How much does Medicaid cost in Indiana? Many Medicaid beneficiaries pay no money at all for their state-sponsored health coverage, due to the fact that they earn low incomes. Medicaid in Indiana may cover 100 percent of your healthcare costs if your individual income is less than $981 per month. For a couple, this threshold is $1,328 per month.

Full Answer

How many people in Indiana have Medicaid coverage?

And nearly 700,000 of those enrollees have Medicaid coverage as a result of the expanded eligibility guidelines implemented by the ACA and the state’s HIP 2.0 waiver. From 2013 to 2014, the uninsured rate in Indiana declined slightly from 14% to 11.9%, according to U.S. Census data.

Will Indiana ever expand Medicaid?

Although Indiana expressed willingness to consider a modified version of Medicaid expansion, both Governor Pence and the head of the Indiana Family and Social Services Administration took the position that Medicaid must be reformed, not just expanded. But there was significant federal money available to states that expand Medicaid.

Does Indiana Medicaid pay for nursing home care?

Phrased differently, if an Indiana resident is medically and financially eligible for nursing home care, then the Indiana Medicaid program is required by law to pay for it. Waiting lists cannot exist.

When did Medicaid start in Indiana?

Background on Indiana’s Medicaid program After Medicaid was founded in 1965, Indiana was one of the last states to implement a Medicaid program, waiting until Jan. 1, 1970. Legislation authorizing the state-federal partnership was enacted in July 1965.

How is the Indiana Medicaid program funded?

Medicaid-A program that offers health insurance to certain low-income families, individuals with disabilities, and elderly individuals with limited financial resources. Medicaid is jointly funded by the federal and state government.

What percentage of Indiana is on Medicaid?

Share of People with Health CoverageShare of Total Population by Coverage Type, 2018Employer- SponsoredMedicare & MedicaidIndiana53.9%2.7%United States49.4%3.4%SOURCE: KFF State Health Facts: Health Insurance Coverage of the Total Population, Multiple Sources of Coverage.

How much money does the government take for Medicare?

Medicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

How much is Medicare in Indiana?

Medicare in Indiana by the NumbersPeople enrolled in Original MedicareAverage plan costAnnual state spending per beneficiary818,031Plan A: $0 to $499 per month* Plan B: $170.10 per month**$10,570Apr 6, 2022

How much does Indiana spend on Medicaid?

Spending details[hide]Medicaid spending detailsStateTotal spending (2016)Percent of state budget (2015)Indiana$10,446,713,81531.2%Illinois$19,298,315,09627.1%Michigan$16,881,112,46830.2%3 more rows

Did Indiana expand Medicaid under Obamacare?

Indiana's expansion under the Affordable Care Act covers 570,000 low-income adults. In the 38 states that have expanded, Medicaid is available to everyone with incomes under 138% of the federal poverty level, or $17,774 for an individual.

Who paid for Medicare?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act - which go toward Medicare.

How much money is taken out of Social Security for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Is Medicare underfunded?

Politicians promised you benefits, but never funded them.

Is Medicare free in Indiana?

Original Medicare costs (Part A and B) in Indiana are the same nationwide. The Medicare Part A premium can cost you $0, $274, or $499, depending on how long you or your spouse worked and paid Medicare taxes. For Part A hospital inpatient deductibles and coinsurance, you pay: $1,556 deductible for each benefit period.

Who pays for Medicaid?

The Medicaid program is jointly funded by the federal government and states. The federal government pays states for a specified percentage of program expenditures, called the Federal Medical Assistance Percentage (FMAP).

How much does Medicare Part B cost in Indiana?

Part B - Monthly Premium 2022Beneficiaries who file an individual tax return with income:Beneficiaries who file a joint tax return with income:Total monthly Part B premium amountabove $114,000 up to $142,000above $228,000 up to $284,000$340.20above $142,000 up to $170,000above $284,000 up to $340,000$442.304 more rows

Has Indiana implemented Medicaid expansion?

In January 2015 —a year after many other states had expanded Medicaid — Indiana won approval from CMS for its amended Healthy Indiana Plan, known a...

Does Indiana have a Medicaid work requirement?

No, Indiana does not have a Medicaid work requirement. A work requirement was approved by the Trump administration but never implemented, and the a...

Who is eligible for Medicaid in Indiana?

Indiana’s Medicaid eligibility guidelines are average for children and pregnant women. Low-income adults can obtain Medicaid coverage under the Hea...

How does Medicaid provide financial help to Medicare beneficiaries in Indiana?

Many Medicare beneficiaries receive help through Medicaid with the cost of Medicare premiums, prescription drug expenses, and costs that aren’t cov...

How do I apply for Medicaid in Indiana?

If you believe you or a family member may qualify for Medicaid, you have several options for submitting an application: Apply online through the In...

Professional Fee Schedule

The Indiana Health Coverage Programs (IHCP) Professional Fee Schedule includes reimbursement information for providers that bill services using professional claims or dental claims reimbursed under the fee-for-service (FFS) delivery system.

Outpatient Fee Schedule

The IHCP publishes the rates for outpatient hospitals and ambulatory surgical centers (ASCs) on the Outpatient Fee Schedule. This fee schedule reflects current IHCP coverage and reimbursement policy for procedure codes and revenue codes billed for IHCP outpatient services under the FFS delivery system.

When did Indiana start accepting Medicaid applications?

Indiana began accepting applications for Medicaid under HIP 2.0 in late January 2015, with coverage beginning as soon as Feb. 1, 2015.

How to apply for medicaid in Indiana?

If you believe you or a family member may qualify for Medicaid, you have several options for submitting an application: 1 Apply online through the Indiana Family and Social Services Administration or at HealthCare.gov. 2 Call 1-800-403-0864 to apply by phone. 3 Apply in person at a Division of Family Resources office. Find a nearby office.

What is the waiver amendment for Medicaid expansion?

The waiver amendment proposed a work requirement for Indiana’s Medicaid expansion population, as opposed to the voluntary job training and employment services program that Indiana already had in place.

What is the lawsuit against CMS in Indiana?

The lawsuit contends that CMS overstepped its bounds in approving the state’s work requirement, and that the approval constitutes “unauthorized attempts to re-write the Medicaid Act.”

What is the Medicaid eligibility for Indiana in 2021?

Indiana’s Medicaid eligibility standards as of 2021 are: 208% percent of the federal poverty level (FPL) for children up to 1 year old. 158% percent of FPL for children 1 to 18 years old; the Children’s Health Insurance Program (CHIP) covers children at higher income levels, up to 250% of FPL. 208% of FPL for pregnant women.

How long is the lockout period in Indiana?

In April 2016, Indiana asked CMS to make the lock-out (now set at six months, and effectively only three months since there’s an initial 90-day reinstatement period) officially part of HIP 2.0, but in August 2016, CMS denied the request.

When will Indiana's waiver end?

On February 1, 2018, CMS approved Indiana’s amended waiver through the end of 2020. The state’s updated waiver included several changes, but the community engagement provision (aka, work requirement) was the most significant.

What is Medicaid in Indiana?

Medicaid is a wide-ranging, jointly funded state and federal program that provides low-income individuals of all ages health care coverage. However, the focus here will be specifically on long-term care Medicaid eligibility for senior Indiana residents (65 years of age and over). With long-term care, services may be provided in a variety ...

How long does Medicaid last in Indiana?

It’s important to be aware that Indiana has a 5-year Medicaid Look-Back Period. This is a period in which Medicaid checks to see if any assets were sold, gifted, or transferred during the 60 months immediately preceding one’s Medicaid application date.

What is CSRA in Medicaid?

This, in Medicaid speak, is called the Community Spouse Resource Allowance (CSRA). As with the spousal income allowance, this asset allowance does not extend to non-applicant spouses whose spouses are regular Medicaid applicants. It’s important to be aware that Indiana has a 5-year Medicaid Look-Back Period.

How much is the shelter cost for a non-medical spouse in 2021?

As of January 2021 through December 2021, this figure is $3,260.00 / month. This spousal impoverishment rule is not relevant for non-applicant spouses of regular Medicaid applicants.

What income is counted for Medicaid?

Examples include employment wages, alimony payments, pension payments, Social Security Disability Income, Social Security Income, IRA withdrawals, and stock dividends.

Does Medicaid cover nursing home care in Indiana?

Nursing home care paid for by Indiana’s Medicaid program is an entitlement. Phrased differently, if an Indiana resident is medically and financially eligible for nursing home care, then the Indiana Medicaid program is required by law to pay for it. Waiting lists cannot exist. Indiana Medicaid also pays for care outside of nursing homes, in assisted living, adult foster care homes, or in the home of the beneficiary. These benefits are paid for through a program called a Medicaid waiver. Medicaid waivers are not entitlements and waiting lists can exist.

Is Medicaid for Indiana seniors?

There are several different Medicaid long-term care programs for which Indiana seniors may be eligible. These programs have slightly different eligibility requirements, such as functional ability and income and asset limits, as well as varying benefits. Further complicating eligibility are the facts that the criteria vary with marital status ...

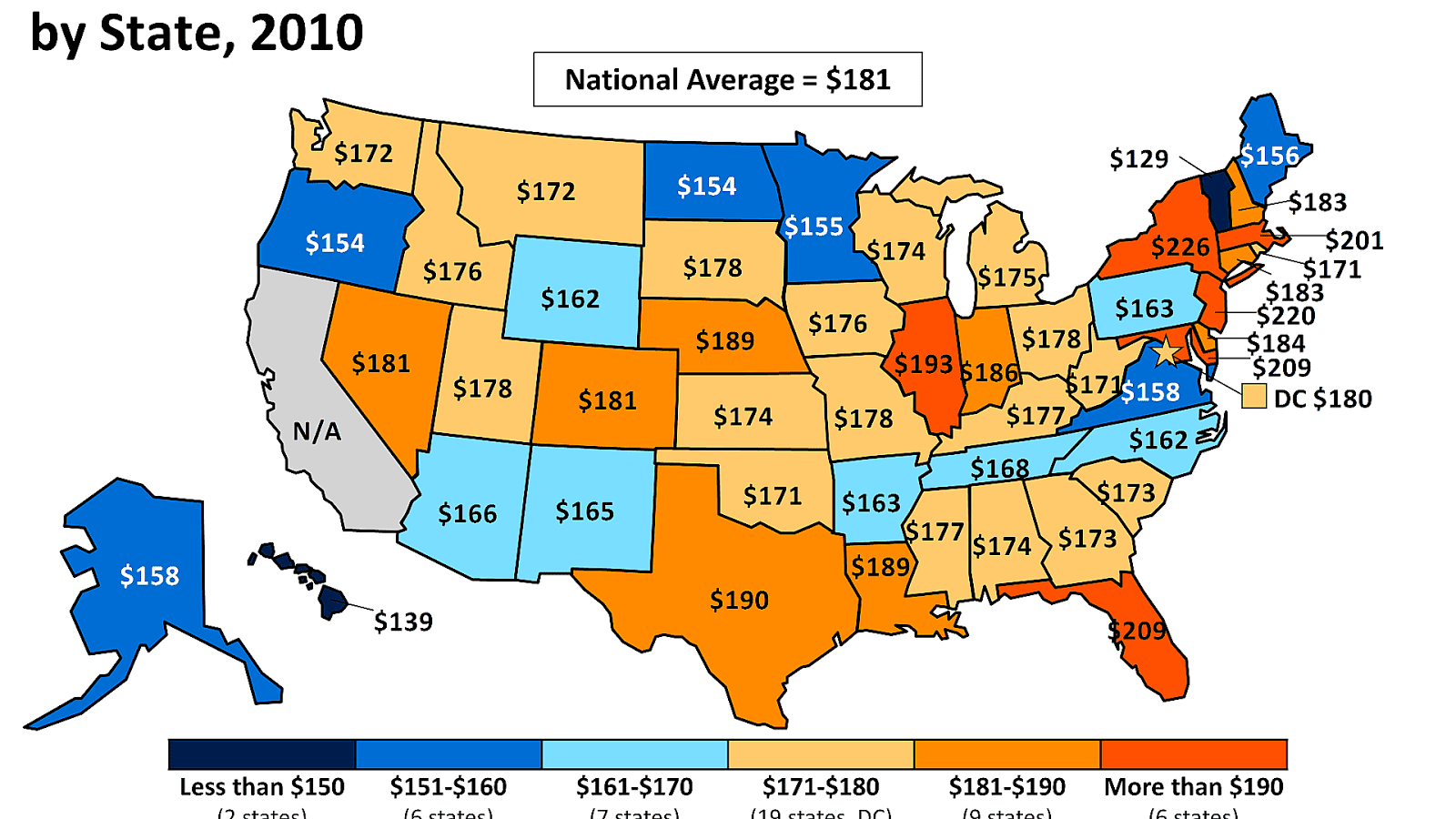

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...

Which pays first, Medicare or Medicaid?

Medicare pays first, and. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. pays second.

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

Does Medicare have demonstration plans?

Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They’re called Medicare-Medicaid Plans. These plans include drug coverage and are only in certain states.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. . If you have Medicare and full Medicaid, you'll get your Part D prescription drugs through Medicare.

Can you get medicaid if you have too much income?

Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid. The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid. In this case, you're eligible for Medicaid because you're considered "medically needy."

Can you spend down on medicaid?

Medicaid spenddown. Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid . The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid.

Does Medicare cover prescription drugs?

. Medicaid may still cover some drugs and other care that Medicare doesn’t cover.

Which states require monthly payments for Medicaid?

Five states—Arkansas, Indiana, Iowa, Michigan, and Montana —operate Medicaid programs that require or encourage certain beneficiaries to pay premiums or make other monthly contributions. Although Title XIX of the Social Security Act normally prohibits states from requiring premiums of Medicaid beneficiaries with family incomes under 150 percent of the federal poverty level (FPL), these states have authority under section 1115 of the Act to waive that prohibition.3 We use the term “monthly payments” to encompass payments considered to be traditional premiums, as in Iowa and Montana, as well as those that take the form of monthly beneficiary account contributions, as in Indiana and Michigan’s ongoing demonstrations, and in Arkansas’s initial demonstration, the Health Care Independence Program (Arkansas implemented a new monthly payment policy in January 2017, under a new demonstration namedArkansas Works4). In this issue brief, we compare the monthly payments policies in the five demonstration states during the 2014–2016 period, including the payment amounts, timing, and consequences of nonpayment, exemptions, and linkages to beneficiary accounts.5

What states are participating in the 1115 Medicaid demonstration?

Five states—Arkansas, Indiana, Iowa, Michigan, and Montana — operate section 1115 Medicaid demonstrations that require or encourage monthly payments from Medicaid beneficiaries with incomes up to 133 percent of the federal poverty level.1 These demonstrations vary in the amount and timing of the required payments, the income levels at which payments are required, and the consequences for nonpayment. In some states, the monthly payments are considered traditional premiums; in others, they are contributions to beneficiary accounts that resemble health savings accounts. We compare the design of monthly payments in the five demonstrations during the 2014–2016 period. We also (1) estimate the number and proportion of potential enrollees in each state who would be subject to monthly payments using data from the American Community Survey and (2) report the proportion of potential enrollees that could be disenrolled for nonpayment to illustrate how broadly nonpayment consequences might apply to demonstration beneficiaries. Overall, we find that the proportion of the demonstration population required or encouraged to make monthly payments ranges from 25 percent in Michigan to 100 percent in Indiana, although in some states beneficiaries may opt out of making payments with few consequences. In Iowa, Indiana, and Montana, about one quarter of the estimated eligible population can be disenrolled for nonpayment. We close by looking aheadto our continuing observation and evaluation ofthese demonstrations, including elements of monthly payment design which could be the basis of valid comparisons across states.2