After that, Supplement G covers all the remaining charges. Medicare will pay 80% of your outpatient costs, including emergency care, and your Supplement will pay the other 20% for medical procedures. Once Medicare covers a service, the Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

How much does plan G cost?

After that, Supplement G covers all the remaining charges. Medicare will pay 80% of your outpatient costs, including emergency care, and your Supplement will pay the other 20% for medical procedures. Once Medicare covers a service, the Medigap Plan G policy must pay the remaining balance.

How much does Medicare supplement plan cost?

Dec 12, 2019 · Plan G also covers 80% of emergency health care costs while in another country. However, you must pay a $250 deductible first, and the care has to occur during the first 60 days of a trip. Also, the plan sets a lifetime limit of $50,000 on this type of coverage. 5 No out-of-pocket limit Original Medicare doesn't have an out-of-pocket limit.

What is the best Medicare supplement plan?

Summary: Medicare Supplement Plan G is one of the most popular Medicare Supplement plans. This plan covers: Medicare Part A coinsurance and hospital costs; Medicare Part B coinsurance or copayment; Blood (first 3 pints) Part A hospice care coinsurance or copayment; Skilled nursing facility care coinsurance; Part A deductible; Part B excess charges; Foreign travel emergency …

What are the top 5 Medicare supplement plans?

Sep 17, 2020 · All Medicare Supplement Insurance Plans are Standardized by the government. This means that the plan benefits are exactly the same from company to company. Benefits Of Plan G. Plan G covers 100% of the Medicare Part A and Part B co-pays and coinsurance, those gaps and holes that Medicare doesn’t cover. Plan G covers Skilled Nursing and rehab facility …

What Plan G does not cover?

What does plan G pay for?

You would pay for medical services — such as outpatient care, preventative care and ambulance services — until you have reached the deductible amount. Then Medicare would cover your health care costs.May 6, 2022

Does Medicare Plan G have a maximum out-of-pocket?

What does Medicare G provide?

What is the deductible for Plan G in 2022?

What is the deductible for Plan G in 2021?

Does Medigap plan G pay Part A deductible?

How much is the deductible for Plan G?

Is Medigap the same as Part G?

Does Part G cover prescriptions?

Does AARP Offer Plan G?

What is the difference between Plan G and high deductible plan G?

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

What does Medicare Part G cover?

Medicare Part G fully pays these healthcare costs: Medicare Part A deductible. Part A coinsurance and hospital costs up to an additional 365 days a...

What are the differences between Medicare Supplement Plan G and Plan F?

The main difference between Medicare Supplement Plan G and Plan F is that MedSup Plan F covers your Medicare Part B deductible. Plan G doesn’t cove...

Why should I choose Medicare Supplement Plan G over Plan F?

One reason to choose Medicare Supplement Plan G over Plan F is that insurance companies no longer offer MedSup Plan F to new Medicare enrollees.

How much does Plan G cover?

Plan G also covers 80% of emergency health care costs while in another country. However, you must pay a $250 deductible first, and the care has to occur during the first 60 days of a trip. Also, the plan sets a lifetime limit of $50,000 on this type of coverage. 5.

What is a plan G?

Plan G is a type of supplemental insurance for Medicare. Supplemental insurance plans help cover certain health care costs, such as deductibles, coinsurance, and copayments. Without a supplement plan, you’d have to pay those expenses yourself.

What is the second most comprehensive Medicare supplement plan?

The plans are named by letter, ranging from A to N. Plan G is the second-most comprehensive Medicare supplement plan available, next to Plan F. Plan G is also growing in popularity. 1.

How to contact Debra from Medicare?

Call a Licensed Agent: 833-271-5571. Debra is 64 and plans to retire next year. She will apply for Medicare Part A and Part B. Debra loves to be outside, gardening or walking her dogs. She has had a few suspicious lesions removed recently by her dermatologist, who doesn’t accept Medicare assignment.

What is the difference between Plan G and Plan F?

Plan G is most similar in coverage to Plan F. The only difference is that Plan F covers your Part B deductible, while Plan G does not. Plan F will have limited enrollment for some beneficiaries beginning in 2020.

When is the best time to enroll in Medigap?

That’s the six months immediately after you turn 65 and sign up for Part B, when you’re guaranteed by federal law to be accepted by any plan, regardless of health.

Does Plan G cover Medicare excess charges?

Part B excess charges. Unlike most Medicare Supplement plans, Plan G covers your Part B excess charges. That means you can see providers who don’t accept Medicare assignment (don’t participate in Medicare), but they can charge 15% more than standard Medicare rates. 4 Without coverage for excess charges, you pay that 15% difference.

What is the Medicare Supplement Plan G?

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203. In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible.

What is a G plan?

This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

How does Medicare pay claims?

Claims-Paying Process – The Medicare Supplement claims process is highly automated. It is easy for you to use the coverage, and most people never see any paperwork. Once Medicare approves your claim, they will pay their portion and notify your provider of what they owe. The company must then pay the amount due per Medicare’s instructions. Due to the automation and standardization in this area, every company is equal in its claims-paying history.

How to select a company for GoMedigap?

We recommend that you check the AM Best ratings for the companies you are comparing to ensure that the company has a positive standing, and then select the company that offers the lowest premium. To make this process easier for you, GoMedigap agents only work with top-rated companies, and we pride ourselves in finding low premiums for our clients.

Is Plan G more cost effective than Plan F?

Because of this, many people find that even after they pay their deductible, Plan G is still the more cost-effective option. Keep in mind: if you become eligible for Medicare in 2020 or later, you will not be able to get Plan F.

Does Medicare Supplement have a doctor network?

The benefits of a Plan G will be the same regardless of the company you select. Doctor’s Network – Medicare Supplement insurance companies don’t have their own doctor’s networks. Their plans are only supplements to your primary Medicare Parts A & B coverage.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G – What does it cover? Plan G is a great option if you’re looking for a plan that has comprehensive benefits and low out of pocket costs.#N#All Medicare Supplement Insurance Plans are Standardized by the government. This means that the plan benefits are exactly the same from company to company.

What does Plan G cover?

Plan G covers Skilled Nursing and rehab facility stays and also Hospice care.

Does Plan G save you money?

Even though Plan F covers the Part B deductible, it’s usually at a much higher cost each month for Plan F premiums . The insurance company charges you much more to pay that deductible for you.

How much does Medicare Supplement Plan G cover?

Up to three pints of blood for medical procedures each year. Medicare Supplement Plan G also covers 80% of medical care you receive while traveling outside the U.S., up to your plan’s limits.

Why is Medicare Supplement Plan G important?

Why? One reason is Medicare Supplement Plan G provides coverage that is nearly as comprehensive as what Plan F provides.

What is the difference between Medicare Supplement Plan G and Plan F?

The main difference between Medicare Supplement Plan G and Plan F is that MedSup Plan F covers your Medicare Part B deductible. Plan G doesn’t cover that cost. Of course, the Part B deductible is just $198 this year, but a buck is a buck, right? However, MedSup Plan G premiums tend to be cheaper than Plan F premiums.

Why do people choose Medicare Supplement Plan G over Plan F?

One reason to choose Medicare Supplement Plan G over Plan F is that insurance companies no longer offer MedSup Plan F to new Medicare enrollees. Thanks to the Medicare Access and CHIP Reauthorization Act of 2015, insurers can’t sell MedSup Plan F to people who became eligible for Medicare on or after Jan. 1, 2020.

What is the best Medicare Supplement?

Here's why it may be the best MedSup plan for you. Medicare Part G — or Plan G — is one of the most popular Medicare Supplement plans available. Plan G sits just behind Plan F in terms of popularity among American Medicare enrollees who want a bit more coverage.

What is the deductible for Medicare Part B 2020?

For 2020, the Medicare Part B deductible is $198 per year. After your out-of-pocket costs hit that limit, you’ll pay 20% of the Medicare-approved amount for most of the services Part B covers. That includes care like doctor visits and outpatient therapy. Also, Plan G usually doesn’t cover prescription drugs.

How long after Medicare benefits end can you get a coinsurance?

Part A coinsurance and hospital costs up to an additional 365 days after your standard Medicare benefits end. Part A hospice care coinsurance or copayment. Part B coinsurance or copayment. Part B excess charge. Skilled nursing facility care coinsurance. Up to three pints of blood for medical procedures each year.

What is Plan G?

Plan G is available to individuals who want comprehensive coverage and became newly eligible to Medicare after January 1, 2020. Ron Elledge. Medicare Consultant and Author. Ron Elledge. Medicare Consultant and Author.

How to apply for Medicare Supplement?

This is an ideal time to apply for a Medicare supplement plan because during that Open Enrollment period, an insurance company is not allowed to use medical underwriting to decide whether to accept your application. This means that the insurance company can’t take certain actions based on any of your existing health conditions, including: 1 Not sell you a policy 2 Upcharge you for a Medigap policy as compared to someone else without your health conditions 3 Make you wait for coverage, aside from a few exceptions

Can an insurance company take medical underwriting?

This is an ideal time to apply for a Medicare supplement plan because during that Open Enrollment period, an insurance company is not allowed to use medical underwriting to decide whether to accept your application. This means that the insurance company can’t take certain actions based on any of your existing health conditions, including:

Do you have to pay a monthly premium for Medicare?

All Medica re supplement plans require you to pay a monthly premium. Premiums are set by each state and each insurance provider. Because Medicare supplement plans are offered through private insurance companies, the companies will set their own premiums, so they will vary.

Can you upcharge for Medigap?

Upcharge you for a Medigap policy as compared to someone else without your health conditions

What is Medicare Plan G?

Plan G offers full coverage of the Part A deductible and the Part A coinsurance charges. Under Original Medicare, inpatient hospital stays are only covered for the first 90 days, with 60 lifetime reserve days available if recipients exceed ...

How long does Medigap Plan G last?

Medigap Plan G extends that coverage for up to 365 additional days once Original Medicare benefits are exhausted. For surgeries that require blood transfusion, Plan G pays for the first three pints.

Does Medigap have an out-of-pocket limit?

Some Medigap plans impose an out-of-pocket limit, which works much the same as an Original Medicare deductible — Plan G, however, does not require enrollees to meet an out-of-pocket limit before coverage begins. It also offers the maximum amount of coverage for treatment during foreign travel, which is 80% of the cost of care.

Does Plan G cover Part B coinsurance?

Although it does not cover the Part B deductible, Plan G does cover costs related to Part B coinsurance or copayment charges. It also covers any excess charges that Medicare allows health care professionals to bill to the recipient for the services they receive.

Does Medigap cover Part B?

Although it does not cover the Part B deductible, Plan G does cover costs related to Part B coinsurance or copayment charges.

Can Medicare expand?

Medicare recipients have several options when it comes to expanding or enhancing their Original Medicare benefits. These options vary widely, so understanding their differences can help recipients make the best choice for their care.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage plans can offer similar coverage options combined with prescription drug coverage, but recipients cannot enroll in both a Medicare Supplement ...

Medicare Plan G Supplement Insurance Basics

Medicare Plan G is a subset of Medicare Supplement or Medigap insurance. Of the 10 plan types under the Medicare Supplement umbrella, Plan G is among the most popular.

Average Medicare Plan G Deductible Cost

Medicare Plan G policies generally don’t have a deductible, but some providers offer high deductible policies with low monthly premiums. In 2021, those policies require members to meet the $2,370 deductible before the policy kicks in to cover expenses. Remember, you still have to pay your Medicare Part B deductible of $203 (as of 2021).

FAQ: Fast Facts About Plan G

Plan G is designed to cover the gaps in Original Medicare coverage. It pays for your Medicare Part A coinsurance, copays, deductibles, and Medicare Part B coinsurance and copays. It does not cover the annual Medicare Part B deductible, which is $203 for 2021.

Why is Medicare Supplement Plan G so popular?

The Medicare Supplement Plan G is currently the most popular Supplement plan on the market. Why? Because it leaves you with almost no bills or fees at the doctor. It is a great plan with great coverage, but that does not mean you don’t need to reevaluate your coverage every few years.

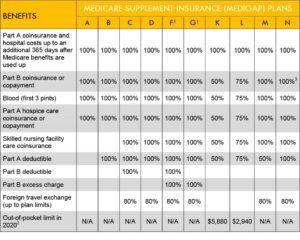

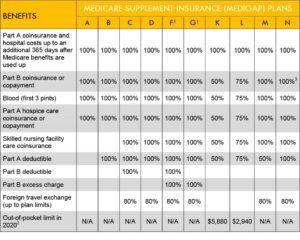

How many Medicare Supplement Plans are there?

Medicare Supplements were designed to cover the gaps of Original Medicare. There are 10 different Medicare Supplement Plans, all named with letters: Plan A, Plan B, Plan C, Plan D, Plan F, Plan G, Plan K, Plan L, Plan M, and Plan N. All these Plans differ in the type of coverage they offer, but they are standardized.

What is the deductible for Medicare Part B in 2021?

The only bill you are going to have with a Plan G is the Medicare Part B annual deductible of $203 in 2021. After paying this, most beneficiaries will see no bills for the rest of the year for their medical coverage. If you turned 65 before 2020, the Plan F is still available for you to purchase.

How much is Plan G for 2021?

The Plan G covers: Part A Hospital Deductible ( $1484 per stay in 2021) Medicare Part A charges beneficiaries for each hospital stay in a benefit period. A benefit period begins when you enter the hospital and ends when you have not received any hospital services for 60 consecutive days.

What is the most popular Medicare supplement?

Medicare: Plan G Supplement. With Original Medicare, you are responsible for 20% of all charges, a Medicare Supplement is what protects you. The most popular Medicare Supplement is the Plan G .

What is Plan G?

Plan G covers this for every benefit period. Like we mentioned above, Original Medicare only pays 80% of your bill, you are left with the other 20%. This amount is uncapped, meaning there is no limit to what you can pay. The great thing is that Plan G not only covers this 20%, but it also does not have a limit.

Does Plan G cover medical expenses?

After meeting a $250 yearly deductible, Plan G will cover 80% of the billed charges for certain medically necessary emergency services in foreign countries. This is really great for Medicare beneficiaries who travel a decent amount.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G is a Medigap plan that provides additional coverage compared to Original Medicare.

Does Medicare Supplement Plan G cover out-of-pocket costs?

For Part B costs, Plan G includes coinsurance and copayment costs and excess charges; however, it does not cover the out-of-pocket costs of the deductible.

Does Medicare cover cataract surgery?

Since cataract surgery is often outpatient and covered by Part B, your Medicare Supplement Plan G will cover all associated costs, with the exception of your annual Part B deductible and your premium payments for your Medigap plan.