The 2014 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $426. The Medicare Part A deductible for all Medicare beneficiaries is $1,216. How Much Does Part B Coverage Cost? You pay the Part B premium each month. Most people will pay up to the standard premium amount.

| If Your Yearly Income Is | You Pay | |

|---|---|---|

| $85,000 or below | $170,000 or below | $104.90* |

| $85,001 - $107,000 | $170,000 - $214,000 | $146.90* |

| $107,001 - $160,000 | $214,000 - $320,000 | $209.80* |

| $160,001 - $214,000 | $320,000 - $428,000 | $272.70* |

How much does Medicare Part B cost per month?

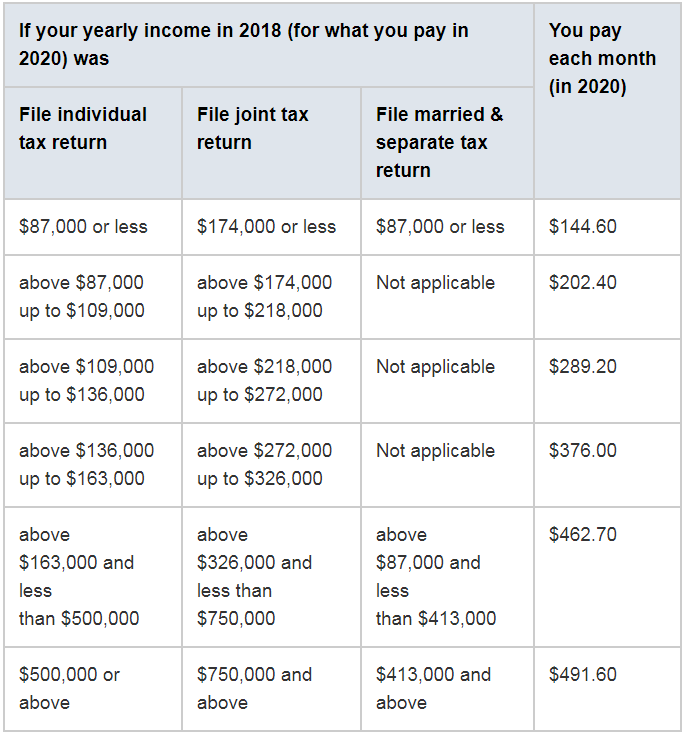

What it costs: 1 Most 2020 Medicare members must pay a monthly premium of $144.60. 2 If you don't enroll in Medicare Part B as soon as you are eligible, you could be assessed a late enrollment penalty when you do enroll. ... 3 Your Part B premium could be higher depending on your income.

When did Medicare Part B premiums go up?

Medicare Part B premiums went up in 2013 from the previous year, but then they stayed the same until the 2017 increase. The 2014, 2015 and 2016 premiums were the same as they were in 2013. They started at $104.90 per month and increased for singles with modified adjusted gross incomes over $85,000 and married taxpayers with MAGIs over $170,000.

What is the standard Medicare Part B premium amount for 2020?

The standard Part B premium amount in 2020 is $144.60. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How much did Medicare Part B cost in 1966?

You can access the table at the link above to see that Medicare Part B premiums started at $3 per month in 1966 and Medicare Part D premiums began in 2006 at $250 per year.

How much did Medicare cost in 2014?

Per-enrollee spending increased by 3.2 percent in 2014. Average growth in per-enrollee spending was 7.4 percent from 2000-2009. Medicare spending, which represented 20 percent of national health spending in 2014, grew 5.5 percent to $618.7 billion, a faster increase than the 3.0 percent growth in 2013.

What was the cost of Medicare Part B in 2015?

$104.90 per monthMost beneficiaries pay $104.90 per month for Medicare Part B.

How much did Medicare cost in 2013?

Most people will pay more for this government health care plan for seniors.2011 ADJUSTED GROSS INCOME$85,000 or less (single), $170,000 or less (joint)More than $214,000 (single), more than $428,000 (joint)2013 Medicare Part B monthly premium$104.90$335.702013 Medicare Part D monthly premiumpremium only$66.40 surcharge

What was the cost of Medicare Part B in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What were Medicare premiums in 2015?

As a result of the Bipartisan Budget Act of 2015, the Part B monthly premium will be increasing for 30 percent of Part B enrollees from $104.90 in 2015 to $121.80 in 2016—a 16 percent increase, but far less than the increase initially projected by the Medicare actuaries (Figure 1).

What will Medicare cost in 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What was Medicare cost in 2010?

CMS ANNOUNCES MEDICARE PREMIUMS, DEDUCTIBLES FOR 2010Beneficiaries who are married but file a separate tax return from their spouse:Income-related monthly adjustment amountTotal monthly premium amountGreater than $85,000 and less than or equal to $129,000$176.80$287.30Greater than $129,000$243.10$353.601 more row•Oct 16, 2009

How much did Medicare cost in 2008?

The standard Medicare Part B monthly premium will be $96.40 in 2008, an increase of $2.90, or 3.1 percent, from the $93.50 Part B premium for 2007.

What is the cost of Medicare Part B for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

When did Medicare start charging a premium?

July 30, 1965July 30, 1965: With former President Harry S. Truman at his side, President Lyndon B. Johnson signs the Medicare bill into law.

How much is Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

What was the Medicare Part B premium for 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What are the Irmaa brackets for 2016?

If Your Yearly Income Is2016 Medicare Part B IRMAA$85,000 or below$170,000 or below$0.00$85,001 - $107,000$170,000 - $214,000$48.70$107,001 - $160,000$214,000 - $320,000$121.80$160,001 - $214,000$320,000 - $428,000$194.903 more rows•Jul 30, 2015

What is the cost of Medicare Part B for 2020?

$144.60 forMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

What is the Medicare Part B deductible 2012?

$140In 2012, the Part B deductible will be $140, a decrease of $22 from 2011.

How much was Medicare Part B in 2014?

How much will I pay in premiums for Medicare Part B in 2014? And is there still a high-income surcharge for Part B and Part D prescription-drug coverage? The monthly premium for Medicare Part B remains $104.90 for most people in 2014 – the same as in 2013.

How much did Medicare deductible increase in 2014?

The Centers for Medicare and Medicaid Services also announced that the Medicare Part A deductible, which people pay when admitted to the hospital, will increase by $32 in 2014, to $1,216.

What is the Part B and Part D surcharge based on?

Both the Part B and Part D surcharges are based on your income in 2012, which is the last tax return the government has on file for most people.

What is the income limit for seniors in 2012?

Seniors whose 2012 adjusted gross income (plus tax-exempt interest income) was more than $170,000 if married filing jointly or $85,000 if single will continue to pay higher premiums, as they have since 2007. The high-income surcharges remain the same as in 2013.

What is the deductible for Medicare Part B in 2014?

If you have to pay a higher amount for your Part B premium and you disagree, you can appeal the IRMAA. The 2014 Medicare Part B annual deductible remains $147 (unchanged from 2013). *If you pay a late-enrollment Penalty, your monthly premium is higher.

What is Medicare Advantage 2014?

2014 Part C (Medicare Advantage) Monthly Premium. Medicare Advantage plan premiums*, deductibles, and benefits will depend on the Medicare Advantage plans available in your service area (county or ZIP code). Along with your Medicare Advantage plan premium, you must continue to pay your Part B premium ...

How much is the 2014 Part D premium?

The 2014 Part D plan premiums range from $3 to $175. The 2014 standard Part D plan deductible is $310, however the actual plan deductible can be anywhere from $0 to $310 .

Do you pay Social Security if your adjusted gross income is above a certain amount?

However, if your modified adjusted gross income as reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS) is above a certain amount (see chart below), you may pay more.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is the premium for Medicare Part B?

Medicare Part B – medical coverage. Most 2020 Medicare members must pay a monthly premium of $144.60. If you don't enroll in Medicare Part B as soon as you are eligible, you could be assessed a late enrollment penalty when you do enroll.

How much is the deductible for Medicare Part B 2020?

There is a $198 annual deductible for Medicare Part B in 2020. After the deductible, you’ll pay a 20% copay for most doctor services while hospitalized, as well as for DME and outpatient therapy. There is a 20% copay of the Medicare-approved amount for doctor visits to diagnose a mental health condition after the deductible.

What is Medicare Part D?

Medicare Part D – prescription drug coverage. Medicare Part D covers prescriptions drugs. Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by plan, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

How much is Medicare after day 91?

After day 91 there is a $704 daily coinsurance payment for each lifetime reserve day used. After the maximum 60 lifetime reserve days are exhausted, there is no more coverage under Part A for inpatient hospital stays. There is a 20% copay for Medicare-approved durable medical equipment (DME). Medicare does not cover any room ...

What happens if you don't enroll in Medicare Part B?

If you don't enroll in Medicare Part B as soon as you are eligible, you could be assessed a late enrollment penalty when you do enroll. The penalty could be as high as a 10% increase in your premium for each 12-month period that you were eligible but not enrolled. Your Part B premium could be higher depending on your income.

Why don't people pay Medicare premiums?

Most people don't pay a monthly premium for Medicare Part A because they paid Medicare taxes while they were working. However, there are costs you will have to deal with.

How much is the coinsurance for skilled nursing?

There is a $176 coinsurance payment for days 21 to 100 for a skilled nursing facility stay. After day 100 you are responsible for all costs. There is a 20% copay for mental health services connected with a hospital stay.

Medicare Part A and Part B Changes from 2013 to 2014

Medicare Part A in 2014

- 2014 Medicare Part A Premium:

The Medicare Part A premium, which only about 1 percent of Medicare recipients are required to pay, will be $426, a $15 decrease from the 2013 rate. - 2014 Medicare Part A Deductible:

The 2014 Medicare Part A deductible will be $1,216per benefit period, up from $1,184 per benefit period in 2013.

Medigap Protection Against Deductibles, Co-Pays, and Coinsurance

- Medicare supplement plans go a long way toward helping eliminate Medicare out-of-pocket costs that often go up from one year to the next. An excellent, budget-friendly solution is Medicare Supplement Plan F, which covers all Medicare-approved costs not covered by Medicare Part A and Medicare Part B. With fixed premiums that can easily fit into your budget, Plan F covers all …