Generally, recipients experience healthcare savings through a Medicare Advantage plan when they choose plans that help cover the costs associated with out-of-pocket expenses. Part C plans have their own monthly premium that is paid separately from the Part B premium, but some plans will pay the Part B premium as part of the benefits offered.

What is a Medicare Advantage plan?

Medicare Advantage plans, also known as Medicare Part C, offer recipients a choice in what kind of healthcare they receive by bundling Original Medicare with additional benefits. Medicare …

Why are Medicare Advantage plans so expensive?

Dec 08, 2021 · 10. Shop around and compare plans. One way to potentially save money on your Medicare coverage is to simply shop around and compare available Medicare Advantage plans in your area. Call today to speak with a licensed insurance agent to learn more about a plan that could fit your health care needs.

Is Medicare Advantage right for You?

Medicare Advantage Plans cover almost all Part A and Part B services. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new …

Do Medicare Advantage plans offer the same level of choice as Medigap?

First, it’s important to understand that there are several different kinds of Medicare Advantage plans, and costs can vary even among plans of the same type. One way a Medicare Advantage …

Does Medicare Advantage save money?

Does getting a Medicare Advantage plan make you lose original Medicare?

What are the advantages of having a Medicare Advantage plan?

Medicare Advantage plans typically include coverage that Original Medicare doesn't. Your plan may include additional benefits like dental, vision, hearing, and prescription drug coverage. Health equipment may be covered.Sep 30, 2021

Can you have both Medicare and a Medicare Advantage Plan?

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

What are the negatives of a Medicare Advantage plan?

Is Medicare Advantage too good to be true?

What are 4 types of Medicare Advantage plans?

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs)

What is the most popular Medicare Advantage plan?

What is the biggest difference between Medicare and Medicare Advantage?

Can you switch back and forth between Medicare and Medicare Advantage?

Who is the largest Medicare Advantage provider?

How Do Medicare Advantage Plans Work?

Medicare Advantage plans are offered by private insurance companies that are approved by Medicare. Every month, Medicare pays the private insurance...

What Are The Downsides of Medicare Advantage Plans?

Since Medicare Advantage plan coverage is administered through a private insurance company, the rules and guidelines can vary, which can lead to re...

What Are The Pros of Medicare Advantage Plans?

1. Some insurance companies could offer a $0 premium for the Medicare Advantage plan. Medicare Advantage plan availability will depend on the count...

How Do I Choose A Medicare Advantage Plan?

It’s up to you to determine which type of coverage is the right option. It’s important to read all of the details of each Medicare Advantage plan,...

Do I Qualify For Enrollment in A Medicare Advantage Plan?

Qualifying for enrollment in a Medicare Advantage plan requires that you are enrolled in both Medicare Part A and Part B. People with end-stage ren...

Why do you keep your Medicare card?

Keep your red, white, and blue Medicare card in a safe place because you’ll need it if you ever switch back to Original Medicare. Below are the most common types of Medicare Advantage Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

What is a special needs plan?

Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

What is Medicare Advantage?

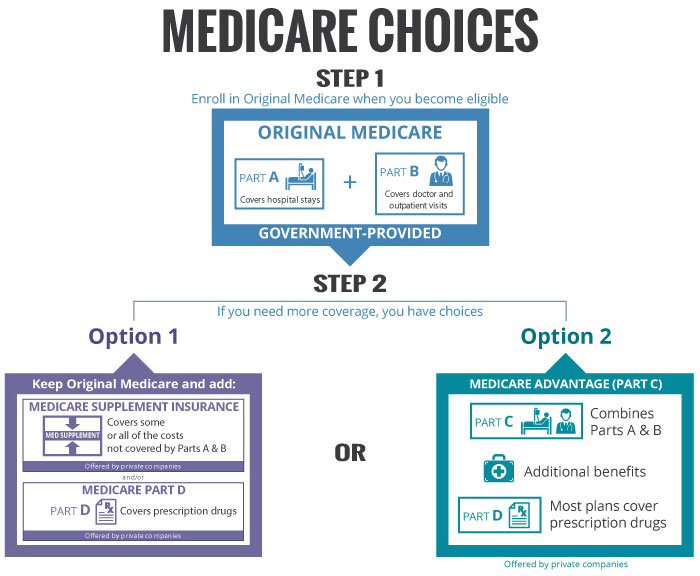

The Medicare Advantage (Medicare Part C) program lets you get your Medicare Part A and Part B benefits through a private, Medicare-approved insurance company. Medicare Advantage plans administer these benefits, and often have extra benefits as well – such as routine dental care.

How much does Medicare Advantage cost?

Medicare Advantage Health Maintenance Organization (HMO) plans can have premiums as low as $0 per month. (Other types of Medicare Advantage plans can also have $0 premiums.)

Do you have to live within the service area of a health insurance plan?

You must live within the plan’s service area.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage plans also include prescription drug coverage, which sets them apart from Original Medicare (Part A and Part B). Original Medicare typically only covers prescription drugs in limited situations, such as in a hospital or clinic.

What are the disadvantages of Medicare Advantage?

A possible disadvantage of a Medicare Advantage plan is you can’t have a Medicare Supplement plan with it. You may be limited to provider networks. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

What is the out of pocket limit for Medicare Advantage?

Once you meet this limit, your plan covers the costs for all Medicare-covered services for the rest of the year. In 2021 the out of pocket limit is $7,550, according to the Kaiser Family Foundation.

What is Pro 7 Medicare?

Pro 7: Lower out of pocket costs. Under Medicare Advantage, each plan negotiates its own rates with providers. You may pay lower deductibles and copayments/coinsurance than you would pay with Original Medicare. Some Medicare Advantage plans have deductibles as low as $0.

Can you use any provider under Medicare Advantage?

Many Medicare Advantage plans have networks, such as HMOs (health maintenance organizations) or PPOs* (preferred provider organization). Many Medicare Advantage plans may have provider networks that limit the doctors and other providers you can use. Under Original Medicare, you can use any provider that accepts Medicare assignment.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage plans have prescription drug coverage. This could be good news if you take one or more prescription drugs.

What are the benefits of a syringe?

Other extra benefits may include: 1 Meal delivery for beneficiaries with chronic illnesses 2 Transportation for non-medical needs like grocery shopping 3 Carpet shampooing to reduce asthma attacks 4 Transport to a doctor appointment or to see a nutritionist 5 Alternative medicine such as acupuncture

Is Medicare Advantage regulated by private insurance companies?

Here are some pros and cons of enrolling in a Medicare Advantage plan. For starters, Medicare Advantage plans are offered by private insurance companies but are regulated by Medicare.

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

Why is Medicare Advantage so expensive?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, the plan only offers a limited network of doctors, which can interfere with a patient's choice. It's not very easy to change to another plan; if you decide to switch to Medigap, there are often lifetime penalties.

How to see how a Medicare Advantage Plan cherry picks its patients?

To see how a Medicare Advantage Plan cherry-picks its patients, carefully review the copays in the summary of benefits for every plan you are considering. To give you an example of the types of copays you may find, here are some details of in-network services from a popular Humana Medicare Advantage Plan in Florida:

What is Medicare Supplement?

Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, such as copayments, deductibles, and healthcare when you travel abroad.

What should prospective Medicare Advantage customers research?

Prospective Medicare Advantage customers should research plans, copays, out-of-pocket costs, and eligible providers.

Can you sell a Medigap plan to a new beneficiary?

But as of Jan. 2, 2020, the two plans that cover deductibles—plans C and F— cannot be sold to new Medigap beneficiaries.

Does Medicare Advantage cover gaps?

Medicare Advantage covers some of the gaps of original Medicare (Part A and Part B), and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or requiring intense medical care. If a patient's situation worsens later on, it might be difficult or expensive to switch plans.

What is the Medicare coverage gap in 2021?

After you and your drug plan have combined to spend a set amount for the prescription drugs covered by your plan ($4,130 in 2021), you move into the center of the donut (i.e., the hole) which is your Medicare coverage gap. While you’re in the donut hole coverage gap, you’re responsible for 25% of your prescription drug costs for both brand name ...

How much is the Medicare donut hole for 2021?

The Medicare donut hole for 2021 starts once you hit $4,130 in out-of-pocket prescription drug costs, and it extends to $6,550. If your prescription drug spending reaches $6,550 in 2021, you’ll have catastrophic coverage for the rest of the year.

What is a Medicare donut hole?

The Medicare donut hole is a gap in coverage that some Medicare beneficiaries may experience at some point during their plan year. The good news? You can save money by knowing how to avoid it and what do to once you’re in it.

How many stages of Medicare Part D coverage?

Basically, there are four Medicare Part D coverage stages you need to understand. Your first Medicare Part D coverage phase can be represented by the left side of the donut ring. On this side of the donut, you pay the entire amount for your prescription drugs until you meet your deductible (assuming your plan has one, but not all Part D plans do). ...

How much is a 2021 deductible?

The good news is that once you meet your deductible ( which can be no higher than $445 in 2021 though some plans may offer $0 deductibles) you move to your initial coverage period. If your plan features a $0 deductible, then your coverage starts in this phase.

How to avoid coverage gap?

One way is to switch from a brand name drug to a generic drug or from a brand name to a less expensive brand name drug, if possible. Ask your physician whether this is possible based on your specific medical condition and health history.

When did Medicare Part D start?

Previously, when Medicare Part D was first rolled out in 2007 and prior to the Affordable Care Act, beneficiaries paid 100% of drug costs while in the donut hole.