How long should you keep receipts and bills?

- Tax returns. Keep them for at least seven years, Cole said. ...

- Home improvement records. Keep them forever or at least until you sell your home. ...

- Old pay stubs. Keep them for one year, Cole said. ...

- Bank statements. Cole said keep them for at least a year, however, she hangs onto the paper for three years. ...

- Bills. ...

- Credit-card statements. ...

- Store receipts. ...

How long should I Keep my EOBs?

The eXtension website, a service of public colleges and universities, recommends keeping the EOB for three to five years after the medical claim is paid in full. The EOBs are helpful in tracking payments from different sources, such as primary and secondary insurance carriers, including Medicare.

How long to keep important documents before shredding them?

When you're done with these documents and no longer need them, feel free to shred them:

- ATM receipts

- Bank statements

- Birth certificate copies

- Canceled and voided checks

- Credit card bills

- Credit reports

- Driver’s licenses (expired)

- Employment documents that have any identifying information

- Expired passports and visas

- Investments account numbers

How long are pharmacies required to keep patient records?

How Long Must A Pharmacy Keep These Records? A pharmacy must retain a patient record, including the record of care, for a minimum of 10 years past the last date of provided pharmacy service; or if the patient is a child, for two years past the age of majority, whichever is greater. For additional pharmacy records, pharmacists must adhere to the ...

How long should I keep Medicare receipts?

one to three yearsHow Long Should You Keep Medicare Summary Notices? Most experts recommend saving your Medicare summary notices for one to three years. At the very least, you should keep them while the medical services listed are in the process of payment by Medicare and supplemental insurance.

How long should Medicare EOBs be kept?

1. Keep medical EOBs in a file for one year. As the bills and EOBs for a medical service come in, match related items together, and address any discrepancies you detect. Examples might include double billing or your health insurance company overlooking the fact that you have met your deductible.

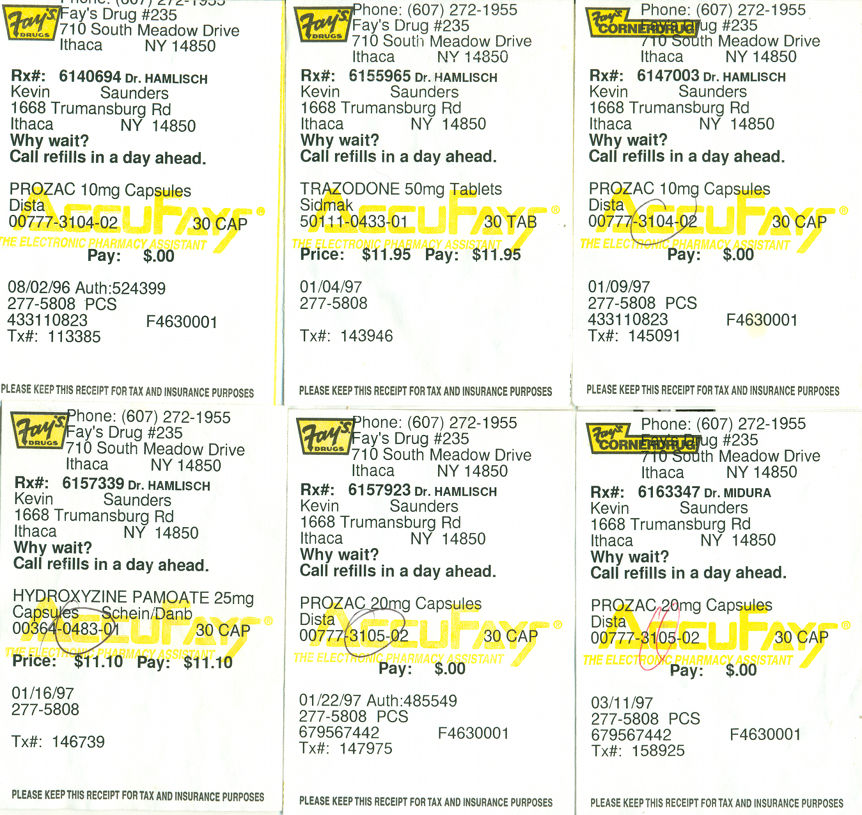

How long should I keep prescription drug summaries?

One suggestion, storage space permitting, is to save medical payment records for three to six years as you would tax deduction records. That way, if you need to refer back to them, they are there.

How long should I keep explanation of benefits?

Comparing your EOBs to your monthly statements is a good way to understand what you are being charged for, and it gives you another opportunity to look for overcharges. Unlike medical bills, EOBs should be kept from three to eight years after your procedure, or indefinitely if you have a reoccurring condition.

What do you need to keep for 7 years?

Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return. Keep records indefinitely if you do not file a return.

How long should you keep monthly statements and bills?

KEEP 3 TO 7 YEARS Knowing that, a good rule of thumb is to save any document that verifies information on your tax return—including Forms W-2 and 1099, bank and brokerage statements, tuition payments and charitable donation receipts—for three to seven years.

How far back do Medicare records go?

Download and complete the Request for Medicare claims information form. This form should only be used to request Medicare claims information from more than 3 years ago. Access your Medicare claims information for at least the last 3 years through myGov.

What receipts should I keep?

For self-employed individuals, it is often helpful to save receipts from every purchase you make that is related to your business and to keep track of all of your utility bills, rent, and mortgage information for consideration at tax time.

What records do I need to keep and for how long?

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.

Is there any reason to keep old insurance policies?

State Laws. State laws vary, but generally require insurance agents to keep copies of their customer's policies for 6–7 years. Since a nonprofit can't always count on having access to the insurance agent's files when needed, each nonprofit should also maintain copies of expired policies.

Should you shred Explanation of Benefits?

Disposal of Explanation of Benefits Once EOBs are no longer needed, it's imperative they are shredded by a trusted, skilled company like TrueShred, rather than with a personal shredder. On-site shredding services allow you to follow the chain of custody, ensuring the integrity of your personal data.

How long should you save pay stubs?

In general, you should keep pay stubs for up to a year, then it's considered safe to throw them away. Make sure you properly shred them so no one can get ahold of your old pay stubs and glean personal information you don't want public.

How long do you keep medical EOBs?

If, at the end of the year, you find you have paid enough in medical bills to qualify for the medical tax deduction, file the medical EOBs with your tax documentation, and keep for seven years. 3.

What is a health history?

Creating (or re-creating) a health history for yourself or someone under your care. Documenting billing errors – or even fraud. Ensuring that you are receiving the full insurance benefits to which you are entitled. Proving that you’ve met your annual deductible, if your health insurance policy has one .

How to keep EOBs in a file?

1. Keep medical EOBs in a file for one year. As the bills and EOBs for a medical service come in, match related items together, and address any discrepancies you detect. Examples might include double billing or your health insurance company overlooking the fact that you have met your deductible. 2.

Can you keep medical records on a computer?

In both of the above situations, you can keep the medical records on paper or scanned onto a computer based on your preference. If you keep paper files, keep them out of areas where they can get wet, e.g., a basement floor. If you go the electronic route, be sure to back up your data reliably.

Can you get cartons of paperwork from Medicare?

A person with multiple medical conditions can quickly acquire cartons of paperwork from Medicare, doctors’ offices, and health insurance companies. It’s helpful to start with what medical EOBs prove: The services the doctor, hospital, or other healthcare entity has provided. The amount the doctor, hospital, or other healthcare provider has billed ...

Whats The Point Of It

The Medicare Summary Notice helps you see your medical expenses and what Medicares been billed on your behalf. Its a secondary piece of information to put with your bills and other documents as part of your at-home medical records.

How Long Should You Keep Eobs

Experts recommend keeping medical EOBs for a set period of time, but how long depends on the individual circumstances of the patient in question.

How Long Should I Keep The Medicare Summary Notices And Supplemental Insurance Summary Of Benefits Documents I Receive In The Mail

There is no hard and fast rule for saving medical payment records. Certainly, they need to be kept while the medical services that are summarized on the forms are in the process of payment by Medicare and supplemental insurance policies.

How Long Should I Keep Medicare Summary Notices

Holding on to your MSNs for at least 12 months is a good rule of thumb. It allows you to keep track of Medicares payment activity. The main reason to save your MSM for 1 year is because Medicare requires that all claims for health care services need to be filed with Medicare within 12 months after the date of service.

Standardized Notices And Forms

A CMS Form number and Office of Management and Budget approval number, which must appear on the notice, identify OMB-approved, standardized notices and forms. CMS has developed standardized notices and forms for use by plans, providers and enrollees as described below:

What To Do With The Notice

If you have other insurance, check to see if it covers anything that Medicare didnt.

Do You Have To Do Anything Once You Get A Medicare Summary Notice

You should read through it and check for errors or potential fraud. If your list of services doesnt match up with the care you remember receiving, then you should follow up with the Medicare program.

How long do you have to keep medical records?

If you deduct medical expenses on your tax return in a given year, you need to keep them for an extended period. In the case of an IRS audit, you’ll need to have three years of tax records on hand for auditors. If you store those unreimbursed medical bills with the tax return where they served as deductions, it will make it easier ...

Why do we need to keep medical bills on hand?

Tax Reasons. One of the most important reasons to keep your medical bills on hand is for tax purposes . Medical expenses are a common tax deduction; taxpayers are allowed to deduct the amount of the total unreimbursed allowable medical care expenses for the year that exceeds 10% of their adjusted gross income.

What is medical bill?

Medical bills can often comprise a significant amount of the expenses you end up paying each month, especially if a family member or you is facing an acute illness that takes a prolonged period to treat. Trips to doctors’ offices and other medical treatment centers generate a significant amount of bills and other paperwork, ...

Do you need medical records to be eligible for the military?

Additionally, if you attend school, play a sport, or enroll in some type of training class, you may need key parts of your medical records, such as vaccinations, to be eligible for the program. People who opt to enter government service, such as in the military, often need to provide documentation of their medical treatment history to enlist ...

Do you need a plan to store medical bills?

Medical procedures and bills generate a great deal of paperwork, so you’ll need a plan to store them. Otherwise, they’ll just end up being an unorganized mess that stresses you out every time you go to look for a bill or a record of treatment.

How long do you have to keep health records?

If so, you will want to keep the records on hand for at least seven years, as this is the amount of time that the IRS has to go back and request them.

How to file medical expenses on taxes?

Proper documentation will help support any medical related tax deductions that you might claim on your taxes, which will save you the trouble of having to track them down years after the fact. Here is what you need to know about this: 1 Records related to health expenses will help you when it comes time to file your taxes. You do not want to forget major expenses incurred that will help you reduce your overall tax bill. 2 The IRS has up to seven years to request complete documentation related to your health insurance records, so it is important to keep them at least that long. 3 It will be difficult to recreate your expenses after the fact, particularly if a provider ceases its operation before you can get the records. Storing these in a secure location is the best way to go.

Can you dispose of health insurance records?

It is generally acceptable to dispose of your health insurance records if your medical treatment was successfully completed quite some time ago and the bill has been paid in its entire ty. Health records can be retained indefinitely if you would like to keep track of your own health related issues and refer back to them at a later time.

Do you have to keep medical records?

There are times when one visit to a doctor or specialist is just not sufficient enough to cure what ails you. If that describes your current situation, you will want to keep all of the health-related records and receipts that you receive until your health provider assures you that they have been paid in full. This means that your health insurance company has paid out your claim.

Can you keep medical records electronically?

That concern is certainly well founded, and paper documentation can leave you vulnerable. If you have been hesitant to keep paper copies of your medical insurance records around the house for fear that you will lose them or they will fall into the wrong hands, it is time to consider storing them electronically.

How long do pharmacies keep records?

How Long Must A Pharmacy Keep These Records? A pharmacy must retain a patient record, including the record of care, for a minimum of 10 years past the last date of provided pharmacy service; or if the patient is a child, for two years past the age of majority, whichever is greater.

What is a pharmacy patient record?

A pharmacy patient record must include demographic information about the patient as well as a profile of the drugs provided and a record of the care provided. The record of care includes documentation for any prescriptions adapted and other drugs prescribed, any known drug therapy issues and the steps that were taken to deal with them accordingly, ...

What is a pharmacist responsible for?

Pharmacists are responsible for an extensive amount of record keeping, including records for patients, prescriptions, drug errors, health disclosures, and narcotic receipts. In order to comply with federal legislation, you must retain all documents for the minimum retention period before disposing of them properly.

How long do you need to keep bank statements?

Credit Card Receipts (Unless needed for tax purposes and then you need to keep for 3 years) Bank Statements (Unless needed for tax purposes and then you need to keep for 3 years) Quarterly Investment Statements (Hold on to until you get your annual statement)

How long do you keep utility bills?

Utility Bills (You can throw out after one year, unless you're using these as a deduction like a home office --then you need to keep them for 3 years after you've filed that tax return) Cancelled Checks (Unless needed for tax purposes and then you need to keep for 3 years)

How long should I keep credit card receipts?

Keep original receipts until your credit card statements arrive and then go through the charges one at a time to ensure they match. You can then discard the receipts. If your statements document any tax-related expenses, retain them for seven years.

How long do you keep records of a property?

Keep all records documenting the purchase price of any property, the cost of all improvements, as well as records of expenses incurred in selling and buying property for seven years after the sale or purchase.

What to keep if you fail to file taxes?

Specific items you should keep in addition to your tax returns themselves include documentation of income, alimony, charitable contributions, mortgage interest, retirement plan contributions and any other tax deductions taken.

What items should I hold onto for insurance?

Be sure to hold onto receipts for big purchases like jewelry, furniture, art, appliances, automobiles and electronics so that you can prove the value of these items to your insurance company in the event they are lost, stolen or destroyed in a covered disaster such as a fire.

Do you need to keep stock statements?

You must keep these until you sell the securities covered by them to prove whether you incur capital gains or losses for your tax return. If you hold stocks or bonds for many years, you will need to keep the statements. The exception is if the cost basis and date of acquisition are listed on the statements. In this case, you only need to keep the year-end statements to support your tax return each year.

Do I need to keep my IRA contributions?

If you made an after-tax contribution to an individual retirement account (IRA), you will need to keep your statements regarding these contributions indefinitely. Otherwise, you won’t be able to prove that you already paid tax on this money when it is time to make a withdrawal.