Other examples of how Medicare supplement plans work with Medicare include:

- All plans include coverage for blood work at varying levels; Plan K covers it 50 percent and Plan L covers it at 75 percent. ...

- If you have to endure a lengthy hospital stay, a Medicare supplement plan can save you money. ...

- Medicare supplement plans don’t cover routine dental or vision care, hearing aids, glasses, private nursing or long-term care. ...

Do I really need a Medicare supplement plan?

So yes…I do recommend buying Medicare Supplement Insurance. You don’t necessarily need an expensive, luxury plan, but having something in place is essential. Even if you can’t afford a Supplement, you can (at the very least), purchase a low or no cost Medicare Advantage Plan that will cap your annual out-of-pocket spending at $4-6,000.

How much will a Medicare supplement insurance plan Save Me?

What is a Medicare Supplement insurance plan? Medicare Supplement (also known as Medigap) insurance plans are offered by private insurance companies. Whether they may save you money, and how much money they might save you, depends on a number of details. Medicare Supplement insurance plans may help you pay for out-of-pocket costs for services covered under Medicare Part A and Part B.

Which Medicare supplement plan should I buy?

One of the most common types of supplemental insurance is Medigap, which is sold by private insurance companies to people enrolled in Original Medicare. (Medigap plans cannot be paired with Medicare Advantage plans).

How do I pay for my Medicare supplement insurance plan?

- Confirm that your treatment aligns with what Medicare will cover by speaking with your doctor and the hospital. Be sure to ask if your surgery is considered inpatient or outpatient.

- Review your Medicare Supplement plan coverage. ...

- Review your Part D Drug Plan coverage. ...

What is the difference between Medicare and a supplemental plan?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance.

What does Medicare Supplement plan a cover?

Medicare Supplement insurance Plan A covers 100% of four things: Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up. Medicare Part B copayment or coinsurance expenses. The first 3 pints of blood used in a medical procedure.

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

How are Medicare Supplement plans funded?

The plans receive some funding through monthly plan premiums, but most of the money comes from Medicare. The private insurance companies that offer the plans receive a payment each month from Medicare. This covers the costs of Medicare parts A and B for each beneficiary.

Do Medicare Supplement plans have a deductible?

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up.

Is plan F better than plan G?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

Does Medicare pay 100 percent of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

How much is Medicare Supplement monthly?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What happens when Medicare runs out of money?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

How many Medicare Supplement Plans are there?

These plans cover more than just out-of-pocket costs from Medicare and may provide additional benefits for some people. Currently, 10 Medicare supplement plans are available. These are:

What does "no" mean in Medicare Supplement?

“Yes” under a plan letter means that it covers 100% of the benefit. “No” under a plan letter means that it does not cover that benefit.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs. This article explains how Medicare supplement plans work, how to find one, and how to work out which plan is best.

Does Medicare cover out of pocket medical expenses?

Medicare is the federal government health coverage program for adults over 65 years of age and people with certain disabilities. However, it does not cover all out-of-pocket healthcare costs. Medicare supplement plans, or Medigap policies, can help.

Can you cancel a Medicare supplement plan if you are married?

Medicare supplement policies have “guaranteed renewable” status. This means that the company cannot cancel the policy as long as a person continues to pay their premium.

Is Medicare Supplement the same as Medicare Advantage?

Medicare supplement plans are not the same as Medicare Advantage plans. People use Medicare Advantage plans as an alternative to Medicare parts A and B. Private companies sell and administer them, just as they do Medicare supplement plans.

Why is Medicare Supplement important?

If you choose the original Medicare option, Medicare supplement plans are important because these plans add an extra element, or boost, to your main coverage by paying for gaps for stand-alone prescription drug plans, employer group health coverage and other retiree benefits. Original Medicare will pay first, followed by the payment by ...

How many Medicare supplement plans are there?

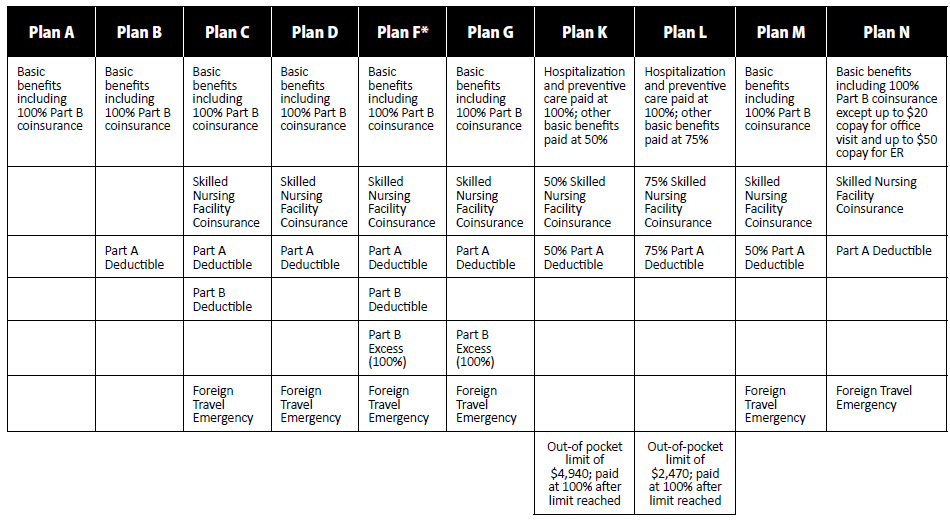

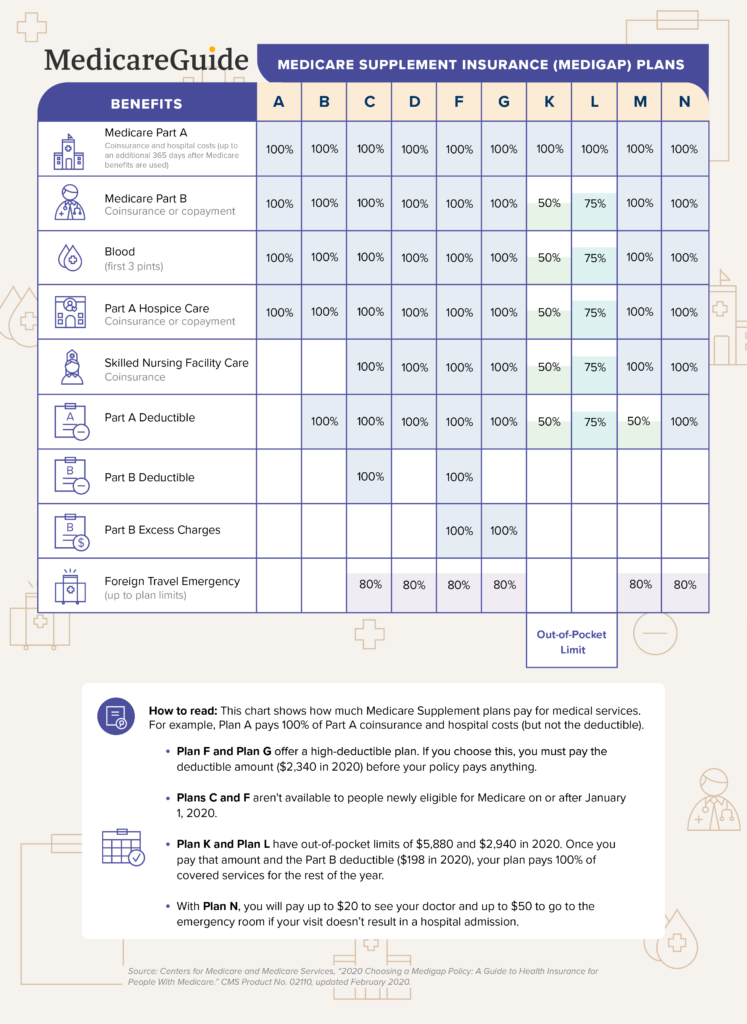

How Medicare supplement insurance plans work with Medicare plans. There are up to 10 standardized plans available – labeled A, B, C, D, F, G, K, L, M and N – that cover anywhere from four to nine of these benefits:

What are the benefits of Medicare?

There are up to 10 standardized plans available – labeled A, B, C, D, F, G, K, L, M and N – that cover anywhere from four to nine of these benefits: 1 Medicare Part A coinsurance for hospital costs (up to an additional 365 days after Medicare benefits are used) 2 Medicare Part B coinsurance, copayment 3 First three pints of blood for a medical procedure 4 Part A hospice care coinsurance or copayment 5 Skilled nursing facility care coinsurance 6 Part A deductible 7 Part B deductible 8 Part B excess charges 9 Foreign travel emergencies

How much does coinsurance cost for hospitalization?

For example, coinsurance for hospitalization costs $335 per day for days 61-90. Beyond day 90, the cost is $670 until a lifetime reserve is met, in which case you must pay the rest of the costs. Keep in mind you must pay your Medicare Part A deductible ($1,340 for 2018) before receiving these benefits. Medicare supplement plans don’t cover routine ...

How long does Medicare cover hospital coinsurance?

Medicare Part A coinsurance for hospital costs (up to an additional 365 days after Medicare benefits are used) Keep in mind, all 10 Medicare supplement plans cover the coinsurance and 100 percent of hospital costs for Medicare Part A, but after that, plans differ in what they cover. For example, only Medicare supplement plans C and F cover ...

Does Medicare Supplement Insurance require a doctor to be listed?

Every Medigap policy must be clearly identified as “Medicare Supplement Insurance.”. Medicare SELECT plans require you to only use doctors and hospitals in provider networks. This is an important factor if your doctor is not listed and you prefer to remain with that doctor’s service.

Do you have to leave Medicare first?

If you have a Medicare Advantage Plan, you must leave it first before your new Medicare supplement (Medigap) policy begins; apply for the Medigap plan first before you leave your other plan. Buy a Medigap policy from an insurance company licensed in your state to sell them.

What are Medicare Supplement Plans?

Medicare Supplement plans, also known as Medigap, are supplement insurance plans that work with Original Medicare Part A and Part B.

Who Regulates Medicare Supplement Plans?

Although Medicare Supplements (Medigap) plans are sold by private insurance companies, the federal government (CMS) regulates each plan’s design in terms of coverages offered.

How Does Medicare Supplement Plans Work?

While there are 10 Medigap plans to choose from in all but three states, each plan, although different from the next, works in the same manner. Medicare would pay its share and then the Medicare Supplement Plan would pay its share.

Which Medicare Supplement Plans Provide the Best Coverage?

Having multiple Medigap plans to choose from enables the policy shopper to select a plan that will best meet their individual needs and their individual budget. It’s also important to keep in mind that the Medigap Plan you select will have a monthly premium charge over and above your Medicare Part B premium.

What are High-Deductible Medicare Supplement Plans?

There are two high-deductible Medicare Supplement Plans available. High deductible Plan F and Plan G both have a regular version and a “high-deductible” version. Since the policyholder is agreeing to accept more out-of-pocket expenses for their annual healthcare expenses, the insurance company offers the plan at a lower monthly premium.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

How does Original Medicare work?

Original Medicare covers most, but not all of the costs for approved health care services and supplies. After you meet your deductible, you pay your share of costs for services and supplies as you get them.

How does Medicare Advantage work?

Medicare Advantage bundles your Part A, Part B, and usually Part D coverage into one plan. Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

What is Medicare Supplemental Insurance?

Medicare supplemental insurance — or Medigap — plans are policies that private insurance companies sell to people with traditional Medicare. These policies help reduce Medicare’s out-of-pocket costs. Examples of out-of-pocket costs include copayments, deductibles, and costs for blood transfusions. Learning the amounts of these costs can help ...

What does Medigap cover?

Medigap policies cover the following out-of-pocket costs for people with traditional Medicare: coinsurance. copayments. deductibles. The Centers for Medicare & Medicaid Services mandate that Medigap policies must provide the same level of coverage, regardless of which company is administering them. Medigap policies range from A to N.

What is the difference between Medigap and Private Insurance?

Medigap policies range from A to N. The premium price is the key difference between them. Private insurance companies do not have to offer every Medigap policy, but the government does require that they at least offer Medigap Plan A.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

Does Medicare Advantage cover deductibles?

They partially cover traditional Medicare’s out-of-pocket costs. If a person has Medicare Advantage, they cannot also have a Medigap plan.

Does Medigap cover dental?

It is important to note that Medigap plans do not cover some elements of care. Examples include long-term care, dental care, eyeglasses, private-duty nursing, and hearing aids. Also, several states have Medicare waivers, including Massachusetts, Minnesota, and Wisconsin.

Does Medicare cover Part B deductible?

Medigap policies help cover out-of-pocket costs of existing Medicare plans. However, as of 2020, they no longer cover the Part B deductible. The following table shows each Medigap plan and what it covers. This is subject to change on a year-by-year basis. Medigap Benefits. A.

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.