| Total Medicare beneficiaries • Aged • Disabled | 61.2 million • 52.6 million • 8.7 million |

|---|---|

| Part B (Supplementary Medical Insurance, SMI) beneficiaries • Aged • Disabled | 56.1 million • 48.2 million • 7.9 million |

| Part C (Medicare Advantage) beneficiaries | 22.2 million |

What is Medicare Part A and B?

Medicare is split into parts with Part A (Hospital Insurance) covering inpatient hospital stays, care in skilled nursing facility, hospice care and parts of home health care. Part B (Medical insurance) covers certain doctors' services, outpatient care, medical supplies, and preventive care.

How much do you pay for Medicare Part B?

Beginning in 2013, workers pay an additional 0.9 percent of their earnings above $200,000 (for those who file an individual return) or $250,000 (for those who file a joint income tax return) – Up to $5 co-payment per prescription for outpatient drugs for pain and symptom management The standard Part B premium is $144.60.

How many people rely on Medicare?

More than 62 million people, including 54 million older adults and 8 million younger adults with disabilities, rely on Medicare for their health insurance coverage.

What is the Medicare Part B deductible for beneficiaries?

Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies. These Part B costs can add up quickly, which is why many beneficiaries search for a way to lower or be reimbursed for these expenses.

What percentage of people have Medicare Part B?

People who do not meet the employment criteria can pay a monthly premium for Part A coverage; about 1 percent of Part A enrollees pay their own premiums. Most people (93 percent) enroll in both programs, while 6 percent enroll in Part A only and 1 percent enroll in Part B only.

How many Medicare beneficiaries are there in 2021?

As of October 2021, the total Medicare enrollment is 63,964,675. Original Medicare enrollment is 36,045,321, and Medicare Advantage and Other Health Plan enrollment is 27,919,354. This includes enrollment in Medicare Advantage plans with and without prescription drug coverage.

Does everyone have Medicare Part B?

You Need Part B if Medicare Is Primary It is your outpatient coverage. Once you retire and have no access to other health coverage, Medicare becomes your primary insurance. Part A pays for your room and board in the hospital. Part B covers most of the rest.

What percentage of the US population is on Medicare?

18.4%Medicare is a federal health insurance program that pays for covered health care services for most people aged 65 and older and for certain permanently disabled individuals under the age of 65. An estimated 60 million individuals (18.4% of the U.S. population) were enrolled in Medicare in 2020.

What state has the most Medicare recipients?

CaliforniaCalifornia has the highest number of Medicare beneficiaries in the United States, according to State Health Facts, a project of the Henry J. Kaiser Family Foundation.

What percent of seniors choose Medicare Advantage?

[+] More than 28.5 million patients are now enrolled in Medicare Advantage plans, according to new federal data. That's up nearly 9% compared with the same time last year. More than 40% of the more than 63 million people enrolled in Medicare are now in an MA plan.

Do most federal retirees take Medicare Part B?

About 70% of federal retirees enroll in Part B, which means paying two premiums and in essence two duplicative insurance programs. A portion of the retirees that join Part B might do so as a hedge against the elimination of FEHB retiree benefits.

What happens if I don't want Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

Can I drop Medicare Part B anytime?

You can disenroll from Part B and stop paying premiums for it in this situation, regardless of whether it was you or your spouse who landed this new job. In other words, you're allowed to delay Part B without penalty if you have health insurance from current employment and the employer plan is primary to Medicare.

How many U.S. citizens Cannot afford health care?

46 million peopleA staggering 46 million people — nearly one-fifth of all Americans — cannot afford necessary healthcare services, according to a new survey. Conducted by West Health and Gallup, the survey polled 3,753 U.S. adults from Feb. 15-21.

Who uses Medicare the most?

The U.S. states with the highest percentage of Medicare beneficiaries among their populations were Maine and West Virginia, where 24 and more percent of the population was enrolled. With over 6.2 million, California was the state with the highest number of Medicare beneficiaries.

How many Americans have no health insurance?

31.1 million peopleAn estimated 9.6% of U.S. residents, or 31.1 million people, lacked health insurance when surveyed in the first six months of 2021, according to preliminary estimates from the National Health Interview Survey released yesterday by the Centers for Disease Control and Prevention.

How many people are on Medicare in 2019?

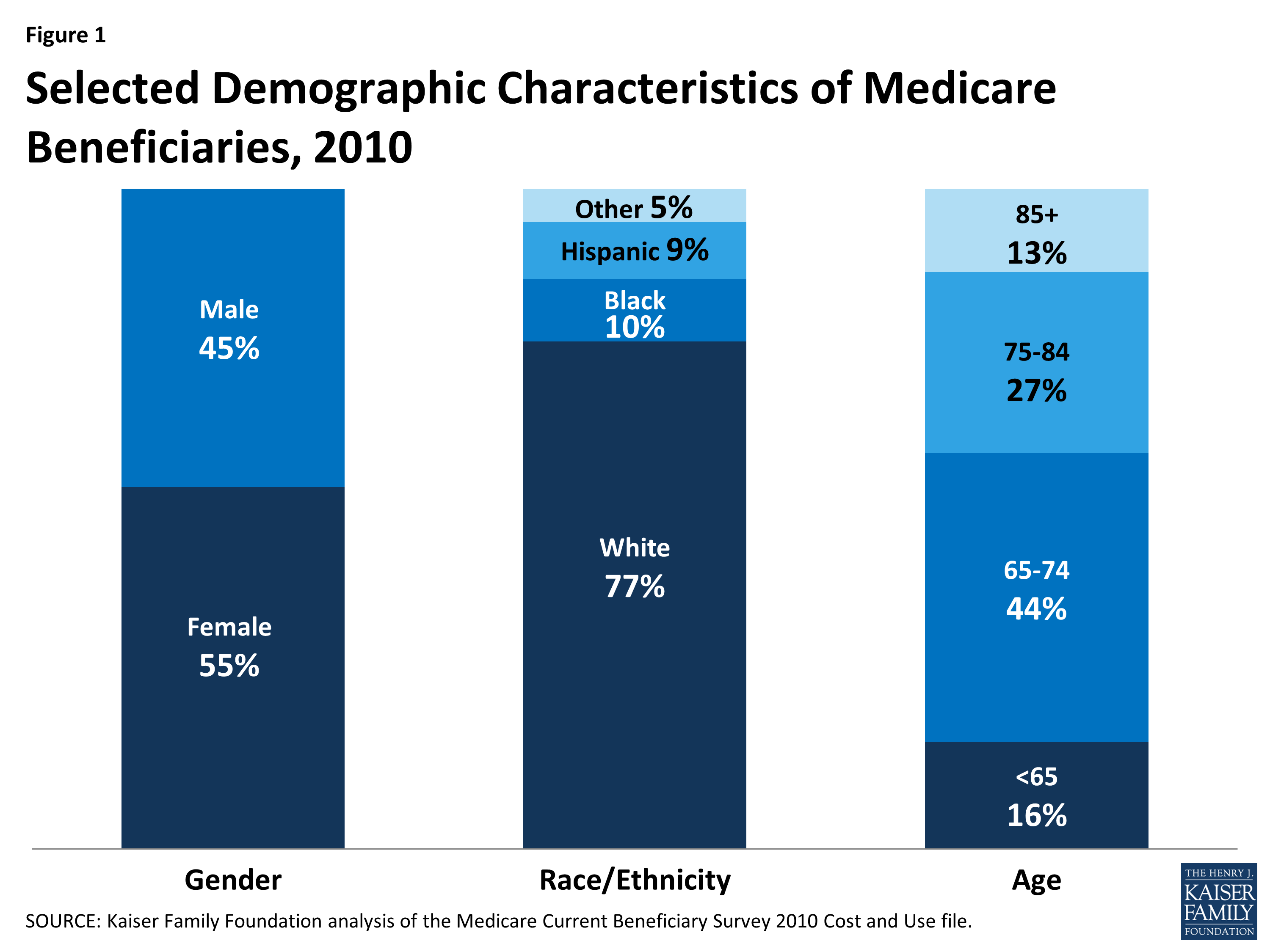

In 2019, over 61 million people were enrolled in the Medicare program. Nearly 53 million of them were beneficiaries for reasons of age, while the rest were beneficiaries due to various disabilities.

What is Medicare in the US?

Matej Mikulic. Medicare is a federal social insurance program and was introduced in 1965. Its aim is to provide health insurance to older and disabled people. In 2018, 17.8 percent of all people in the United States were covered by Medicare.

Which state has the most Medicare beneficiaries?

With over 6.1 million, California was the state with the highest number of Medicare beneficiaries . The United States spent nearly 800 billion U.S. dollars on the Medicare program in 2019. Since Medicare is divided into several parts, Medicare Part A and Part B combined were responsible for the largest share of spending.

What is Medicare inpatient?

Hospital inpatient services – as included in Part A - are the service type which makes up the largest single part of total Medicare spending. Medicare, however, has also significant income, which amounted also to some 800 billion U.S. dollars in 2019.

How much is Medicare Part A deductible?

– Initial deductible: $1,408.

What is Medicare Advantage?

Medicare Advantage (MA): Eligibility to choose a MA plan: People who are enrolled in both Medicare A and B, pay the Part B monthly premium, do not have end-stage renal disease, and live in the service area of the plan. Formerly known as Medicare+Choice or Medicare Health Plans.

What is Medicare Part B?

Medicare Part B is medical insurance. Along with Medicare Part A (hospital insurance), it makes up Original Medicare, the federal health insurance program. Here’s something important to know about Medicare Part B: you need this coverage if you decide to sign up for a Medicare Advantage plan, or buy a Medicare Supplement insurance plan.

How much is Medicare Part B 2021?

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services.

What happens if you don't sign up for Medicare Part B?

However, when that coverage ends, be aware that if you don’t sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty. Here’s one reason you might want to sign up for Medicare Part B. Suppose you decide you’d like to buy a Medicare Supplement insurance plan.

How much is the Part B deductible for 2021?

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021. After you pay your deductible, you generally pay a 20% coinsurance (as mentioned above) for most covered services.

Does Medicare cover long term care?

If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it .

Is a hospital inpatient covered by Medicare?

Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B. Some tests and services that your doctor might order or recommend for you.

Do you have to pay Medicare Part B premium?

Please note that even if you decide to get your Original Medicare benefits through a Medicare Advantage plan, you still have to pay our monthly Medicare Part B premium. Of course, if the Medicare Advantage plan charges a premium, you’ll need to pay that as well. Some Medicare Advantage premiums are as low as $0.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

How many people are covered by Medicare Supplement?

Medicare supplement insurance, also known as Medigap, provided supplemental coverage to 2 in 10 (21%) Medicare beneficiaries overall, or 34% of those in traditional Medicare (roughly 11 million beneficiaries) in 2018. As with other forms of supplemental insurance, the share of beneficiaries with Medigap varies by state.

How many Medicare beneficiaries have employer sponsored retirement?

Employer-sponsored Retiree Health Coverage. In total, 14.3 million of Medicare beneficiaries – a quarter (26%) Medicare beneficiaries overall — also had some form of employer-sponsored retiree health coverage in 2018. Of the total number of beneficiaries with retiree health coverage, nearly 10 million beneficiaries have retiree coverage ...

What is Medicare Advantage?

Medicare Advantage plans provide all benefits covered by Medicare Parts A and B, often provide supplemental benefits, such as dental and vision, and typically provide the Part D prescription drug benefit. Many traditional Medicare beneficiaries also rely on other sources of coverage to supplement their Medicare benefits.

Does Medicare have supplemental coverage?

No Supplemental Coverage. In 2018, 5.6 million Medicare beneficiaries in traditional Medicare– 1 in 10 beneficiaries overall (10%) or nearly 1 in 5 of those with traditional Medicare (17%) had no source of supplemental coverage. Beneficiaries in traditional Medicare with no supplemental coverage are fully exposed to Medicare’s cost-sharing ...

Does Medigap increase with age?

While Medigap limits the financial exposure of Medicare beneficiaries and provides protection against catastrophic expenses for services covered under Parts A and B, Medigap premiums can be costly and can rise with age, depending on the state in which they are regulated.

Does Medicare Part B cover Part B?

As of January 1, 2020, Medigap policies are prohibited from covering the full Medicare Part B deductible for newly-eligible enrollees; however, older beneficiaries who are already enrolled are permitted to keep this coverage.

Can you enroll in a Part D plan?

Beneficiaries can also enroll in a Part D plan for prescription drug coverage, either a stand-alone plan to supplement traditional Medicare or a Medicare Advantage plan that covers drugs. This data note explores sources of coverage among beneficiaries in Medicare and the demographic characteristics of people with different types of coverage, ...

For those who qualify, there are multiple ways to have your Medicare Part B premium paid

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

What is the Part B premium reduction benefit?

The giveback benefit, or Part B premium reduction, is when a Part C Medicare Advantage (MA) plan reduces the amount you pay toward your Part B monthly premium. Your reimbursement amount could range from less than $1 to the full premium amount, which is $170.10 in 2022.

How to find plans that offer the giveback benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2022, these plans are offered in nearly all states, so you may find one close to you.

Other Part B reimbursement options

There are other ways you can lower or eliminate how much you pay for the Medicare Part B premium. This includes certain Medicaid programs or benefits from some retiree health plans.