How much to earn a Medicare quarter?

You typically need to have worked and paid Medicare taxes for 40 quarters – equal to 10 years ¬– to qualify for premium-free Medicare Part A (hospital insurance). Learn more about your coverage options. When learning about your Medicare costs, you …

How much can you make to qualify for Medicare?

Jun 24, 2020 · For premium-free Medicare Part A, an individual must have worked 40 quarters. A quarter of coverage indicates a 3-month period of work that includes Medicare taxes. Also, in 2021, a person must...

How many quarters of coverage is required for Social Security?

Jun 03, 2021 · Normally, you need to have earned about 40 “credits” or “quarters” by paying Social Security and Medicare payroll taxes while working — equal to about 10 years of work — in order to get Part A services without paying premiums. The premiums have already been covered by …

How many Medicare quarters do I have?

For the Social Security Administration, the number of employment quarters that qualify you for retirement and premium-free Medicare Part A depends on your date of birth. If you were born in 1929 or later, you need 40 credits (equal to 10 years of work).

Do you have to work 10 years for Medicare?

Answer: Medicare is a big umbrella, covering several different aspects of health care. ... Normally, you need to have earned about 40 “credits” or...

What are the 3 important eligibility criteria for Medicare?

You qualify for Medicare if you are 65 or older, a U.S. citizen or a permanent legal resident who's been in the United States for at least five yea...

Do you have to wait two years to get Medicare?

You have to wait two years after you are entitled to disability benefits to get Medicare unless you fit into an exception. All Social Security disa...

How many quarters must you work to qualify for Medicare?

40Medicare Part A is free if you: Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S. Are eligib...

What Are Employment Quarters For Social Security?

The Social Security Administration calls employment quarters by several names, such as “quarter of coverage” and “Social Security credits” or simpl...

What Are Employment Quarters For The Railroad Retirement Board?

If you worked for a railroad, your retirement benefits are calculated by how many calendar months you worked. Beginning at age 60 and with a minimu...

How Many Employment Quarters Do You Need to Have Worked to Get Premium-Free Medicare Part A?

For the Social Security Administration, the number of employment quarters that qualify you for retirement and premium-free Medicare Part A depends...

Qualifying For Premium-Free Medicare Part A Through Your Spouse’S Employment

If you have never worked or have not worked enough employment quarters to qualify for premium-free Part A and you’re married, you might gain this b...

How many quarters do you have to work to qualify for Medicare?

To qualify for premium-free Medicare Part A, an individual must have worked 40 quarters in their lifetime. The Social Security Administration fund Medicare.

What are the requirements for Medicare Part A?

Adults aged younger than 65 may also qualify for free Medicare Part A if they have: 1 received Social Security Disability benefits for 2 years 2 amyotrophic lateral sclerosis ( Lou Gehrig’s disease) 3 end stage renal disease

What is Medicare Part A?

Summary. When a person has worked and paid taxes for 40 quarters during their life, they may be entitled to premium-free Medicare Part A. Medicare Part A is part of the federal health insurance program for adults aged 65 and over and younger adults with qualifying disabilities.

What is a quarter of coverage?

A quarter of coverage is a 3-month calendar quarter in which a person worked in a job and paid Medicare taxes. Every quarter of coverage earned counts as one credit toward qualifying for free Medicare Part A. During a quarter of coverage, an employee pays Federal Insurance Contributions Act ...

How much will Medicare cost in 2021?

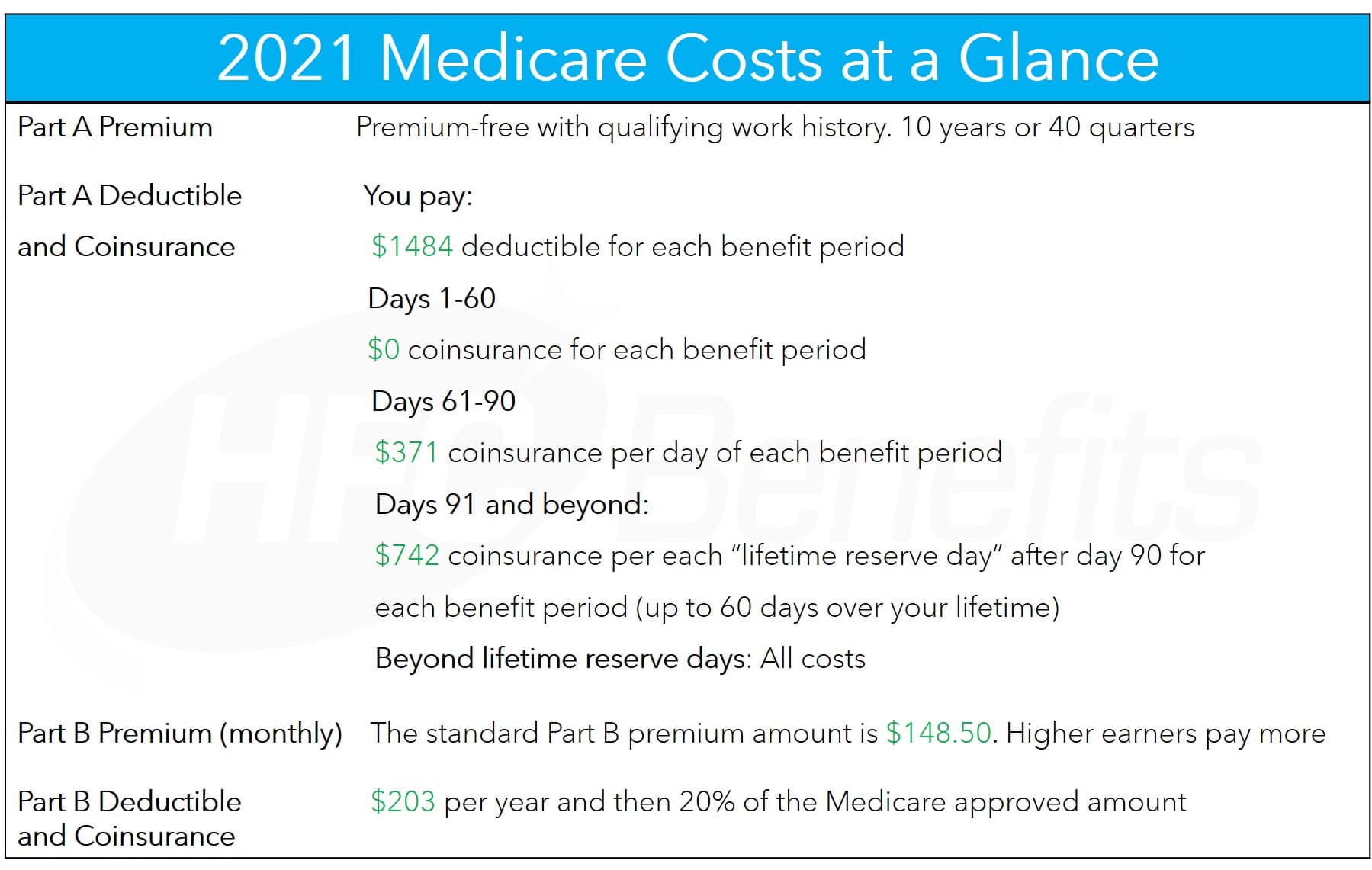

The monthly cost for Medicare Part A may change, but in 2021, people who paid Medicare taxes and earned between 30 and 39 quarters pay a monthly Part A premium of $259. Individuals who paid Medicare taxes for less than 30 quarters pay $471 a month.

How many credits do you need to work to get a disability?

This means that a person would have to have worked for 4 years, gaining 16 credits. Age 31 and older: An individual must have earned a minimum of 20 credits in the 10 years before they acquired a disability.

What is Lou Gehrig's disease?

amyotrophic lateral sclerosis ( Lou Gehrig’s disease) end stage renal disease. When in receipt of Social Security Disability benefits, individuals must have worked a certain number of quarters, depending on their age, to be entitled to premium-free Medicare Part A. The numbers of quarters required include:

How does Medicare Part A work?

Medicare Part A is funded largely by payroll taxes paid by employees, employers, people who are self-employed, and Medicare Part A premiums.

What is a quarter of Social Security?

What are employment quarters for Social Security? The Social Security Administration calls employment quarters by several names, such as “quarter of coverage” and “Social Security credits” or simply “credits.”. How credits for Social Security retirement benefits (and thus, Medicare benefits) have been calculated has changed over the years.

How many credits do you need to qualify for Medicare?

Before someone can qualify for Medicare or Social Security benefits, they must have 40 work credits. People earn credits, or qualifying quarters, as they work and pay Social Security taxes on their income. A person can earn up to four credits per year, so it will take 10 years to earn the required 40. Qualifying quarters worked are also called ...

How many credits do you need to get Medicare Part A?

People aged 65 years old are eligible to receive premium-free Medicare Part A if they or their spouse have 40 work credits. This equates to around 10 years of work in which they paid Social Security taxes.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What happens if you don't enroll in health insurance?

In many cases, if they do not enroll when they are first eligible, they may incur a late enrollment penalty in the form of higher monthly premiums. On the other hand, people who work past the age of 65 years and have health insurance with their employer may wonder if they should delay enrolling in parts A and B.

How many work credits are eligible for Part A?

People with 40 work credits are eligible for premium-free Part A. In 2021, people with fewer than 30 work credits must pay the monthly premium of $471 to receive Part A benefits.

Is Medigap part of Medicare?

Each Part D plan covers at least two medications in the commonly prescribed categories. Medigap is Medicare supplement insurance. It is available to people with original Medicare. It pays 50–100% of the parts A and B out-of-pocket costs.

How old do you have to be to get Medicare?

If you are age 65 or older, you are generally eligible to receive Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) if you are a United States citizen or a permanent legal resident who has lived in the U.S. for at least five years in a row.

When do you get Medicare Part A and Part B?

If you meet Medicare eligibility requirements and you have received Social Security benefits for at least four months prior to turning age 65, you will typically get Medicare Part A and Part B automatically the first day of the month you turn age 65.

Is Medicare available to everyone?

Medicare coverage is not available to everyone. To receive benefits under this federal insurance program, you have to meet Medicare eligibility requirements. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

How many credits do you need to get Medicare?

Normally, you need to have earned about 40 “credits” or “quarters” by paying Social Security and Medicare payroll taxes while working — equal to about 10 years of work — in order to get Part A services without paying premiums. The premiums have already been covered by your payroll taxes.

What is Medicare Part B?

But you most likely qualify for Medicare Part B ( which covers doctors’ services, outpatient care and medical equipment) and for Part D (prescription drug coverage) because these have nothing to do with how long you’ve worked.

How many credits do I need to qualify for SSDI?

How Many Work Credits Do I Need To Qualify For SSDI? Generally speaking, to be insured for SSDI benefits you must have earned at least 20 work credits during the past 40 quarters (10 years) prior to the onset of your disability. The date in which your SSDI coverage expires is referred to as your “date last insured.”.

What is the number to call for Social Security Disability?

Learn more about us and disability benefits like SSDI & SSI or give us a call (800)492-3260.

What is Citizens Disability?

Since 2010, Citizens Disability has been America’s premier Social Security Disability institution. Our services include helping people in applying for SSDI benefits, managing the process through Reconsideration, and representing people in person at their Hearing, and if necessary, bringing their case to the Appeals Council. Our mission is to give a voice to the millions of Americans who are disabled and unable to work, helping them receive the Social Security Disability benefits to which they may be entitled. Learn more about us and disability benefits like SSDI & SSI or give us a call (800)492-3260.

How much Social Security do I need to retire?

To qualify for retirement benefits, you need 40 Social Security credits. You earn credits by paying Social Security tax on your income, and you can earn up to four per year. In 2021, $1,470 in earnings equals one credit; you earn four credits after making $5,880 for the year.

How much can I earn on Social Security in 2021?

You earn credits by paying Social Security tax on your income, and you can earn up to four per year. In 2021, $1,470 in earnings equals one credit; you earn four credits after making $5,880 for the year. For eligibility purposes, it doesn’t matter how long it takes you to earn your 40 credits, but practically speaking most people qualify ...

Do you have to work to get SSI?

There is no work requirement for Supplemental Security Income (SSI), a safety-net program administered by Social Security that provides cash assistance for people who are over 65, blind or disabled and have very limited income and financial assets.