How much is the LEP for Part D? The Medicare Part D penalty is based on the number of months you went without PDP coverage. For each month without coverage, you will pay an additional premium of 1 percent of the current “national base beneficiary premium.” For 2022, the average Part D premium is $33.37; up slightly from the 2021 $33.06 1.

Full Answer

How much is the LEP for Medicare Part D?

How much is the LEP for Part D? The Medicare Part D penalty is based on the number of months you went without PDP coverage. For each month without coverage, you will pay an additional premium of 1 percent of the current “national base beneficiary premium.” For 2022, the average Part D premium is $33.37; up slightly from the 2021 $33.06 1 .

How much does Medicare Part a cost?

Medicare costs at a glance. Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $437 each month. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240.

How much can you pay out-of-pocket for Medicare?

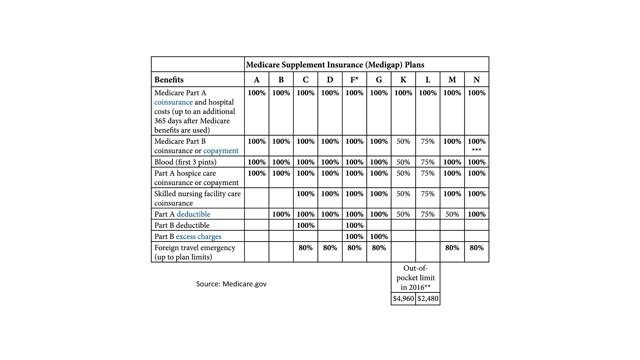

There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance ( An insurance policy you can buy to help lower your share of certain costs for Part A and Part B services (Original Medicare).

Is there a late enrollment fee for Medicare Part B?

If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $17 per month to your Part B premium. There is no late enrollment penalty for Medicare Part C (Medicare Advantage plans).

How is Medicare LEP calculated?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $. 10 and added to your monthly Part D premium.

Why does Medicare charge LEP?

The purpose of the LEP is to encourage Medicare beneficiaries to maintain adequate drug coverage. The penalty is 1% of the national base beneficiary premium ($33.37 in 2022) for every month you did not have Part D or certain other types of drug coverage while eligible for Part D.

How long does Medicare Part D penalty last?

Since the monthly penalty is always rounded to the nearest $0.10, she will pay $9.70 each month in addition to her plan's monthly premium. Generally, once Medicare determines a person's penalty amount, the person will continue to owe a penalty for as long as they're enrolled in Medicare drug coverage.

What is the maximum Part D Penalty?

The Part D penalty has no cap. For example: The national average premium is $33.37 a month in 2022. If you went 29 months without creditable coverage, your penalty would be $9.70.

How do I avoid Part D Penalty?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

How do I get rid of Part B late enrollment penalty?

You can appeal to remove the penalty if you think you were continuously covered by Part B or job-based insurance. You can also appeal to lower the penalty amount if you think it was calculated incorrectly. Call your former employer or plan and ask for a letter proving that you were enrolled in coverage.

What is the cost of Part D Medicare for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

Can I drop Medicare Part D without penalty?

“Creditable” means that Medicare considers this coverage at least as good as Part D. If you have this kind of coverage, you don't need Part D. And if you lose it involuntarily sometime in the future, you'll get a special enrollment period of two months to sign up with a Part D plan without penalty.

Can you delay Medicare Part D?

For each month you delay enrollment in Medicare Part D, you will have to pay a 1% Part D late enrollment penalty (LEP), unless you: Have creditable drug coverage. Qualify for the Extra Help program. Prove that you received inadequate information about whether your drug coverage was creditable.

Can I add Part D to my Medicare at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

Why is Medicare charging late fees?

Charging late fees helps to reduce these costs overall and encourage people to enroll on time.

What is the Medicare penalty?

A Medicare penalty is a fee that you’re charged if you don’t sign up for Medicare when you’re eligible. For most people, this is around the time they turn 65 years old.

What happens if you don't sign up for Medicare?

If you’re not automatically enrolled and don’t sign up for Medicare Part A during your initial enrollment period, you’ll incur a late enrollment penalty when you do sign up. The late enrollment penalty amount is 10 percent of the cost of the monthly premium. You’ll have to pay this additional cost each month for twice the number ...

How long does it take to enroll in Medicare Part D?

You can enroll in Medicare Part D without incurring a late enrollment penalty during the 3-month period that begins when your Medicare parts A and B become active. If you wait past this window to enroll, a late enrollment penalty for Medicare Part D will be added to your monthly premium. This fee is 1 percent of the average monthly prescription ...

What happens if you delay Medicare enrollment?

Delaying enrollment in Medicare can subject you to long-lasting financial penalties added to your premiums each month. A late enrollment penalty can significantly increase the amount of money you’re required to pay for each part of Medicare for years. Share on Pinterest.

Why is there a special enrollment period for Medicare Part B?

Special enrollment periods are provided for people who don’t sign up for Medicare Part B during initial enrollment because they have health insurance through their employer, union, or spouse.

How long does Medigap last?

This period starts on the first day of the month you turn 65 and lasts for 6 months from that date. If you miss open enrollment, you may pay a much higher premium for Medigap.

What is the LEP for Medicare Part B?

If you did not enroll in Medicare Part B when you were first eligible (during your Initial Enrollment Period- IEP) your monthly premium may go up 10% for each 12-month period you could have had Medicare Part B, but did were not enrolled. The penalty is based on the standard Medicare Part B premium, regardless of the premium amount you actually pay

What is the late enrollment penalty for Medicare?

The late enrollment penalty amount is typically 1% of the national base beneficiary premium for each full, uncovered month that you did not have Medicare Part D Prescription Drug plan or other creditable coverage.

Is there a Cap on the Part B Penalty?

Currently, there is no cap on the Medicare Part B late enrollment penalty.

What if I Don’t Agree with the Part D Late Enrollment Penalty?

If you do not agree with your Late Enrollment Penalty, or feel it was added in error, you may be able to request a "reconsideration." Your Medicare Part D Prescription Drug plan will send information about how to request a reconsideration.

What if you Receive a Medicare Part D Late Enrollment Penalty but had Creditable Coverage?

When you join a Medicare Part D Prescription Drug plan, the plan will review Medicare’s systems to see if you had a potential break in creditable coverage for 63 days or more in a row. If so, the plan will send you a notice asking for information about prior prescription drug coverage. It’s critica l that you complete this form and return it by the date on the form! This represents your chance to let the plan know about prior coverage that might not be in Medicare’s systems.

What is the Medicare premium for 2022?

The national base beneficiary premium for 2022 will be $33.37. The monthly penalty is rounded to the nearest $0.10 and is added to the monthly Medicare Part D Prescription Drug plan premium. You could expect to pay an estimated $0.33 penalty for every month without drug coverage. The national base beneficiary premium may change each year, so your penalty amount may also change each year.

How long does Medicare Part B penalty last?

In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Medicare Part B. So similar to the LEP for Medicare Part D, this is permanent for as long as you are enrolled in Medicare. And, the penalty increases the longer you go without Medicare Part B coverage.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

How long do you have to pay late enrollment penalty?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

How much is the penalty for Part B?

Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers.

When will Part B coverage start?

You waited to sign up for Part B until March 2019 during the General Enrollment Period. Your coverage starts July 1, 2019. Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.)

How long does it take for Medicare to reconsider a LEP?

The IRE generally will notify the enrollee of the final LEP reconsideration decision (including a decision to dismiss the reconsideration request), within 90 calendar days of receiving a request for reconsideration. For more information, plans may view the Part D QIC Reconsideration Procedures Manual (click on "Part D QIC Manual" in the "Related Links" section below) on the IRE’s website.

What is the form C2C for LEP?

An enrollee may use the form, “Part D LEP Reconsideration Request Form C2C” to request an appeal of a Late Enrollment Penalty decision. The enrollee must complete the form, sign it, and send it to the Independent Review Entity (IRE) as instructed in the form. The fillable form is available in the "Downloads" section at the bottom of this page.

How long does Medicare Part D last?

A Medicare Part D plan notifies an enrollee in writing if the plan determines the enrollee has had a continuous period of 63 days or more without creditable prescription drug coverage at any time following his or her initial enrollment period for the Medicare prescription drug benefit.

How long does Medicare late enrollment last?

Overview. Medicare beneficiaries may incur a late enrollment penalty (LEP) if there is a continuous period of 63 days or more at any time after the end of the individual's Part D initial enrollment period during which the individual was eligible to enroll, but was not enrolled in a Medicare Part D plan and was not covered under any creditable ...

Can you request a review of a LEP?

The enrollee or his or her representative may request a review, or reconsideration, of a decision to impose an LEP. An enrollee may only obtain review under the circumstances listed on the LEP Reconsideration Request Form.

How much does Medicare add to your premium if you owe a late fee?

If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $14.85 per month to your Part B premium.

How much is Medicare Part A 2021?

In 2021, Medicare Part A premiums are either $259 or $471 per month, depending on the amount of Medicare taxes you paid during your lifetime. The 2021 Part A late enrollment penalty can be as high as $26 or $47 per month, depending on your Medicare Part A premium cost.

What is the penalty for late enrollment in Medicare?

There are special circumstances that could exempt beneficiaries from a penalty. The Medicare Part A late enrollment penalty is 10 percent of the Part A premium, which must be paid for twice the number of years for which you were eligible for Part A but did not sign up. For example, if you were eligible for Part A for two years before finally ...

How long does Medicare enrollment last?

When you first become eligible for Medicare, you have an Initial Enrollment Period. This is a seven-month period that begins three months before you turn 65 years old, includes the month of your birthday, and then continues for three more months thereafter.

What happens if you go 63 days without Medicare?

If you go 63 consecutive days without “creditable drug coverage” after your Initial Enrollment Period is over, you could face a Part D late enrollment penalty if you eventually choose to sign up for a plan. Creditable drug coverage can include: A Medicare Part D plan. A Medicare Advantage plan that offers drug coverage.

What happens if you wait too long to enroll in Medicare?

If you wait too long after your Initial Enrollment Period to sign up for Medicare Part A (hospital insurance), Part B (medical insurance) or Part D (Medicare prescription drug plans), you could be subject to a Medicare late enrollment penalty.

How long does it take to enroll in Medigap?

During your Medigap Open Enrollment Period (which is a six-month period that begins the day you are 65 years old and enrolled in Medicare Part B), insurance companies are not allowed to use medical underwriting to determine your Medigap plan rates.