CSRS covered employees contribute 7, 7 1/2 or 8 percent of pay to CSRS and, while they generally pay no Social Security retirement, survivor and disability (OASDI) tax, they must pay the Medicare tax (currently 1.45 percent of pay). The employing agency matches the employee's CSRS contributions.

Full Answer

How much is the monthly premium for Medicare Part A?

Monthly Premium. : Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $422 each month in 2018 ($437 in 2019). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $422 ($437 in 2019).

Are CSRS employees eligible for Medicare?

I am close to 65, and the answer to one of the questions asked states that people in CSRS are not eligible for Medicare because they didn’t pay into Social Security. I was in CSRS before the change to FERS and stayed with CSRS. I had Medicare deductions taken from my pay from 1983-84 till I retired in 2009.

How much does Medicare Part C pay for doctors?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) The Part C monthly Premium varies by plan.

How much does the government pay for Medicare Part B?

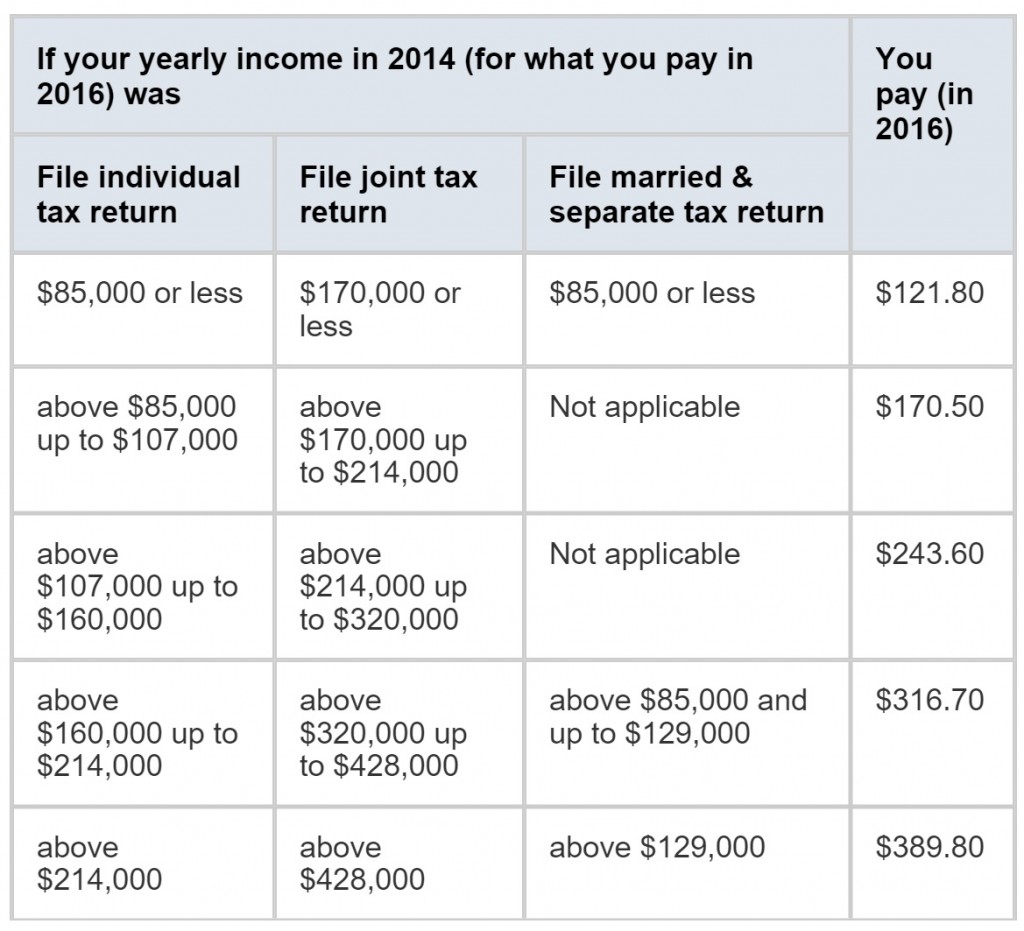

For most beneficiaries, the government pays a substantial portion—about 75 percent—of the Part B premium, and the beneficiary pays the remaining 25 percent. If you’re a higher-income beneficiary, you’ll pay a larger percentage of the total cost of Part B based on the income you report to the Internal Revenue Service (IRS).

How do CSRS retirees pay for Medicare?

Those who chose to remain in CSRS are still not covered under Social Security and are not eligible for SS retirement benefits. But they do qualify for Medicare through taxes paid on federal earnings.

Do federal retirees pay for Medicare?

Most Federal employees and annuitants are entitled to Medicare Part A at age 65 without cost. When you don't have to pay premiums for Medicare Part A, it makes good sense to obtain coverage. It can reduce your out-of-pocket expenses as well as costs to FEHB, which can help keep FEHB premiums down.

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

What are Medicare premiums for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Do CSRS retirees pay Medicare tax?

CSRS covered employees contribute 7, 7 1/2 or 8 percent of pay to CSRS and, while they generally pay no Social Security retirement, survivor and disability (OASDI) tax, they must pay the Medicare tax (currently 1.45 percent of pay).

Do CSRS retirees get Social Security?

Unlike most employer-sponsored pensions in the private sector, CSRS annuities were not intended to supplement Social Security benefits. Yet, most Federal workers who earn a CSRS annuity also receive Social Security benefits at some time.

Does Social Security count as income for Medicare premiums?

(Most enrollees don't pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

How can I lower my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

Do Medicare premiums change each year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Is Medicare free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What is the Medicare Part B premium for 2022?

In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm™.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

When did CSRS retire?

I’m currently insured under federal BCBS. A. CSRS employees who retired before Dec. 31, 1983, aren’t eligible for Medicare Part A. Nor are CSRS employees who retired after that date but before having Medicare deductions taken from their pay for 10 years.

Is Medicare Part B open to 65 year olds?

On the other hand, they are eligible to enroll in Medicare Part B, which is open to everyone 65 or older.

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is Medicare Part B?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

Is Medicare Advantage the lowest in 14 years?

The Medicare Advantage average monthly premium will be the lowest in fourteen years (since 2007). Premiums and deductibles for Medicare Advantage and Medicare Part D Prescription Drug plans are already finalized and are unaffected by this announcement.

What is CSRS in retirement?

The Civil Service Retirement System (CSRS) is a defined benefit, contributory retirement system. Employees share in the expense of the annuities to which they become entitled. CSRS covered employees contribute 7, 7 1/2 or 8 percent of pay to CSRS and, while they generally pay no Social Security retirement, survivor and disability (OASDI) tax, they must pay the Medicare tax (currently 1.45 percent of pay). The employing agency matches the employee's CSRS contributions.

When did the CSRS become effective?

Retirement Services CSRS Information. Retirement Services. CSRS Information. The Civil Service Retirement Act, which became effective on August 1, 1920 , established a retirement system for certain Federal employees. It was replaced by the Federal Employees Retirement System (FERS) for Federal employees who first entered covered service on ...

What is service credit?

Service Credit – Payment to increase your annuity for civilian service when no CSRS retirement deductions were withheld or were refunded or for military service after 1956.

What is creditable service?

Creditable Service – Rules showing the civilian and military service that can be used to compute your CSRS retirement benefits. Planning and Applying – It's never too early to start planning for retirement in order to ensure it goes smoothly. Here you will find information to help ensure your retirement starts well.

Is TSP tax deferred?

Employees may also contribute a portion of pay to the Thrift Savings Plan (TSP) (external link) . There is no Government contribution, but the employee contributions are tax-deferred. This section of the website covers the Civil Service Retirement System (CSRS).

How a CSRS retiree can have Medicare premiums withheld from their annuity payment?

If you are eligible for Medicare and not eligible for Social Security, you can have Medicare premiums withheld from your annuity payments. OPM must receive a request for the withholding from the Centers for Medicare and Medicaid Services. They cannot withhold premiums based on your direct request or even one from the Social Security Administration. The request must come from the Centers for Medicare and Medicaid Services (CMS) to withhold Medicare premium s from annuity payments.

How is Medicare Part B premium determined?

Medicare Part B premiums are determined by your Modified Adjusted Gross Income (MAGI). The more you earn the higher your Part B premium. For most beneficiaries, the government pays a substantial portion—about 75 percent—of the Part B premium, and the beneficiary pays the remaining 25 percent.

How to withdraw from Medicare Part B After Signing Up?

Once you withdraw from Medicare B you would have to notify your FEHB provider, Blue Cross Blue Shield in your case , immediately because they would revert back to primary provider for medical services. To cancel Medicare Part B coverage you will have to use form CMS-1763. This form isn’t available online and you must contact your Social Security Administration office to complete the form. They will discuss the consequences of canceling your coverage, including how penalties are accessed, and process the form for you over the phone. The Social Security FAQ titled How do I terminate my enrollment with Medicare Part B when I have other health insurance explains the process in more detail. Typically your monthly premium for Part B may go up 10% for each full 12-month period that you could have had Part B, but didn’t sign up for it.

What is Medicare Part A and B?

Medicare Part A, B, C and D. The Original Medicare Plan (Medicare Part A & B) is available everywhere in the United States. It is the way everyone used to get Medicare benefits and is the way most people get their Medicare Part A and Part B benefits now. You may go to any doctor, specialist, or hospital that accepts Medicare.

How to contact Medicare Advantage?

To learn more about enrolling in a Medicare Advantage plan, contact Medicare at 1-800-MEDICARE (1-800-633-4227) or at www.medicare.gov. Part D (Medicare prescription drug coverage).

How many parts does Medicare have?

Medicare has four parts: Part A (Hospital Insurance). Most people do not have to pay for Part A. If you or your spouse worked for at least 10 years in Medicare-covered employment, you should be able to qualify for premium-free Part A insurance.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare premium for 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What is Medicare Part B?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

How old do you have to be to be eligible for Medicare Part A?

Enrollees age 65 and over who have fewer than 40 quarters of coverage and certain persons with disabilities pay a monthly premium in order to voluntarily enroll in Medicare Part A.

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020).

When is Medicare open enrollment?

The Medicare open enrollment period started on October 15, 2020 and runs through December 7, 2020. “With the 2021 Medicare Part B premium information now available, I encourage everyone with Medicare to take time over the next four weeks to review their options during Medicare Open Enrollment,” said CMS Administrator Seema Verma.

Is Medicare Part B deductible higher in 2021?

Each year the Medicare premiums, deductibles, and coinsurance rates are adjusted according to the Social Security Act. For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts.