How much will I pay for premiums in 2022?

| Yearly income in 2020: single | Yearly income in 2020: married, joint fi ... | 2022 Medicare Part B monthly premium | 2022 Medicare Part D monthly premium |

| ≤ $91,000 | ≤ $182,000 | $170.10 | just your plan’s premium |

| > $91,00–$114,000 | > $182,000–$228,000 | $238.10 | your plan’s premium + $12.40 |

| > $114,000–$142,000 | > $228,000–$284,000 | $340.20 | your plan’s premium + $32.10 |

| > $142,000–$170,000 | > $284,000–$340,000 | $442.30 | your plan’s premium + $51.70 |

Full Answer

How much money do you have to make to qualify for Medicaid?

6 rows · Nov 16, 2021 · $170.10 per month if you make $91,000 or less; $544.30 per month if you make more than ...

How to save money with Medicare?

Jun 11, 2019 · Medicare Part D Plans Commissions for initial enrollments increased from $74 per member per year to $78 per member per year, which is an increase of 5.4 percent. Commissions for renewals increased from $37 per member per year to $39 per member per year, which is also an increase of 5.4 percent. Maximum Medicare Commissions in 2019 and 2020

What is the yearly cost of Medicare?

In 2013, independent agents earned an average of $63,000 selling Medicare products — and this is just the average; agents who are willing to go above and beyond can make much more than this. What’s more, over that past few years, maximum commission rates for Medicare Advantage and Medicare Part D plans have been on the rise, which means that the potential for earning …

How often do you pay for your Medicare?

Aug 18, 2020 · On average, Medicare supplements pay between 15% to 26% of the annual premium. This depends on both the plan and the company. Some carriers pay the commissions as earned but the majority pay on a 9 month advance with a …

How much money can you make before it affects your Medicare?

A Qualifying Individual (QI) policy helps pay your Medicare Part B premium. To qualify, your monthly income cannot be higher than $1,357 for an individual or $1,823 for a married couple. Your resource limits are $7,280 for one person and $10,930 for a married couple.

What is the Medicare earnings limit for 2020?

The resulting maximum Social Security tax for 2020 is $8,537.40. There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax....2020 Social Security and Medicare Tax Withholding Rates and Limits.Tax2019 Limit2020 LimitMedicare liabilityNo limitNo limit3 more rows

What income is used to determine Medicare premiums 2021?

modified adjusted gross incomeThe adjustment is calculated using your modified adjusted gross income (MAGI) from two years ago. In 2022, that means the income tax return that you filed in 2021 for tax year 2020.Dec 2, 2021

Is Medicare based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Is Medicare Part B based on income?

The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

Do Medicare premiums increase with income?

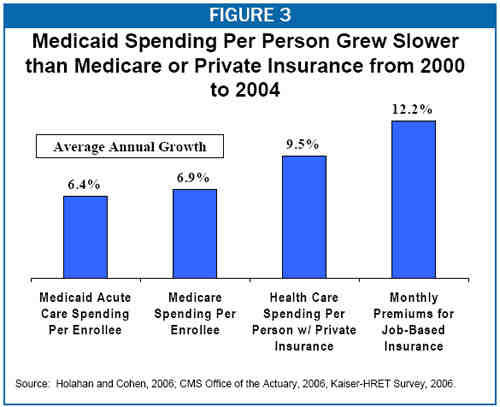

If You Have a Higher Income If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the “income-related monthly adjustment amount.” Here's how it works: Part B helps pay for your doctors' services and outpatient care.

How does working affect Medicare?

Generally, if you have job-based health insurance through your (or your spouse's) current job, you don't have to sign up for Medicare while you (or your spouse) are still working. You can wait to sign up until you (or your spouse) stop working or you lose your health insurance (whichever comes first).

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

What is a hold harmless?

If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.

How Much Money Can You Make Selling Medicare?

With more than 10,000 baby boomers turning 65 every single day, there is an increasing opportunity to sell Medicare insurance policies. However, many aspiring agents wonder how much money they can really make selling Medicare.

Interested in a Career as an Independent Agent?

Here at MCC Brokerage, we provide our agents with the tools they need to be successful when selling Medicare products.

How much do Medicare agents make: How commission is paid

Typically, both Medicare Advantage and Medicare Part D plan commission payments are paid one year in advance. In other words; the companies pay the full year’s commission up front. The renewal on Medicare Advantage and PDP plans are half of the initial commission payment. Most companies pay renewal commission on an as earned basis.

How many sales can be made?

The amount of sales a Medicare sales agent makes can vary greatly. There are several things this depends on including; the skill of the sales person, type of marketing, hours worked per week and access to natural markets. Some agents can sell only a few plans a year while others will send 300+ a year.

Sales example

Lets say an agent is able to sell 80 MAPD plans a year in PA. Of those sales, we will assume 50 are new to Medicare and the other 30 are changes from one MAPD to another. Here is how the compensation to that agent will look over the course of 4 years:

How much do Medicare agents make: Medicare Supplements (Also called Medigap)

The CMS does not set Medicare supplement compensation. As a result, there may be a big difference in payment amounts from one carrier to another. On average, Medicare supplements pay between 15% to 26% of the annual premium. This depends on both the plan and the company.

Overall

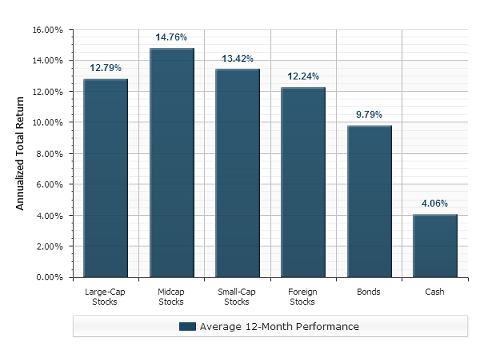

Medicare sales is lucrative for those that have an effective marketing strategy and stay in it for the long term. Most insurance agents will sell other products in addition to Medicare plans such as Final Expense, Life, Annuities, DI, P & C and ancillary products such as dental plans.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How Much Does an Insurance Agent Make on Medicare Sales?

Generally speaking, agents earn two types of commissions selling Medicare plans: a flat dollar amount per application (Medicare Advantage and prescription drug plans) or a percentage of the premium sold (Medicare Supplements).

Commissions With an FMO vs. Without an FMO

Carriers pay agents for the business they write, even if those commissions go through an FMO first (scroll down for a note about assigned commissions). It’s important for agents to know that carriers pay agents and FMOs separately. Your relationship with an FMO is comparable to your clients’ relationship with you.