What you should know about Medicare Part D?

Part 1 - The Initial $480 Deductible - Some Medicare Part D prescription drug plans (PDP) and Medicare Advantage plans that provide drug coverage (MAPD) have an initial deductible that you must pay out-of-pocket before the start of your plan coverage (or before the start of your plan's cost-sharing). Many Medicare Part D plans (both PDPs and MAPDs) have a $0 deductible and …

What are the benefits of Medicare Part D?

How Part D works with other insurance. This is health coverage from your, your spouse’s, or other family member’s current or former employer or union. If you have drug coverage based on your current or previous employment, your employer or union will notify you each year to let you know if your drug coverage is creditable.

How does Medicare Part D work with other insurance?

Sep 26, 2021 · Medicare Part D plans cover prescription drug costs. Plans are offered by private insurance companies, and the coverage gap can be a little complicated. Read to find out more about these plans.

What is covered by Medicare Part D?

Sep 26, 2021 · Understanding Medicare Part D and How It Works. Medicare Part D plans cover prescription drug costs. Plans are offered by private insurance companies, and the coverage gap can be a little complicated.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

What are the 4 phases of Medicare Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.Oct 1, 2021

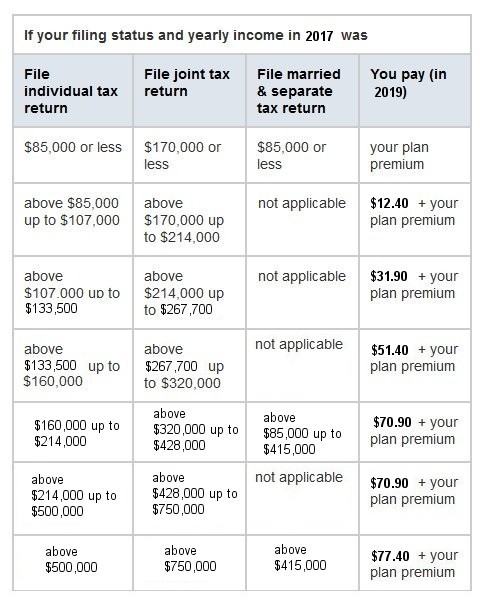

Why is Medicare charging me for Part D?

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you're married and file jointly), you'll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”).

Does Medicare Part D come out of your Social Security check?

Your Medicare Part B premiums will be automatically deducted from your Social Security benefits. Most people receive Part A without paying a premium. You can choose to have your Part C and Part D premiums deducted from your benefits. Medicare allows you to pay online or by mail without a fee.Dec 1, 2021

Do Medicare Part D plans have deductibles?

This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022. Some Medicare drug plans don't have a deductible.

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

How are Medicare Part D premiums paid?

Part D Financing The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments.Oct 13, 2021

Is Part D mandatory?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

Does Social Security offer Part D?

The agency has a specific role in the Medicare Prescription Drug Program (Part D). Social Security takes and decides applications for Extra Help with Medicare Prescription Drug Plan Costs, a provision to subsidize costs for Part D prescription drug plans for qualifying low income applicants.Sep 28, 2021

What is Medicare Part D?

Medicare Part D plans are like any insurance that provides lower-costing coverage for your prescription drugs. And like any other insurance coverage, you usually pay the plan a monthly premium, you may have an initial deductible that you must pay first before your insurance coverage begins to pay a portion of your drug costs, ...

Does Medicare cover all prescription drugs?

And it is important to understand that no Medicare Part D plan covers all prescription drugs. Part D plans are only required to cover a certain number of drugs in specific drug classes. However, Medicare Part D plans can decide to cover a particular generic and exclude the corresponding brand-name drug from coverage.

Does Medicare Part D have a deductible?

Many Medicare Part D plans (both PDPs and MAPDs) have a $0 deduct ible and provide "first dollar coverage" for your formulary prescriptions. You can see our Medicare Part D Plan Finder for examples of Medicare plans with different deductibles (just choose your state to see plans in your area).

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs , like premiums, deductibles, and coinsurance. with your prescription drug costs. If you don't join a plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What is a copayment for Medicare?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. for each drug. If you don't join a drug plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

Does Medicare pay for prescription drugs?

Your drug costs are covered by Medicare. You'll need to join a Medicare drug plan for Medicare to pay for your drugs. In most cases, you'll pay a small amount for your covered drugs. If you have full coverage from Medicaid and live in a nursing home, you pay nothing for covered prescription drugs.

What is the state pharmaceutical assistance program?

State Pharmaceutical Assistance Program. Each state decides how its State Pharmaceutical Assistance Program (SPAP) works with Medicare prescription drug coverage. Some states give extra coverage when you join a Medicare drug plan. Some states have a separate state program that helps with prescriptions.

Do long term care pharmacies have Medicare?

Long-term care pharmacies contract with Medicare drug plans to provide drug coverage to their residents. If you're entering, living in, or leaving a nursing home, you'll have the opportunity to choose or switch your Medicare drug plan. This allows you to choose a plan that contracts with your nursing home's pharmacy.

What is extra help?

Extra Help. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. , your food stamp benefits may decline, but that decline will be offset by Extra Help.

Does Medicare help with housing?

, you won't lose your housing assistance. However, your housing assistance may be reduced as your prescription drug spending decreases.

How long is the Part D enrollment period?

The Part D special enrollment period is a 63-day period that allows you to enroll in Part D without penalty. The special enrollment period is intended to cover you if you have Original Medicare but still have an insurance plan from your employer or union that covers your prescription drug costs.

How much does Medicare pay for brand name drugs?

According to Medicare.gov, once you have entered the coverage gap, you will pay 25 percent of the cost of brand-name prescription drugs. Of the remaining 75 percent, 70 percent will be covered by the manufacturer of the drug, and 5 percent will be covered by your insurance, even though you are in the coverage gap.

When does Medicare open enrollment start?

Each year from October 15 to December 7, Medicare offers open enrollment, meaning you can freely make changes to your plans without penalty. During this time, you can choose to enroll in a Part D plan, and your coverage will begin on January 1 of the following year.

Does Medicare Part D cover prescription drugs?

Medicare Part D plans cover prescription drug costs . Plans are offered by private insurance companies, and the coverage gap can be a little complicated. Read to find out more about these plans.

What is Medicare Part D?

Key Takeaways. Medicare Part D is an optional coverage available for a cost that can help pay for prescription drugs. Medicare Part D is sold by private insurance companies that have contracted with Medicare to offer it to people eligible for Medicare. Not all Part D plans operate everywhere, nor do all of the plans offer ...

What drugs are covered by Part D?

Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

What are the different tiers of Medicare?

The drugs in the plan’s formulary may be further placed into different tiers that determine your cost. For example: 1 Tier 1: The most generic drugs with the lowest copayments 2 Tier 2: Preferred brand-name drugs with medium copayments 3 Tier 3: Non-preferred brand name drugs with higher copayments 4 Specialty: Drugs that cost more than $670 per month, the highest copayments 4

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't enroll in Part D?

Not enrolling in Part D during the initial enrollment period could result in a late-enrollment penalty that permanently increases your Part D premium.

What is Medicare Part D?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier’s network of pharmacies to purchase your prescription medications.

When does Medicare Part D change?

Part D drug plans also have changes from year to year. Your plan’s benefits, formulary, pharmacy network, provider network, premium and/or co-payments/co-insurance may change on January 1st of each year. Medicare gives you an Annual Election Period during which you can change your plan if you desire to do so.

What are the rules for Medicare?

Medicare allows drug plan carriers to apply certain rules for safety reasons and also for cost containment. The most common utilization rules that you may run into are: 1 Quantity Limits – a restriction on how much medication you can purchase at one time or upon each refill. If your doctor prescribes more than the quantity limit, then the insurance company will need him to file an exception form to explain why more is needed. 2 Prior Authorization – a requirement that you or your doctor must obtain plan approval before allowing a pharmacy to dispense your medication. The insurance company may ask for proof that the prescription is medically necessary before they allow it. This usually affects medications that are expensive or very potent. The doctor must show why this specific medication is necessary for you and why alternative drugs might be harmful or ineffective. 3 Step Therapy – the plan requires you to try less expensive alternative medications that treat the same condition before they will consider covering the prescribed medication. If the alternative medication works, both you and the insurance company save money. If it doesn’t, your doctor will need to help you file a drug exception with your carrier to request coverage for the original medication prescribed. He will need to explain why you need the more expensive medication when less expensive alternatives are available. Often this requires that he shows that you have already tried less expensive alternatives that were not effective.

What is the Medicare Part D deductible for 2021?

In 2021, the allowable Medicare Part D deductible is $445. Plans may charge the full Part D deductible, a partial deductible, or waive the deductible entirely. You will pay the network discounted price for your medications until your plan tallies that you have satisfied the deductible. After that, you enter initial coverage.

Does Medicare track your out of pocket costs?

It’s important to note that Medicare itself tracks your True Out of Pocket Costs (TrOOP) for each year. This can protect you from paying certain costs twice. For example, say you have already satisfied the deductible on one plan. Then you later switch mid-year to a different Medicare Part D plan because you moved out of state. Your new plan will already see that you have paid the deductible for that year. The costs for the coverage gap and catastrophic coverage work the same way.