Is Plan G the best Medicare supplement plan?

With Plan F not available to people new to Medicare, Medigap Plan G has now become the most popular of all the Medicare supplement plans for 2022, and for good reason. Plan G offers fantastic coverage for those on Part A and B Medicare, with only one small annual deductible to pay.

Is Medicare plan N a cost-effective choice?

"If you are pretty healthy and don't go to the doctor often, Plan N may be a more cost-effective option than Plan G," says Medicare expert Danielle Roberts. "If you go to the doctor once a month, Plan G would likely be more cost-effective than Plan N."

Which is better Medicare Plan F or G?

When it comes to coverage, Plan F will give you the most coverage since it’s a first-dollar coverage plan and leaves you with zero out of pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Plan G may be better for you.

Should You Choose Medicare supplement plan F or Plan G?

The reason is simple: Plan G is less expensive than F and there is speculation that because of the Changes in Medicare Supplement plans in 2020, the prices of Plan F will increase significantly. While nothing is yet certain, switching to Plan G is worth considering. What is the difference between Medigap Plan G and Plan F?

What is a Medigap Plan G?

What is a plan G?

How do companies set their premiums?

What is Medicare Part B?

Do you have to pay monthly premiums for Medigap?

Does Medicare have a supplemental plan?

Does Medigap cover prescription drugs?

See more

About this website

Is Plan N cheaper than Plan G?

Premiums for each plan can vary by the carrier that offers it, but Plan G is typically more expensive than Plan N because it offers a higher level of coverage. However, while Plan G usually has higher premiums, it could save you money in the long run.

Is Plan n Better Than G?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

What is the average cost of Medicare Plan N?

between $120 and $180Monthly premiums for Plan N can average between $120 and $180, climbing to over $200 in some states and dropping as low as $80 in other states. Rates are determined by location, age, gender and in some instances, current health status. This monthly cost is on top of the cost of Original Medicare (Parts A and B).

Is Medicare Part G expensive?

Annual premiums for Medicare Plan G typically cost between $1,500 and $2,000. Some insurance companies offer extra perks and benefits for vision and dental care with Medicare Plan G.

Can I switch from plan G to plan N?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to answer health questions to switch. Your approval is not guaranteed.

Does plan N cover excess charges?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor's office and emergency room visits.

What is the difference between Plan G and N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

Does Plan N have a deductible?

Similar to Medicare Supplement Plan G in many ways, Plan N offers significant cost-sharing benefits to policyholders. These benefits include: Medicare Part A coinsurance. Medicare Part A deductible.

What is the most expensive Medicare plan?

That's in spite of the fact that Plan F is the most expensive, and many people will go years paying the premiums without getting their money's worth. Does that make choosing it a good or bad decision? “The reason most people pick F is that it covers every row on the Medicare coverage chart.

What is the monthly premium for plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

What is the deductible for plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

What is the plan g deductible for 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What’S Covered on Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dol...

What’S Covered Under Medigap Plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductibl...

What’S Covered Under Medigap Plan N?

This is another fast-selling plan because it offers a good balance between protection against catastrophic out-of-pocket expenses and affordable pr...

When Comparing Medicare Plan F vs Plan G vs Plan N

Be sure to give some thought to the type of coverage you think you’ll want over the long term. Here’s why:In most cases, you do not have a guarante...

CMS Releases 2022 Premiums and Cost-Sharing Information for Medicare ...

The Centers for Medicare & Medicaid Services (CMS) released the 2022 premiums, deductibles and other key information for Medicare Advantage and Part D prescription drug plans in advance of the annual Medicare Open Enrollment to help Medicare enrollees decide on coverage that fits their needs.

Medicare Supplement Insurance (Medigap) Plan G in 2021-2022

Medicare Plan G, a Medigap plan, pays for many of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Medicare Plan G, which is similar to Plan F, can be worth the cost if you expect significant medical bills during the year.

How much does Medicare Advantage cost?

Medicare Advantage plans typically have multiple copays with a maximum out-of-pocket cost limit of $4,000-$6,700/year. For years with high use of medical care including hospitalizations, the total cost (including premiums) of a Medicare Supplement Plan G approach will usually be less expensive.

What is the best Medicare Supplement Plan?

The simple answer is that a Medicare Supplement Plan G is the best option for most Medicare enrollees currently initially enrolling in a Medicare Supplement plan. (There is both a standard [low deductible] and a high deductible version of Plan G.

How much is Medicare Part B deductible in 2021?

Medicare Plan G with the standard (low) deductible has a $203 Medicare Part B deductible in 2021. This deductible amount is indexed to the inflation rate and will change annually. (Three states, Massachusetts, Minnesota, and Wisconsin, use a different system and the comments on this website don’t apply.) top of page.

How long does it take to switch to Medicare Supplement?

In contrast, after initially choosing a Medicare Advantage plan, changing to a Medicare Supplement plan can be very difficult. After the initial 12 months of being in a Medicare Advantage plan, an individual usually no longer has the right to go to any Medicare Supplement plan.

Is there a high deductible for Medicare Supplement Plan G?

Update: As of 2020, in addition to the standard Medicare Supplement Plan G, there is a Medicare Supplement Plan G with a high deductible option ($2,370 in 2021): Plan G- HD. The following comments are for the standard Medicare Supplement Plan G with the lower deductible- ($203 in 2021).

Does Medicare Supplement Plan have a separate drug plan?

With a Medicare Supplement plan approach, a separate drug prescription plan (Medicare Part D) needs to be purchased. The government heavily subsidizes both the Medicare Advantage drug plan and the separate Medicare Part D drug plan. 5. Best Medicare option for most individuals when turning 65 years of age.

Is Medicare Supplement Plan G better than Medicare Advantage Plan?

A Medicare Supplement Plan G is a much better choice for many. ( Also called a Medigap Plan G ). (As of 2020, there is now a High Deductible version of Plan G in addition to the standard Plan G.)

What is the difference between Medicare Supplements Plan F and Plan G?

The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise they function just the same. There is one important feature that Medicare Supplements Plan F and G have over all the other Medigap plans.

Which is the most comprehensive Medicare plan?

The most comprehensive plan currently available is Medigap Plan F. It covers all of the gaps in Medicare. The next most comprehensive plan is Plan G, which covers nearly as much, with the Part B deductible being the only difference. Finally, Plan N is probably the third most popular plan because it operates similar to Plan G except ...

What is a Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dollar coverage means that both your Part A and Part B deductibles are covered by the plan, so you pay nothing before your Medicare benefits kick in.

What happens if you don't have Medicare?

When you see a provider that doesn’t participate with Medicare, he can charge up to 15% more than the standard Medicare rate for your services. You will pay this money out of pocket unless you have Medigap Plan F or Plan G. It’s definitely something to consider if provider choice is important to you.

How many Medigap plans are there?

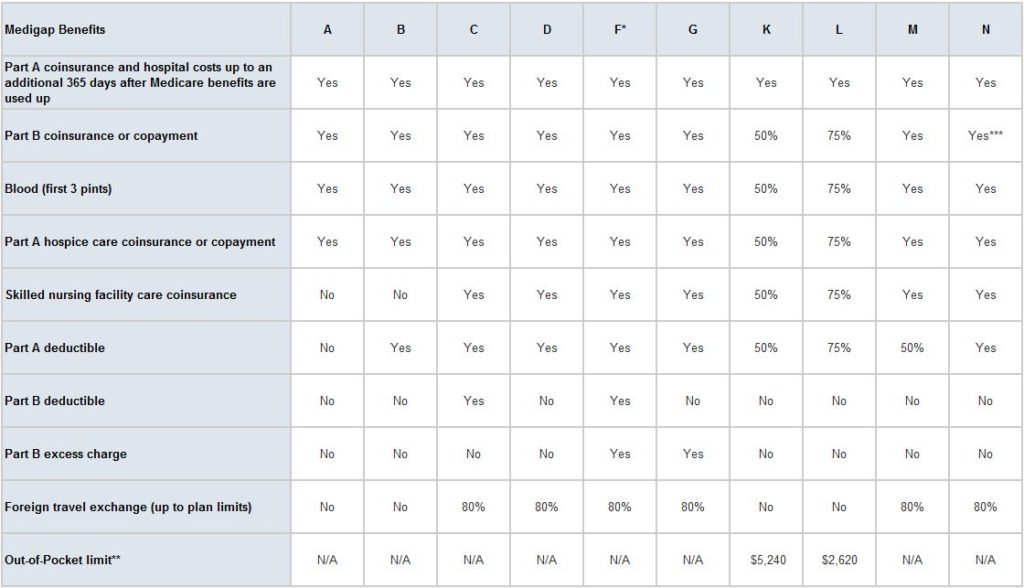

There are currently 10 different Medigap plans that are standard across most states. (Massachusetts, Minnesota, and Wisconsin have their own plan standards.) What this means for consumers, however, is that Plan A offered by Company X in Anaheim is exactly the same as Plan A offered by Company Y in Boise.

How much does a 66 year old spend on Medicare?

The average 66-year-old couple spends about 57% of their Social Security benefits on health care, according to a 2016 study. Learn Medicare for Free: Enroll in 6-Day Medicare Mini Course.

Is Medigap Plan G the same as Plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deduct ible, which is $203 in 2021. Medigap Plan G is now the most popular plan among beneficiaries new to Medicare.

What is a Medigap Plan G?

The takeaway. Medigap Plan G is a Medicare supplement insurance plan. It covers a variety of expenses that aren’t covered by Medicare parts A and B, such as coinsurance, copays, and some deductibles. If you buy a Plan G policy, you’ll pay a monthly premium, which can vary by the company offering the policy.

What is a plan G?

Additionally, Plan G covers 80 percent of health services provided during foreigntravel. Medigap plans are standardized, which means each company must offer the same basic coverage. When you purchase a Plan G policy, you should receive all of the benefits listed above regardless of the company you purchase it from.

How do companies set their premiums?

The three main ways they set premiums are: Community rated. Everyone with the policy pays the same monthly premium, regardless of his or her age. Issue-age rated. Monthly premiums are set based on how old you are when you purchase your policy.

What is Medicare Part B?

Medicare Part B (medical insurance) Medicare Part C (Medicare Advantage) Medicare Part D (prescription drug coverage) While Medicare covers manyexpenses, there are some things that aren’t covered. Because of this, about 90 percent. Trusted Source. of people with Medicare have some form of supplemental insurance.

Do you have to pay monthly premiums for Medigap?

Monthly premiums. If you enroll in a Medigap plan, you’ll have to pay a monthly premium . This will be in addition to your Medicare Part B monthly premium. Because private insurance companies sell Medigap policies, monthly premiums will vary by policy. Companies can choose to set their premiums in a variety of ways.

Does Medicare have a supplemental plan?

of people with Medicare have some form of supplemental insurance. Medigap is supplemental insurance that can cover some things that Medicare doesn’t. About one in four. Trusted Source. people enrolled in Medicare parts A and B are also enrolled in a Medigap policy. Medigap has 10 different plans, each offering different types ...

Does Medigap cover prescription drugs?

If you want to purchase a Medigap policy, you’ll have to switch back to original Medicare (parts A and B). Medigap policies cannot cover prescription drugs. If you’d like prescription drug coverage, you’ll need to enroll in a Medicare Part D plan.

What percentage of Medicare beneficiaries are enrolled in a Medigap plan?

Close to 34 percent of all Medicare beneficiaries are enrolled in a Medicare supplement insurance (Medigap) plan. These optional plans, issued by private insurance companies, help pay for some of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Plan F has long been the most popular Medigap plan.

What percent of private insurance companies sell Plan F?

85 percent of private insurance companies sell Plan F, and 66 percent sell Plan G policies. While new Plan F policies are no longer sold to new Medicare beneficiaries, existing policies still provide ongoing coverage in many states. Residents in most states can purchase and use Plan G policies, though Massachusetts, Minnesota, ...

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F provides coverage for two areas that Plan N does not: Medicare Part B deductible. Part B excess charges. Doctors who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for services and items they provide.

Is Medigap Plan F deductible?

While the deductibles mean you must pay a certain amount of money out of pocket before the plan coverage kicks in, the monthly premiums are typically much lower than the premiums for other Medigap plans or for the standard non-deductible versions of Plan F and Plan G.

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

Can I sell my Medicare Part B policy?

As part of that act, from January 1, 2020, insurers couldn't sell a policy that covers the annual Medicare Part B deductible to new Medicare beneficiaries. This ruling effectively meant insurers couldn't offer Plan F or Medigap Plan C ...

What is the best alternative to Plan G?

Best alternative to Plan G Medicare supplement: Plan N. Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Is Plan F a good plan?

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is Medigap Plan F?

Medigap Plan F provides a person with coverage for some parts of healthcare that original Medicare does not cover. However, there are some restrictions on enrollment: A person newly enrolled in Medicare can no longer get Plan F.

How many Medigap policies are there?

There are 10 Medigap policies: A, B, C, D, F, G, K, L, M, and N. The plans offer standardized benefits to Medicare recipients and help pay coinsurance, deductibles, and copays that original Medicare may not cover. Medigap plans may also cover emergency healthcare if a person needs treatment while they are away from the United States.

How much is the deductible for Medicare 2021?

In addition to the basic Plan F, there is a high deductible version of Plan F available. In 2021, this has a deductible of $2,370. A person must reach the deductible before the plan starts to cover costs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

Can you have a Medigap plan if you are enrolled in Medicare Advantage?

In addition, if a person is enrolled in a Medicare Advantage plan, they cannot also have a Medigap plan.

Does Medigap work with original Medicare?

Comparing the plans. Costs. Summary. Medicare supplemental health insurance plans, also called Medigap, work with original Medicare. Medigap Plan F provides many of the same benefits as Plan G, with some differences. Medigap plans help a person pay their out-of-pocket Medicare expenses. A person can get a Medigap plan, ...

What is Medicare Select?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. policies that may require you to use certain providers. If you buy this type of Medigap policy, your premium may be less.

What does each insurance company decide?

Each insurance company decides how it will set the price, or. premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. , for its Medigap policies. It’s important to ask how an insurance company prices its policies. The way they set the price affects how much you pay now ...

Why do premiums go up?

They may be the least expensive at first, but they can eventually become the most expensive. Premiums may also go up because of inflation and other factors.

Can you compare a Medigap policy?

As you shop for a Medigap policy, be sure to compare the same type of Medigap policy, and consider the type of pricing used .

What is Medicare Supplement Plan G?

Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries. Medicare Supplement Plan G, like other Medigap plans (A through N), is standardized by the federal government.

What states have high deductible plan G?

High-Deductible Plan G is available in 13 states, including Alabama, Arizona, Delaware, Georgia, Illinois, Iowa, Kansas, Louisiana, Maryland, North Carolina, Ohio, Pennsylvania, and South Carolina. Aetna’s Medicare Supplement Plan G has a premium discount of 7% if someone in your home is also on one of its plans.

How much did Medicare spend in 2016?

In 2016, the average Medicare beneficiary spent more than $5,400 out of pocket for health care and more than $7,400 when they did not have supplemental insurance. Thankfully, Medicare Supplement Plans, also known as Medigap, help fill in the gaps. Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries.

When did Medicare stop allowing Part B deductible?

When Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015, it changed which Medicare Supplement Plans could be made available to new Medicare beneficiaries. The law required discontinued plans that paid the Part B deductible. This is why, starting on January 1, 2020, Medicare Plans C and F were no longer available to people who were newly eligible for Medicare. There are no current plans to discontinue Plan G, and high-deductible plans were made available for the first time in 2020. 5

Does BCBS offer a discount on Medicare?

Although AARP by UnitedHealthcare offers a higher New to Medicare discount in its first year, BCBS offers the most discount savings over time. Check with your state’s plan for details about BCBS discount programs. BCBS prices Medicare Supplement Plan G according to attained-age in most states.

Is Humana a high deductible plan?

It offers Medicare Supplement Plan G in all 47 states where traditional Medicare Supplement Plans are available. High-Deductible Plan G is available in all of those states except Missouri.

Does Mutual of Omaha offer Medicare Supplement Plan G?

Mutual of Omaha offers Medicare Supplement Plan G in all 47 states where traditional Medicare Supplement Plans are available, and High-Deductible Plan G in all of those states except New York.

What is a Medigap Plan G?

The takeaway. Medigap Plan G is a Medicare supplement insurance plan. It covers a variety of expenses that aren’t covered by Medicare parts A and B, such as coinsurance, copays, and some deductibles. If you buy a Plan G policy, you’ll pay a monthly premium, which can vary by the company offering the policy.

What is a plan G?

Additionally, Plan G covers 80 percent of health services provided during foreigntravel. Medigap plans are standardized, which means each company must offer the same basic coverage. When you purchase a Plan G policy, you should receive all of the benefits listed above regardless of the company you purchase it from.

How do companies set their premiums?

The three main ways they set premiums are: Community rated. Everyone with the policy pays the same monthly premium, regardless of his or her age. Issue-age rated. Monthly premiums are set based on how old you are when you purchase your policy.

What is Medicare Part B?

Medicare Part B (medical insurance) Medicare Part C (Medicare Advantage) Medicare Part D (prescription drug coverage) While Medicare covers manyexpenses, there are some things that aren’t covered. Because of this, about 90 percent. Trusted Source. of people with Medicare have some form of supplemental insurance.

Do you have to pay monthly premiums for Medigap?

Monthly premiums. If you enroll in a Medigap plan, you’ll have to pay a monthly premium . This will be in addition to your Medicare Part B monthly premium. Because private insurance companies sell Medigap policies, monthly premiums will vary by policy. Companies can choose to set their premiums in a variety of ways.

Does Medicare have a supplemental plan?

of people with Medicare have some form of supplemental insurance. Medigap is supplemental insurance that can cover some things that Medicare doesn’t. About one in four. Trusted Source. people enrolled in Medicare parts A and B are also enrolled in a Medigap policy. Medigap has 10 different plans, each offering different types ...

Does Medigap cover prescription drugs?

If you want to purchase a Medigap policy, you’ll have to switch back to original Medicare (parts A and B). Medigap policies cannot cover prescription drugs. If you’d like prescription drug coverage, you’ll need to enroll in a Medicare Part D plan.