How much Commission do you get on a Medicare Advantage sale?

Lower amounts are generally paid in subsequent years (renewal commissions). The maximum commission for a Medicare Advantage (MA) sale in 2022 will be $573, a 6.3 percent increase over 2021. Some states have different levels.

How do broker commissions work for Medicare supplements?

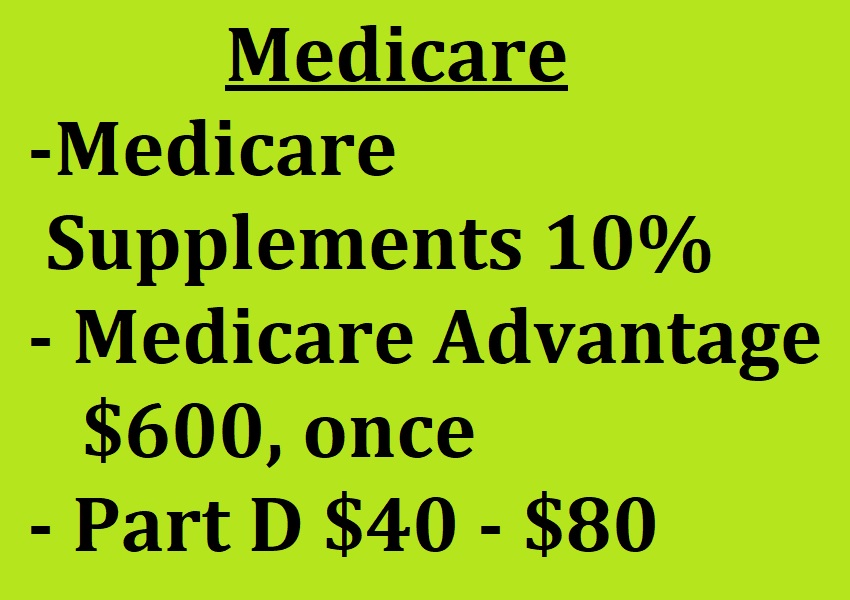

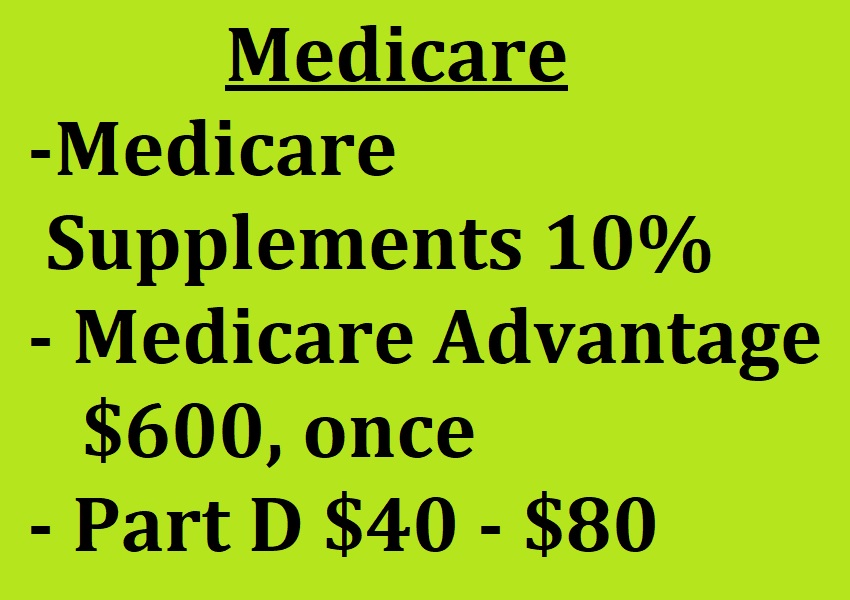

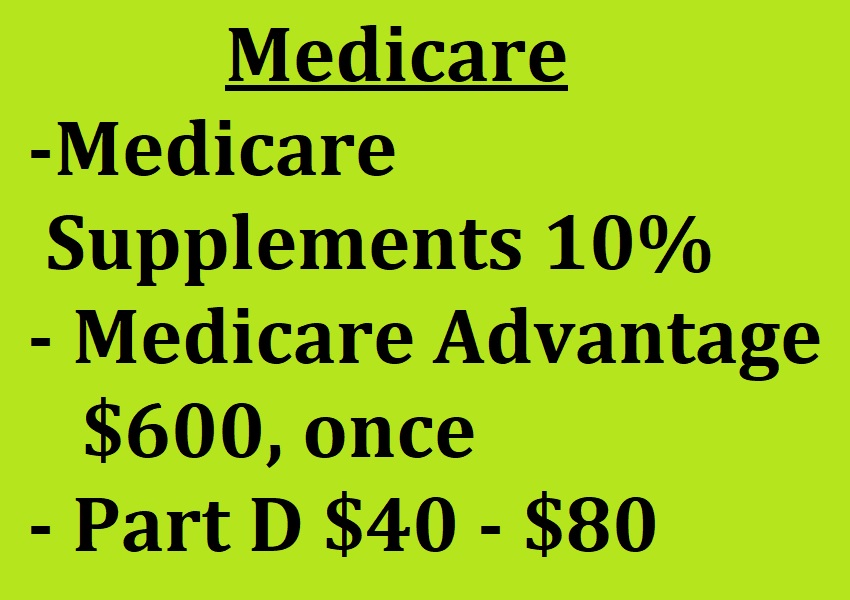

When selling Medicare Supplements, agents earn a percentage of the premiums of the policies they sell. Unlike with Medicare Advantage and Part D, CMS does not set a maximum broker commission for Medicare Supplements. These commissions also vary from carrier to carrier and contract to contract.

How do agents get paid for selling Medicare plans?

Agents selling Medicare Advantage and Part D plans get a flat dollar amount of money per application. This comes to them in the form of initial commissions and renewal commissions. Carriers pay out initial commissions when an agent makes a new sale or when the beneficiary enrolls in a new, “unlike” plan (different type).

What are the different types of Medicare commissions?

Generally speaking, agents earn two types of commissions selling Medicare plans: a flat dollar amount per application (Medicare Advantage and prescription drug plans) or a percentage of the premium sold (Medicare Supplements). Medicare Advantage and Part D Commissions

How does Medicare commision work?

Medicare Advantage commissions are paid per application. Initial commissions and renewal commissions are how they get it. Typically, both Medicare Advantage commissions and Medicare Part D plan commission payments are paid one year in advance. In other words, the companies pay the full year's commission upfront.

Can you make good money selling Medicare?

Selling Medicare can be very lucrative, but just like any other self-starter type of job, the more effort you put in, the bigger the payoff. When it comes to making money selling Medicare, there are two main ways you can earn income which include commissions and residual income.

What is the Medicare commissions for 2022?

2020 Medicare Advantage Commission Maximums The maximum commission for a Medicare Advantage (MA) sale in 2022 will be $573, a 6.3 percent increase over 2021. Some states have different levels.

Is being a Medicare agent worth it?

Is Selling Medicare Lucrative? In short, yes. The average Medicare Advantage policy pays around $287 a year in commission if the purchase replaces an existing plan. However, you can get approximately double that — $573— if you write up a new Medicare Advantage plan for someone who hasn't had one before.

What is street level commission?

Street level commission is the base commission amount paid by the company you work for. This is normally expressed as "base commission" or "street level commission" on the rate sheet you receive from your insurance company or General Agent.

How do I get Medicare Advantage leads?

⍟ 14 Ways to Generate Medicare Supplement LeadsBuild & Maintain a Website. ... Social Media Presence. ... Video Marketing. ... Blogging, Writing Articles. ... Email. ... Online Events: Live webinars, podcasts. ... Direct Requests / Client Referrals. ... Lead Swapping Partnerships (Asking other professionals for referrals)More items...

How does a Medicare agent get paid?

Once a beneficiary is enrolled in an MA or Part D plan, agents earn a commission when the beneficiary switches to a new plan or stays with the original plan. The commission is paid to the agent of record as long as the beneficiary does not have an enrollment submitted to a new insurer by another agent.

Are Medicare commissions prorated?

Payments at the initial Rate for beneficiaries that are “new to Medicare” are for full Initial rate regardless of effective date. Any payment at the renewal rate for beneficiaries that make a “like plan change” MUST be prorated.

Are Medicare brokers unbiased?

Working with an independent Medicare insurance agent means you get to choose policy options from different companies. Independent agents and brokers are more likely to give unbiased plan recommendations and advice. But they may not have in-depth knowledge of these plans.

What is the best insurance company for Medicare?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCoverage areaBlue Cross Blue Shield5.0Offers plans in 48 statesCigna4.5Offers plans in 26 states and Washington, D.C.United Healthcare4.0Offers plans in all 50 statesAetna3.5Offers plans in 44 states1 more row•Jun 8, 2022

What is an FMO in Medicare?

FMO stands for field marketing organization, which is very similar to an independent marketing organization (IMO). FMOs provide independent agents with perks and resources and help them get contracted with carriers to sell plans.

What are the three main ways in which Medicare sales occur?

There are three different types of Medicare products sold by agents and brokers: Medicare Supplement plans (Also called Medigap plans), Medicare Advantage plans and Medicare Part D Rx plans.

How hard is it to sell Medicare?

No, it's not hard to sell Medicare Supplements. When you're first starting, it should be easy, because everyone on Medicare needs one. It's just an insurance product. You're not a member – you're a policyholder, and that means a lot to people.

What are the three main ways in which Medicare sales occur?

There are three different types of Medicare products sold by agents and brokers: Medicare Supplement plans (Also called Medigap plans), Medicare Advantage plans and Medicare Part D Rx plans.

What is an FMO in Medicare?

FMO stands for field marketing organization, which is very similar to an independent marketing organization (IMO). FMOs provide independent agents with perks and resources and help them get contracted with carriers to sell plans.

What is one CMS marketing rule that impacts how Medicare insurance plans market to consumers?

Marketing Rules CMS also regulates marketing and plan presentations, including when you're allowed to market, and how you market. Agents must wait until October 1 to begin marketing next year's plans to potential beneficiaries and cannot enroll members until October 15.

When will Medicare Advantage Commissions be higher?

Higher Medicare Advantage Commissions. Medicare Advantage Commissions Announced for 2022 have been announced by the Centers for Medicare & Medicaid Services (CMS). CMS released the amounts that companies may pay to agents and brokers who sell their Medicare drug and health plans.

What is the maximum Medicare Advantage commission for 2022?

The maximum commission for a Medicare Advantage (MA) sale in 2022 will be $573, a 6.3 percent increase over 2021. Some states have different levels. For example in California and New Jersey, the initial MA commissions increased from to $715-per-year, a 6.4% increase over 2021.

How much is MA commission 2022?

For 2022, the initial MA commissions increased from $370 to $394. This represents a 6.5 percent increase. Renewal commissions for Puerto Rico and the Virgin Islands increased from $185 to $197.

What is initial payment on insurance?

It can also include independent agents or brokers. The initial payment refers to the compensation during the first year of the policy. Lower amounts are generally paid in subsequent years (renewal commissions).

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap , covers some of Original Medicare's out-of-pocket costs. In most states, there are up to 10 standardized Medigap policies to choose from, and each plan provides a unique mix of basic benefits. However, the costs vary widely from insurer to insurer. Here's what you should know before you select a policy.

Why do Medigap policies vary?

However, each Medigap plan of the same type offers the same basic benefits no matter where you live. For example, Medigap Plan A sold by a company in one state will offer the same basic benefits as Medigap Plan A sold by a different company in another state.

What is the monthly commission of an insurance agent?

An insurance agent’s monthly commission consists of two types of income. These are: Although, an expected salary is absent but some companies do offer some training allowance to the agents at the starting phase of work in order to encourage the newly appointed candidates.

Do Medicare Advantage plans get more commissions?

They get more commissions paid in the first year rather in the renewal years in regard to Medicare advantage plans. A larger group policy though has a high amount of flexibility with the commissions and renewals paid to agents.

How does Medicare Advantage work?

Agents selling Medicare Advantage and Part D plans get a flat dollar amount of money per application. This comes to them in the form of initial commissions and renewal commissions. Carriers pay out initial commissions when an agent makes a new sale or when the beneficiary enrolls in a new, “unlike” plan (different type). Each year and beyond, carriers pay out renewal commissions to the agent if the beneficiary remains enrolled in the plan or enrolls in a new, “like” plan (same type).

What does it mean when you assign commissions to the FMO?

When you assign your commissions to the FMO, this means the carrier will pay the FMO, who will then pay you . Agents signing an Assignment of Commissions contract must be careful, because depending on their contract, their upline could keep their renewals should they choose to leave.

Do carriers pay agents?

It’s important for agents to know that carriers pay agents and FMOs separately. Your relationship with an FMO is comparable to your clients’ relationship with you.

Do insurance carriers have to pay Medicare Advantage commissions?

The Centers for Medicare & Medicaid Services (CMS) set the maximum broker commissions for Medicare Advantage and Medicare Part D annually; however, insurance carriers aren’t required to pay these amounts. What you earn for Medicare Advantage and PDP sales could be less, depending on the carrier and your contract with them.

What happens to a broker if they don't comply with Medicare?

Agents/brokers are subject to rigorous oversight by their contracted health or drug plans and face the risk of loss of licensure with their State and termination with their contracted health or drug plans if they don't comply with strict rules related to selling to and enrolling Medicare beneficiar ies in Medicare plans.

When do brokers receive initial payment?

Generally, agents/brokers receive an initial payment in the first year of the policy (or when there is an “unlike plan type” enrollment change) and half as much for years two (2) and beyond if the member remains enrolled in the plan or make a “like plan type” enrollment change.

What is agent broker compensation?

Below is a link to a file containing the amounts that companies pay independent agents/brokers to sell their Medicare drug and health plans. Companies that contract with Medicare to provide health care coverage or prescription drugs typically use agents/brokers to sell their Medicare plans to Medicare beneficiaries.

Do brokers have to be licensed in the state they do business in?

Agents/brokers must be licensed in the State in which they do business, annually complete training and pass a test on their knowledge of Medicare and health and prescription drug plans, and follow all Medicare marketing rules.