.01 (1% penalty) x 31 months =.31 penalty.31 × $33.37 (2022 base beneficiary premium) = $10.34 $10.34 rounded to the nearest $0.10 = $10.30

Full Answer

How much do hospitals get paid for Medicare penalties?

Overall, out of 3,129 U.S. hospitals included in the penalty program, 2,583 hospitals (83%) received penalties totaling $563 million. The average penalty was 0.71% of total Medicare payments. 56 hospitals received the maximum (3%) penalty.

How many hospitals have been penalized under the Affordable Care Act?

Of those, 1,360 hospitals have been penalized at least twice, and 77 hospitals have been penalized each year the program has been in place. Congress exempts the more than 1,000 critical access hospitals, as well as Maryland hospitals, and certain specialized hospitals (children's, psychiatric, and veterans) from the penalties.

How much will the patient safety penalties cost hospitals?

The patient safety penalties cost hospitals 1 percent of Medicare payments over the federal fiscal year, which runs from October through September. Maryland hospitals are exempted from penalties because that state has a separate payment arrangement with Medicare.

How much did Ohio hospitals get penalized for Medicare fraud?

Overall, out of 3,129 U.S. hospitals included in the penalty program, 2,583 hospitals (83%) received penalties totaling $563 million. The average penalty was 0.71% of total Medicare payments. 56 hospitals received the maximum (3%) penalty. In Ohio, 90% of hospitals were penalized.

What percent of charges does Medicare pay?

According to the AHA, private insurance payments average 144.8 percent of cost, while payments from Medicare average 86.8 percent of cost.

What is hospital gross charge?

1. The gross charge (the charge for an individual item or service that is reflected on a hospital's chargemaster, absent any discounts). 2. The discounted cash price (the charge that applies to an individual who pays cash, or cash equivalent, for a hospital item or service). 3.

Does Medicare pay for hospital-acquired conditions?

Starting in 2009, Medicare, the US government's health insurance program for elderly and disabled Americans, will not cover the costs of “preventable” conditions, mistakes and infections resulting from a hospital stay.

Does Medicare cover hospital readmissions?

Medicare counts as a readmission any of those patients who ended up back in any hospital within 30 days of discharge, except for planned returns like a second phase of surgery. A hospital will be penalized if its readmission rate is higher than expected given the national trends in any one of those categories.

Do hospitals lose money on Medicare patients?

Those hospitals, which include some of the nation's marquee medical centers, will lose 1% of their Medicare payments over 12 months. The penalties, based on patients who stayed in the hospitals anytime between mid-2017 and 2019, before the pandemic, are not related to covid-19.

How do hospitals decide how much to charge?

Hospitals charge the same amount for a service regardless of whether or not the patient is in the hospital. Anyone getting routine tests or a diagnostic workup from a hospital is likely to be charged five to ten times what an insurance company would pay for it (five to ten times what the service is really worth).

How does the hospital acquired condition reduction program work?

On an annual basis, CMS evaluates overall hospital performance by calculating Total HAC Scores as the equally weighted average of scores on measures included in the program. Hospitals with a Total HAC Score greater than the 75th percentile of all Total HAC Scores will receive a 1-percent payment reduction.

What hospitals are subject to reimbursement penalties for hospital acquired conditions HACs )?

Hospital-Acquired Condition Reduction ProgramCritical access hospitals.Rehabilitation hospitals and units.Long-term care hospitals.Psychiatric hospitals and units.Children's hospitals.Prospective Payment System-exempt cancer hospitals.Veterans Affairs medical centers and hospitals.More items...•

What is considered a hospital acquired condition?

A Hospital Acquired Condition (HAC) is a medical condition or complication that a patient develops during a hospital stay, which was not present at admission. In most cases, hospitals can prevent HACs when they give care that research shows gets the best results for most patients.

How are readmission penalties calculated?

The penalties were calculated by subtracting each adjustment factor from 1 and turning it into a percentage. Thus, a hospital losing the most money because of its high readmission rate (which CMS gave an adjustment factor of 0.97) is listed by KHN as receiving a 3 percent penalty.

What is the maximum penalty that a hospital can incur based on their readmission rates during the performance period?

The penalty is a percentage of total Medicare payments to the hospital; the maximum penalty has been set at 1% for 2013, 2% for 2014, and 3% for 2015. The penalties assessed to hospitals are CMS' savings.

What are Medicare fines?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $. 10 and added to your monthly Part D premium.

What is the maximum penalty for CMS?

CMS’ penalties are an “adjustment factor” that will be applied to Medicare reimbursements for care for patients admitted for any reason. The lowest adjustment factor, 0.97, is the maximum penalty; it means that a hospital would be reimbursed only 97 percent of the amount Medicare usually pays. The highest adjustment factor is 1 and means ...

How much would Medicare pay for kidney failure?

Thus, if Medicare would normally pay a hospital $15,000 for a kidney failure patient, with a 1.5 percent penalty Medicare would deduct $225 and pay $14,775.

Do hospitals lose money with 0 percent penalty?

Hospitals receiving a 0 percent penalty are not losing any money. Because the penalty will be applied prospectively over the next federal fiscal year, the exact amount of dollars a hospital will lose is not yet known, although many hospitals can estimate their likely losses based on previous years’ Medicare payments.

How does Medicare respond to the penalty based on a given hospital’s patient demographics?

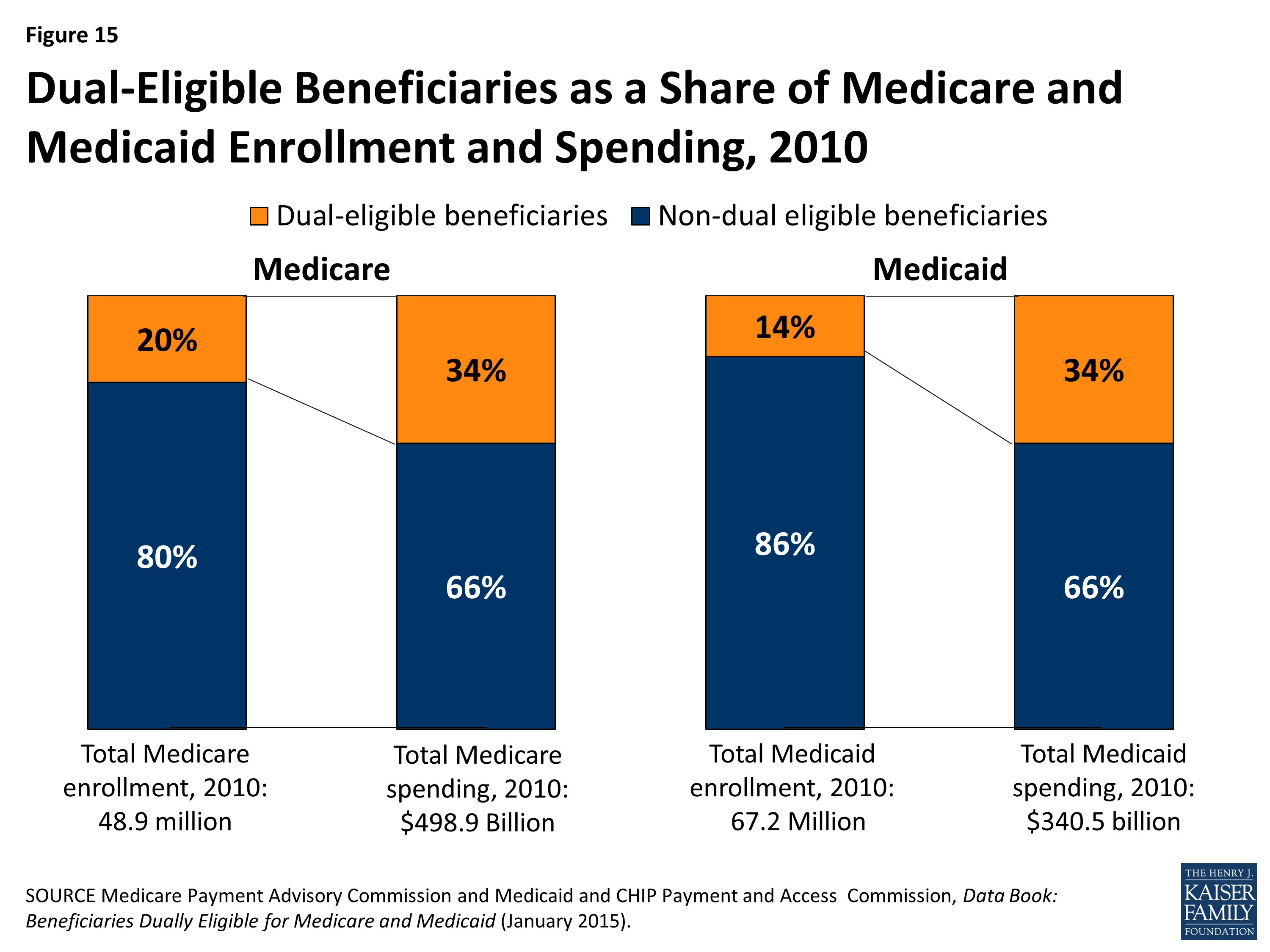

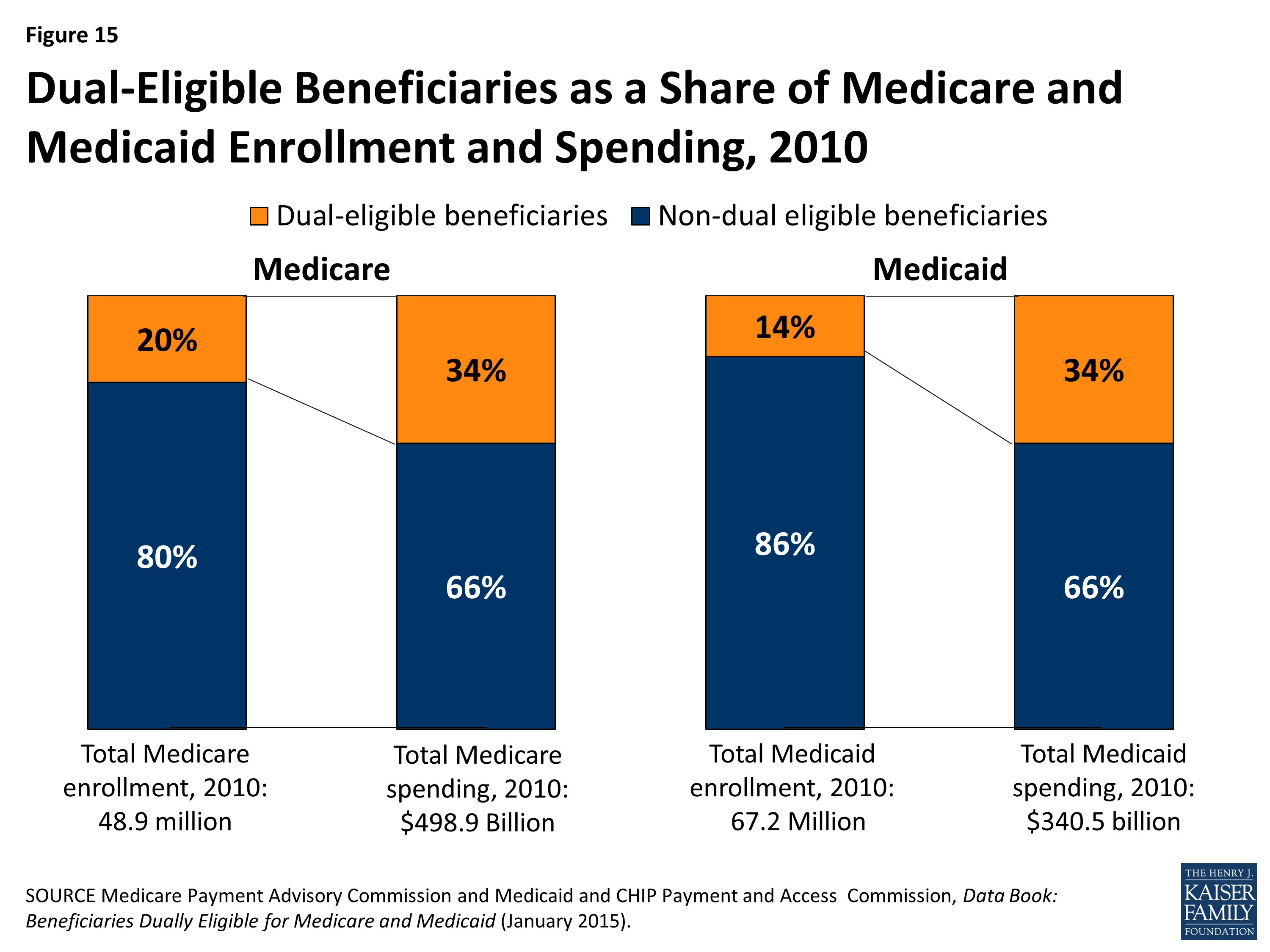

Medicare responded by making 2 adjustments to the penalty based on a given hospital’s patient demographics: The severity of illness of the hospital’s patients (often called the case mix index) with the premise that the sicker a patient is, the more likely that patient is to be readmitted to the hospital. The rate of “dual eligible” patients, that ...

What is the Medicare readmission penalty for 2020?

The 2020 Medicare Readmission Penalty Program. Each year, Medicare analyzes the readmission rate for every hospital in the United States and then imposes financial penalties on those hospitals determined to have excessively high readmission rates. And every year, most U.S. hospitals get penalized. This year is no exception – 83% ...

What is the Medicare quintile?

Medicare divided all U.S. hospitals into quintiles based on the percentage of dual eligible patients. Hospitals were only compared to other hospitals within the same quintile for the purposes of penalty calculation; therefore, a hospital with a high percentage of dual eligible patients was held to a different readmission rate expectation ...

What is readmission reduction?

The hospital readmission reduction program was created as a part of the Affordable Care Act as a way to improve quality of care and reduce overall Medicare costs. Readmissions are defined as a patient being readmitted to any hospital and for any reason within 30 days of discharge from the hospital being analyzed.

Why are hospitals financially incentivized to discharge patients?

Since hospitals are paid by the DRG (in other words, by the diagnosis), hospitals are financially incentivized to discharge patients as quickly as possible in order to reduce their expenses. The Medicare hospital readmission reduction program was designed to offset that financial incentive by penalizing hospitals that discharge patients prematurely.

Is the readmission penalty fair?

Overall, the current readmission penalty program appears to be more fair to hospitals that care for socioeconomically disadvantaged patients. However, the danger remains that by creating a barrier for hospitals to readmit patients who truly need to be readmitted, outpatient mortality can increase. November 17, 2019.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How many hospitals were penalized in 2017?

In 2018, the American Hospital Association (AHA) published an analysis showing that only 41% of the 768 hospitals penalized in 2017 had HAC rates significantly higher than the hospitals that were not penalized.

How many hospitals have Medicare reduced?

This year, 774 hospitals will have their Medicare payment rates reduced for having high infection rates and other patient complications between mid-2017 and 2019, before the Covid-19 pandemic hit the United States.

Why is the methodology punishing hospitals?

The industry has also argued that the methodology punishes hospitals that thoroughly test for infections and other patient safety hazards, as they may uncover more problems and appear statistically worse than others with lower testing standards.

What is HAC in hospitals?

The HAC program, which launched in October 2014, evaluates hospitals based on their rates of several avoidable complications, including bed sores, blood clots, central line infections, falls, and infection from methicillin-resistant Staphylococcus aureus (MRSA) or Clostridium difficile (C. diff).

How many hospitals will be penalized in 2020?

Of the 786 hospitals being penalized during the 2020 fiscal year, just 145 are being punished for the first time. Conversely, there were 16 hospitals that had been penalized during each year of the program but finally escaped punishment for the first time this year.

Why are hospitals punished?

Some hospitals may be punished simply for doing an efficient job at reporting their infections and injuries , while others may get away with under-reporting such incidents.

Why are hospitals reducing their Medicare reimbursement?

Hundreds of hospitals across the U.S. may see a decrease in their Medicare reimbursement rates due to high rates of infections and patient injuries. A total of 786 hospitals were identified by the Centers for Medicare & Medicaid Services (CMS) as having rates of infections and injuries that were higher than other facilities.

What are the issues that Medicare covers?

These issues include infections, blood clots, sepsis, bedsores, hip fractures and other complications that occurred in a hospital and may have been prevented. Reimbursement rates for the offending parties are reduced by one percent of the Medicare-approved amount (the amount Medicare would typically pay for covered services).

What are the benefits of Medicare Advantage?

Some Medicare Advantage plans may also offer benefits such as routine dental and vision care, hearing care, home-delivered meals and more. You can call to speak with a licensed insurance agent to learn more about Medicare Advantage plans available near you, and you can compare plans online with no obligation to enroll.

How many fewer hospital stays does Medicare Advantage plan have?

According to a 2018 study, beneficiaries of Medicare Advantage plans (Medicare Part C) experienced 33 percent fewer emergency room visits and 23 percent fewer hospital stays than beneficiaries who were enrolled in fee-for-service traditional Medicare.

What is the hospital acquired condition reduction program?

The Hospital-Acquired Condition Reduction Program is a product of the Affordable Care Act (ACA, also called Obamacare) and is now in its sixth year of operation. Under the law, Medicare is required to punish the 25 percent of general care hospitals with the highest rates of patient safety issues.

How much do hospitals lose in Medicare?

Each year, hundreds of hospitals lose 1 percent of their Medicare payments through the Hospital-Acquired Conditions Reduction Program. The penalties — now in their fourth year — were created by the Affordable Care Act to drive hospitals to improve the quality of their care.

Which states have been penalized by Medicare?

In New York and Nevada, 4 in 10 hospitals were penalized. A third were punished in Rhode Island and Georgia.

What are HACs in hospitals?

All these types of potentially avoidable events are known as hospital-acquired conditions, or HACs. A mix of factors contributes to why more hospitals are punished in certain states. The penalties fall more frequently on teaching hospitals and on facilities with large portions of low-income patients. There are more of those in some states ...

What conditions does Medicare consider?

The conditions Medicare considers include rates of infections from colon surgeries, hysterectomies, urinary tract catheters and central line tubes inserted into veins. Medicare also examines rates of methicillin-resistant Staphylococcus aureus, or MRSA, and Clostridium difficile, known as C-diff. The frequency of 10 types ...

Does Medicare do spot checks?

Medicare says it performs spot checks, but Dr. Karl Bilimoria, director of the Surgical Outcomes and Quality Improvement Center at the Northwestern University Feinberg School of Medicine, says more policing is needed for the rates to be credible.

Did Medicare investigate hospital infections?

Medicare Didn't Investigate Suspicious Reports Of Hospital Infections. There is also some element of statistical chance, since the number of reported conditions in one hospital on the edge of the bottom quartile might just have one or two more incidents than a hospital that narrowly escapes that designation.

How much does Medicare Part A cost in 2020?

In 2020, the Medicare Part A deductible is $1,408 per benefit period.

How long does Medicare Part A deductible last?

Unlike some deductibles, the Medicare Part A deductible applies to each benefit period. This means it applies to the length of time you’ve been admitted into the hospital through 60 consecutive days after you’ve been out of the hospital.

How many days can you use Medicare in one hospital visit?

Medicare provides an additional 60 days of coverage beyond the 90 days of covered inpatient care within a benefit period. These 60 days are known as lifetime reserve days. Lifetime reserve days can be used only once, but they don’t have to be used all in one hospital visit.

What is the Medicare deductible for 2020?

Even with insurance, you’ll still have to pay a portion of the hospital bill, along with premiums, deductibles, and other costs that are adjusted every year. In 2020, the Medicare Part A deductible is $1,408 per benefit period.

How much is coinsurance for 2020?

As of 2020, the daily coinsurance costs are $352. After 90 days, you’ve exhausted the Medicare benefits within the current benefit period. At that point, it’s up to you to pay for any other costs, unless you elect to use your lifetime reserve days. A more comprehensive breakdown of costs can be found below.

What is Medicare Part A?

Medicare Part A, the first part of original Medicare, is hospital insurance. It typically covers inpatient surgeries, bloodwork and diagnostics, and hospital stays. If admitted into a hospital, Medicare Part A will help pay for:

How long do you have to work to qualify for Medicare Part A?

To be eligible, you’ll need to have worked for 40 quarters, or 10 years, and paid Medicare taxes during that time.