much you pay for that benefit. People who must pay Medicare’s premiums for Part B and Part D — and nearly everyone on Medicare does — face high-income surcharges ...

How to increase Medicare premiums?

Here are five financial moves you have control over that are likely to increase your Medicare premiums for a full year: Converting your traditional IRA or 401 (k) to a Roth IRA. Selling your business. Turning company stock options into cash. Selling your home and having a large capital gain.

Is a 401(k) a regular income?

Remember that distributions from a traditional IRA or 401 (k) are taxed as regular income, so cashing out your account to buy a dream retirement home also could boost your Medicare premiums for a year.

Is Medicare free at 65?

Medicare – health insurance that kicks in at 65 — is not free. Nor are premiums fixed. You can unwittingly send your Medicare Part B premium – the part that covers certain doctors, outpatient care and preventive care — sky-high by poorly planning your income beginning at age 63.

Does Medicare Part A cover nursing?

This “hospital insurance” covers hospital stays, surgeries, and long-term skilled nursing care. Part B premiums don’t cover everything.

Is Medicare Part B premiums permanent?

The good news is that these increases in Medicare Part B premiums aren’t permanent.

What happens when Social Security changes your records?

When Social Security has revised its records, you’ll receive a refund of any money due to you.

How much is the capital gains surcharge for 2009?

According to circumstances and income levels, the surcharge adds between $38.50 and $211.90 a month to the regular Part B premium in 2009.

Is Part B premium based on 2008?

That’s because the amount of your 2009 Part B premium is based on the tax return you filed in 2008 reporting your income for 2007. (In cases where a 2008 tax return is unavailable, it would be based on your 2007 return, which reflects your income in 2006.)

Will Social Security pay Part B premium in 2009?

If Social Security accepts that your 2008 income has been reduced as a result of one of those events, you will not be required to pay the higher Part B premium in 2009, even if this was based on a windfall income you received in 2007. In other words, reduced income due to a life-changing event trumps the sale of a house ...

Selling your home could lead to higher Medicare premiums if your taxable income sees a boost

Although your Medicare benefits shouldn't change when you sell your home, your monthly premiums may. It depends on whether the sale of your home affects your taxable income.

What Is the High-Earner Threshold?

Medicare considers you a high earner if your modified adjusted gross income (MAGI) exceeds $91,000 per year if you file your taxes as a single, or $182,000 for married couples filing jointly.

How Does Selling Your Home Affect Medicare Premiums?

The capital gains tax may apply when you make a profit on an investment, which includes the sale of real estate. Luckily, the IRS does allow you to exclude a portion of your capital gains on real estate.

When Can't You Take Advantage of Capital Gains Exclusions?

It wouldn't be the U.S. tax code if there weren't limits to the real estate exclusion. If any of the following apply, you will have to pay tax on the whole gain, meaning it will count toward your MAGI:

Appealing the Income-Related Monthly Adjustment Amount

Although Medicare premiums are determined by the Centers for Medicare & Medicaid Services (CMS), the " Initial IRMAA Determination Notice " comes from the Social Security Administration. This notice describes how SSA determined you owe IRMAA and provides information on filing an appeal.

How Long Does IRMAA Apply?

The good news is that an IRMAA determination doesn't mean you owe the high-earner surcharge forever. If your adjusted gross income dropped below the IRMAA threshold, you'll pay the standard Medicare premiums next year.

If I Sell My House, Will I Lose My Medicare Benefits?

Selling your home will not cause you to lose your Medicare benefits. However, if you have a Medicare plan and move to a new address, you may need to change your plan.

When creating a long-term tax plan, should the focus be on minimizing one year's tax liability?

When creating a long-term tax plan, the focus should not be on minimizing one year’s tax liability, but rather on minimizing a family’s lifetime liability. This often takes the form of evaluating a person’s current marginal tax rate and comparing it to their expected future marginal rate.

How much is taxable after a conversion?

After a conversion of $40,000, $34,000 of their Social Security benefit is taxable, resulting in a taxable income of a little over $71,000, or approximately $8,000 of federal tax.

Is realizing income a simple arithmetic equation?

But realizing income isn’t always a simple arithmetic equation of adding just enough to stay in a lower tax bracket. Without careful thought, added income could end up being effectively taxed at a higher rate due to how the added income affects other aspects of one’s taxes.

Does Medicare Part B go up?

The premium for the Medicare Part B program goes up at different income levels. Even adding $1 of income around these thresholds can move a person from one premium level to another. It is important to be aware of these thresholds when developing a tax plan.