For instance, some individuals with social security benefits may pay a little less, and some Medicare Advantage plans pay all or part of Part B premiums. The average premium for a Medicare Advantage plan in 2021 was $21.22 per month. For 2022 it will be $19 per month.

How much do Medicare Advantage plans cost?

50 rows · Feb 15, 2022 · A closer look at 2021 data also reveals: Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug (MAPD) plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

What is the average cost of a Medicare supplement insurance plan?

Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium (and the Part A premium if you don't have premium-free Part A). Whether the plan pays any of your monthly Medicare Part B (Medical Insurance) premium. Some plans will help pay all or part of your Part B premium.

Are Medicare Advantage premiums deductible from my social security check?

Apr 08, 2022 · Medicare Advantage Plan Premiums. According to the Kaiser Family Foundation, a non-profit organization that focuses on health issues in the U.S., 60% of Medicare Advantage enrollees pay only their Part B premium each month. Another 17% pay $20 to $49 a month in addition to Part B, while 12% pay $50 to $99 monthly.

How much does Medicare Advantage cost in 2022?

The standard Part B monthly premium for 2022 is $158.50. The Centers for Medicare & Medicaid Services estimates the average Medicare Advantage monthly premium will be $19 in 2022. That’s down from the $21.22 average monthly premium in 2021.

What is the average maximum out of pocket cost for a Medicare Advantage plan?

Is Medicare Advantage premium deducted from Social Security?

Do Medicare Advantage plans pay the 20 %?

What is the most popular Medicare Advantage plan?

How much does Medicare take out of Social Security in 2021?

Do you still pay Medicare Part B with an Advantage plan?

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

What are the negatives of a Medicare Advantage plan?

Can you switch back and forth between Medicare and Medicare Advantage?

What are 4 types of Medicare Advantage plans?

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs)

Who is the largest Medicare Advantage provider?

What Medicare plans cover dental?

What is Medicare Advantage Plan?

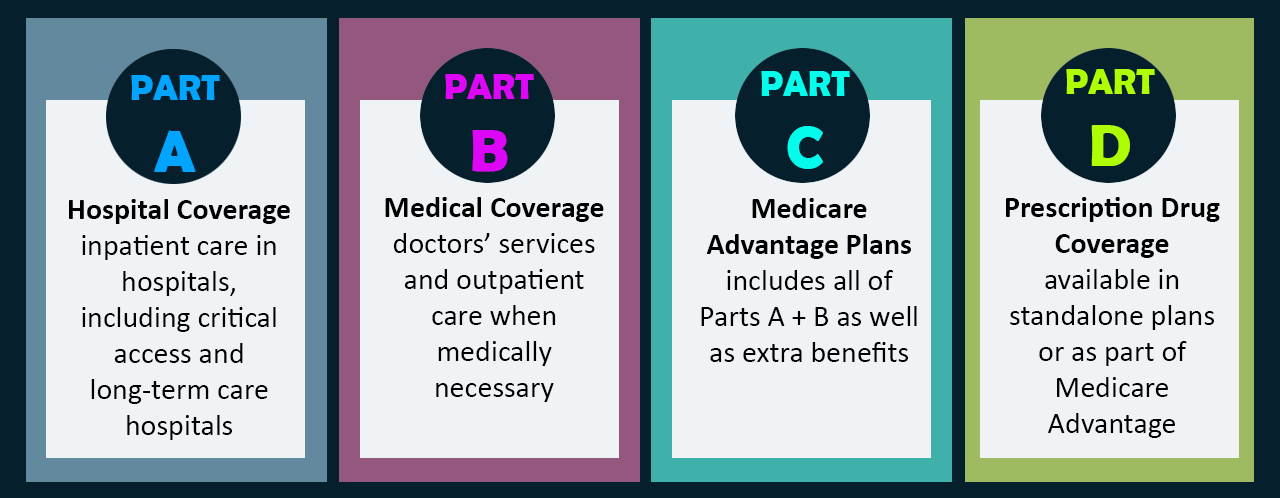

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium. Whether the plan pays any of your monthly.

What is the difference between Medicare and Original Medicare?

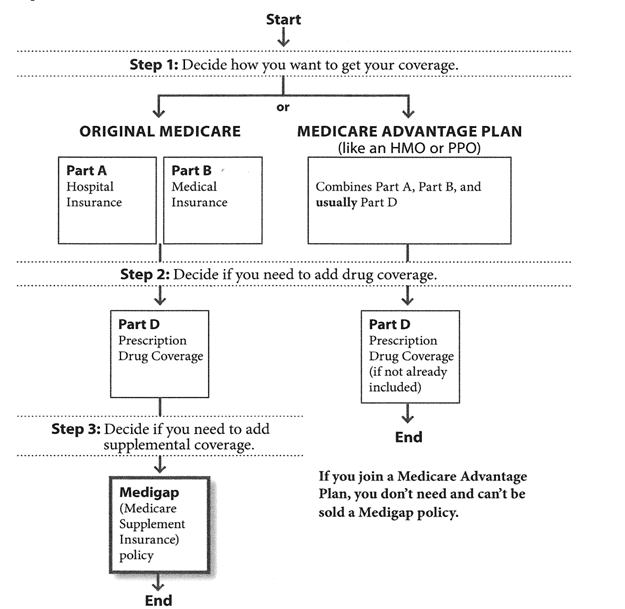

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). .

What is a medicaid?

Whether you have. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. and if the plan charges for it. The plan's yearly limit on your out-of-pocket costs for all medical services. Whether you have.

Who accepts Medicare?

who accepts. assignment. An agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance. if: You're in a PPO, PFFS, or MSA plan.

What is out of network Medicare?

out-of-network. A benefit that may be provided by your Medicare Advantage plan. Generally, this benefit gives you the choice to get plan services from outside of the plan's network of health care providers. In some cases, your out-of-pocket costs may be higher for an out-of-network benefit. .

How much does Medicare Advantage pay?

According to the Kaiser Family Foundation, a non-profit organization that focuses on health issues in the U.S., 60% of Medicare Advantage enrollees pay only their Part B premium each month. Another 17% pay $20-49 a month in addition to Part B, while 12% pay $50-99 monthly.

What is Medicare Advantage?

Medicare Advantage plans, also called Medicare Part C, are offered by private insurers working in conjunction with the U.S. Centers for Medicare and Medicaid Services. They are required to offer at least the same coverage as Original Medicare, which consists of Part A (hospital and skilled nursing care, hospice, and home health care) and Part B (many outpatient services, as well as ambulance, clinical research, and mental health costs). You may also purchase optional Part D, prescription drug coverage, separate from your Original Medicare plan.

What are the four types of Medicare benefits?

The four plan types are: Qualified Medicare Beneficiary Program, if your individual income is $1,084 or less per month and you have less than $7,860 in resources (resources include money in checking or savings account, stocks, and bonds)..

How many types of Medicare are there?

There are four different types of plan, and you may qualify if you have low monthly income and/or are a working disabled person under the age of 65. These plans generally pay for Medicare Part A and B premiums, and may help with deductibles, coinsurance, and copayments. The four plan types are:

What is a coinsurance deductible?

There’s one more term you should be aware of, and that’s your deductible. A deductible is the amount that you have to pay before any Medicare payments kick in.

Does Medicare Advantage cost more?

In some cases, you may find that Medicare Advantage offers you more services and coverage for less money than Original Medicare.

Do you have to pay out of pocket for Medicare Advantage?

There is a silver lining, though: Unlike Original Medicare, Medicare Advantage plans are required to have an annual out-of-pocket maximum. Once you’ve paid that maximum amount, you should have 100% coverage for your health care costs for the rest of the year.

Medicare Advantage Introduction

One of the most common questions customer ask is: “How much do Medicare Advantage plans cost?” For individuals who want to control their health care expenses, Medicare Advantage plans can offer a wide range of benefits and more peace of mind with maximum out-of-pocket limits.

What Is the Cost of Medicare Advantage Plans?

The exact costs of Medicare Advantage plans (also called Part C) depend on several factors because not all plans are the same. Private insurance companies set their own amounts for monthly premiums, deductibles, coinsurance, and copayments. Compare plans to find which one best fits your budget and lifestyle.

What Is the Average Cost of Medicare Advantage Plan Premiums?

Monthly premiums can range from $0 to over $100. Also, some Medicare Advantage plans pay all or part of Part B’s premium. This affects your overall costs. The standard Part B monthly premium for 2022 is $158.50.

Medicare Advantage Plan Annual Deductibles

Annual deductibles are the amount you must spend out-of-pocket for care and drugs before the insurer starts to pay for treatments.

What Affects Medicare Advantage Plan Costs?

Medicare Advantage costs can be affected by how often you use certain types of healthcare services and where you use them.

Determining Your Costs Can Get Complicated

When you’re first determining your own costs for Medicare Advantage, there can be a large number of personal needs and situations to factor in. That’s why, in addition to your own research, it’s a good idea to speak to a licensed insurance agent. They can help you compare plans in your area at no additional cost.

What is the monthly income limit for a qualified Medicare beneficiary?

The four kinds of MSPs include: Qualified Medicare Beneficiary Program: The monthly income limit to enroll is $1,084 for an individual and $1,457 for a married couple.

How much will Medicare cost in 2022?

On average, the monthly premiums for Medicare Advantage in 2022 are $170.10 for Medicare Part B and $19 for an Advantage plan.

How often do Medicare premiums come out of Social Security?

For people receiving social security retirement benefits, Medicare Part B premiums will come out of their monthly check. Those who do not receive benefits may pay their premiums every 3 months by check, credit card, or automatic debit from a checking account.

What is Medicare's tool?

Medicare has a tool that a person may use to compare the yearly cost of Original Medicare with that of Medicare Advantage plans.

How often does Medicare change the cost?

Medicare may change the costs for each plan annually.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs. The amounts of the above payments vary with both the state and the plan.

Who pays Medicare Part B?

A person who has enrolled in Medicare Advantage must pay Medicare Part B monthly premiums in addition to premiums for their Advantage plan.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

How much is the Part B premium for 2021?

In 2021, the Part B premium is $148.50. Keep in mind that the Part B premium is based on income, so while most people will pay $148.50, some people will pay more.

Is Medicare Part A free?

Medicare Part A, which covers hospitalization, is usually free for anyone who is eligible for Social Security, even if they have not claimed benefits yet.

Does Medicare cover outpatient prescriptions?

Neither Medigap nor Original Medicare will cover outpatient prescription drugs, so enrollees can also purchase Part D prescription drug coverage, which would be another separate policy with a separate monthly premium.

Can Medicare premiums be deducted from Social Security?

About half of Medicare Advantage plans have $0 premiums, but if you do have a premium, you can deduct it right from your Social Security check. This is your choice, as it is not required to come from the Social Security check.

Does Medicare Part B have premiums?

Typically, only Medicare Part B. Part A does not usually have premiums. If you wish to add a Part D drug plan, there may be extra payments that would require money that could come from your Social Security benefits.

Does Medigap cover prescriptions?

Note: Some Medigap plans that were purchased prior to 2006 included limited prescription drug coverage, and some enrollees have maintained these plans. If you have one of those plans, please let us know and we’ll adjust accordingly.

How much does Medicare Advantage cost?

The average premium for a Medicare Part C plan (also known as Medicare Advantage) was $35.55 per month in 2018. 1. Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live.

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.