How Much Does the Average Medicare Supplement Plan Cost in 2022?

| Average Monthly Cost of Plan F | Age in Years | Average Monthly Cost of Plan G |

| $184.93 | 65 | $143.46 |

| $186.76 | 66 | $144.94 |

| $188.48 | 67 | $146.35 |

| $192.55 | 68 | $149.62 |

Full Answer

Are You paying too much for your Medicare supplement?

11 rows · Jun 16, 2021 · You can compare Medicare Supplement plans and how much they cost online for free. Getting a ...

What is the average cost of a Medicare supplement plan?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty. How much is the Part A late enrollment penalty?

What are the top 5 Medicare supplement plans?

Summary: The cost of a Medicare Supplement insurance plan will be dependent on factors such as plan rating systems, if you have guaranteed issue rights, and the type of plans of you choose. If you’re enrolled in Medicare, or will soon be eligible for the program, you may be thinking about buying a Medicare Supplement insurance plan to work alongside your Medicare Part A and …

How much do Medicare supplements increase each year?

Nov 07, 2019 · Medicare Supplement insurance coverage for these expenses varies by plan type. If you enroll in a Medicare Supplement plan, you will typically pay the insurance company a monthly premium in exchange for coverage. How much a Medicare Supplement plan will cost may depend on factors such as: The plan you select. The insurance company you choose to ...

How much a month is Medicare Supplement?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

How much is an AARP Medicare Supplement?

In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it's $209 for those aged 85.Jan 24, 2022

What is the most basic Medicare Supplement plan?

There are 10 different Medicare Supplement plans approved by Medicare, each with a different level of provided benefits. Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold).Sep 25, 2021

Does Medicare Supplement cost increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the difference between Medicare Supplement and Medicare Advantage plans?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.Mar 1, 2022

Does Plan G cover Medicare deductible?

Get online quotes for affordable health insurance Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

Why does AARP endorse UnitedHealthcare?

What is AARP Medicare Supplement insurance? AARP Medicare Supplement plans are insured and sold by private insurance companies like UnitedHealthcare to help limit the out-of-pocket costs associated with Medicare Parts A and B.

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

Do Medicare supplements go up every year?

Medicare supplement rate increases usually average somewhere between 3% and 10% per year. And sometimes Medicare supplement rate increases even happen twice in the same year!5 days ago

What is the average cost of Plan G?

Annual premiums for Medicare Plan G typically cost between $1,500 and $2,000. Some insurance companies offer extra perks and benefits for vision and dental care with Medicare Plan G.Sep 22, 2021

How Insurance Companies Set Medicare Supplement Insurance Plan Costs & Premiums

Insurance companies can decide the premium costs for the Medicare Supplement insurance plans they offer. They can use any of three ways to set prem...

When You Apply For A Medicare Supplement Insurance Plan

The time period when you apply for a Medicare Supplement insurance plan can affect your out-of-pocket costs. If you apply during the Medicare Suppl...

The Type of Medicare Supplement Insurance Plan Type You Select

The benefit coverage of the Medicare Supplement insurance plan you choose usually also affects the premium you will pay. For example, you might be...

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is Medicare Supplement?

Medicare insurance Supplement insurance plans (also known as Medigap plans) are offered by private insurance companies and are designed to help pay out-of-pocket costs for services covered under Medicare Part A and Part B, such as deductibles, copayments, and coinsurance. Medicare supplement insurance coverage for these out-of-pocket expenses ...

How does Medicare Supplement insurance work?

How insurance companies set Medicare Supplement insurance plan costs & premiums 1 Community rating: Generally the premium is priced so that everyone who purchases a Medicare Supplement insurance plan of a particular type pays the same premium each month. Over time, premiums may increase because of inflation and other factors, but they won’t change because of your age. 2 Issue-age rating: The premium you pay is based on your age when you buy the Medicare Supplement insurance plan. Premiums are lower if you purchase the Medicare Supplement insurance plan when you are age 65 than if you wait until you are older. Over time, premiums may increase because of inflation and other factors, but they won’t increase because of your age. 3 Attained-age-rating: The premium you pay is based on your current age. Younger buyers may find Medicare Supplement insurance plans that are rated this way very affordable. Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors.

Why do Medicare premiums increase?

Premiums may also increase because of inflation and other factors. If you are interested in purchasing a Medicare Supplement insurance plan offered by an insurance company, it is a good idea to ask what rating system they use to set their premiums.

Which states have standardized Medicare Supplement plans?

With the exception of Massachusetts, Minnesota and Wisconsin, which have their own standardized plans, insurance companies offer standardized Medicare Supplement insurance plans identified by alphabetic letters (such as Medicare Supplement insurance Plan M). However, the premiums (the monthly amount you pay for a Medicare Supplement insurance plan) ...

How long does Medicare Part B last?

This period begins the month you are both 65 years old and enrolled in Medicare Part B, and lasts for six months. If you apply during this period, you’re not required to go through medical underwriting, which can lead to a higher premium cost if you have health conditions at the time you apply.

How does community rating work?

Community rating: Generally the premium is priced so that everyone who purchases a Medicare Supplement insurance plan of a particular type pays the same premium each month. Over time, premiums may increase because of inflation and other factors, but they won’t change because of your age.

What is Medicare Supplement Plan?

Medicare Supplement plans (also known as Medigap plans) are designed to work alongside Part A and Part B and to help pay out-of-pocket costs, which may include deductibles, copayments, and coinsurance, for example. Medicare Supplement insurance coverage for these expenses varies by plan type. If you enroll in a Medicare Supplement plan, you will ...

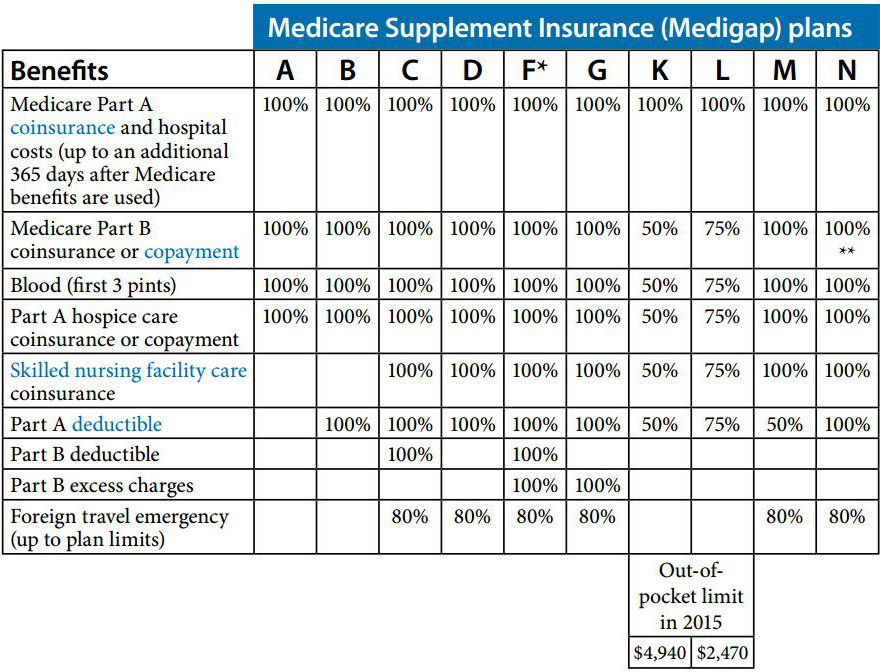

What are the benefits of Medicare Supplement?

All the standardized Medicare Supplement plans share some basic benefits. Aside from the first benefit listed below, not all plans cover these benefits at 100%. Basic benefits include: 1 Medicare Part A coinsurance and coverage for hospital services 2 Medicare Part B coinsurance or copayment 3 Blood transfusions (first three pints) 4 Hospice care coinsurance or copayment

How many states have Medicare Supplement Plans?

In 47 states, there are up to 10 standardized Medicare Supplement plans available. With the exception of Massachusetts, Minnesota and Wisconsin, which have their own standardized Medicare Supplement plan types, Medicare Supplement benefit plans are labeled with alphabetic letters for easy reference.

When is the best time to apply for Medicare Supplement?

Probably the best time to apply for a Medicare Supplement plan is the six-month period that begins the first month you are enrolled in Medicare Part B and you are age 65 or older.

Does Medicare cover emergency care?

For example, if you travel abroad frequently, a Medicare Supplement plan that covers emergency care outside the United States may be worthwhile insurance protection. Some plans pay for 80% of approved emergency medical expenses when you’re out of the country, up to plan limits.

Is Medicare Supplement Plan renewable?

Medicare Supplement plans are guaranteed renewable in most cases; generally as long as you continue to pay your premiums, you may continue your coverage from the Medicare Supplement plan year after year. You may also want to consider the long-range cost of your Medicare Supplement plan as well as the short-range, ...

What are the factors that affect the cost of Medicare Supplement?

There may be plans available in your area that cost less than the average listed above for your age. Other factors such as gender, smoking status, health and where you live can also affect Medigap plan rates. A licensed insurance agent can help you compare Medicare Supplement Insurance plan costs in your area so that you can find a plan ...

What are the Medicare premiums for 2020?

Based on our analysis, we noted several key takeaways: 1 Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). 2 Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

When will Medicare plan F be available?

Important: Plan F is not available to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020. If you already have Medicare, you can still enroll in Plan F if the plan is available in your area.

What is the age factor in Medicare?

Age is one factor that Medicare Supplement Insurance (Medigap) companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan. Medicare Supplement Insurance premiums tend to increase with age. As you compare Medigap quotes , it may be helpful to consider how your age could ...

What is Medicare Supplement Plan?

A Medicare Supplement plan (aka, Medigap) is additional insurance that helps pay some of the deductibles. A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share.... , copayments.

When will Medicare Supplements be available in 2021?

June 27, 2021. According to MedicareWire research, the average Medicare Supplement insurance. Medicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare (Medicare Part A and Medicare Part B) health insurance coverage....

What is Medicare premium?

A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ... . Several other factors influence Medicare supplement insurance cost, too, so read on.

How much does Medicare pay for skilled nursing?

But, Medicare only pays for the first 20 days. After that, you’ll pay $176 per day. Medicare Part B deductible: The Part B deductible is $198 per year.

How much does a hip replacement cost?

The average cost of a hip replacement in the United States is almost as costly at $32,000. Most of us simply can’t afford to pay 20% of those kinds of costs out-of-pocket. That’s what makes it necessary to buy supplemental Medicare insurance. As with car insurance, we really don’t have a choice.

What is a copayment?

A copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service.... , and coinsurance. Coinsurance is a percentage of the total you are required to pay for a medical service. ... that’s baked into Original Medicare.

What factors influence insurance premiums?

Zip code and age significantly influence the monthly premium. Costs vary by insurance carrier and rating method (attained-age, issue-age, community). Gender and the use of tobacco also influence premiums. A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis.

How many different Medicare Supplement plans are there?

However, this is not such a straightforward question to answer as one might think. For starters, there are 10 different standardized Medicare Supplement plans with different costs and coverage. The best way to find out how much ...

Which states have higher Medigap premiums?

Connecticut and New York, for example, have higher Medigap premiums than those of Texas because CT and NY have protections in place that allow members to enroll or switch plans without health reviews. This drives up cost in those states as the providers are forced to enroll less healthy members than in Texas.

What are the factors that affect insurance?

Not only that, but the following issues can affect your price: 1 The state you live in 2 The insurance company you choose 3 Age 4 Available discounts 5 Tobacco use 6 Gender

Does Medigap offer discounts?

Different Medigap companies tend to offer different discounts such as household discounts, new to Medicare discounts and even autopay discounts. These discounts can really impact what you end up paying. Contact us to find the best one for you.

Is there a fee for Senior65?

We at Senior65 dedicate ourselves to help people enroll in Medigap, Medicare Advantage and Part plans at no additional cost. There is never a fee or hidden charge to work with Senior65.com. Since Medicare insurance pricing is regulated, no one can sell you the same plan for less than we can.

What is the difference between Medigap Plan N and Plan G?

It can start as low as $75 depending on state, age, etc. Medigap Plan N has a lower premium than G or F and should be considered if you cannot afford the above.

Does Medigap Plan N cover Part B?

Medigap Plan N has a lower premium than G or F and should be considered if you cannot afford the above. It does not cover the Part B deductible or the dreaded Medicare Excess Charges. Also Medigap Plan N has a $20 copay for doctor visits and a $50 copay for emergency room.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans help pay for some of the out-of-pocket expenses you’ll face when you use Medicare Part A and Part B benefits. Medigap plans are sold by private insurance companies. These costs can include certain Medicare deductibles, coinsurance, copayments and other charges.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much is coinsurance for skilled nursing in 2021?

Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay. Skilled nursing care is based on benefit periods like inpatient hospital stays.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

Who is Alex Wender?

Alex Wender. Alex Wender is the founder and CEO of Bluewave Insurance. He has been blogging about Medicare-related topics since 2010. Since then, he and his agency have helped thousands of people across the country choose the right Medicare to fit their needs.

Does Medicare increase over time?

ALL standardized Medigap plans will increase in price over time. There are several driving factors that affect the rates. Your Medicare supplement rate can increase with your age, inflation, the insurance companies internal reasons (claims, cost of doing business, etc), or a combination of all three. See our full explanation on how policies are ...