Full Answer

How much do Medicare supplement plans cost?

While these amounts will vary greatly, we can still give you an idea what you may spend. These average monthly premium price can range from $150 to $200. 1 How Much Do Supplemental Medicare Plans Cost? The average cost of Medicare Supplement plans varies because health insurance companies have three ways that they price these plans:

When does my spouse become eligible for Medicare supplement insurance?

When your spouse turns 65, he or she will then be eligible to enroll in Medicare Part A and B and then purchase a Medicare Supplement insurance plan. Should my spouse and I purchase the same Medicare Supplement insurance plan?

How much does Medicare pay for medical expenses?

After paying this amount, you’ll typically pay 20% of the Medicare-approved amount for medical expenses covered by Part B, including: Even if you share a Medicare health plan with your spouse, you’ll still pay your own premiums, deductibles and copays.

Do married couples get a price break in Medicare?

Unlike other kinds of health insurance you may have had in the past, there are no family packages or price breaks for married couples in Medicare.

How much does supplemental Medicare cost?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

Does Medicare Supplement cover spouses?

No Medicare Supplement insurance plans provide spouse coverage. This means that a married couple who both want Medicare Supplement insurance coverage must purchase two separate policies.

Are Medicare Supplement plans based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Are Medicare premiums per person or per family?

Your premiums may change because of your total income. There are no family plans or special rates for couples in Medicare. You will each pay the same premium amount that individuals pay.

How does Medicare work for married couples?

Medicare has no family plans, meaning that you and your spouse must enroll for Medicare benefits separately. This also means husbands, wives, spouses and partners pay separate Medicare premiums.

Can my wife get Medicare at 62?

Traditional Medicare includes Part A (hospital insurance) and Part B (medical insurance). To qualify for Medicare, your spouse must be age 65 or older. If your spouse is age 62 (or any age under 65), he or she could only qualify for Medicare by disability.

What is the monthly premium for Plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

Who has the cheapest Medicare supplement insurance?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022.

Why is my Medicare premium more than my husbands?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $170,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $85,000, you'll pay higher premiums.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

How much are Medicare premiums for 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

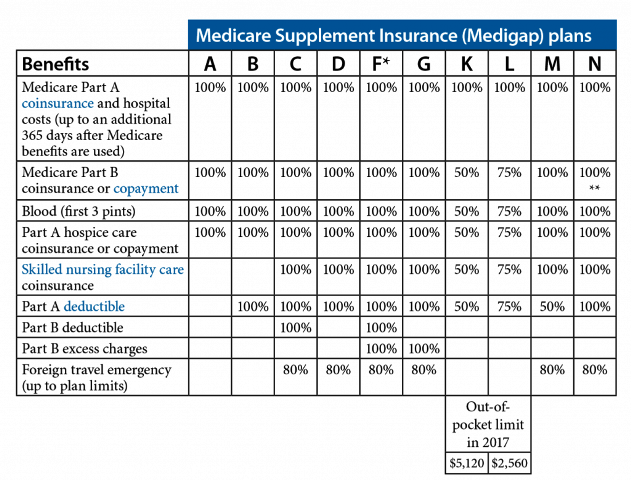

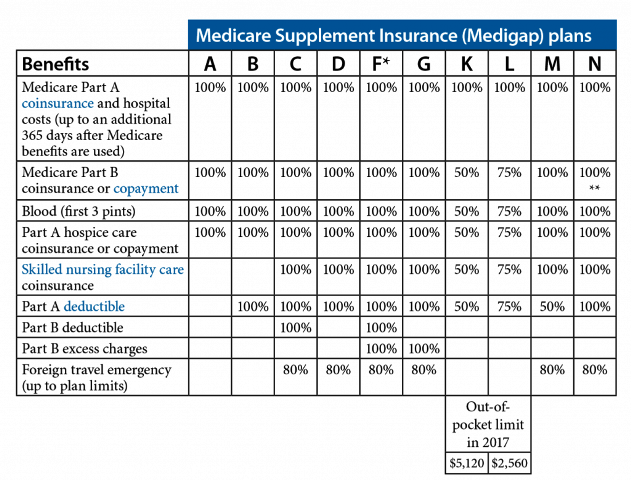

What does Medicare Supplement cover?

All Medicare Supplement insurance plans (standardized in most states with lettered names: A, B, C*, D, F*, G, K, L, M, N) cover 100% of Medicare Part A coinsurance and hospital costs. All Medicare Supplement insurance plans also cover at least 50% of Medicare Part B coinsurance, at least 50% of blood, and at least 50% of Part A hospice care ...

What kind of insurance do I need if my spouse is younger than me?

If your spouse is younger than you and isn’t yet eligible for Medicare, he or she will need some different kind of health insurance when you become eligible for Medicare. Other types of health-care could be an employer-sponsored group plan, or health insurance purchased through the Health Insurance Marketplace.

When is the best time to enroll in Medicare Supplement?

The best time to enroll in a Medicare Supplement insurance plan is typically during your Medicare Supplement Open Enrollment Period. During this period, insurance companies may not use medical underwriting to deny coverage on the basis of current or past health problems, although you might face a waiting period before coverage starts. ...

When does Medicare open enrollment start?

The Medicare Supplement Open Enrollment Period begins on the first day of the month that you are both 65 or older and enrolled in Medicare Part B. Depending on your age and your birthdays, you and your spouse may likely have different Open Enrollment Periods. Some states have additional Open Enrollment Periods including those for people ...

Can I buy Medicare Supplement insurance?

In many cases, you can buy a Medicare Supplement (Medigap) insurance plan to cover out-of-pocket costs that Medicare Part A and Medicare Part B don’t cover, such as coinsurance and deductibles. Some Medicare Supplement insurance plans even include limited coverage of foreign travel emergencies.

Can I get different insurance if my spouse travels?

If your spouse travels and you don’t, you may want different plans. As you shop, know that different insurance companies may charge different premiums for the same policy. If you compare prices among Medicare Supplement insurance plans, you may find a cheaper policy with the same coverage from a different insurance company.

Does Medicare cover spouses?

If you’re looking for a plan that covers both you and your spouse, you need to know that Medicare Supplement insurance plans don’t cover spouses. Like most Medicare plans, a Medicare Supplement insurance plan is designed to cover only one person. No Medicare Supplement insurance plans provide spouse coverage.

What is the factor that determines the premiums for Medicare Supplement Insurance?

Age is one factor that Medicare Supplement Insurance (Medigap) companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan. Medicare Supplement Insurance premiums tend to increase with age .

What are the factors that affect the cost of Medicare Supplement?

There may be plans available in your area that cost less than the average listed above for your age. Other factors such as gender, smoking status, health and where you live can also affect Medigap plan rates. A licensed insurance agent can help you compare Medicare Supplement Insurance plan costs in your area so that you can find a plan ...

Why does my Medigap premium increase?

As you age, your Medigap plan premiums will gradually increase each year. Medigap premiums can increase over time due to inflation and other factors , regardless of the pricing model your insurance company uses.

What is the lowest Medicare premium for 2020?

Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

How does age affect Medicare premiums?

How Does Age Affect Medicare Supplement Insurance Premiums? 1 Community-rated Medigap plans#N#With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.#N#For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market. 2 Issue-age-rated Medigap plans#N#With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.#N#You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age. 3 Attained-age-rate Medigap plans#N#Attained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

How much is the 203 deductible?

The $203 annual deductible equates to around $17.00 per month. This means that a Plan G with a premium of no more than $17.00 per month more than a Plan F option could actually serve as a better value, provided you meet the entire Part B deductible.

When will Medicare plan F be available?

Important: Plan F is not available to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020. If you already have Medicare, you can still enroll in Plan F if the plan is available in your area.

Medicare supplement plan explained

First things first, before we dig deeper into the costs associated with the Medicare Supplement plan, let’s make sure we’re on the same page with what this plan is.

Why should you get Medicare supplement insurance?

Medicare supplement insurance plans bring plenty of benefits to people aged 65 or those with disabilities. And, it all comes down to efficiently tackling increasing healthcare costs. So, if you’re wondering whether or not Medicare Supplement Plans are worth it, find out that the answer is, “Absolutely!”

How much does Medigap policy cost on average?

Now, let’s get to the main question that probably everybody interested in getting Medigap has on their minds, “what is the average cost of supplemental insurance from MedicareWire ?”. The average Medicare Supplement policy premium cost $154.50 per month in 2022.