What is the exact Medicare Part D Donut Hole amount?

The Donut Hole remains the third phase or part of your Medicare Part D prescription drug coverage and you only enter the Donut Hole when (if) the total retail value of your purchased medications exceeds your plan's 2022 Initial Coverage Limit (ICL) of $4,430.

What you should know about Medicare Part D?

You are eligible for a Medicare Part D plan if:

- You are 65 years of age or older.

- You have a qualifying disability for which you have been receiving Social Security Disability Insurance (SSDI) for more than 24 months.

- You have been diagnosed with End-Stage Renal Disease (permanent kidney failure requiring a kidney transplant or dialysis).

- You are entitled to Medicare Part A or Part B.

What are the rules of Medicare Part D?

What it means to pay primary/secondary

- The insurance that pays first (primary payer) pays up to the limits of its coverage.

- The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover.

- The secondary payer (which may be Medicare) may not pay all the uncovered costs.

What are the costs for Medicare Part D?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

Do Part D plans cover the donut hole?

The Medicare Part D donut hole or coverage gap is the phase of Part D coverage after your initial coverage period. You enter the donut hole when your total drug costs—including what you and your plan have paid for your drugs—reaches a certain limit. In 2022, that limit is $4,430.

How much is the donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

What is the dollar amount of the Medicare donut hole?

Once you and your Medicare Part D plan have spent a certain amount on covered prescription drugs during a calendar year ($4,430 in 2022), you reach the coverage gap and are considered in the “donut hole.” Not everyone will enter the “donut hole,” and people with Medicare who also have Extra Help will never enter it.

How does the donut hole work in Medicare Part D?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs.

Is the Medicare donut hole going away in 2021?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

How much is the donut hole for 2022?

$4,430In a nutshell, you enter the donut hole when the total cost of your prescription drugs reaches a predetermined combined cost. In 2022, that cost is $4,430.

How do you calculate the donut hole?

An individual and their insurance company have spent $4,020 on medications since the start of their plan. That person is now in the donut hole. The person pays 25% of their medication costs. For example, if they have a medicine that costs $100, they will pay $25.

What will the donut hole be in 2022?

In 2022, the coverage gap ends once you have spent $7,050 in total out-of-pocket drug costs. Once you've reached that amount, you'll pay the greater of $3.95 or 5% coinsurance for generic drugs, and the greater of $9.85 or 5% coinsurance for all other drugs. There is no upper limit in this stage.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

How do I avoid the Medicare Part D donut hole?

Here are some ideas:Buy Generic Prescriptions. ... Order your Medications by Mail and in Advance. ... Ask for Drug Manufacturer's Discounts. ... Consider Extra Help or State Assistance Programs. ... Shop Around for a New Prescription Drug Plan.

What is the maximum out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000 (beginning in 2024), while under the GOP drug price legislation and the 2019 Senate Finance bill, the cap would be set at $3,100 (beginning in 2022); under each of these proposals, the out-of-pocket cap excludes the value of the manufacturer price ...

How long do you stay in the donut hole?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

Key Takeaways

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold.

Let's keep in touch

Subscribe to receive important updates from NCOA about programs, benefits, and services for people like you.

What is the doughnut hole?

The doughnut hole, more formally called the coverage gap, has been one of Part D’s more detested features since the drug benefit took effect in 2006. Part D initially suspended coverage at a certain dollar threshold, forcing beneficiaries to pay out of pocket for drugs until they hit a second threshold and coverage resumed.

How much did the deductible for a prescription drug cost in 2006?

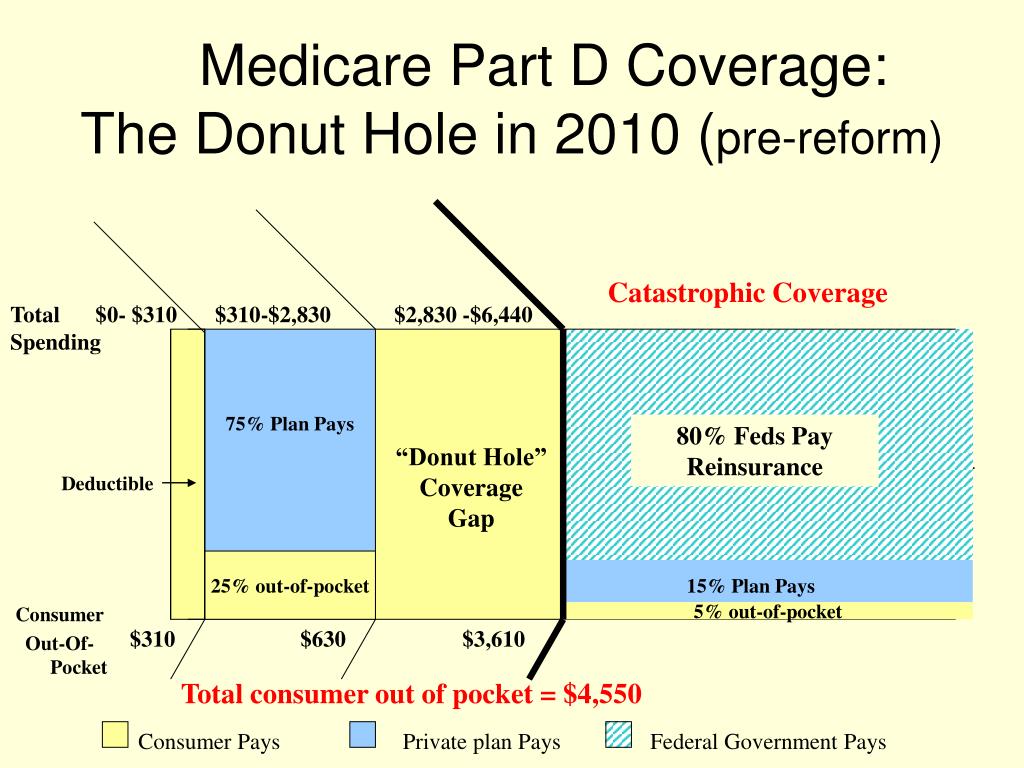

In 2006, after meeting the deductible ($250 at the time), participants paid 25 percent of the negotiated cost of each prescription until the cost of their drugs totaled $2,250. Then, they became responsible for all drug costs — 100 percent — until they’d spent $3,600, after which they qualified for catastrophic coverage and paid just 5 percent ...

Do you pay a flat price for Part D?

Several reasons have to do with Part D itself. This year, after meeting the $435 deductible, you generally pay a flat price for each covered drug during the so-called initial coverage period. Different plans assign drugs to different tiers for which you pay specified amounts.

Is there a coverage gap in Medicare?

Now, supposedly, there is no coverage gap. Federal regulations require that your plan (most Medicare beneficiaries can choose from nearly 30) average 25 percent cost-sharing for any drug. Part D premiums have remained stable (averaging about $30 a month) for years; the proportion of Medicare beneficiaries with Part D has risen to nearly 75 percent, ...

What is the donut hole in insurance?

This means that you may be responsible for a bigger share of your drug costs while in this coverage gap, known as the donut hole.

What is Medicare Part D cost sharing?

Medicare Part-D Cost Sharing Basics. Under Part D, Medicare's "standard benefit" package for Part D drug plans (PDPs) is based on the Medicare beneficiary (you) and the PDP sharing the cost of covered drugs. Your plan may choose to follow Medicare's standard benefit package or offer a different plan with different cost sharing structures.

How much will Medicare cost in 2021?

In 2021, this amount is $6,550. Once you've spent this amount, you will have to pay only a small amount coinsurance or copayment amount for your medications for the rest of the year. In 2021, you will be responsible for the greater of 5% of the drug costs or $3.70 for a generic or preferred drug or $9.20 for a brand name drug.

What is the donut hole?

Overview of the Donut Hole. When the Medicare Prescription Drug program was created in 2003, the law allowed for a coverage gap that has come to be called the "donut hole.". When you entered the Donut Hole, you became responsible for 100% of the cost of a covered drug until you spent enough on medications to reach the level ...

What is Medicare Extra Help?

Medicare beneficiaries are encouraged to look into Medicare's " Extra Help " program, designed to help people with limited income and resources pay for Medicare prescription drug plan costs, such as premiums, deductibles, and coinsurance.

How much is Medicare Part D deductible in 2021?

The maximum amount for a Part D deductible is $445 in 2021. In other words, until you spend $445 on medications, you have to pay 100% of the cost of your medications.

How much of the drug cost will be covered by Part D in 2021?

However, in 2021, you can only be responsible for paying up to 25% of the cost for covered brand name drugs or generic drugs, until you reach the other side of the coverage gap. For many people with Part D coverage, their share of cost is 25% before they get to the donut hole and while they're in the donut hole.

Part 1 of your drug coverage

The Initial Deductible Phase The standard Initial Deductible can change each year. In 2022 , the Initial Deductible is $480 ($445 in 2021). If your Medicare Part D plan has an Initial Deductible , you will usually pay 100% for your medications and the amount you pay will count toward the Donut Hole.

Part 2 of your drug coverage

The Initial Coverage Phase After the Initial Deductible (if any), you will continue into your Initial Coverage phase where your Medicare Part D plan covers a portion of your prescription costs and you pay some cost-sharing (co-payment or co-insurance).

Part 3 of your drug coverage

The Coverage Gap or Donut Hole You will leave the Initial Coverage phase and enter the Donut Hole when your total retail drug cost (what you spent plus what your Medicare drug plan spent) exceeds the Initial Coverage Limit ($4,430). As mentioned, the Coverage Gap this is the portion of your Medicare Part D coverage where you traditionally paid a larger percentage of the retail drug cost.

Part 4 of your drug coverage

The Catastrophic Coverage Phase You will stay in the Coverage Gap or Donut Hole phase until your out-of-pocket costs (called TrOOP or total drug spend) reaches a certain level. The TrOOP level in 2022 is $7,050 .

What Is the Medicare Part D Donut Hole?

The “donut hole” refers to a coverage gap that exists in Medicare prescription drug coverage. When you’re in the donut hole coverage gap, your Medicare drug plan pays a limited amount of the drug costs for generic drugs and brand name drugs.

How does the donut hole affect beneficiaries?

Let’s say your Medicare drug plan has a coinsurance requirement of 10%. During the initial coverage phase, you will be responsible for 10% of the cost of your prescriptions.

Did the Donut Hole Go Away in 2020?

The Medicare donut hole started shrinking and was set to close to its current rate in 2020, due to provisions in the Affordable Care Act (also known as ACA or Obamacare), which was signed into law in 2010 by President Barack Obama.

How much does Medicare pay for a donut hole?

Medicare Part D beneficiaries who reach the Donut Hole will also pay a maximum of 25% co-pay on generic drugs purchased while in the Coverage Gap (receiving a 75% discount). For example: If you reach the 2020 Donut Hole, and your generic medication has a retail cost of $100, you will pay $25. The $25 that you spend will count toward your TrOOP ...

When will the Medicare doughnut hole close?

From 2017 to 2020, brand-name drug manufacturers and the federal government will be responsible for providing subsidies to patients in the doughnut hole.

What is LIS in Medicare?

The Low-Income Subsidy (LIS), also known as "Extra Help" provides additional cost-sharing and premium assistance for eligible low-income Medicare Part D beneficiaries with incomes below 150% the Federal Poverty Level and limited assets. Individuals who qualify for the Low-Income Subsidy (LIS) or who are also enrolled in Medicaid do not have a coverage gap.

What is Medicare Part D coverage gap?

Period of consumer payment for prescription medication costs. The Medicare Part D coverage gap (informally known as the Medicare doughnut hole) is a period of consumer payment for prescription medication costs which lies between the initial coverage limit and the catastrophic-coverage threshold, when the consumer is a member ...

How much is Medicare Part D 2020?

The 2020 Medicare Part D standard benefit includes a deductible of $435 (amount beneficiaries pay out of pocket before insurance benefits kick in) and 25% co-insurance, up to $6,350.

What percentage of Medicare Part D enrollees in 2007 were not eligible for low income subsidies?

The most common forms of gap coverage cover generic drugs only. Among Medicare Part D enrollees in 2007 who were not eligible for the low-income subsidies, 26 percent had spending high enough to reach the coverage gap. Fifteen percent of those reaching the coverage gap (four percent overall) had spending high enough to reach ...

What is the gap between insurance and consumer?

The gap is reached after shared insurer payment - consumer payment for all covered prescription drugs reaches a government-set amount, and is left only after the consumer has paid full, unshared costs of an additional amount for the same prescriptions.

Overview of The Donut Hole

- When the Medicare Prescription Drug program was created in 2003, the law allowed for a coverage gap that has come to be called the "donut hole." When you entered the Donut Hole, you became responsible for 100% of the cost of a covered drug until you spent enough on medications to reach the level of "Catastrophic Coverage." At that point, your prescription drug pl…

Medicare Part-D Cost Sharing Basics

- Under Part D, Medicare's "standard benefit" package for Part D drug plans (PDPs) is based on the Medicare beneficiary (you) and the PDP sharing the cost of covered drugs. Your plan may choose to follow Medicare's standard benefit package or offer a different plan with different cost sharing structures. Your actual drug plan costs will vary and depend upon many factors, including: 1. yo…

Part D Drug Plan Costs

- Part D Premiums. Most plans charge a monthly Part D premium in addition to any Part B premium you are paying. Yearly Deductible.This is the initial amount that you must pay for the cost of drugs until the Medicare prescription drug plan pays anything towards your drug costs. The maximum amount for a Part D deductible is $445 in 2021. In other words...

Additional Information

- Medicare beneficiaries are encouraged to look into Medicare's "Extra Help" program, designed to help people with limited income and resources pay for Medicare prescription drug plan costs, such as premiums, deductibles, and coinsurance.