How are Medicare and supplemental policies billed?

When you have Medicare and other health insurance, such as a Medicare Supplement insurance plan, each type of coverage is called a “payer.” The primary payer will pay what it owes on your health-care bills first and then send the balance to the secondary payer.

What is the purpose of Medicare Supplement policies?

Medicare Supplement Insurance provides coverage for gaps in medical costs not covered by Medicare. Medicare Supplement plans are standardized and offer various benefits to help offset your healthcare cost.

How do you determine which insurance is primary and which is secondary?

The insurance that pays first is called the primary payer. The primary payer pays up to the limits of its coverage. The insurance that pays second is called the secondary payer. The secondary payer only pays if there are costs the primary insurer didn't cover.Dec 1, 2021

What is true about Medicare supplement insurance plans?

Medicare supplement plans don't work like most health insurance plans. They don't actually cover any health benefits. Instead, these plans cover the costs you're responsible for with Original Medicare.Aug 26, 2018

What is not covered by Medigap?

Medigap is extra health insurance that you buy from a private company to pay health care costs not covered by Original Medicare, such as co-payments, deductibles, and health care if you travel outside the U.S. Medigap policies don't cover long-term care, dental care, vision care, hearing aids, eyeglasses, and private- ...Nov 18, 2020

What is the difference between Medicare Advantage and Medicare Supplement?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What is the birthday rule?

Birthday Rule: This is a method used to determine when a plan is primary or secondary for a dependent child when covered by both parents' benefit plan. The parent whose birthday (month and day only) falls first in a calendar year is the parent with the primary coverage for the dependent.

Is baby automatically added to insurance?

If you have insurance through an employer, your baby will be automatically covered for a set period immediately after birth. Notify your insurer, or your human resources or benefits department, within 30 days of the baby's arrival to add them onto the insurance plan.

Can you have two health insurances at the same time?

Yes, you can have two health insurance plans. Having two health insurance plans is perfectly legal, and many people have multiple health insurance policies under certain circumstances.Jan 21, 2022

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

What is Medicare Advantage?

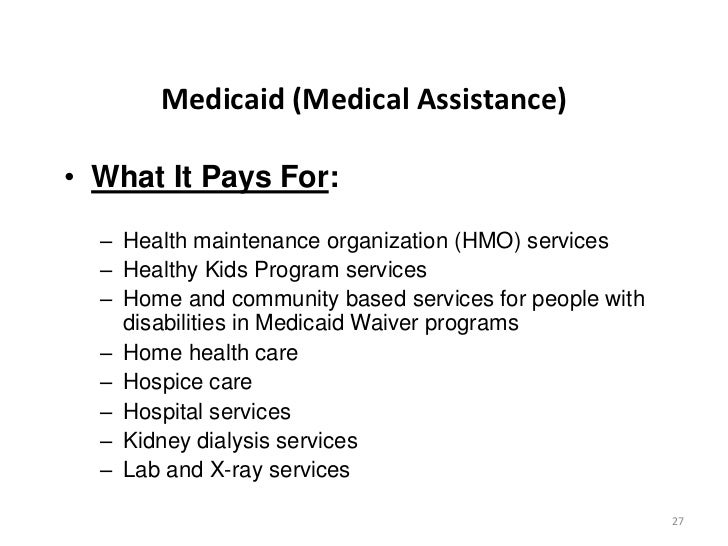

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

How does Original Medicare work?

Original Medicare covers most, but not all of the costs for approved health care services and supplies. After you meet your deductible, you pay your share of costs for services and supplies as you get them.

How does Medicare Advantage work?

Medicare Advantage bundles your Part A, Part B, and usually Part D coverage into one plan. Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

How Medicare works with other insurance

Learn how benefits are coordinated when you have Medicare and other health insurance.

Retiree insurance

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

What's Medicare Supplement Insurance (Medigap)?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

When can I buy Medigap?

Get the facts about the specific times when you can sign up for a Medigap policy.

How to compare Medigap policies

Read about different types of Medigap policies, what they cover, and which insurance companies sell Medigap policies in your area.

Medigap & travel

Read about which Medigap policies offer coverage when you travel outside the United States (U.S.).

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

Does Medicare pay for secondary insurance?

should send the bill to Medicare for secondary payment. Medicare will pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim. You'll have to pay any costs Medicare or the group health plan doesn't cover.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What happens if a group health plan doesn't pay?

If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment. Medicare may pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim.

Why is Medicare Supplement important?

If you choose the original Medicare option, Medicare supplement plans are important because these plans add an extra element, or boost, to your main coverage by paying for gaps for stand-alone prescription drug plans, employer group health coverage and other retiree benefits. Original Medicare will pay first, followed by the payment by ...

How many Medicare supplement plans are there?

How Medicare supplement insurance plans work with Medicare plans. There are up to 10 standardized plans available – labeled A, B, C, D, F, G, K, L, M and N – that cover anywhere from four to nine of these benefits:

What are the benefits of Medicare?

There are up to 10 standardized plans available – labeled A, B, C, D, F, G, K, L, M and N – that cover anywhere from four to nine of these benefits: 1 Medicare Part A coinsurance for hospital costs (up to an additional 365 days after Medicare benefits are used) 2 Medicare Part B coinsurance, copayment 3 First three pints of blood for a medical procedure 4 Part A hospice care coinsurance or copayment 5 Skilled nursing facility care coinsurance 6 Part A deductible 7 Part B deductible 8 Part B excess charges 9 Foreign travel emergencies

What to do when you turn 65?

However, when you turn 65, you have other choices to consider when it comes to health care coverage. You will need to decide on signing up for a Medicare Advantage plan or decide on Medicare with a Medicare supplement plan (Medigap) to fill in the gaps associated with Medicare. Medicare Advantage and Medicare supplement plans do not work together – ...

How long does Medicare cover hospital coinsurance?

Medicare Part A coinsurance for hospital costs (up to an additional 365 days after Medicare benefits are used) Keep in mind, all 10 Medicare supplement plans cover the coinsurance and 100 percent of hospital costs for Medicare Part A, but after that, plans differ in what they cover. For example, only Medicare supplement plans C and F cover ...

Does Medicare cover prescription drugs?

In the past, some Medigap policies covered prescription drugs; however, this is not possible today. For prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D), which is a stand-alone policy. You can also look into prescription drug discount cards.

Is Medigap available in Minnesota?

If you live in Minnesota, Massachusetts or Wisconsin, Medigap policies are standardized differently. Medigap policies are not always available to disabled beneficiaries under the age of 65. Don’t just consider the price per month of a Medicare supplement insurance policy plan.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Does Medicare cover out of pocket medical expenses?

Medicare is the federal government health coverage program for adults over 65 years of age and people with certain disabilities. However, it does not cover all out-of-pocket healthcare costs. Medicare supplement plans, or Medigap policies, can help.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

How many Medicare Supplement Plans are there?

These plans cover more than just out-of-pocket costs from Medicare and may provide additional benefits for some people. Currently, 10 Medicare supplement plans are available. These are:

Does Medicare cover all of the costs?

A person can choose to enroll in Medicare parts A and B. However, these may not cover all healthcare costs. People with Medicare will still have to pay different deductibles and coinsurances based on the type of care they receive. Medicare supplement plans can help a person reduce out-of-pocket costs on Medicare parts A and B. ...

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs. This article explains how Medicare supplement plans work, how to find one, and how to work out which plan is best.

Can you cancel a Medicare supplement?

This means that the company cannot cancel the policy as long as a person continues to pay their premium. Usually, Medicare supplement plans do not cover vision care, dental care, eyeglasses, or private-duty nursing. A range of different plans are available with several different insurance providers.

What are the benefits of Medicare Supplement?

These are the benefits that may be available with a Medicare Supplement plan: 1 Coverage for Part A hospital coinsurance costs for up to 365 days once Part A’s coverage is used up. 2 Part B copayments and coinsurance amounts. 3 Coverage for the first three pints of blood if required during treatment. 4 Hospice care share-of-cost obligations with Part A. 5 Coinsurance related to a stay in a skilled nursing facility. 6 Coverage for the deductibles for Part A or Part B. 7 Excess charges not covered by Part B. 8 Medical emergencies while traveling in a foreign country.

What is Medicare Part A?

Medicare Part A covers some costs associated with inpatient hospital treatment, a skilled nursing facility, or hospice. Medicare Part B covers some costs associated with medically necessary outpatient services ...

How long does a special enrollment period last?

A special enrollment period begins 60 days before a loss of coverage is expected to occur and can last up to 63 days after it happens.

Does Medicare Part A cover coinsurance?

Although Medicare Part A and Part B can help cover many expenses, recipients are still obligated to pay deductibles, copayments and coinsurance amounts. A Medigap plan can help alleviate the burden of some of the costs of deductibles, coinsurance, copayment, and medical care outside of the United States. There are a variety of policies that offer ...

Does Medigap work with Medicare?

However, Medigap works as a supplement to Original Medicare Part A and Part B only.

How long does it take to enroll in Medigap?

The initial enrollment period for a Medigap plan begins the month a recipient turns 65 and is enrolled in Part B. Recipients have a 6-month period to purchase any Medigap plan available in their state.

What is Medicare and Medigap?

Medicare and Medigap insurance comprise a sound financial plan for someone over age 65. Medicare works as the primary coverage, with the Medigap plan (sometimes called a Medicare Supplement) filling in the gaps in Medicare. But, how exactly do Medicare and Medigap work together?

What is Medicare crossover?

This system was created to simplify and streamline the claims payments process for Medicare and Medigap policies.

What is the Medicare Part B deductible for 2020?

Plan G which is the next step down, and usually is the best deal, pays all but the Medicare Part B deductible, which is $198/year (for 2020). NOTE: For people who were first eligible for Medicare after 1/1/2020, Plan F is no longer available.

Does Medicare pay for 80% of the cost?

Medicare pays, in most cases, 80% of the Medicare-approved costs (after the Medicare deductibles), and the Medigap plan pays, with most plans, the other 20% and some combination of the deductibles. Medigap Plan F pays both of the Medicare deductibles and the remaining 20%, thereby filling in all the “ gaps” in Medicare and being full coverage.

Do Medicare and Medigap work together?

Medicare and Medigap plans work together seamlessly. One the major concerns that we address in people turning 65 is how the Federal government health program could possibly work well together with a private insurance company’s individual health insurance policy. Although we certainly recognize the root of this concern, ...

Does Medicare have a network?

FACT 3: Medicare and Medigap Do Not Have Specific Networks. Neither Medicare nor Medigap plans have any specific networks that you must use. Medicare is a fee-for-service plan – in other words, it is not a PPO or an HMO which requires adherence to a certain, predetermined network of doctors/hospitals.

Does Medicare accept medicaid?

Most doctors and medical facilities do, of course, accept Medicare. Most importantly, anywhere that Medicare is accepted, your Medigap plan will also be accepted. As the primary coverage, Medicare determines where you can use your plans.

When will Medicare Part B deductible be available?

Medigap plans that cover the Part B deductible will no longer be available to newly-eligible enrollees after the end of 2019, under the terms of 2015’s Medicare Access and CHIP Reauthorization Act (MACRA).

How many Medicare premiums are there for Medicare Part B?

If you have Original Medicare (ie, Medicare A and B) along with a Medigap plan, you’ll pay two premiums: one for Medicare Part B, and another for the Medigap plan (assuming you have premium-free Medicare A ). Medicare B premiums are deducted from your Social Security check, but Medigap premiums are paid directly to the private insurance carrier ...

What is a Medigap plan?

A: Medigap plans are Medicare supplement insurance plans, and are sold by private insurance companies that agree to abide by federal Medicare guidelines.

How many Medigap plans are there?

Although Medigap plans are issued by private insurance carriers, the policies are standardized. As of 2019, in all but three states, there are up to ten different Medigap plans: A, B, C, D, F, G, K, L, M, and N (not all plans are available in all areas).

Does Medicare cover dental and vision?

So Medigap plans do not cover dental and vision charges, for example, as Original Medicare does not cover routine dental and vision services. Medicare A and B both have deductibles and coinsurance. After the deductible, Medicare Part B pays 80 percent of the Medicare-approved amount, leaving the patient to pay the other 20 percent, ...

How much is coinsurance for skilled nursing?

There’s also a coinsurance charge under Part A for skilled nursing facility stays that exceed 20 days ($170.50 per day for days 21 through 100 in 2019; this daily amount is projected to increase to $177.50 in 2020 ).

Does Medicare cover out-of-pocket costs?

For the most part, Medigap plans are designed to cover out-of-pocket costs for services that are covered by Medicare, as opposed to care that Medicare doesn’t cover and that the enrollee has to pay entirely out-of-pocket.