Will Republicans cut Social Security and Medicare after tax cuts pass?

Marco Rubio Makes It Clear: Republicans Will Cut Social Security And Medicare After Tax Cuts Pass

Are the 2020 and 2021 tax cuts a bang for your buck?

The temporary fiscal interventions of 2020 and 2021, which the senators opposed, provide a much higher bang for the buck than the long-term budget busting trickle-down tax cuts of 2017, which many supported. Where do Social Security, Medicare and Medicaid fit into the picture?

How much of a tax cut will you get under Obamacare?

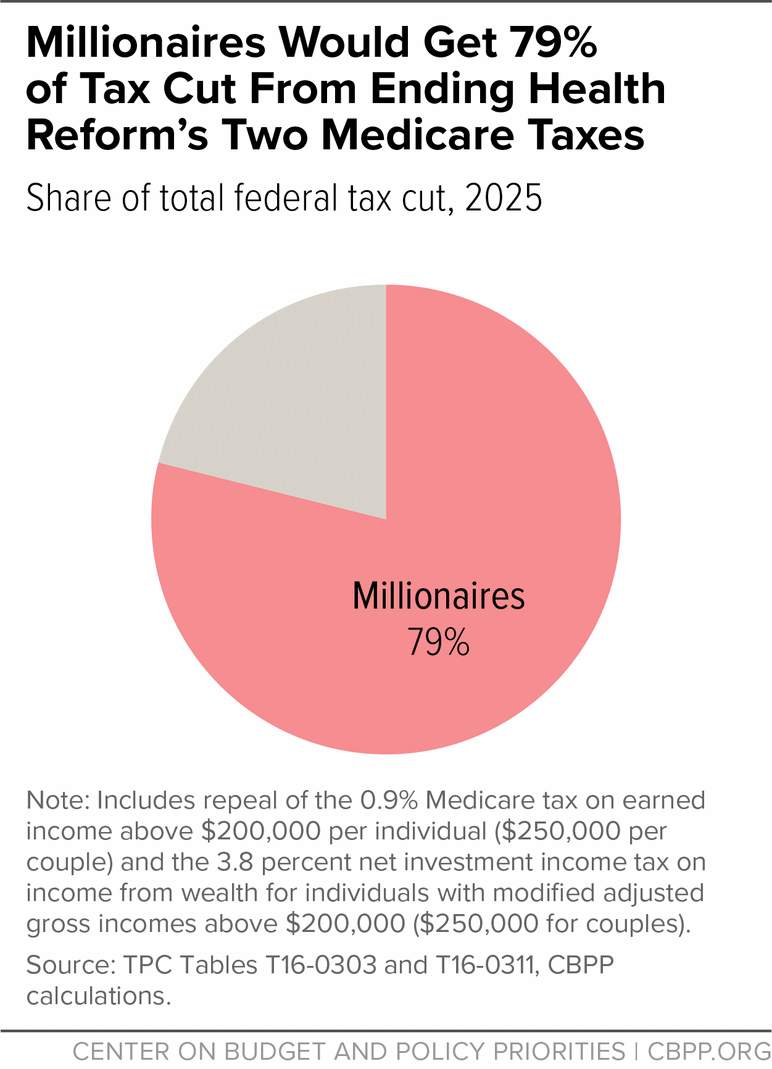

This is more than 75 percent of all the tax cuts in the plan. Households earning less than $100,000 are not even getting 10 percent of the total benefit.

Are Republicans being reckless by cutting taxes on the rich?

If it weren’t for the trillions of dollars wasted on the military and trillions spent on past failed wars such as Viet-Nam, Iraq, Afghanistan and others, plus the Bush Tax cuts, we wouldn’t have a 20 Trillion Dollar debt. Republicans are being RECKLESS by cutting taxes on the Rich and corporations when we have a 20 Trillion Dollar debt.

What is the step 3 of the tax cut?

Step 3: Cut important benefits for American families, like Medicare, Social Security, and education assistance, while doing nothing to make millionaires pay their fair share. Gives a massive tax cut to millionaires ― Millionaires get an average tax cut of $230,000 each year, once the plan is fully phased in 2027.

Which class pays for the tax cuts?

Middle class pays for the tax cuts for big corporations, wealthy partnerships, and rich estates ― Individual income taxes actually go up by $471 billion, while big corporations, wealthy passthroughs, and rich estates get their taxes cut by $2.9 trillion.

What is the Republican tax plan?

Republican Tax Plan: Tax Cuts for the Rich, Paid for by Everyone Else. This budget’s primary purpose is to provide reconciliation instructions for tax reform, but the Republican plan is not tax reform – it is a $2.4 trillion tax cut for the wealthy at the expense of everyone else. The inequities are startling.

What are the steps of the GOP?

This is step one of the GOP’s three steps to giving to the rich and making American families pay for it Republicans are trying to take away critical investments and benefits in a deceitful three-step process: Step 1: Cut taxes for the rich, and claim that economic growth will pay for it.

How to fix the deficit?

Step 2: Pretend to be shocked when the deficit explodes; insist that the only way to fix it is through more spending cuts.

When did trickle down economics fail?

History proves it: trickle-down economics failed in the 1980s, it failed under President George W. Bush, and it just failed spectacularly in Kansas. We need bipartisan tax reform, not partisan tax cuts ― Republicans plan to use reconciliation so that they can give a tax cut to the rich without any Democratic votes.

Will the middle class get taxed in 2027?

For every provision in the Republican plan which might help the middle class, Republicans take away other middle-class tax benefits, and many see their taxes go up. By 2027, nearly 30 percent of households earning $50k to $150k would see a tax increase, and 45 percent of all households with children face a tax increase.

Why did Matt Gaetz vote to allow Medicare cuts?

Matt Gaetz (R-FL) said in a statement that he voted to allow the cuts because the bill "fails to address the financial needs of our country now, in real time [... and] allows Medicare to circumvent the rules to add on to an already unbalanced budget.".

Why was the American Rescue Plan enacted without a Republican vote?

The legislation was necessary because the $1.9 trillion American Rescue Plan — enacted without a single Republican vote — relied on deficit spending. Under the 2010 Statutory Pay-As-You-Go Act, that relief package automatically triggered cuts to Medicare, farm subsidies, and other programs.

What was the effect of the 2010 Pay As You Go Act?

Under the 2010 Statutory Pay-As-You-Go Act, that relief package automatically triggered cuts to Medicare, farm subsidies, and other programs. According to an estimate by the Congressional Budget Office, this would have resulted in $36 billion in Medicare reductions and tens of billions in cuts to other things.

Did the GOP vote to let the cuts happen?

But rather than fix it, the GOP lawmakers on Tuesday voted to let the cuts happen.

Will Medicare be cut in 2031?

Tuesday's legislation will prevent those automatic Medicare cu ts for this year, but extend the deficit reduction provisions by an extra year — leaving them in place until the 2031 budget. On March 19, the House passed a bill by Budget Committee Chair John Yarmuth, to prevent all of the automatic budget cuts triggered by the law.

What programs are exempt from cuts?

Just to make this a little more complex, it's worth emphasizing that a whole bunch federal programs are exempt from these cuts, including Social Security and Veterans Affairs, but the cuts would affect priorities such as Medicare and student loans. (Vox explained that cuts to Medicare "are capped at 4 percent," which is where the $25 billion figure comes from.)

Will the federal deficit get bigger if the GOP tax plan passes?

The federal budget deficit, which Republicans used to pretend to care about, is poised to get vastly larger if the GOP tax plan passes. There's reason to believe, however, that Republicans will renew their interest in balancing the budget -- just as soon as they're done slashing tax rates on the wealthy and corporations.

Can Congress circumvent PayGo?

The catch is, Congress can simply vote to circumvent PAYGO and prevent unpopular cuts from taking effect, and Republicans are now saying this is what would happen to prevent Medicare cuts. But that would require approval from both chambers, including 60 votes in the Senate, where Democrats may not be in the mood to help Republicans clean up their own mess.

How much will Medicare be cut?

According to a Congressional Budget Office estimate, this would mean $36 billion in Medicare reductions as well as and tens of billions in cuts to other things — unless Congress votes to stop them.

Who opposed the $1.9 trillion Medicare?

House Minority Leader Kevin McCarthy and more than a dozen other House Republicans cited the potential automatic cuts to Medicare as a major reason they opposed the $1.9 trillion relief bill.

How much money will the American Rescue Plan provide?

The American Rescue Plan, passed last week without a single Republican vote, will provide $1.9 trillion to help curb the coronavirus pandemic and remedy the economic damage it has wrought. Advertisement.

What did the House of Representatives vote against?

They voted against a fix that would prevent automatic cuts to Medicare and other programs. The House of Representatives voted 246 to 175 on Friday to pass a technical fix that would prevent tens of billions in cuts to Medicare and other programs. 175 House Republicans opposed the effort.

How much was the Medicare tax cut in 2017?

In a letter to Democratic Whip Steny Hoyer of Maryland, the Congressional Budget Office confirmed that the House's nearly $1.5 trillion tax bill would indeed trigger these cuts, highlighted by a $25 billion annual reduction in Medicare spending, or 4 percent, the highest allowed under the law.

Why is Medicare being cut?

The Medicare cuts stem from the current iteration of PAYGO, a law that requires Congress to offset increases in mandatory spending or reductions in tax revenue so that they don't increase the deficit. If Congress violates the provision, the bill makes automatic cuts elsewhere unless the House and Senate vote to waive the requirement.

What is the GOP tax cut?

It's become a staple of Democratic attacks on the Republican tax bills in the last week: A vote for the GOP's $1.5 trillion tax cut is a vote to cut Medicare by $25 billion a year.

What would happen if the GOP tax plan was a disaster?

Democratic members have regularly raised the issue in speeches, interviews and on social media. Not only would the GOP tax plan blow a hole in the deficit, but as a result, it would trigger major cuts to programs that many Americans depend on, including a $25 billion cut to Medicare. This plan is a disaster for the middle class.

Will Medicare be reduced next year?

The claim is technically accurate, but the political reality is more complex. It is unlikely Medicare spending will actually be reduced next year as an immediate consequence of the tax bill — in fact, doing so could require Democrats to insist on cuts over Republican objections.

Who received the CBO letter?

Hoyer, the recipient of the CBO letter, hinted at a bipartisan solution in a statement even as he kept his focus on the current tax fight.

Can the House pass a tax bill?

They can’t do it in the tax bill itself for procedural reasons since the House and Senate are using a budget reconciliation bill to avoid a Democratic filibuster. But they could include the waiver in a separate bill that would need 60 votes to pass in the Senate. That would require significant Democratic support, which might be necessary on the House side as well, depending on which bill is the vehicle for the waiver.

Who is the Republican who slashed Social Security?

Robert Reich explains the longtime Republican plan to slash Social Security, Medicare and Medicaid.

How many people would lose health insurance?

Lawrence O’Donnell talks to Ezra Klein about the “catastrophic” CBO report – which estimates 22 million people would lose health care coverage – and GOP Rep. David Jolly shares his personal story of what happened when he found himself unemployed and uninsured. (June 26, 2017)

How much debt did the Bush administration have?

Under president Bush, Republicans ran up a huge debt of 10 Trillion Dollars. Now, they want to balance the budget on the backs of the poor and middle class, by cutting food stamps, social security, medicare and medicaid while refusing to cut military spending.

What do Paul Ryan and Republicans want to do?

Paul Ryan and Republicans want to give tax breaks to the rich and make the middle class & the poor pay for those tax breaks by increasing their taxes AND cutting Social Security, Medicare, and Medicaid.

Did the Senate GOP draft a secret health care bill?

Senate GOP drafted a secret, partisan health care bill behind closed doors, refusing any meaningful bipartisan input on the bill and refusing to hold any hearings on this legislation that would impact one sixth of our economy. Senate Democrats today urged the GOP to reverse course on this tactic and release to the public the legislation that would impact the health and bottom lines of millions of Americans. (Jun 13, 2017)

Will Trump cut Medicare?

Despite Trump’s promises NOT to cut Medicare, Medicaid & Social Security, that is exactly what he intends to do IF he is re-elected in 2020.

Did Democrats succeed in keeping the benefit cuts out of the short term fiscal cliff?

Democrats in Congress succeeded in keeping these devastating benefit cuts out of the short-term “fiscal cliff” deal. Unfortunately, important leverage was also lost. Washington’s well-financed anti-entitlement lobby continues to pretend that “shared sacrifice” means that if a millionaire loses a tax break (which he or she doesn’t need and America can’t afford) then the middle-class and poor must also pay more for or risk losing their health care benefits in Medicare and Medicaid. [Source: http://ncpssm.org/EntitledtoKnow/entryid/1962/Cutting-Medicare-Medicaid-Social-Security-in-the-113th-Congress]

When did the Cares Act expire?

The pandemic-related deficits are mainly temporary. Congress enacted the CARES Act in March 2020, which offered temporary relief mainly to families, unemployed workers and closed business. Most of its provisions expired in the second half of 2020. The newly elected Congress then enacted the American Rescue Plan in March 2021.

What are the immediate benefits of a tax increase?

The immediate benefits are less inequality and better health outcomes, both of which ultimately support stronger economic growth. Improving revenues for these programs by, for example, increasing payroll taxes on the top income earners will ultimately result in stronger growth and shrinking federal deficits.

What are the temporary fiscal interventions of 2020 and 2021?

The temporary fiscal interventions of 2020 and 2021, which the senators opposed, provide a much higher bang for the buck than the long-term budget busting trickle-down tax cuts of 2017, which many supported.

What was Donald Trump's signature legislative achievement?

Donald Trump’s signature legislative achievement was the Tac Cuts and Jobs Act of 2017. It showered trillions of dollars on highly profitable corporations and the richest American households that had seen the largest economic gains in the wake of the Great Recession from 2007 to 2009. Moreover, many provisions of this tax legislation are now permanent fixtures of the tax code and many temporary ones, such as tax cuts for high-income earners will likely become permanent, if past supply-side tax cuts are any indication.

Is the program cutting push for a balanced budget wrong?

The program-cutting push for a balanced budget ignores two key aspects of fiscal policy. First, it matters whether fiscal interactions create temporary or permanent deficits and second, it matters whether the spending or tax cuts underlying the deficits resulted in faster growth. On both counts, using the pandemic-related fiscal measures to justify cuts for Social Security, Medicare and Medicaid is wrong.

Does the Cares Act help the economy?

In contrast, the CARES Act offered much needed relief amid the worst unemployment crisis since the Great Depression, while it helped to stem the tide on declining economic growth. And experts predict that ARPA will boost economic growth to its highest rate in decades.

Did the Republican senators push for Medicare and Social Security?

Republican Senators Push Social Security, Medicare And Medicaid Cuts After Supporting Ineffective Tax Cuts. Opinions expressed by Forbes Contributors are their own. The economy is recovering from the depths of the pandemic in large part due to the massive relief packages that Congress passed in 2020 and 2021.