For a generic drug, you will pay $25 and your Part D plan will pay $75. Prescription medications can be costly, but don't let that intimidate you. Know what your Medicare Part D plan covers and how much you can expect to pay. With this information in hand, you can budget for the year ahead and keep any surprises at bay.

Full Answer

What is the cheapest Medicare Part D?

52 rows · Nov 18, 2021 · Medicare Part D provides coverage for prescription medications. The average Part D plan premium in 2022 is $47.59 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans …

What is the average cost of Medicare Part D?

How much is the Part D penalty? You’ll pay an extra 1% for each month (that’s 12% a year) you could have signed up for Part D, but didn’t. The penalty is added to your monthly premium. It’s not a one-time late fee — you’ll pay the penalty each month for as long as you have Part D coverage (even if you change plans).

What are the requirements for Medicare Part D?

If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you’re married and file jointly), you’ll pay an extra ...

Who is eligible for Medicare Part D?

Dec 21, 2021 · For each full month after eligibility that you don’t have prescription drug coverage, you’ll typically have to pay 1% of the base premium ($33.37 in 2022), and you’ll have to pay that for as long as you have Medicare prescription drug coverage. 8 The penalty amount may change from year to year. What Is Your Deductible?

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What is the Part D premium for 2021?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.Nov 6, 2020

What is the cost of Part D for 2022?

The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.Nov 2, 2021

What is Medicare Part D 2022 premium?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.Dec 31, 2021

How much is the Medicare Part D deductible for 2021?

$445Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the cheapest Medicare Part D plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

What is the max out of pocket for Medicare Part D?

A Medicare Part D deductible is the amount you must pay every year before your plan begins to pay. Medicare requires that Medicare Part D deductibles cannot exceed $445 in 2021, but Medicare Part D plans may have deductibles lower than this. Some Medicare Part D plans don't have deductibles.

Do you have to pay for Medicare Part D?

How much does Part D cost? Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

How does Part D Medicare work?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications.

Are Part D premiums based on income?

Part D monthly premium The chart below shows your estimated drug plan monthly premium based on your income. If your income is above a certain limit, you'll pay an income-related monthly adjustment amount in addition to your plan premium.

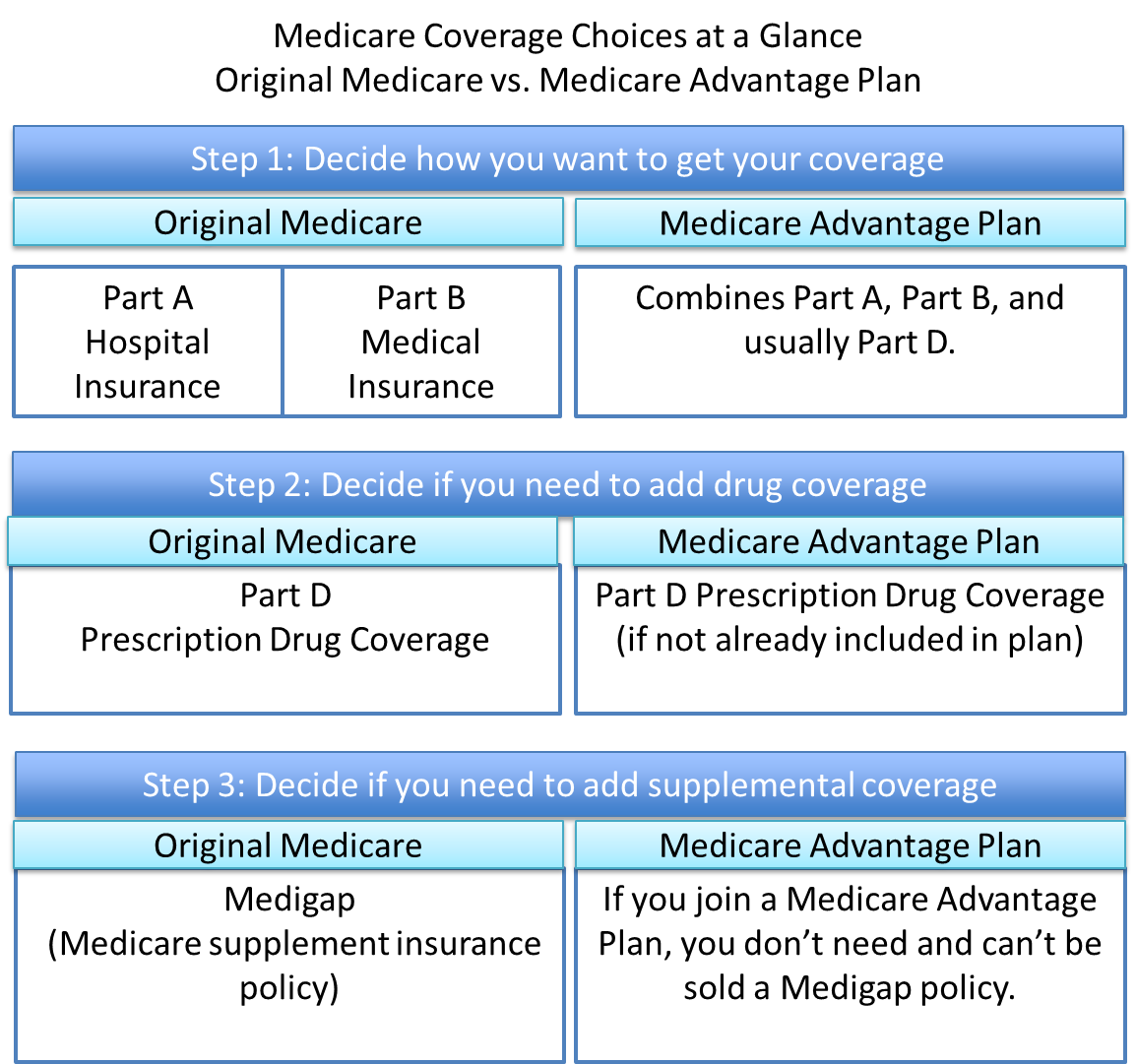

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Does Medicare cover emergency services?

In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for under Original Medicare (your Cost Plan pays for emergency services or urgently needed services ). with drug coverage, the monthly premium may include an amount for drug coverage.

What is Medicare Part D?

Since 2006, Americans have had the option to purchase Medicare Part D, an insurance plan that helps cover drug costs for those with Medicare. 1. Unlike Medicare Part A and Part B, you purchase Part D from private insurers or get it as part of your Medicare Advantage Plan. 2 The average Medicare beneficiary had 30 prescription drug plans ...

How much is the deductible for Medicare 2021?

Your deductible varies based on your plan but cannot exceed $445 in 2021, up from $435 in 2020. 9 Some Medicare drug plans don’t have any deductible at all. Before choosing a low- or no-deductible plan, it’s important to calculate the total cost of your plan, including premiums and copays or coinsurance.

What are the tiers of drugs?

What Are Drug Tiers? Drug plans publish a formulary, or list of covered drugs. Often, they separate their formularies into “tiers,” with Tier 1 drugs (usually generic drugs) costing the least and Tier 4 drugs (non-preferred, brand name prescription drugs) costing the most.

How much is extra help?

If you have limited resources, you can apply for “Extra Help,” worth about $5,000 from the Social Security Administration. 12 To qualify, you’ll need to have a net worth (excluding your home and personal possessions) of less than $14,610 and an income of less than $19,140.

Who is Beth Braverman?

Beth Braverman is a full-time freelance journalist covering personal finance, healthcare, and careers. A former reporter for MONEY magazine, her work has appeared in dozens of publications, including CNBC.com, CNNMoney.com, and WebMD. ×.

What is Medicare Part D?

1 The law created what we now know of as Medicare Part D, an optional part of Medicare that provides prescription drug coverage. Part D plans are run by private insurance companies, not the government.

What is a Part D premium?

Part D Premiums. A premium is the amount of money you spend every month to have access to a health plan. The government sets no formal restrictions on premium rates and prices may change every year. 3 Plans with extended coverage will cost more than basic-coverage plans.

Who is Lisa Sullivan?

Lisa Sullivan, MS, is a nutritionist and a corporate health and wellness educator with nearly 20 years of experience in the healthcare industry. Learn about our editorial process. Lisa Sullivan, MS. Updated on November 09, 2020. Before 2006, Medicare did not cover prescription medications, at least not most of them.

What is the donut hole in Medicare?

In fact, it has a big hole in it. The so-called donut hole is a coverage gap that occurs after you and Medicare have spent a certain amount of money on your prescription medications.

What is the maximum deductible for 2021?

A deductible is the amount of money you spend out-of-pocket before your prescription drug benefits begin. Your plan may or may not have a deductible. The maximum deductible a plan can charge for 2021 is set at $445, 2 an increase of $10 from 2020.

When will the donut hole close?

The donut hole closed in 2020 thanks to the Affordable Care Act (aka Obamacare). Starting in 2013, regulations in the Affordable Care Act gradually decreased how much you would be forced to spend out-of-pocket on your medications. 5 Starting in 2020, you will not be allowed to pay more than 25% of the retail costs for your drugs.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

Does Medicare Part A require coinsurance?

Part A also requires coinsurance for hospice care and skilled nursing facility care. Part A hospice care coinsurance or copayment. Medicare Part A requires a copayment for prescription drugs used during hospice care. You might also be charged a 5 percent coinsurance for inpatient respite care costs.

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much is coinsurance for skilled nursing in 2021?

Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay. Skilled nursing care is based on benefit periods like inpatient hospital stays.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.