How much does the US spend on Medicare and Medicaid each year?

Jan 30, 2020 · Medicaid outlays as percentage of the federal budget: 9.5 percent, FY 2018[5] Growth rates: Medicaid expenditures are estimated to have increased 2.7 percent to $616.1 billion in 2018, with Federal expenditures having grown an estimated 4.4 percent to $386.5 billion. The Federal share of all Medicaid expenditures is estimated to have been 63 percent in 2018.

How much does Medicare cost per person?

Mar 11, 2022 · If we look at each program individually, Medicare spending grew 3.5% to $829.5 billion in 2020, which is 20% of total NHE, while Medicaid spending grew 9.2% to $671.2 billion in 2020, which is 16%...

Where can I find information about state spending per Medicaid enrollee?

Mar 01, 2021 · Medicare outlays in the United States amounted to 917 billion U.S. dollars in 2020. The forecast predicts an increase in Medicare …

How is Medicare and Medicaid funded?

Dec 15, 2021 · Historical NHE, 2020: NHE grew 9.7% to $4.1 trillion in 2020, or $12,530 per person, and accounted for 19.7% of Gross Domestic Product (GDP). Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE.

How much money is the federal government spending on Medicare Medicaid?

The federal government spent nearly $1.2 trillion on health care in fiscal year 2019 (table 1). Of that, Medicare claimed roughly $644 billion, Medicaid and the Children's Health Insurance Pro-gram (CHIP) about $427 billion, and veterans' medical care about $80 billion.

How much does Medicaid cost the US government per year?

Medicaid expenditure totaled around 639 billion U.S. dollars in 2019, increasing for the 13th consecutive year. The federal government paid approximately 60 percent of total Medicaid expenditures in 2019, with states picking up the other 40 percent.Feb 16, 2022

How much of the federal budget goes to healthcare?

U.S. health care spending grew 9.7 percent in 2020, reaching $4.1 trillion or $12,530 per person. As a share of the nation's Gross Domestic Product, health spending accounted for 19.7 percent.Dec 15, 2021

How much did the government spend on Medicare in 2020?

$829.5 billionMedicare spending totaled $829.5 billion in 2020, representing 20% of total health care spending. Medicare spending increased in 2020 by 3.5%, compared to 6.9% growth in 2019. Fee-for-service expenditures declined 5.3% in 2020 down from growth of 2.1% in 2019.Dec 15, 2021

What state spends the most on Medicaid?

Here are the 10 states that spend the most on Medicaid:Massachusetts. ... Illinois. ... Ohio. ... Florida. Medicaid spending: $21.8 billion. ... Pennsylvania. Medicaid spending: $27.6 billion. ... Texas. Medicaid spending: $40.3 billion. ... New York. Medicaid spending: $62.9 billion. ... California. Medicaid spending: $82 billion.More items...

How much does the average American spend on healthcare 2021?

$7,056In 2021, Americans Will Spend An Average of $5,952/Year for Health InsuranceHow Much Will Health Insurance Cost In Your State in 2021?RankStateAnnual cost8California$7,0569Alaska$6,86910Nevada$6,79245 more rows•Nov 23, 2020

Is there a federal budget for 2021?

The United States federal budget for fiscal year 2021 ran from October 1, 2020 to September 30, 2021....2021 United States federal budget.Submitted byDonald TrumpSubmitted to116th CongressTotal revenue$4.046 trillion (actual) 18.1% of GDPTotal expenditures$6.818 trillion (actual) 30.5% of GDPDeficit$2.772 trillion (actual) 12.4% of GDP2 more rows

How much does the government spend on healthcare each year?

Annual health expenditures stood at over four trillion U.S. dollars in 2020, and personal health care expenditure equaled 10,202 U.S. dollars per resident.Jan 18, 2022

How much does the average American spend on healthcare 2020?

Health spending per person in the U.S. was $11,945 in 2020, which was over $4,000 more expensive than any other high-income nation. The average amount spent on health per person in comparable countries ($5,736) is roughly half that of the U.S.

Is Medicare funded by the federal government?

The Centers for Medicare & Medicaid Services (CMS) is the federal agency that runs Medicare. The program is funded in part by Social Security and Medicare taxes you pay on your income, in part through premiums that people with Medicare pay, and in part by the federal budget.

How much does the US spend on Social Security and Medicare?

In 2019, the combined cost of the Social Security and Medicare programs is estimated to equal 8.7 percent of GDP. The Trustees project an increase to 11.6 percent of GDP by 2035 and to 12.5 percent by 2093, with most of the increases attributable to Medicare.

Is Medicare federal?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

How is Medicare funded?

How Medicare Is Funded. Medicare is funded by two trust funds that can only be used for Medicare. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits. 11 .

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

How is Medicare supplemental insurance fund funded?

Medicare's supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Part D benefits, and program administration expenses.

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is the Medicare tax rate for 2013?

On Jan. 1, 2013, the ACA also imposed an additional Medicare tax of 0.9% on all income above a certain level for high-income taxpayers. Single filers have to pay this additional amount on all earned income they receive above $200,000 and married taxpayers filing jointly owe it on earned income in excess of $250,000.

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

How much did Medicaid spend in 2019?

Medicaid spending grew 2.9% to $613.5 billion in 2019, or 16 percent of total NHE. Private health insurance spending grew 3.7% to $1,195.1 billion in 2019, or 31 percent of total NHE. Out of pocket spending grew 4.6% to $406.5 billion in 2019, or 11 percent of total NHE.

How much did Utah spend on health care in 2014?

In 2014, per capita personal health care spending ranged from $5,982 in Utah to $11,064 in Alaska. Per capita spending in Alaska was 38 percent higher than the national average ($8,045) while spending in Utah was about 26 percent lower; they have been the lowest and highest, respectively, since 2012.

What was the per person spending for 2014?

In 2014, per person spending for male children (0-18) was 9 percent more than females. However, for the working age and elderly groups, per person spending for females was 26 and 7 percent more than for males. For further detail see health expenditures by age in downloads below.

How much did hospital expenditures grow in 2019?

Hospital expenditures grew 6.2% to $1,192.0 billion in 2019, faster than the 4.2% growth in 2018. Physician and clinical services expenditures grew 4.6% to $772.1 billion in 2019, a faster growth than the 4.0% in 2018. Prescription drug spending increased 5.7% to $369.7 billion in 2019, faster than the 3.8% growth in 2018.

How much did prescription drug spending increase in 2019?

Prescription drug spending increased 5.7% to $369.7 billion in 2019, faster than the 3.8% growth in 2018. The largest shares of total health spending were sponsored by the federal government (29.0 percent) and the households (28.4 percent). The private business share of health spending accounted for 19.1 percent of total health care spending, ...

Which region has the lowest health care spending per capita?

In contrast, the Rocky Mountain and Southwest regions had the lowest levels of total personal health care spending per capita ($6,814 and $6,978, respectively) with average spending roughly 15 percent lower than the national average.

How much did the NHE increase in 2019?

NHE grew 4.6% to $3.8 trillion in 2019, or $11,582 per person, and accounted for 17.7% of Gross Domestic Product (GDP). Medicare spending grew 6.7% to $799.4 billion in 2019, or 21 percent of total NHE. Medicaid spending grew 2.9% to $613.5 billion in 2019, or 16 percent of total NHE.

Who funds Medicaid and CHIP?

The federal government and states jointly fund and administer Medicaid and the Children’s Health Insurance Program (CHIP). The following data present a snapshot of recent annual expenditure statistics, such as expenditures by service category and state.

What is managed care expenditure?

Managed care expenditures cover the same services that are delivered via fee-for-service. Data do not permit allocation of managed care expenditures to the different service categories.

How much will Medicaid cost in 2030?

By 2030, the cost will almost double to $665 billion, exceeding that of Medicaid. 1 It's not a mandatory program, but it must be paid in order to avoid a U.S. debt default. These estimates will increase if interest rates rise.

What is the next largest expense for Social Security?

10 It also means that Congress can no longer "borrow" from the Social Security Trust Fund to pay for other federal programs. Medicare ( $722 billion) and Medicaid ($448 billion) are the next largest expenses.

How much is the national debt in 2021?

These are part of mandatory spending, which are programs established by prior Acts of Congress. The interest payments on the national debt total $378 billion for FY 2021. They are necessary to maintain faith in the U.S. government. About $1.485 trillion in FY 2021 goes toward discretionary spending, which pays for all federal government agencies.

What is the budget for FY 2021?

Key Takeaways. Government spending for FY 2021 budget is $4.829 trillion. Despite sequestration to curb government spending, deficit spending has increased with the government’s effort to continually boost economic growth. Two-thirds of federal expenses must go to mandatory programs such as Social Security, Medicare, and Medicaid.

How much will the mandatory budget cost in 2021?

The mandatory budget will cost $2.966 trillion in FY 2021. 1 Mandatory spending is skyrocketing, because more baby boomers are reaching retirement age. By 2030, one in five Americans will be older than 65. 8

How much is discretionary spending?

Discretionary spending is $1.485 trillion. 1 It pays for everything else. Congress decides how much to appropriate for these programs each year. It's the only government spending that Congress can cut. 12

How much is the emergency fund for FY 2021?

For FY 2021, the emergency fund is $74.3 billion. The largest component is Overseas Contingency Operations (OCO) that pay for wars. 13 . Once you include the OCO fund, then security-related spending is $915.1 billion. It's spread out among different agencies and budget categories, so you must add it all together.

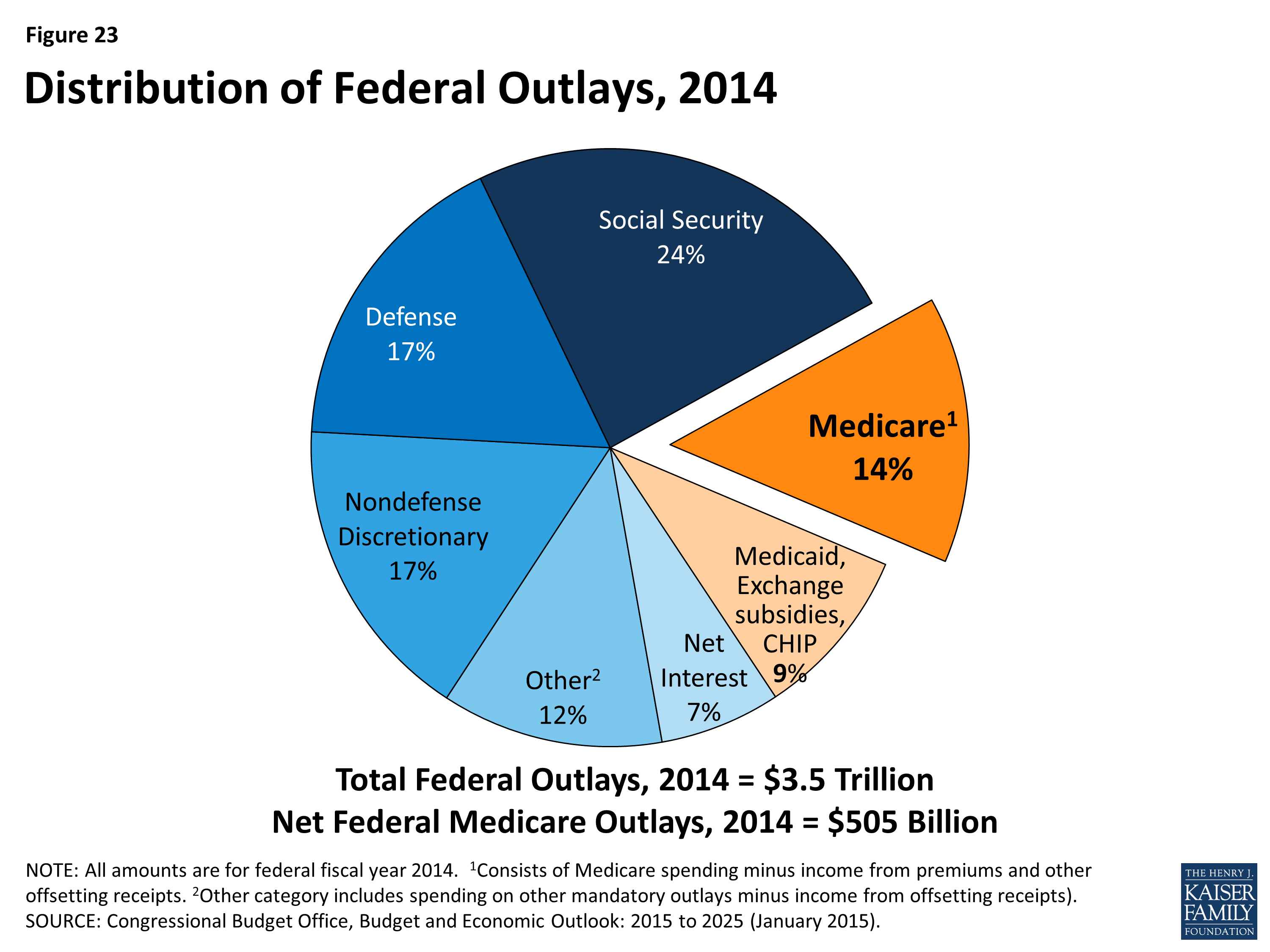

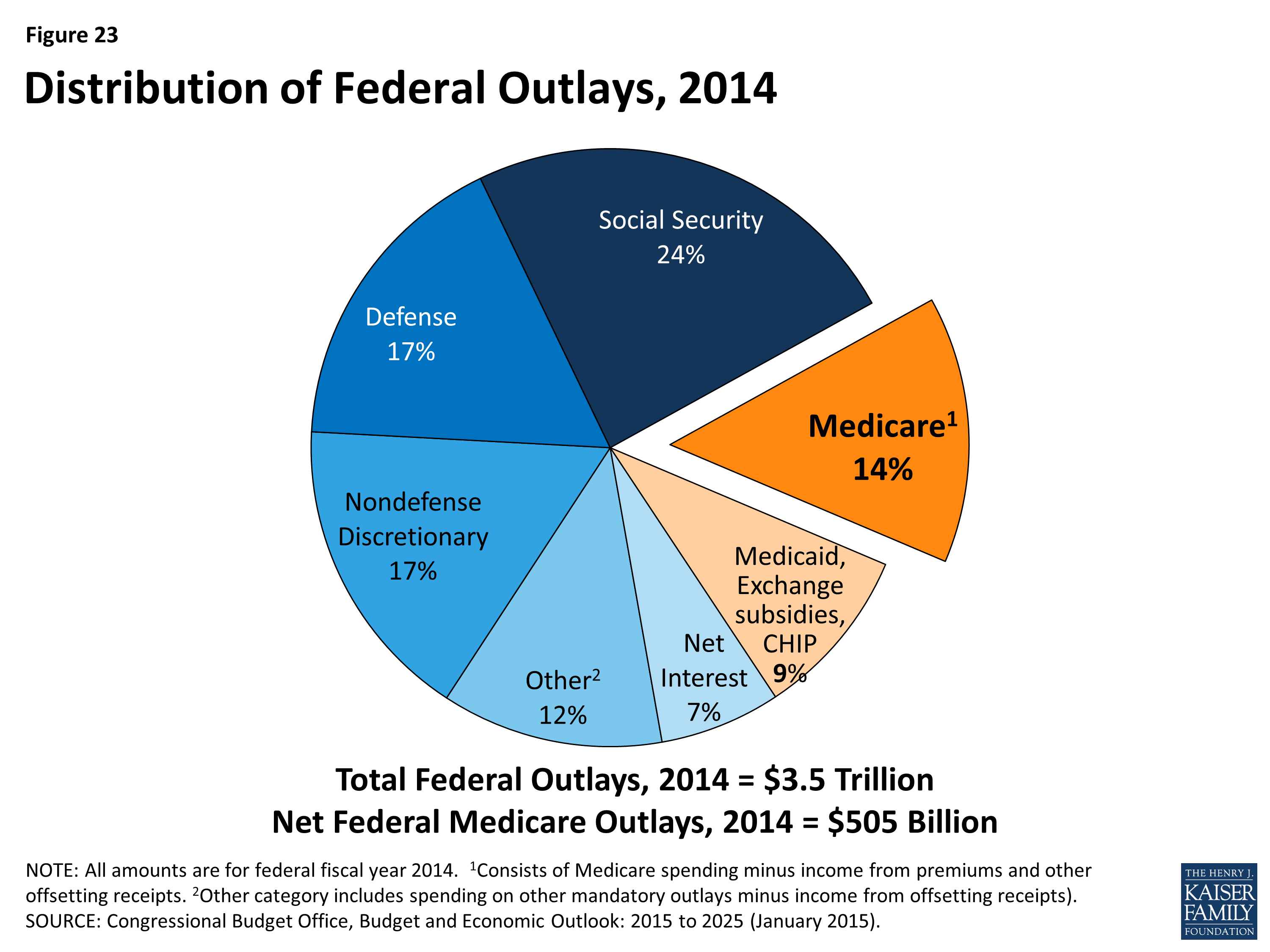

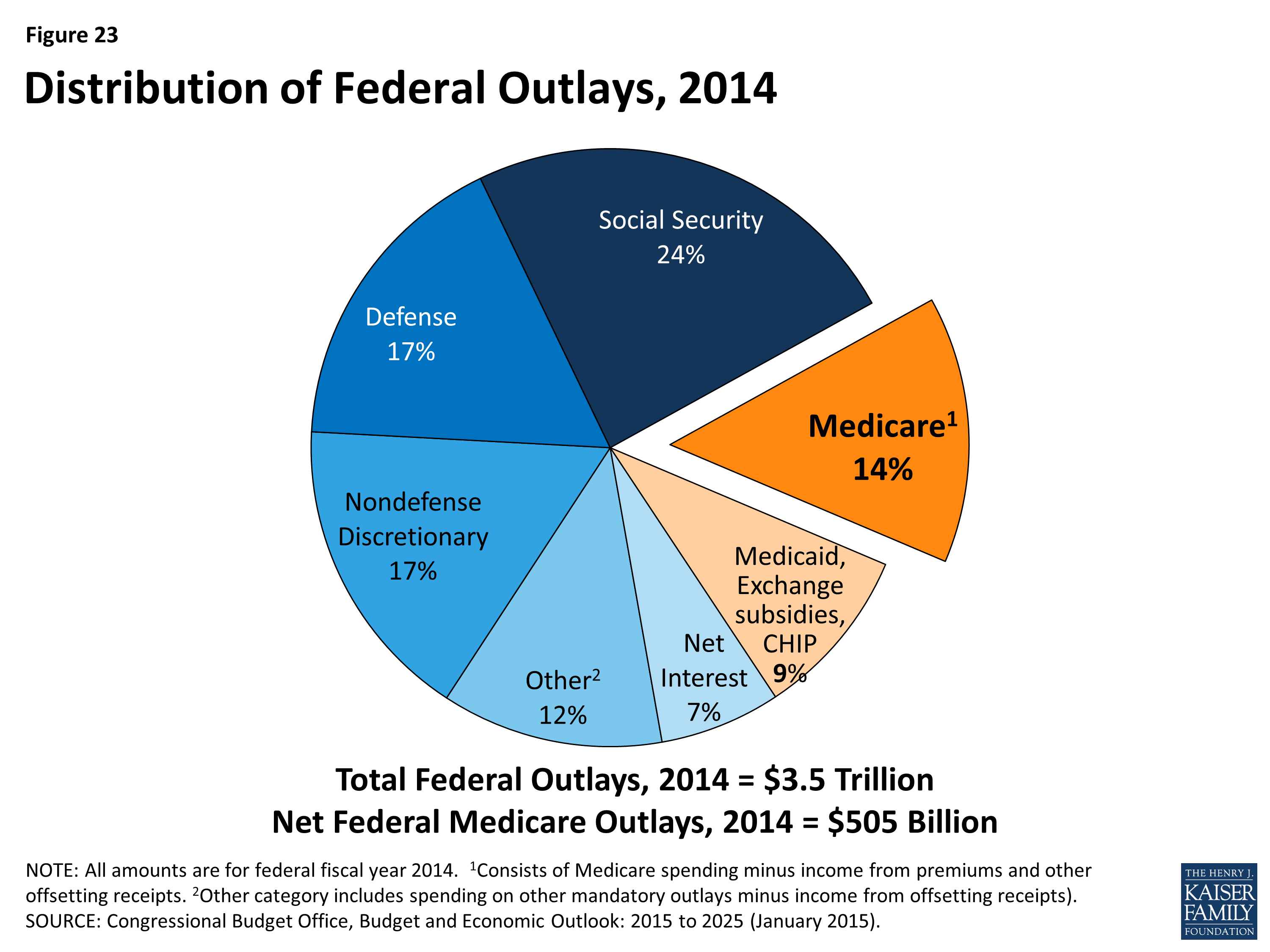

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How fast will Medicare spending grow?

On a per capita basis, Medicare spending is also projected to grow at a faster rate between 2018 and 2028 (5.1 percent) than between 2010 and 2018 (1.7 percent), and slightly faster than the average annual growth in per capita private health insurance spending over the next 10 years (4.6 percent).

Why is Medicare spending so high?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis.

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

How is Medicare's solvency measured?

The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases.

How much will Medicare per capita increase in 2028?

Medicare per capita spending is projected to grow at an average annual rate of 5.1 percent over the next 10 years (2018 to 2028), due to growing Medicare enrollment, increased use of services and intensity of care, and rising health care prices.

How much of Medicare will be paid by 2034?

That means Medicare contributes to the budget deficit. Rising health care costs mean that general revenues would have to pay for 49% of Medicare costs by 2034. 13 As with Social Security, the tax base is insufficient to pay for this.

What is Medicare Part A?

Medicare has two sections: The Medicare Part A Hospital Insurance program, which collects enough payroll taxes to pay current benefits. Medicare Part B, the Supplementary Medical Insurance Program, and Part D, the new drug benefit. Payroll taxes and premiums cover only 57% of benefits.

What does it mean when the government has a high level of mandatory spending?

In the long run, the high level of mandatory spending means rigid and unresponsive fiscal policy. This is a long-term drag on economic growth.

How is Social Security funded?

Social Security is funded through payroll taxes.

What is mandatory program?

Congress established mandatory programs under so-called authorization laws. 3 These laws also mandated that Congress appropriate whatever funds are needed to keep the programs running. The mandatory portion of the U.S. budget estimates how much it will cost to fulfill these authorization laws.

How much is mandatory spending in 2021?

Mandatory spending is estimated to be $2.966 trillion for FY 2021. 1 The two largest mandatory programs are Social Security and Medicare. That's 38.5% of all federal spending. It's more than two times more than the military budget. 2.

Why is mandatory spending growing?

That's one reason mandatory spending continues to grow. Another reason is the aging of America. As more people require Social Security and Medicare, costs for these two programs will almost double in the next 10 years. 18 At the same time, birth rates are falling. As a result, the elder dependency ratio is worsening.

Child Poverty Remains High

Child poverty remains a significant and costly challenge in the United States. In 2020, the child poverty rate was 16.1 percent — an increase from the 14.4 percent rate in the previous year. The poverty rate for children is significantly higher than the 10.4 percent rate for adults (ages 18 to 64) and the 9.0 percent rate for older Americans.

Only 7 Percent of Federal Outlays Goes Toward Children

In 2020, federal spending on children amounted to $482 billion, or 7 percent of the federal budget.

Federal Outlays on Children are Projected to Decline as a Share of the Budget

Despite growth in the absolute dollars spent on children in 2020 from pandemic relief funds, spending on children fell as a share of total federal funding and that proportion is projected to decline further over the next decade.

Health Spending and Tax Provisions Account for About Three-Fifths of All Federal Expenditures on Children

Health programs and various tax provisions constituted 63 percent of federal expenditures on children.

In the Coming Years, We Will Spend More on Interest Payments on the National Debt than on Children

One of the most damaging effects of rising debt is growing interest costs, which makes it harder to invest in our nation’s economy. In 2020, spending on interest payments totaled $345 billion — nearly three-quarters of the amount of federal spending on children.

Possible Legislation Would Affect Future Spending on Children

While the Kids’ Share report outlines the impact federal spending had on children in 2020, lawmakers are currently considering additional policies in this area. The Build Back Better Act, which was passed in November by the House of Representatives and is under consideration by the Senate, proposes additional spending on children.