In South Carolina, applicants can qualify for Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

What are the income limits for Medicaid in South Carolina?

In South Carolina, applicants can qualify for Medicaid for the aged, blind and disabled with monthly incomes up to $1,063 (single) and $1,437 (married). Low-income Medicare beneficiaries can receive assistance with prescription drug costs in South Carolina.

How much does Medicare Part D cost in my state?

The lowest average Part D premiums were for plans in Mississippi, Kentucky and Delaware, with average premiums around $35 or $36 per month. West Virginia, Florida, South Carolina and Florida had Part D plans with the highest average premiums, around $46 per month. Learn more about Medicare Part D plans in your state.

How much do you pay for Medicare after deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible. If you have limited income and resources, you may be able to get help from your state to pay your premiums and other costs, like deductibles, coinsurance, and copays.

How much does Medicare Part A and Part B cost per month?

Wisconsin, Hawaii and Iowa had the plans with the lowest average monthly premiums, around $102 per month. The highest average monthly Medigap premiums were in New York, at $304.72 per month. How much do Medicare Part A and Part B cost in 2022? Part A and Part B of Medicare have standardized costs that are the same across every state.

At what income do you have to pay for Medicare?

Monthly Medicare Premiums for 2022Modified Adjusted Gross Income (MAGI)Part B monthly premium amountIndividuals with a MAGI above $170,000 and less than $500,000 Married couples with a MAGI above $340,000 and less than $750,000Standard premium + $374.205 more rows

How do you qualify for Medicare in SC?

Original Medicare is available to American citizens and permanent legal residents (of at least five continuous years) aged 65 or older, those who qualify by disability, people with permanent kidney failure (ESRD) and amyotrophic lateral sclerosis also known as Lou Gehrig's disease (ALS).

What is the lowest income to qualify for Medicare?

Qualifying Individual (QDWI) program an individual monthly income of $4,379 or less. an individual resources limit of $4,000. a married couple monthly income of $5,892 or less.

What is the maximum income to qualify for Medicaid in South Carolina?

Income Limit: Monthly Net Income Limit may not exceed $1,526 per month. The individual's resources must not exceed $2,000.

What is the highest income to qualify for Medicaid?

Federal Poverty Level thresholds to qualify for Medicaid The Federal Poverty Level is determined by the size of a family for the lower 48 states and the District of Columbia. For example, in 2022 it is $13,590 for a single adult person, $27,750 for a family of four and $46,630 for a family of eight.

Who is eligible for Medicare?

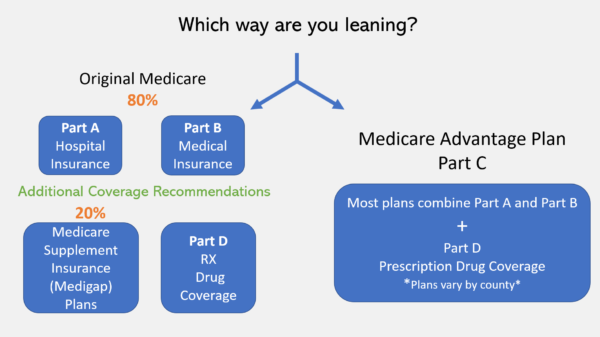

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

Can you be denied Medicare?

In all but four states, insurance companies can deny private Medigap insurance policies to seniors after their initial enrollment in Medicare because of a pre-existing medical condition, such as diabetes or heart disease, except under limited, qualifying circumstances, a Kaiser Family Foundation analysis finds.

What is the Medicare limit for 2021?

2021 updates. For 2021, an employee will pay: 6.2% Social Security tax on the first $142,800 of wages (maximum tax is $8,853.60 [6.2% of $142,800]), plus. 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus.

What qualifies you for Medicaid in SC?

Who is eligible for South Carolina Medicaid?Pregnant, or.Be responsible for a child 18 years of age or younger, or.Blind, or.Have a disability or a family member in your household with a disability, or.Be 65 years of age or older.

What is chip in SC?

Medicaid and the Children's Health Insurance Program (CHIP) provide no-cost or low-cost health coverage for eligible children in South Carolina. These programs provide health coverage for children so that they can get routine check-ups, immunizations and dental care to keep them healthy.

Do you automatically get Medicare with Social Security?

If you are already getting benefits from Social Security or the RRB, you will automatically get Part A and Part B starting on the first day of the month when you turn 65. If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.

Does South Carolina help with my Medicare premiums?

Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). In...

Who's eligible for Medicaid for the aged, blind and disabled in South Carolina?

Medicare covers a great number services – including hospitalization, physician services, and prescription drugs – but Original Medicare doesn’t cov...

Where can Medicare beneficiaries get help in South Carolina?

Insurance Counseling Assistance and Referrals for Elders (I-Care) You can receive free Medicare counseling by contacting the Insurance Counseling A...

Where can I apply for Medicaid in South Carolina?

South Carolina’s Medicaid program is overseen South Carolina Department of Health and Human Services (SCDHHS). You can apply for Medicaid ABD or an...

How much does a spouse need to keep for Medicaid in South Carolina?

Spousal impoverishment rules in South Carolina allow spouses who don’t have Medicaid to keep a Minimum Monthly Maintenance Needs Allowance that is between $2,155 and $3,216 per month. South Carolina requires Medicaid LTSS applicants to have a home equity interest of $595,000 or less.

What is Medicare Savings Program in South Carolina?

Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). In South Carolina, these programs pay for Medicare Part B premiums, Medicare Part A and B cost-sharing, and – in some cases – Part A premiums. Qualified Medicare Beneficiary (QMB): The income limit is ...

What is the income limit for a QMB in South Carolina?

Specified Low-Income Medicare Beneficiary (SLMB): The income limit is from QMB levels up to $1,276 a month if single and $1,724 a month if married. SLMB pays for Part B premiums. Qualified Individuals (QI): The income limit is from SLMB levels up to $1,436 a month ...

What is the income limit for qualified Medicare?

Qualified Medicare Beneficiary (QMB): The income limit is $1,063 a month if single and $1,437 a month if married. QMB pays for Part A and B cost sharing, Part B premiums, and – if a beneficiary owes them – it also pays their Part A premiums. All QMB enrollees also receive full Medicaid benefits in South Carolina.

What is the home equity limit for Medicaid in South Carolina?

In 2020, states can choose a home equity limit based on a federal minimum of $595,000 and maximum of $893,000. South Carolina uses the most restrictive home equity limit allowed – meaning ...

How much Medicaid can a spouse have in South Carolina in 2020?

These rules apply when one spouse needs Medicaid coverage for LTSS, and the other spouse doesn’t have Medicaid. In South Carolina in 2020, these “community spouses” are allowed to keep: An MMMNA that is between $2,155 and $3,216 per month. A Community Spouse Resource Allowance (CSRA) that is up to $128,640.

What age can you recover Medicaid?

A state’s Medicaid agency is required to recover what it paid for long-term care related medical expenses while an enrollee was 55 or older. States can choose to also pursue estate recovery for all other Medicaid costs.

Medically Indigent Assistance Program (MIAP)

Additionally, an applicant’s resources and assets cannot exceed the following thresholds:

Optional State Supplementation Program (OSS)

Monthly Net Income Limit may not exceed $1,456 per month. The individual’s resources must not exceed $2,000.

What is Medicaid in South Carolina?

Medicaid is a wide-ranging, jointly funded state and federal health care program for low-income individuals of all ages.

How much can a spouse retain on Medicaid in 2021?

For married couples, in 2021, the community spouse (the non-applicant spouse) can retain up to a maximum of $66,480 of the couple’s joint assets, as the chart indicates above. This, in Medicaid terminology, is called the Community Spouse Resource Allowance (CSRA).

How much is the community spouse allowance for 2021?

From January 2021 – December 2021, a non-applicant spouse may receive as much as $3,259.50 / month as a community spouse income allowance from his or her applicant spouse. This rule prevents non-applicant spouses from becoming impoverished.

How long does it take for a Medicaid application to be reviewed?

Doing so can violate Medicaid’s 5-year look-back rule, a period of 60 months from the date of application in which all past asset transfers are reviewed. If one is found to be in violation of this rule, a penalty period in which the applicant is ineligible for Medicaid benefits will result.

How to contact Healthy Connections in South Carolina?

For Medicaid related questions or for assistance, persons can contact Healthy Connections at 888-549-0820. Prior to submitting a Medicaid application for long-term care in South Carolina, it is imperative that seniors are certain that they meet all eligibility requirements, which are detailed above.

What is the South Carolina Community Choices Waiver?

South Carolina Community Choices Waiver – This wavier, also known as the Elderly and Disabled Waiver, provides assistance for elderly and disabled individuals who require a level of care consistent to that which is provided in a nursing home, but who wish to remain living in their own homes. A variety of benefits are available, including home modifications, adult day care, durable medical equipment, and assistance with Activities of Daily Living (ADLs), such as bathing, mobility, and eating.

Who can benefit from Medicaid planning?

Persons who have income and / or resources in excess of the limit (s) can benefit from Medicaid planning for the best chance of acceptance into a Medicaid program. Learn more about Medicaid planning. To learn more about the long-term care Medicaid application process, click here.

How old do you have to be to get Medicare in South Carolina?

To be eligible for Medicare South Carolina, you must: be age 65 or older. have a disability or a chronic illness, such as end stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS), regardless of age. be an American citizen or permanent resident of the United States.

What is Medicare Advantage in South Carolina?

Medicare Advantage in South Carolina. Medicare Advantage (Part C) plans provide all-in-one coverage from private health insurance agencies. Along with covering the costs of hospital and medical care, Advantage plans can be tailored to match your needs, such as by adding prescription drug, dental, or vision coverage.

How many people in South Carolina are on Medicare in 2021?

The Centers for Medicare & Medicaid Services (CMS) reported the following information on Medicare trends in South Carolina for the 2021 plan year: A total of 1,100,624 residents of South Carolina are enrolled in Medicare.

What is the number to get care in SC?

You can also call them at 800-868-9095. South Carolina Healthy Connections provides information on affordable insurance programs, and eligibility for assistance.

What insurance companies cover South Carolina?

These carriers offer unique plans to suit a variety of budgets and coverage needs: Aetna. Blue Cross and Blue Shield of South Carolina. Cigna.

Does South Carolina have Medigap?

These policies can help you pay for deductibles, coinsurance, and copayments. In South Carolina, many insurance companies offer Medigap plans. As of 2021, some of the companies offering Medigap plans across the state include: AARP – UnitedHealthcare. Aetna.

Is Medicare available in South Carolina in 2021?

South Carolina Medicare Plans in 2021. Whether you’re retiring next month or next year, it’s never too soon to learn about Medicare plans in South Carolina. Medicare is a federal health insurance program that provides health coverage to adults age 65 and older, as well as adults with disabilities.

Get help paying costs

Learn about programs that may help you save money on medical and drug costs.

Part A costs

Learn about Medicare Part A (hospital insurance) monthly premium and Part A late enrollment penalty.

Part B costs

How much Medicare Part B (medical insurance) costs, including Income Related Monthly Adjustment Amount (IRMAA) and late enrollment penalty.

Costs for Medicare health plans

Learn about what factors contribute to how much you pay out-of-pocket when you have a Medicare Advantage Plan (Part C).

Compare procedure costs

Compare national average prices for procedures done in both ambulatory surgical centers and hospital outpatient departments.

Ways to pay Part A & Part B premiums

Learn more about how you can pay for your Medicare Part A and/or Medicare Part B premiums. Find out what to do if your payment is late.

Costs at a glance

Medicare Part A, Part B, Part C, and Part D costs for monthly premiums, deductibles, penalties, copayments, and coinsurance.

Which states have the lowest Medicare premiums?

Florida, South Carolina, Nevada, Georgia and Arizona had the lowest weighted average monthly premiums, with all five states having weighted average plan premiums of $17 or less per month. The highest average monthly premiums were for Medicare Advantage plans in Massachusetts, North Dakota and South Dakota. *Medicare Advantage plans are not sold in ...

How to contact Medicare Advantage 2021?

New to Medicare? Compare Medicare plan costs in your area. Compare Plans. Or call. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent.

What is the second most popular Medicare plan?

Medigap Plan G is, in fact, the second-most popular Medigap plan. 17 percent of all Medigap beneficiaries are enrolled in Plan G. 2. The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018. 3.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What are the expenses that go away when you receive Medicaid at home?

When persons receive Medicaid services at home or “in the community” meaning not in a nursing home through a Medicaid waiver, they still have expenses that must be paid. Rent, mortgages, food and utilities are all expenses that go away when one is in a nursing home but persist when one receives Medicaid at home.

How long does it take to get a medicaid test?

A free, non-binding Medicaid eligibility test is available here. This test takes approximately 3 minutes to complete. Readers should be aware the maximum income limits change dependent on the marital status of the applicant, whether a spouse is also applying for Medicaid and the type of Medicaid for which they are applying.

Is income the only eligibility factor for Medicaid?

Medicaid Eligibility Income Chart by State – Updated Mar. 2021. The table below shows Medicaid’s monthly income limits by state for seniors. However, income is not the only eligibility factor for Medicaid long term care, there are asset limits and level of care requirements.

Administration

- In South Carolina, Medicaid is called Healthy Connections and is administered by the South Carolina Department of Health and Human Services (SCDHHS).

Summary

- Medicaid is a wide-ranging, jointly funded state and federal health care program for low-income individuals of all ages. However, this page is focused on Medicaid eligibility for South Carolina elderly residents, aged 65 and over, and specifically for long term care, whether that be at home, in a nursing home, or in an assisted living facility.

Healthcare

- There are several different Medicaid long-term care programs for which South Carolina seniors may be eligible. These programs have slightly different financial and medical eligibility requirements, as well as differing benefits. Further complicating eligibility are the facts that the requirements vary with marital status and that South Carolina offers multiple pathways towards …

Programs

- 1) Institutional / Nursing Home Medicaid this is an entitlement program, meaning anyone who is eligible will receive assistance, and is provided only in nursing home facilities. 2) Medicaid Waivers / Home and Community Based Services (HCBS) these programs limit the number of participants. Therefore, wait lists may exist. Services are provided at home, adult day care, or in …

Components

- Countable assets include cash, stocks, bonds, investments, credit union, savings, and checking accounts, and real estate in which one does not reside. However, for the purposes of Medicaid eligibility, there are many assets that are considered exempt (non-countable). Exemptions include personal belongings, such as clothing and jewelry, household furnishings, one vehicle, burial fun…

Risks

- Please make note, its important that one does not give away assets or sell them for under fair market value in an attempt to meet South Carolinas Medicaid asset limit. Doing so can violate Medicaids 5-year look-back rule, a period of 60 months from the date of application in which all past asset transfers are reviewed. If one is found to be in violation of this rule, a penalty period i…

Qualification

- For South Carolina elderly residents, aged 65 and over, who do not meet the eligibility requirements in the table above, there are other ways to qualify for Medicaid.

Definition

- 1) Qualified Income Trusts (QITs) QITs, also referred to as Miller Trusts, are special trusts for Medicaid applicants who are over the income limit (also known as the Medicaid Cap in South Carolina), but still cannot afford to pay for their long-term care. (For South Carolina Medicaid purposes, a Miller Trust is often simply called an Income Trust.) This type of trust offers a way f…

Example

- Unfortunately, Income Only Trusts do not assist one with extra assets in qualifying for Medicaid. Said another way, if one meets the income requirements for Medicaid eligibility, but not the asset requirement, the above option cannot assist one in reducing their extra assets. However, one can spend down assets by spending excess assets on ones that are non-countable, such as home m…

Issues

- 2) Medicaid Planning the majority of persons considering Medicaid are over-income or over-asset or both, but still cannot afford their cost of care. For persons in this situation, Medicaid planning exists. By working with a Medicaid planning professional, families can employ a variety of strategies to help them become Medicaid eligible. Read more or connect with a Medicaid planner.

Benefits

- 1. South Carolina Community Choices Waiver Provides assistance for elderly and disabled individuals who require a level of care consistent to that which is provided in a nursing home, but who wish to remain living in their own homes. A variety of benefits are available, including home modifications, adult day care, durable medical equipment, and assistance with Activities of Dail…