What is the difference between APC payments and physician payments?

APCs are an outpatient prospective payment system applicable only to hospitals, and have no impact on physician payments under the Medicare Physician Fee Schedule. APC payments are made only to hospitals when the Medicare outpatient is discharged from the ED or clinic or is transferred to another hospital...

What are the co-pays for APC services?

Co-pays vary between 20 and 40% of the APC payment rate. Eventually this percent will be capped at 20% of the payment rate. A status indicator is assigned to each code to identify how the service is priced for payment.

Does Medicare pay for inpatient DRG or APC?

If the patient is admitted from a hospital clinic or ED, then there is no APC payment, and Medicare will pay the hospital under inpatient DRG methodology. APCs or "Ambulatory Payment Classifications" are the government's method of paying facilities for outpatient services for the Medicare program.

Are drugs and supplies included in the payment for APCs?

Most drugs and supplies have their costs included in the payment for specific visit level or procedure APCs. This is generally applicable to drugs and supplies which cost less than $60 per day. For many drug or supply items which cost $60 or more, there is separate payment under unique APCs.

How is Medicare APC calculated?

Calculating the Medicare Payment Amount and Coinsurance A program payment percentage is calculated for each APC by subtracting the unadjusted national coinsurance amount for the APC from the unadjusted payment rate and dividing the result by the unadjusted payment rate.

What are the two new comprehensive APCs for 2020?

The new C-APCs that are effective January 1, 2020, include: • C-APC 5182 (Level 2 Vascular Procedures) and • C-APC 5461 (Level 1 Neurostimulator and Related Procedures). The addition of these new C-APCs increases the total number of C-APCs to 67 for CY 2020.

What is the APC payment system?

APCs or "Ambulatory Payment Classifications" are the government's method of paying facilities for outpatient services for the Medicare program.

What is Medicare outpatient prospective payment system?

The Outpatient Prospective Payment System (OPPS) is the system through which Medicare decides how much money a hospital or community mental health center will get for outpatient care provided to patients with Medicare. The rate of reimbursement varies with the location of the hospital or clinic.

How many APCs are there?

The 346 APCs consist of 134 surgical APCs, 46 significant APCs, 122 medical APCs, and 44 ancillary APCs. Surgical, significant and ancillary APCs are assigned using only the CPT-4 procedure codes, while medical APCs are based on the combination of the ICD-9-CM diagnosis code and the E&M CPT-4 code.

What are APC codes?

APC Codes (Ambulatory Payment Classifications) APCs or Ambulatory Payment Classifications are the United States government's method of paying for facility outpatient services for the Medicare (United States) program.

What are ambulatory payment classification APC groups based on?

Ambulatory payment classification or “APC” means an outpatient service or group of services for which a single rate is set. The services or groups of services are determined according to the typical clinical characteristics, the resource use, and the costs associated with the service or services.

What is the difference between APG and APC?

APGs are a derivative of the diagnosis-related groups (DRGs). APCs are a clone of the Medicare physician payment system. APCs will replace the present cost-based method by which Medicare reimburses hospitals for outpatient services. The present method has been in use since the Medicare program began in the 1960s.

Is APC the same as opps?

APCs are used in outpatient surgery departments, outpatient clinic emergency departments, and observation services. An OPPS payment status indicator is assigned to every CPT/HCPCS code and the indicators identify if the code is paid under OPPS and if it is a separate or packaged code.

What percentage of ambulatory care services is reimbursed in Medicare Part B?

When an item or service is determined to be coverable under Medicare Part B, it is reimbursed at 80% of a payment rate approved by Medicare, known as the “approved charge.” The patient is responsible for the remaining 20%.

When was the outpatient prospective payment system?

Payment policies for services furnished in hospital outpatient departments are constantly changing due to technological advances and changes in law and regulation. Medicare originally based payments for outpatient care on hospitals' costs, but CMS began using the outpatient prospective payment system in August 2000.

When was the outpatient prospective payment system implemented?

August 1, 2000The Balanced Budget Act of 1997 (BBA) mandated that the Centers for Medicare & Medicaid Services (CMS) implement a Medicare prospective payment system for hospital outpatient services. As such, CMS implemented the outpatient prospective payment system (OPPS), which did not become effective until August 1, 2000.

What is the scope of APC?

The scope of an APC’s practice authority varies by state, and both the AAPA and the AANP strongly advocate for their member APCs to have full authority to practice at the limit of their educational credentialing.

How many physicians will be needed in 2025?

The AAMC report concludes that, by 2025, the overall demand for physicians will exceed the supply by 46,000 to nearly 90,000 physicians, with the shortage of primary care physicians (excluding primary care trained hospitalists) amounting to about 15,000 to 36,000. This shortfall is concerning, because primary care providers are ...

Can APCs be practiced in a team setting?

They also can practice in team-based environment or autonomously. Nonetheless, there have been only a few recent studies of their quality and cost effectiveness within a practice setting (although the use of APCs has been endorsed by the American Congress of Obstetricians and Gynecologists [ACOG]).

Do APCs pay for physician services?

Generally, commercial and government payers pay APCs for the same services that would be considered physician services if they were delivered by a medical doctor or an osteopathic physician. Payment for APCs differs by carrier, just as it does with physicians. The scope of an APC’s practice authority varies by state, and both the AAPA and the AANP strongly advocate for their member APCs to have full authority to practice at the limit of their educational credentialing.

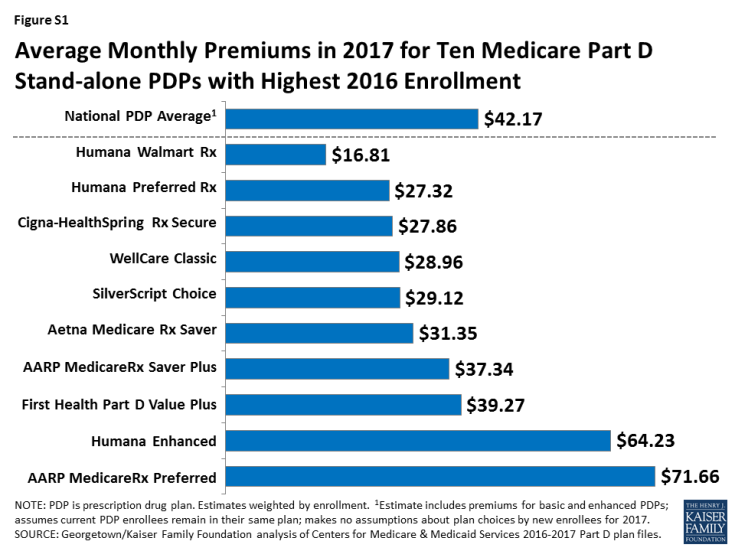

What is the Medicare premium for 2017?

For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80. Because of the “hold harmless” provision covering the other 70 percent of beneficiaries, premiums for the remaining 30 percent must cover most ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is Medicare Part A deductible?

The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,316 per benefit period in 2017, an increase of $28 from $1,288 in 2016. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

How many procedures were removed from the inpatient only list?

Seven procedures were removed from the inpatient-only list; none were added. Five of the seven are add-on codes and assigned status indicator N Items and services packaged into APC rates:

Can CMS report all services?

Without reporting all services, CMS has no information in the claims data on which to base future payment. Individual line item payment should not be the sole reason for reporting services on a claim; and in fact, it’s crucial to report packaged items/services on the claim, or the cost is lost.

Do non-excepted PBDs have to bill G codes?

Non-excepted PBDs are required to bill G codes for radiation treatment services. The payment for separately paid drugs and biologicals are excluded from the relativity adjuster methodology, as these items are paid separately in a physician’s office setting.

Is Medicare static?

Anyone who’s been in the business of healthcare for more than a day knows Medicare policies are never static. The information related here merely highlights some of the changes CMS finalized for the 2017 OPPS. Be sure to review the final rule and the January update transmittal for complete details on changes that will affect your outpatient facility in the coming year, and stay tuned for revisions and corrections.

What is C-APC 8011?

As part of the expansion of the C-APC payment policy methodology, payment for all qualifying extended assessment and management encounters [formerly APC 8009 “Extended Assessment and Management (EAM)” composite] will be paid through C-APC 8011 “Comprehensive Observation Services”. The status indicator of J2 is assigned to the new C–APC 8011 to distinguish between the logic required to identify the claims qualifying for the new C–APC 8011 and the other C–APCs. A claim is qualified for C–APC 8011 when it contains a specific combination of services performed with each other, as opposed to the presence of a single service identified by status indicator J1 for all other C-APCs.

Does scaler apply to OPPS?

Scaling does not apply to OPPS services that have a predetermined payment amount, especially separately paid drugs and biologicals and new technology APCs. Items with a predetermined payment amount were included in the budget neutrality comparison of total weight across years by using a weight equal to the payment rate divided by the CY 2017 final rule conversion factor. However, scaling of the relative payment weights only applies to those items that do not have a predetermined payment amount. Specifically, we remove the total amount of weight for items with predetermined payment amount in the prospective year from both the prospective and current year and calculate the weight scaler from the remaining difference. In doing this, those services without a predetermined payment amount would be scaled by the proportional amount not applied to the services with a predetermined payment amount. We do not make any behavioral predictions about changes in utilization, case mix, or beneficiary enrollment when calculating the weight scaler.

When is APC paid?

APC payments are made only to hospitals when the Medicare outpatient is discharged from the ED or clinic or is transferred to another hospital (or other facility) which is not affiliated with the initial hospital where the patient received outpatient services.

What is APC payment?

Answer. APC payments apply to outpatient surgery, outpatient clinics, emergency department services, and observation services. APC payments also apply to outpatient testing (such as radiology, nuclear medicine imaging) and therapies (such as certain drugs, intravenous infusion therapies, and blood products).

Why are APCs important?

By transferring financial risk to hospitals, APCs incentivize hospitals to provide outpatient services economically, efficiently and profitably. Answer. APCs were created to transfer some of the financial risk for provision of outpatient services from the Federal government to the individual hospitals, thereby achieving potential cost-savings ...

Does Medicare pay for APC?

If the patient is admitted from a hospital clinic or ED, then there is no APC payment, and Medica re will pay the hospital under inpatient DRG methodology. APCs or "Ambulatory Payment Classifications" are the government's method of paying facilities for outpatient services for the Medicare program. A part of the Federal Balanced Budget Act ...

How many people are on Medicare in 2019?

In 2019, over 61 million people were enrolled in the Medicare program. Nearly 53 million of them were beneficiaries for reasons of age, while the rest were beneficiaries due to various disabilities.

What is Medicare in the US?

Matej Mikulic. Medicare is a federal social insurance program and was introduced in 1965. Its aim is to provide health insurance to older and disabled people. In 2018, 17.8 percent of all people in the United States were covered by Medicare.

Which state has the most Medicare beneficiaries?

With over 6.1 million, California was the state with the highest number of Medicare beneficiaries . The United States spent nearly 800 billion U.S. dollars on the Medicare program in 2019. Since Medicare is divided into several parts, Medicare Part A and Part B combined were responsible for the largest share of spending.

What is Medicare inpatient?

Hospital inpatient services – as included in Part A - are the service type which makes up the largest single part of total Medicare spending. Medicare, however, has also significant income, which amounted also to some 800 billion U.S. dollars in 2019.

Claim Data Affects APC Assignments

Device-Intensive APC Edits Remain in Place, But Changed

Packaging Continues to Expand

Changes For Off-Campus, Outpatient, Provider-Based Departments

New Modifier Requirements For Radiology

Outlier Fixed-Dollar Thresholds Updated

Packaging, Payments, and Pass-Through Updates

- Four HCPCS Level II codes remain eligible for pass-through payment for 2017: C2623 Catheter, transluminal angioplasty, drug-coated, non-laser C2613 Lung biopsy plug with delivery system C1822 Generator, neurostimulator (implantable), high frequency, with rechargeable battery and charging system Q4172 PuraPly, and PuraPly Antimicrobial, any type, pe...

Inpatient-Only Procedures Thin Out

We’Ve only Just Begun