How many years of work is 40 quarters for Medicare?

When learning about your Medicare costs, you may have come across the mention of “quarters.” Medicare quarters refer to the amount of qualified time that you …

How many quarters do you need to qualify for Medicare?

How many employment quarters do you need to have worked to get premium-free Medicare Part A? For the Social Security Administration, the number of employment quarters that qualify you for retirement and premium-free Medicare Part A depends on your date of birth. If you were born in 1929 or later, you need 40 credits (equal to 10 years of work).

What are Medicare quarters and how do they work?

Jun 03, 2021 · To qualify for Medicare under the elderly category, individuals must be at least 65 years old and a U.S. citizen or permanent legal resident with at least 5 years of continuous residency. from Essentials of Health Policy and Law. by Joel B. Teitelbaum, Sara E. Wilensky. Jones & Bartlett Learning, 2016.

What is a quarter of health insurance coverage?

If you or your spouse worked between 30 and 39 quarters (7.5 and 10 years) $437. If you or your spouse worked fewer than 30 quarters (7.5 years) If your income is low, you may be eligible for the Qualified Medicare Beneficiary (QMB) program, which pays for your Medicare Part A and B premiums and other Medicare costs.

/cdn.vox-cdn.com/uploads/chorus_image/image/35391622/179789963.0.jpg)

How many years is 40 quarters for Medicare?

10 yearsA: Part A is free if you or your spouse has worked and paid taxes to Medicare for at least 40 quarters (10 years). If you do not have enough working quarters, you will have to pay a premium for Part A. Part B always has monthly premium.

How long is a quarter in Medicare?

three-monthA calendar quarter is a three-month period of time ending with March 31, June 30, September 30, or December 31. Social Security counts each calendar quarter that you work and pay into Social Security and Medicare taxes toward your eligibility for premium-free Part A.

How many quarters are in a year for Medicare?

four quartersEach year has four quarters. Roughly, 40 quarters equals 10 years of work. The 40-quarters rule only applies to premium-free Medicare Part A. Other parts of Medicare, including Medicare Part B, involve a monthly premium regardless of how long a person has worked in their lifetime.Jun 24, 2020

How many quarters work for Medicare?

40 calendar quartersMedicare Part A is free if you: Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S.

How many quarters do you need to retire?

40 quartersTo even be eligible for retirement benefits, you generally need 10 years (40 quarters) of gainful employment. In 2017, you need to earn at least $1,300 in a quarter for it to count as a credit.

How do you calculate 40 qualifying quarters?

To get 40 quarters of work to qualify for federal SNAP benefits, the legal immigrant household member can count quarters she has worked, quarters her spouse has worked, and quarters her parents worked before she turned 18.

What are the quarter dates for 2021?

Past 5 YearsQuarterStart DateEnd DateQ101-01-202131-03-2021Q201-04-202130-06-2021Q301-07-202130-09-2021Q401-10-202131-12-20214 more rows

How many years is 10 quarters?

Quarter to Year Conversion TableQuarter [quarter]Year [y]71.758292.25102.58 more rows

How much does 400 quarters equal?

400 quarters equals $100.00 in dollars!

How do I find out how many quarters I have worked?

Go to www.ssa.gov/mystatement/ and open an account with Social Security to view your statement. (You can no longer request a printed statement either using Form SSA 7004.)

How many years is 40 credits for Social Security?

10 yearsAnyone born in 1929 or later needs 10 years of work (40 credits) to be eligible for retirement benefits.

How much is Medicare if you don't have enough credits?

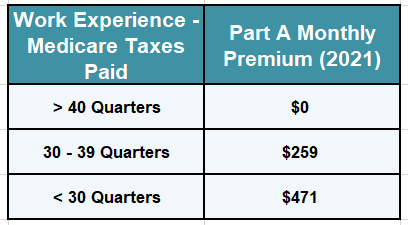

If you have fewer than 30 credits, you may have to pay a premium of $471 per month for Medicare Part A in 2021. If you have 30 to 39 credits, the standard Part A premium is $259. Some exceptions may allow you to get premium-free Medicare Part A even if you don't have enough credits.Jul 28, 2020

What Are Employment Quarters For Social Security?

The Social Security Administration calls employment quarters by several names, such as “quarter of coverage” and “Social Security credits” or simpl...

What Are Employment Quarters For The Railroad Retirement Board?

If you worked for a railroad, your retirement benefits are calculated by how many calendar months you worked. Beginning at age 60 and with a minimu...

How Many Employment Quarters Do You Need to Have Worked to Get Premium-Free Medicare Part A?

For the Social Security Administration, the number of employment quarters that qualify you for retirement and premium-free Medicare Part A depends...

Qualifying For Premium-Free Medicare Part A Through Your Spouse’S Employment

If you have never worked or have not worked enough employment quarters to qualify for premium-free Part A and you’re married, you might gain this b...

Do you have to work 10 years for Medicare?

Answer: Medicare is a big umbrella, covering several different aspects of health care. ... Normally, you need to have earned about 40 “credits” or...

What are the 3 important eligibility criteria for Medicare?

You qualify for Medicare if you are 65 or older, a U.S. citizen or a permanent legal resident who's been in the United States for at least five yea...

Do you have to wait two years to get Medicare?

You have to wait two years after you are entitled to disability benefits to get Medicare unless you fit into an exception. All Social Security disa...

How many quarters must you work to qualify for Medicare?

40Medicare Part A is free if you: Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S. Are eligib...

What is a quarter of Social Security?

What are employment quarters for Social Security? The Social Security Administration calls employment quarters by several names, such as “quarter of coverage” and “Social Security credits” or simply “credits.”. How credits for Social Security retirement benefits (and thus, Medicare benefits) have been calculated has changed over the years.

How does Medicare Part A work?

Medicare Part A is funded largely by payroll taxes paid by employees, employers, people who are self-employed, and Medicare Part A premiums.

How many quarters do you have to work to qualify for Medicare?

To qualify for premium-free Medicare Part A, an individual must have worked 40 quarters in their lifetime. The Social Security Administration fund Medicare.

What is a quarter of coverage?

A quarter of coverage is a 3-month calendar quarter in which a person worked in a job and paid Medicare taxes. Every quarter of coverage earned counts as one credit toward qualifying for free Medicare Part A. During a quarter of coverage, an employee pays Federal Insurance Contributions Act ...

What are the requirements for Medicare Part A?

Adults aged younger than 65 may also qualify for free Medicare Part A if they have: 1 received Social Security Disability benefits for 2 years 2 amyotrophic lateral sclerosis ( Lou Gehrig’s disease) 3 end stage renal disease

What is Medicare Part A?

Summary. When a person has worked and paid taxes for 40 quarters during their life, they may be entitled to premium-free Medicare Part A. Medicare Part A is part of the federal health insurance program for adults aged 65 and over and younger adults with qualifying disabilities.

How much will Medicare cost in 2021?

The monthly cost for Medicare Part A may change, but in 2021, people who paid Medicare taxes and earned between 30 and 39 quarters pay a monthly Part A premium of $259. Individuals who paid Medicare taxes for less than 30 quarters pay $471 a month.

How many credits do you need to work to get a disability?

This means that a person would have to have worked for 4 years, gaining 16 credits. Age 31 and older: An individual must have earned a minimum of 20 credits in the 10 years before they acquired a disability.

What is Lou Gehrig's disease?

amyotrophic lateral sclerosis ( Lou Gehrig’s disease) end stage renal disease. When in receipt of Social Security Disability benefits, individuals must have worked a certain number of quarters, depending on their age, to be entitled to premium-free Medicare Part A. The numbers of quarters required include:

What is QMB in Medicare?

If you or your spouse worked fewer than 30 quarters (7.5 years) If your income is low, you may be eligible for the Qualified Medicare Beneficiary (QMB) program, which pays for your Medicare Part A and B premiums and other Medicare costs.

Is Medicare Part A free?

Register. Medicare Part A is free if you: Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S. Are eligible for Railroad Retirement benefits. Or, have a spouse that qualifies for premium -free Part A. [bsa_pro_ad_space id=3]

How many years do you have to work to qualify for Medicare?

Four is the maximum number of credits a person can earn per year, so it takes at least 10 years or 40 quarters of employment to be eligible for Medicare. The Social Security statement available to registered users on ssa.gov reveals if you have earned enough credits to qualify for Medicare when you reach age of 65.

How much is Medicare premium for 2020?

For those who do not meet the criteria and have to pay a premium, the rates for 2020 is as follows: $458 per month for those who paid Medicare taxes for less than 30 quarters. $252 per month for those who paid Medicare taxes for 30-39 quarters.

What is included in W-2?

The annual W-2 Form that U.S. employees receive includes not only year-to-date earnings but also taxes paid toward Social Security and Medicare. Forty credits are required to be eligible for benefits. The requirements may be modified for young people claiming disability or survivor benefits.

Is Medicare the same for everyone?

Medicare is a federal program that mandates standardization of services nationwide, so many people may assume the premiums would be the same for everyone. In reality, there are variations in the premiums people pay, if they pay any at all.

How many credits do you need to be a survivor?

The younger you are, the fewer credits needed. Nobody needs more than 40 credits.

How many credits do you need to qualify for disability?

The number of credits necessary to meet the recent work test depends on your age. The rules are as follows: Before age 24 - You may qualify if you have 6 credits earned in the 3-year period ending when your disability starts.