When can I enroll in Medicare Part D?

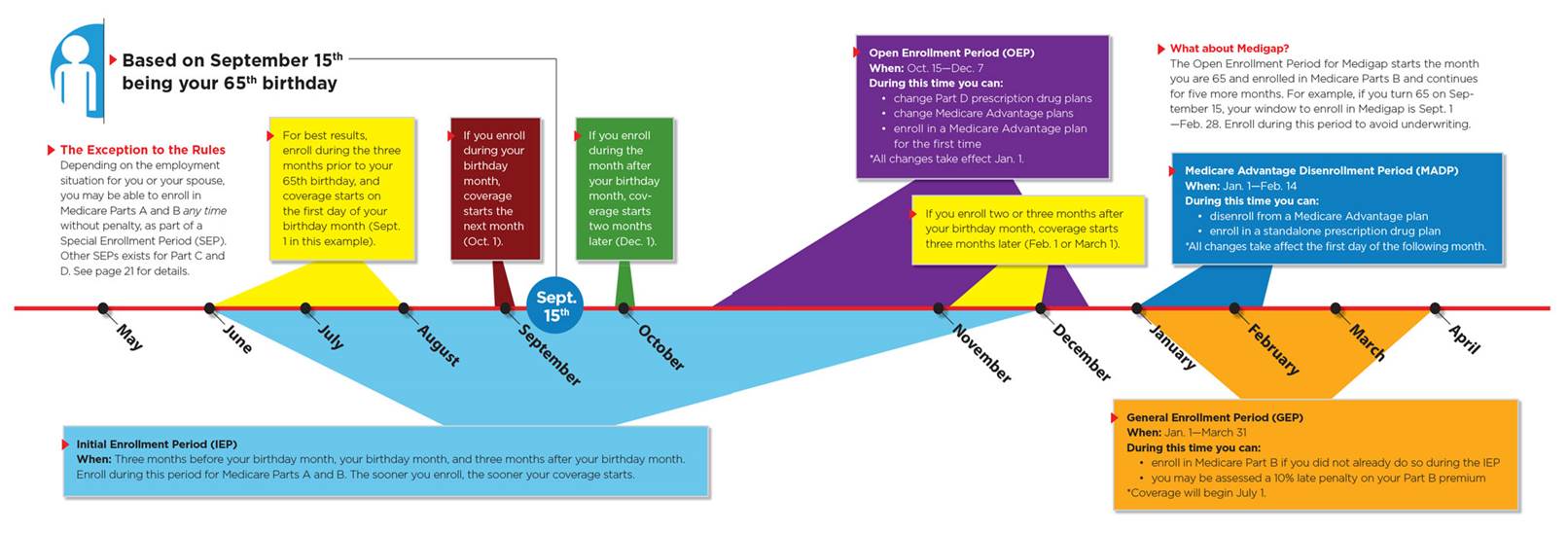

You can enroll in Medicare Part D coverage during your Initial Enrollment Period (IEP) for Part D, which is the period that you first become eligible for Medicare Part D. For most people, the IEP for Part D is the same as the IEP for Medicare Part B and begins three months before you turn 65 years of age, includes the month you turn 65, and ends three months after.

How do I enroll in Medicare Part D?

To avoid late enrollment penalties:

- Enroll in Part D when you are first eligible. ...

- Make sure the drug coverage you have is considered creditable.

- Enroll in Part D within 63 days if you lose your creditable coverage.

- Keep records of your creditable coverage as evidence to show your new Medicare plan.

Who is eligible for Medicare Part D?

Medicare Part D is an outpatient prescription drug benefit available to people who have Medicare (Part A and/or Part B). While technically Part D is optional coverage, Medicare “encourages” you to enroll in Part D by assessing a late penalty if you don ...

How to enroll in a Medicare Part D drug plan?

The proposed rule would improve beneficiaries’ experiences with MA and Part ... Plans (D-SNPs). D-SNPs are plans offered by MA organizations that enroll individuals who are eligible for both ...

How many different Medicare Part D plans are there?

The average Medicare beneficiary has a choice of 54 Medicare plans with Part D drug coverage in 2022, including 23 Medicare stand-alone drug plans and 31 Medicare advantage drug plans.

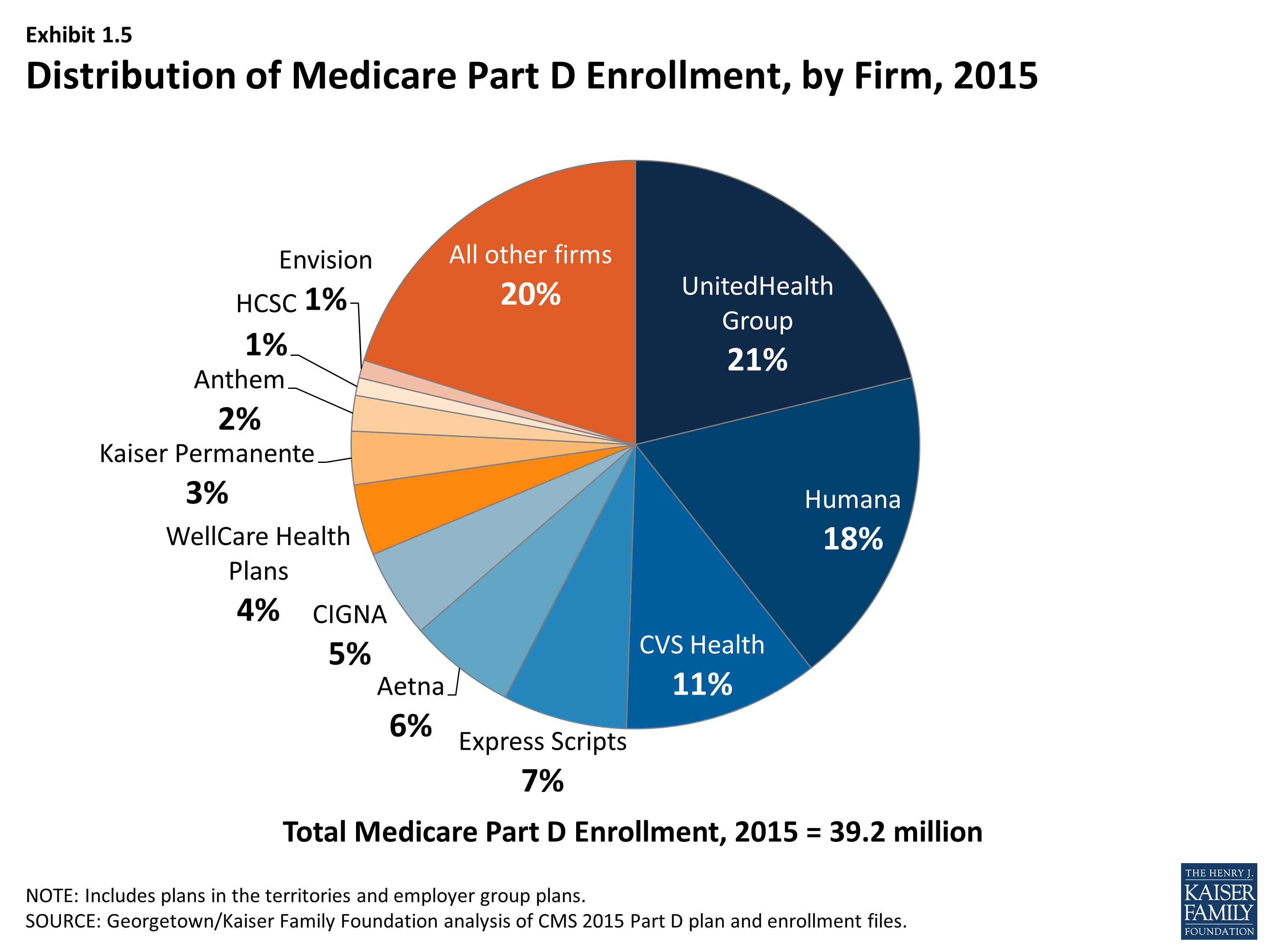

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

How many enrollees Does Medicare have?

6.2 millionWith over 6.2 million, California was the state with the highest number of Medicare beneficiaries.

Does the Medicare Part D donut hole still exist?

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold. See what your clients, the drug plans, and government will pay in each spending phase of Part D.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Who has the cheapest Medicare Part D plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

Who are Medicare enrollees?

Medicare serves nearly 63 million beneficiaries, providing critical access to health care services and financial security for the nation's seniors, people with disabilities, and people with end-stage renal disease (ESRD).

Who is the largest Medicare Advantage provider?

AARP/UnitedHealthcareAARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

How many Medicare Advantage plans are there in 2022?

3,834 Medicare Advantage plansIn total, 3,834 Medicare Advantage plans are available nationwide for individual enrollment in 2022 – an 8 percent increase (284 more plans) from 2021 and the largest number of plans available in more than a decade (Figure 2; Appendix Table 1).

What will the donut hole be in 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

Is the Medicare donut hole going away in 2021?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

What will the donut hole be in 2022?

$4,430For example, in 2022 the coverage gap — or donut hole — begins once you reach your plans Part D initial coverage limit of $4,430 in prescription costs. While you're in the coverage gap, you'll pay 25% coinsurance for covered generic drugs and 25% coinsurance for covered brand-name drugs.

Is SilverScript Smart Rx a good Part D plan?

All of Aetna's PDPs have a Medicare star quality rating of 3.5 out of five stars. CVS/Aetna's SilverScript Smart RX plan has the lowest average monthly premium in 2022, and CVS is one of four main providers of stand-alone Part D prescription drug plans in the United States.

Is SilverScript a good Medicare Part D plan?

The SilverScript family includes several distinct plans. SilverScript was the only Medicare Part D prescription drug plan serving over half a million beneficiaries to earn a 4 out of 5 Star Rating from Medicare in 2020.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

Is SilverScript worth?

SilverScript has a consumer rating of 1.28 stars from 50 reviews indicating that most customers are generally dissatisfied with their purchases. Consumers complaining about SilverScript most frequently mention customer service and last year problems. SilverScript ranks 74th among Health Insurance sites.

How many Medicare beneficiaries are enrolled in Part D?

Medicare beneficiaries who delay enrollment into Part D may be required to pay a late-enrollment penalty. In 2019, 47 million beneficiaries were enrolled in Part D, which represents three-quarters of Medicare beneficiaries.

How much of Medicare is covered by Part D?

In 2019, about three-quarters of Medicare enrollees obtained drug coverage through Part D. Program expenditures were $102 billion, which accounted for 12% of Medicare spending. Through the Part D program, Medicare finances more than one-third of retail prescription drug spending in the United States.

What is Medicare Part D?

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs.

What is Medicare Part D cost utilization?

Medicare Part D Cost Utilization Measures refer to limitations placed on medications covered in a specific insurer's formulary for a plan. Cost utilization consists of techniques that attempt to reduce insurer costs. The three main cost utilization measures are quantity limits, prior authorization and step therapy.

What is excluded from Part D?

Excluded drugs. While CMS does not have an established formulary, Part D drug coverage excludes drugs not approved by the Food and Drug Administration, those prescribed for off-label use, drugs not available by prescription for purchase in the United States, and drugs for which payments would be available under Part B.

When did Medicare Part D go into effect?

Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Under the program, drug benefits are provided by private insurance plans that receive premiums from both enrollees and the government.

What is part D coverage?

Part D coverage excludes drugs or classes of drugs that may be excluded from Medicaid coverage. These may include: Drugs used for anorexia, weight loss, or weight gain. Drugs used to promote fertility. Drugs used for erectile dysfunction. Drugs used for cosmetic purposes (hair growth, etc.)

How many people are in Medicare Part D?

A total of 48 million people with Medicare are currently enrolled in plans that provide the Medicare Part D drug benefit, representing more than three-quarters (77%) ...

What is Medicare Part D 2021?

Published: Jun 08, 2021. The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

How much does a PDP payer pay in 2021?

For drugs on the non-preferred tier (which can be all brands or a mix of brands and generics), virtually all PDP enrollees pay coinsurance between 25% and 50% in 2021, while most MA-PD enrollees (83%) pay copayments between $90 and $100. The maximum cost-sharing amount permitted by CMS is $47 or 25% for preferred brands ...

How much is Part D 2021?

For PDPs, the average Part D deductible in 2021 is $350, 3.5 times larger than the average drug deductible in MA-PDs ($102) (Figure 5). The increase in the weighted average Part D deductible for PDPs was particularly steep between 2019 and 2020, when two national PDPs modified their plan design from charging no deductible to charging a partial ...

How many Medicare beneficiaries will receive low income subsidies in 2021?

An increasing share of beneficiaries receiving low-income subsidies are enrolled in Medicare Advantage drug plans, with just over half now enrolled in MA-PDs. In 2021, nearly 13 million Part D enrollees, or just over 1 in 4, receive premium and cost-sharing assistance through the Part D Low-Income Subsidy (LIS) program.

How much is MA PD insurance in 2021?

For MA-PDs, the monthly premium for the Part D portion of covered benefits averages $12 in 2021 (and $21 for Part C and Part D benefits combined). The average premium for drug coverage in MA-PDs is lower than the average premium for PDPs due in part to the ability of MA-PD sponsors to use rebate dollars (which may include bonuses) ...

What is a SNP in Medicare?

SNPs limit enrollment to beneficiaries with certain characteristics, including those with certain chronic conditions (C-SNPs), those who require an institutional level of care (I-SNPs), and those who are dually enrolled in Medicare and Medicaid ( D-SNPs), which account for the majority of SNP enrollees.

What is Medicare Part D?

Medicare Part D is a voluntary outpatient prescription drug benefit for people with Medicare, provided through private plans approved by the federal government. Beneficiaries can choose to enroll in either a stand-alone prescription drug plan (PDP) to supplement traditional Medicare or a Medicare Advantage prescription drug plan (MA-PD), mainly HMOs and PPOs, that cover all Medicare benefits including drugs. In 2020, 46 million of the more than 60 million people covered by Medicare are enrolled in Part D plans. This fact sheet provides an overview of the Medicare Part D program, plan availability, enrollment, and spending and financing, based on data from the Centers for Medicare & Medicaid Services (CMS), the Congressional Budget Office (CBO), and other sources.

What is a Part D plan?

Part D plans also receive additional risk-adjusted payments based on the health status of their enrollees, and plans’ potential total losses or gains are limited by risk-sharing arrangements with the federal government (“risk corridors”).

How many PDPs will be available in 2021?

In 2021, 996 PDPs will be offered across the 34 PDP regions nationwide (excluding the territories). This represents an increase of 48 PDPs from 2020 (a 5% increase) and an increase of 250 plans (a 34% increase) since 2017 (Figure 1).

How many people with Medicare have no drug coverage?

Another 12% of people with Medicare are estimated to lack creditable drug coverage.

How many people will be covered by Medicare in 2020?

In 2020, 46 million of the more than 60 million people covered by Medicare are enrolled in Part D plans. This fact sheet provides an overview of the Medicare Part D program, plan availability, enrollment, and spending and financing, based on data from the Centers for Medicare & Medicaid Services (CMS), the Congressional Budget Office (CBO), ...

What is the Part D coverage phase?

The Part D defined standard benefit has several phases, including a deductible, an initial coverage phase, a coverage gap phase, and catastrophic coverage. Between 2020 and 2021, the parameters of the standard benefit are rising, which means Part D enrollees will face higher out-of-pocket costs for the deductible and in the initial coverage phase, ...

Does Medicare help with out of pocket costs?

The Medicare drug benefit has helped to reduce out-of-pocket drug spending for enrollees, which is especially important to those with modest incomes or very high drug costs. But with drug costs on the rise, more plans charging coinsurance rather than flat copayments for covered brand-name drugs, and annual increases in the out-of-pocket spending threshold, many Part D enrollees are likely to face higher out-of-pocket costs for their medications.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

How many people are on Medicare in 2019?

In 2019, over 61 million people were enrolled in the Medicare program. Nearly 53 million of them were beneficiaries for reasons of age, while the rest were beneficiaries due to various disabilities.

What is Medicare in the US?

Matej Mikulic. Medicare is a federal social insurance program and was introduced in 1965. Its aim is to provide health insurance to older and disabled people. In 2018, 17.8 percent of all people in the United States were covered by Medicare.

What is Medicare inpatient?

Hospital inpatient services – as included in Part A - are the service type which makes up the largest single part of total Medicare spending. Medicare, however, has also significant income, which amounted also to some 800 billion U.S. dollars in 2019.

Which state has the most Medicare beneficiaries?

With over 6.1 million, California was the state with the highest number of Medicare beneficiaries . The United States spent nearly 800 billion U.S. dollars on the Medicare program in 2019. Since Medicare is divided into several parts, Medicare Part A and Part B combined were responsible for the largest share of spending.

Medicare Part D: The Basics

Medicare eligibility begins at 65. Most older adults approaching 65 feel overwhelmed when it comes to signing up for Medicare coverage. Learning about enrollment periods, the parts of Medicare, and plan options can be stressful.

What is Medicare Part D?

Before we discuss when to enroll in Medicare Part D, it’s important to first understand what Medicare Part D is. Medicare Part D is the part of Medicare that helps Medicare beneficiaries pay for some or all of their prescription drug costs. Part D plans are offered by private insurance companies as stand-alone prescription drug plans.

Who can Enroll in Medicare Part D?

A Medicare Part D plan is available to anyone who is eligible for Medicare. However, you must be enrolled in Original Medicare (Part A and Part B) or a Medicare Advantage plan to enroll in a Part D prescription drug plan. It is important to note, enrolling in Original Medicare does not automatically enroll you in a prescription drug plan.

Medicare Part D Enrollment Periods

There are a few specific enrollment periods to be aware of when signing up for a Medicare Part D plan:

How to Enroll in Medicare Part D

Enrolling in Medicare Part D is simple. However, before you begin the enrollment process it’s important to shop and compare plans to ensure you receive the right coverage for your needs. Here are some questions to consider before enrolling in a Part D plan

Appealing a Late Enrollment Penalty

Medicare Part D enrollees have the right to appeal a decision they believe to be wrong about a late enrollment penalty. Common reasons individuals appeal a decision include

Medicare Part D Enrollment FAQs

Should I enroll in Medicare Part D if I don’t currently take any medications?

Overview

Program specifics

To enroll in Part D, Medicare beneficiaries must also be enrolled in either Part A or Part B. Beneficiaries can participate in Part D through a stand-alone prescription drug plan or through a Medicare Advantage plan that includes prescription drug benefits. Beneficiaries can enroll directly through the plan's sponsor or through an intermediary. Medicare beneficiaries who delay enrollm…

History

Upon enactment in 1965, Medicare included coverage for physician-administered drugs, but not self-administered prescription drugs. While some earlier drafts of the Medicare legislation included an outpatient drug benefit, those provisions were dropped due to budgetary concerns. In response to criticism regarding this omission, President Lyndon Johnson ordered the forma…

Program costs

In 2019, total drug spending for Medicare Part D beneficiaries was about 180 billion dollars. One-third of this amount, about 120 billion dollars, was paid by prescription drug plans. This plan liability amount was partially offset by about 50 billion dollars in discounts, mostly in the form of manufacturer and pharmacy rebates. This implied a net plan liability (i.e. net of discounts) of roughly 70 billion dollars. To finance this cost, plans received roughly 50 billion in federal reinsur…

Cost utilization

Medicare Part D Cost Utilization Measures refer to limitations placed on medications covered in a specific insurer's formulary for a plan. Cost utilization consists of techniques that attempt to reduce insurer costs. The three main cost utilization measures are quantity limits, prior authorization and step therapy.

Quantity limits refer to the maximum amount of a medication that may be dispensed during a gi…

Implementation issues

• Plan and Health Care Provider goal alignment: PDP's and MA's are rewarded for focusing on low-cost drugs to all beneficiaries, while providers are rewarded for quality of care – sometimes involving expensive technologies.

• Conflicting goals: Plans are required to have a tiered exemptions process for beneficiaries to get a higher-tier drug at a lower cost, but plans must grant medically-necessary exceptions. However, the rule denies beneficiaries the right to reques…

Impact on beneficiaries

A 2008 study found that the percentage of Medicare beneficiaries who reported forgoing medications due to cost dropped with Part D, from 15.2% in 2004 and 14.1% in 2005 to 11.5% in 2006. The percentage who reported skipping other basic necessities to pay for drugs also dropped, from 10.6% in 2004 and 11.1% in 2005 to 7.6% in 2006. The very sickest beneficiaries reported no reduction, but fewer reported forgoing other necessities to pay for medicine.

Criticisms

The federal government is not permitted to negotiate Part D drug prices with drug companies, as federal agencies do in other programs. The Department of Veterans Affairs, which is allowed to negotiate drug prices and establish a formulary, has been estimated to pay between 40% and 58% less for drugs, on average, than Part D. On the other hand, the VA only covers about half the brands that a typical Part D plan covers.

Medicare Prescription Drug Plan Availability in 2022

Low-Income Subsidy Plan Availability in 2022

- Beneficiaries with low incomes and modest assets are eligible for assistance with Part D plan premiums and cost sharing. Through the Part D Low-Income Subsidy (LIS) program, additional premium and cost-sharing assistance is available for Part D enrollees with low incomes (less than 150% of poverty, or $19,320 for individuals/$26,130 for married couples in 2021) and modest as…

Part D Plan Premiums and Benefits in 2022

- Premiums

The 2022 Part D base beneficiary premium – which is based on bids submitted by both PDPs and MA-PDs and is not weighted by enrollment – is $33.37, a modest (1%) increase from 2021. But actual premiums paid by Part D enrollees vary considerably. For 2022, PDP monthly premiums r… - Benefits

The Part D defined standard benefit has several phases, including a deductible, an initial coverage phase, a coverage gap phase, and catastrophic coverage, although it does not have a hard cap on out-of-pocket spending. Between 2021 and 2022, the parameters of the standard benefit are risi…

Part D and Low-Income Subsidy Enrollment

- Enrollment in Medicare Part D plans is voluntary, except for beneficiaries who are eligible for both Medicare and Medicaid and certain other low-income beneficiaries who are automatically enrolled in a PDP if they do not choose a plan on their own. Unless beneficiaries have drug coverage from another source that is at least as good as standard Part D coverage (“creditable coverage”), the…

Part D Spending and Financing

- Part D Spending

The Congressional Budget Office (CBO) estimates that spending on Part D benefits will total $111 billion in 2022, representing 15% of net Medicare outlays (net of offsetting receipts from premiums and state transfers). Part D spending depends on several factors, including the total n… - Part D Financing

Financing for Part Dcomes from general revenues (73%), beneficiary premiums (15%), and state contributions (11%). The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by …

Issues For The Future

- The Medicare drug benefit has helped to reduce out-of-pocket drug spending for enrollees, which is especially important to those with modest incomes or very high drug costs. But in the face of rising drug prices, more plans charging coinsurance rather than flat copayments for covered brand-name drugs, and annual increases in the out-of-pocket spending threshold, many Part D e…