The Affordable Care Act has made Medicare prescription drug coverage (Part D) more affordable during the coverage gap by gradually closing the prescription drug donut hole over time. In 2016, people with Medicare paid 45% for brand-name drugs and 58% for generic drugs while in the coverage gap.

Did the Affordable Care Act increase the cost of healthcare?

Has the ACA Increased the Cost of Healthcare? It is no wonder people are upset by rising medical costs, but insurance premiums were going up by about 10% a year before the ACA went into effect. Insurance premiums have increased by 213% since 1999 for family coverage through an employer.

How much did health insurance premiums go up before the ACA?

It is no wonder people are upset by rising medical costs, but insurance premiums were going up by about 10% a year before the ACA went into effect. Insurance premiums have increased by 213% since 1999 for family coverage through an employer. There was an increase of 30%-40% in the three years before the ACA.

Does the Affordable Care Act affect Medicaid enrollment?

Medicaid enrollment changes following the ACA Medicaid and the Affordable Care Act The Patient Protection and Affordable Care Act (ACA, P.L. 111-148, as amended) establishes new avenues to coverage for low- and moderate-income individuals.

Is Medicare Part A covered under Affordable Care Act?

Get A Quote. In many instances, Medicare coverage meets the Affordable Care Act’s requirement that all Americans have health insurance. For example, those who have Medicare Part A (hospital insurance) are considered covered under the law and don’t need to purchase a Marketplace plan or other additional coverage.

How did Affordable Care Act affect Medicare?

Medicare Premiums and Prescription Drug Costs The ACA closed the Medicare Part D coverage gap, or “doughnut hole,” helping to reduce prescription drug spending. It also increased Part B and D premiums for higher-income beneficiaries. The Bipartisan Budget Act (BBA) of 2018 modified both of these policies.

Did the ACA expand Medicare?

The Affordable Care Act's (ACA) Medicaid expansion expanded Medicaid coverage to nearly all adults with incomes up to 138% of the Federal Poverty Level ($17,774 for an individual in 2021) and provided states with an enhanced federal matching rate (FMAP) for their expansion populations.

Who benefited the most from ACA?

More than 20 million Americans gained health insurance under the ACA. Black Americans, children and small-business owners have especially benefited. Thirty-seven states have expanded Medicaid, deepening their pool of eligible residents to those who live at or below 138% of the federal poverty level.

How did the ACA increase coverage?

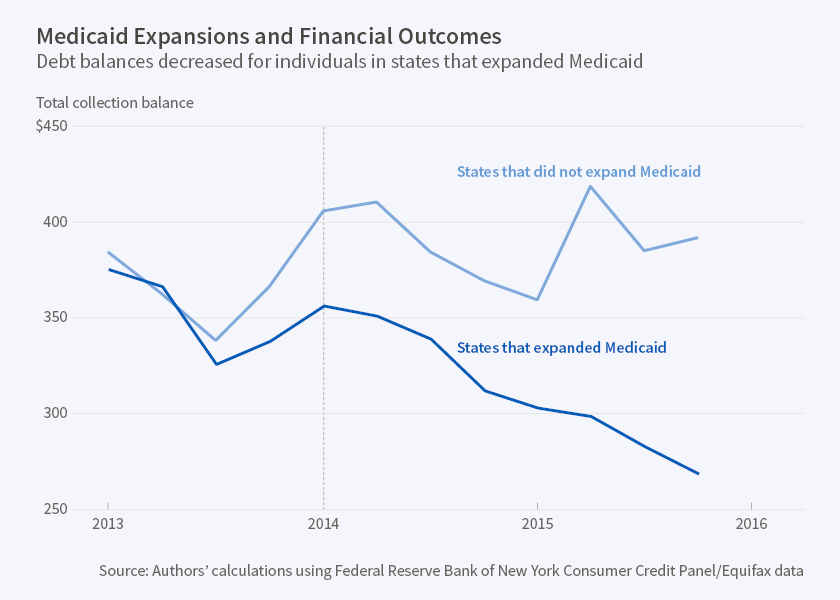

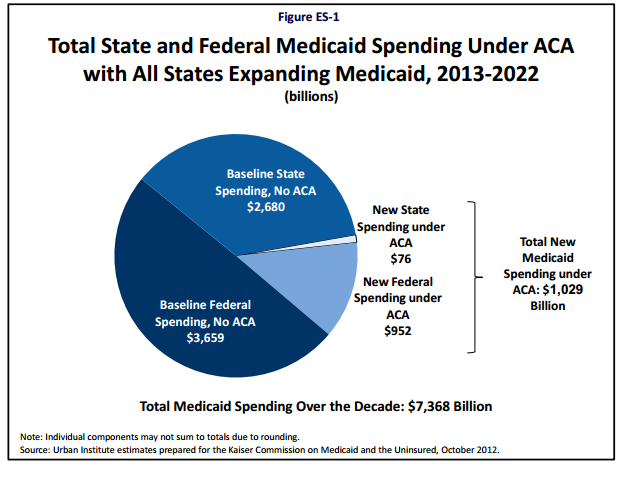

The net gain in health coverage because of the ACA is entirely or almost entirely due to an increase in Medicaid enrollment. A sizeable percentage of the new enrollees in Medicaid do not meet eligibility rules for the program. On a per enrollee basis, the ACA's cost is far higher than was projected.

How did the ACA impact Medicaid?

The ACA also made a number of other significant Medicaid changes, such as preventing states from reducing children's Medicaid eligibility until FY 2019; setting a uniform standard for children's eligibility at 138 percent FPL; streamlining eligibility, enrollment, and renewal processes; and updating payments to safety- ...

How will ACA repeal affect Medicare?

Dismantling the ACA could thus eliminate those savings and increase Medicare spending by approximately $350 billion over the ten years of 2016- 2025. This would accelerate the insolvency of the Medicare Trust Fund.

Why the Affordable Care Act failed?

Not only did the ACA fail to control the rising cost of insurance, but it also failed to make health care and prescribed medicines affordable. According to a West Health and Gallup, 30 percent of surveyed individuals did not seek needed medical treatment due to the cost from September to October 2021.

Has Affordable Care Act been successful?

The ACA was intended to expand options for health coverage, reform the insurance system, increase coverage for services (particularly preventive services), and provide a funding stream to improve quality of services. By any metric, it has been wildly successful. Has it improved coverage? Indisputably, yes.

Who suffered the most from Obamacare?

Low-income, privately insured people had the worst results in the analysis, seeing no benefit from the ACA: They had the highest rate of catastrophic health care spending before the law passed in 2010 and continued to have it in 2017: 35% compared with 8% for people on Medicaid.

Did the ACA reduce the number of the uninsured?

Today's report shows the important role the ACA has played in providing coverage to millions of Americans nationwide. The report also shows that between 2010 and 2016, the number of nonelderly uninsured adults decreased by 41 percent, falling from 48.2 million to 28.2 million.

Has the ACA improved the quality of care?

The ACA is the most consequential and comprehensive health care reform enacted since Medicare. The ACA has gained a net increase in the number of individuals with insurance, primarily through Medicaid expansion. The reduction in costs is an arguable achievement, while quality of care has seemingly not improved.

Why is the ACA controversial?

The ACA has been highly controversial, despite the positive outcomes. Conservatives objected to the tax increases and higher insurance premiums needed to pay for Obamacare. Some people in the healthcare industry are critical of the additional workload and costs placed on medical providers.

How did the Affordable Care Act affect Medicare?

The Affordable Care Act also affected Medicare by adding coverage for a "Wellness Visit" and a “Welcome to Medicare” preventative visit. It also eliminated cost-sharing for almost all of the preventive services covered by Medicare.

When was the Affordable Care Act signed into law?

December 10, 2019. The Affordable Care Act was signed into law on March 23, 2010. Its goals were to provide greater access to health care coverage, to improve the quality of health care services provided, and to slow the rate of increase in health spending. As far as Medicare is concerned, the Affordable Care Act primarily made improvements ...

What is the Affordable Care Act?

The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

What are the initiatives under the Affordable Care Act?

Under these initiatives, your doctor may get additional resources that will help ensure that your treatment is consistent. The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

How much does Medicare pay for generic drugs?

In 2016, people with Medicare paid 45% for brand-name drugs and 58% for generic drugs while in the coverage gap. These percentages have shrunk over the last few years. Starting in 2020, however, you’ll pay only 25% for covered brand-name and generic drugs during the coverage gap.

How long does Medicare cover preventive visits?

This is a one-time visit. During the visit, your health care provider will review your health, as well as provide education and counseling about preventive services and other care.

How long does it take to sign up for Medicare?

You will get an initial enrollment period to sign up for Medicare. In most cases, the initial enrollment period begins three months before your 65th birthday and ends three months afterward. For most people, it’s beneficial to sign up for Medicare during this time. This is because those who sign up for Medicare after the initial enrollment period ends, face some negative consequences. For example, you might be required to pay a Part B (medical insurance) late enrollment penalty for as long as you have Medicare. Also, you are only permitted to enroll in Medicare Part B (and Part A in some cases) during the Medicare general enrollment period that runs from January 1 to March 31 each year. However, coverage will not begin until July of that year. This could create a gap in your insurance coverage.

How much will Medicare pay in 2020?

For instance, if your adjusted gross income in 2018 was $87,000 to $109,000 a year ($174,000 to $218,000 for a couple), you pay $202.40 for your Part B coverage in 2020.

When is the open enrollment period for Medicare Advantage?

That’s why it’s important to shop for plans each year during the Open Enrollment Period from October 15 to December 7 each year.

Do you pay higher premiums if you have a high income?

Have a High-Income? You'll Pay Higher Premiums

Can Medicare Advantage plan change from year to year?

If you have a Medicare Advantage plan, which is also known as Medicare Part C , from a private company, your coverage may change from year to year. Unlike traditional Medicare, if you are in a Medicare Advantage plan you must get your care from a network provider. The Affordable Care Act says that your insurance company will get a bonus ...

When was the Affordable Care Act enacted?

Recurring Publications. The Affordable Care Act, enacted in March 2010, made significant changes in federal programs and tax policies regarding health care (and in other areas)—including changes affecting insurance coverage, affordability and accessibility of insurance, the financing of medical care, and the operation of the Medicare program.

How much will the federal government subsidize health insurance in 2021?

CBO and JCT project that federal subsidies, taxes, and penalties associated with health insurance coverage for people under age 65 will result in a net subsidy from the federal government of $920 billion in 2021 and $1.4 trillion in 2030.

How many people will be uninsured in 2016?

June 5, 2014. Under the ACA, most legal residents must get health insurance or pay a penalty. CBO and JCT estimate that 30 million will be uninsured in 2016, but most will be exempt from the penalty; 4 million will make payments totaling $4 billion.

How much will Medicare be reduced?

The nonpartisan Congressional Budget Office estimated that Medicare spending would be reduced by $716 billion over 10 years, mainly because the law puts the brakes on annual increases in Medicare reimbursement for Medicare Advantage, hospital costs, home health services, hospices and skilled nursing services.

How much less will Medicare get in 2022?

Other cuts include $66 billion less for home health, $39 billion less for skilled nursing services and $17 billion less for hospice care — all by 2022. Medicare costs will still grow, just more slowly than they would without the ACA. But some experts predict that beneficiaries will feel ...

How does the Medicare law affect hospitals?

It also penalizes hospitals with too many readmissions of Medicare patients who have heart attacks , heart failure or pneumonia within 30 days of a hospital stay.

How much discount do you get for Part D?

People who reach the doughnut hole — the Part D coverage gap — get a 52.5 percent discount on brand-name drugs and 28 percent discount on generics. More than 7.1 million older and disabled people in the doughnut hole have saved $8.3 billion between 2010 and October 2013.

How many states have Medicare cut doctors?

The American Medical Association says that in at least 11 states, Medicare Advantage plans have cut thousands of physicians. Critics worry that more doctors may stop taking Medicare patients or that patients will face lengthy waits for appointments or other changes.

What is Medicare Advantage?

About three in 10 Medicare beneficiaries are enrolled in Medicare Advantage options, which are premium insurance plans that often include dental, vision and drug insurance. These plans have been subsidized by the federal government for years. The ACA is simply aiming to equalize costs, according to its proponents.

Did Medicare change before the law?

Insurers changed Medicare Advantage plans before the law, and they're still changing them, he says. "Overall, seniors are not paying that much more, and more people are still enrolling in Medicare Advantage plans," says Gruber, who advised the Obama administration on the ACA.

How much did healthcare premiums increase before the ACA?

There was an increase of 30%-40% in the three years before the ACA. Since the ACA, premiums have not been rising as fast as they were before. [3] Healthcare businesses and startups have been tremendously profitable.

When did the ACA increase?

Although it’s true that some of the ACA’s benefits, rights, and protections were the cause of a temporary increase around 2014 and 2015, the law itself does as much to keep costs down as it did to cause the initial increases.

Have Insurance Companies Been Hurt by the ACA? Is That Why Costs Have Going Up?

The ACA has increased the number of people with access to healthcare. Before 2014, people who were old or sick paid exorbitantly for health coverage if they could get it at all. Many faced lifetime or annual maximums. Premature infants and others with complex medical needs often saw their families bankrupted by the cost of care. People died.

Why is it profitable to offer health insurance to employees under the ACA?

Many employers found it profitable to offer employees health insurance under the ACA, either because they were mandated to or subsidized for doing so.

How much has the deductible increased since 2010?

If you have health insurance, you probably realize that the out of pocket medical costs of high deductibles has increased 67% since 2010 alone according to the Henry J. Kaiser Family Foundation. You can find the statistics at the Kaiser Family Foundation website.

Why did insurance companies raise the cost of insurance?

People died. It is easy to think that insurance companies raised the cost of insurance because they had to insure sick people and pay for services such as annual wellness visits under the ACA. While these expenses increased costs, the companies have also sold more policies because more people were insured.

What is the health care economy?

The health care economy is creating extraordinary profits for insurance companies, entrepreneurs, and medical companies. At the same time, the insurance products available to many of us have become increasingly costly, and consumers must pay out-of-pocket for a significant portion of their medical expenses.

What is the Affordable Care Act?

The Patient Protection and Affordable Care Act (ACA, P.L. 111-148, as amended) establishes new avenues to coverage for low- and moderate-income individuals. As enacted, the law required states to extend Medicaid eligibility to adults with incomes below 133 percent of the federal poverty level (FPL), ...

How much did Medicaid enrollment increase in Georgia in 2020?

Between July and September 2013 and July 2020: enrollment increased by 2.3 million or 12.6 percent; these increases ranged from 0.2 percent to 28.4 percent in Georgia;

How many children are on medicaid in 2020?

As of July 2020, 36.9 million children were enrolled in Medicaid or CHIP in 49 reporting states and the District of Columbia, with child enrollment comprising nearly half (49.9) percent) of enrollment in these states ( CMS 2020 ). [3]

Why is Medicaid enrollment growing?

One of the underlying reasons for the welcome-mat effect may be that previously eligible individuals may not have known they were eligible for coverage and applied as a result of increased outreach efforts surrounding ACA implementation.

How much will CMS increase in 2021?

This represents a 24.7 percent increase over the baseline ( CMS 2021 ).

Which expansion states are declining enrollment?

one expansion state (Vermont) experienced a decline in enrollment Kentucky ( CMS 2021 ).

Has the uninsured rate increased?

For example, the American Community Survey found a 0.3 percent increase in the uninsured rate between 2018 and 2019.

How many Americans believe their health coverage has improved since the ACA?

Despite the benefits, only 13% of Americans believe that their health coverage benefits have improved since the adoption of the ACA. This data comes from a set of Affordable Care Act statistics from 2017, when millions of people had already signed up for the ACA.

How has the ACA helped Americans?

The ACA has helped millions of Americans get health insurance and seek medical attention without having to acquire major debt. Along with the advantages it clearly provides, the Affordable Care Act statistics show that there are numerous areas of improvement that the US Federal Government needs to focus on.

How many people were enrolled in the ACA in 2017?

In 2017, 73.8 million people were enrolled in the ACA-based Medicaid insurance program. Based on the affordable health care statistics, we can conclude that the ACA was and continues to be a great success in terms of enrollment numbers. Of course, any policy has its downfalls, and Obamacare is no exception.

What is the ACA's main challenge?

First and foremost, the ACA’s main challenge is to make health insurance affordable for more people. Our Affordable Care Act statistics indicate that the ACA offers subsidies, commonly referred to as premium tax credits. These lower the cost of health care services for people residing in households with an income situated at 100% to 400% below ...

What were preventive medical services like before the ACA?

Before the ACA policy was enacted, preventive medical services like flu shots, birth control, or year ly medical check-ups were not universally provided by insurance companies. Yearly check-ups and other preventive measures are a huge coup, granted their essentiality in ensuring that life-threatening conditions are caught early, thus improving survival rates.

Why did Obama create the Affordable Care Act?

To improve the system and make health care more affordable, President Obama initiated the Affordable Care Act, also called the ACA, or Obamacare. The Obamacare statistics outlined in this article should help US residents learn more about their legal rights with health care and how to find affordable insurance policies.

Why do people not have health insurance?

With this in mind, even with the Affordable Care Act, numerous Americans choose to risk not having health insurance, due to high costs, according to the Obamacare statistics. It’s also believed that a large percentage doesn’t receive insurance coverage through an employer, whereas others are uneducated about the insurance market and its benefits.

How does the ACA make individual health insurance more affordable?

Placing certain limits on what insurance providers can charge consumers. Insurers are prohibited from charging consumers higher premiums because they have a pre-existing condition such as cancer or diabetes .

What does the Affordable Care Act cover?

The Affordable Care Act aims to make healthcare coverage more accessible in several ways:

How do I enroll in the ACA?

Use the Find Local Help tool to locate in-person assistance in your area with a navigator as well as with an agent or broker. All of them are trained to walk you through the marketplace process, and services are free.

How does my income affect what I pay for coverage?

The ACA provides savings for low-income and moderate-income individuals and families. Generally, the less money you make, the more financial help you will receive under the law.

How much did the ACA reduce the deficit?

In the decade from 2026 to 2035, it would have reduced the deficit by around 1 percent of gross domestic product (GDP) or several trillion dollars, with or without macroeconomic feedback, according to CBO’s 2015 estimate. While the revenue from the Cadillac tax would have grown considerably faster than GDP after 2025, the revenue lost from repealing it and the two other ACA taxes is substantially smaller than the projected savings.

Will the Affordable Care Act reduce the deficit?

The Affordable Care Act (ACA) remains likely to reduce federal budget deficits substantially in coming years , despite December’s repeal of three ACA taxes. Repealing the excise tax on high-cost health plans (the “Cadillac tax”), the fee on health insurance providers (the “health insurance tax”), and the medical device excise tax will sacrifice hundreds of billions in revenues and marks a significant step backwards in health and fiscal policy, as we’ve written. But the ACA’s remaining spending reductions and tax increases will more than offset the cost of its coverage expansions.

Is the ACA making the deficits bigger?

In sum, assertions that the ACA is making deficits larger are inaccurate. Even without the repealed taxes, the law’s Medicare payment reforms, Medicare taxes on high-income people, and other savings will more than cover the cost of extending health coverage to tens of millions more Americans.