As of Mar 29, 2022, the average annual pay for a Medicare Consultant in the United States is $65,406 a year. Just in case you need a simple salary calculator, that works out to be approximately $31.45 an hour. This is the equivalent of $1,258/week or $5,450/month.

Full Answer

How much should you charge as a consultant?

What does Medicare cost? Generally, you pay a monthly premium for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance ( Medigap ) policy, or you join a Medicare Advantage Plan .

How can I See and compare costs for my Medicare plan?

How much does a Medicare Consultant make? As of Mar 29, 2022, the average annual pay for a Medicare Consultant in the United States is $65,406 a year. Just in case you need a simple salary calculator, that works out to be approximately $31.45 an hour. This is the equivalent of $1,258/week or $5,450/month.

How much does Medicare Part C pay for doctors?

If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. Part A hospital inpatient deductible and coinsurance: You pay: $1,556 deductible for each benefit period

Is it hard to price your consulting services?

Dec 13, 2021 · All years of Experience 0-1 Years 1-3 Years 4-6 Years 7-9 Years 10-14 Years 15+ Years $107,556 / yr Total Pay Confident $76,064 / yr Base Pay $31,493 / yr Additional Pay $107,556 / yr $57K $208K $33K$383K Most Likely Range Possible Range The estimated total pay for a Medicare Consultant is $107,556 per year in the United States.

What is the commission on a Medicare supplement policy?

A recent report indicates that first-year commissions for enrollments in Medigap are approximately 20 percent of annual premiums, but they can vary based on the state or plan type. The commission for subsequent years (i.e., the renewal commission) is set at 10 percent of the premium.Oct 12, 2021

Is selling Medicare lucrative?

Is Selling Medicare Lucrative? In short, yes. The average Medicare Advantage policy pays around $287 a year in commission if the purchase replaces an existing plan. However, you can get approximately double that — $573— if you write up a new Medicare Advantage plan for someone who hasn't had one before.Feb 22, 2022

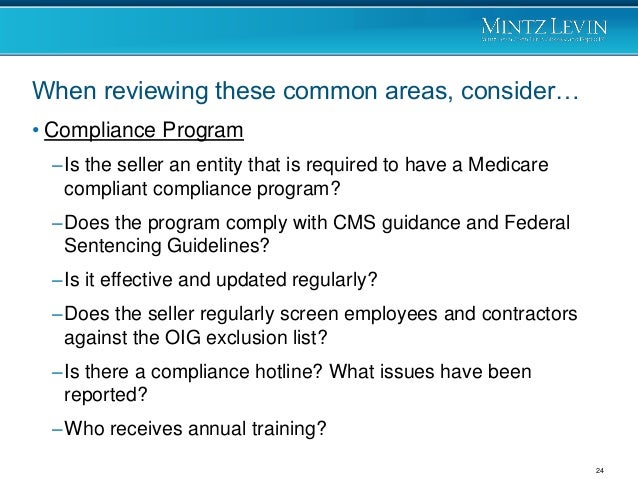

What is Medicare compliance?

The Medicare Compliance Program is specifically designed to prevent, detect, and correct noncompliance as well as fraud, waste, and abuse.

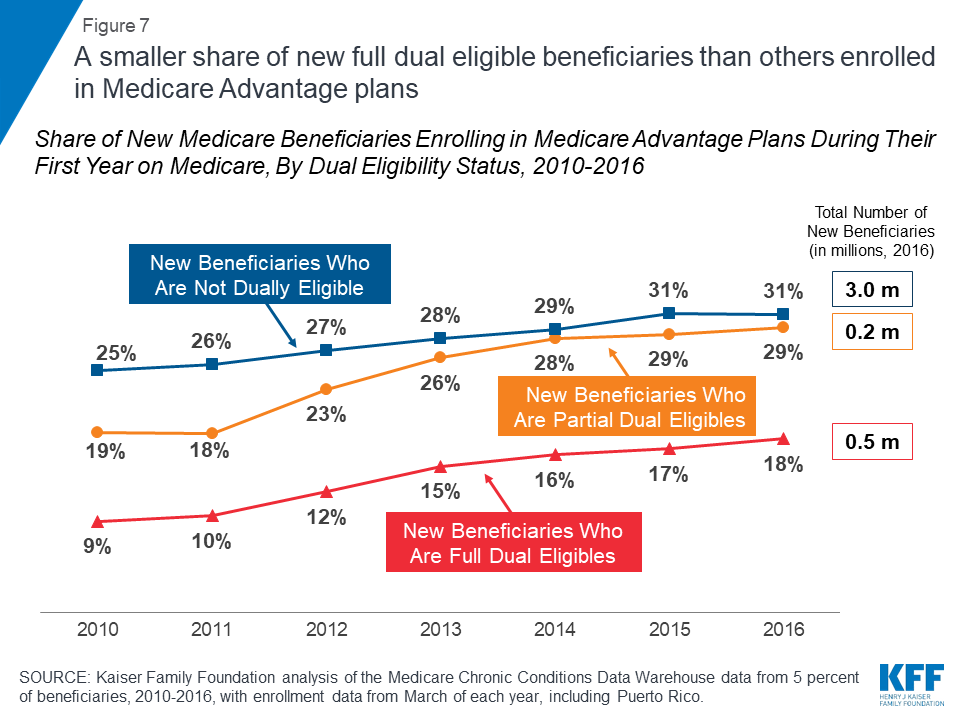

Is Medicare Advantage an FFS?

Almost one-third of the Medicare population, approximately 19 million beneficiaries, receive their benefits through a Medicare Advantage (MA) plan. MA plans are private plans that provide Medicare benefits as an alternative to traditional Medicare, also known as Medicare fee-for-service (FFS).

Is being a Medicare agent worth it?

Medicare agents have significant earning potential and a promising future of stable career growth – but it's not just about the money. Medicare agents also get to help others while taking control of their own careers. For the right person, Medicare sales can be a very rewarding and lucrative career.Jul 1, 2020

Which type of insurance agents make the most money?

Overview of the Insurance Field While there are many kinds of insurance (ranging from auto insurance to health insurance), the most lucrative career in the insurance field is for those selling life insurance.

How do I ensure Medicare compliance?

Develop standards of conduct. ... Establish a method of oversight. ... Conduct staff training. ... Create lines of communication. ... Perform auditing and monitoring functions. ... Enforce standards and apply discipline. ... Respond appropriately to detected offenses.

Does Medicare require a compliance program?

Compliance Program Requirement The Centers for Medicare & Medicaid Services (CMS) requires Sponsors to implement and maintain an effective compliance program for its Medicare Parts C and D plans.

What are the 7 elements of a compliance program?

Seven Elements of an Effective Compliance ProgramImplementing written policies and procedures. ... Designating a compliance officer and compliance committee. ... Conducting effective training and education. ... Developing effective lines of communication. ... Conducting internal monitoring and auditing.More items...

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Is Medicare Part B fee-for-service?

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

Does Medicare still use fee-for-service?

Since Medicare was created in 1965, the program has changed with the times in the ways physicians and APRNs get paid. Today, Medicare pays 1) under fee-for-service, also known as Original Medicare; or 2) through Medicare Advantage plans.

How much does a Medicare Consultant make?

The average annual pay for a Medicare Consultant in Chicago is $65,406 an year. Just in case you need a simple salary calculator, that works out to...

What are Top 10 Highest Paying Cities for Medicare Consultant Jobs?

San Francisco, CA($80,293)Fremont, CA($77,077)San Jose, CA($75,289)Oakland, CA($74,465)Tanaina, AK($74,258)Wasilla, AK($74,257)Sunnyvale, CA($73,33...

What are Top 5 Best Paying Related Medicare Consultant Jobs in the U.S.?

Medicare Set Aside($178,004)Medicare Set Aside Nurse($165,052)Medicare Set Aside Specialist($162,018)VP Medicare($152,993)Medicare Compliance Offic...

How much does a Medicare Consultant make?

As of Aug 25, 2021, the average annual pay for a Medicare Consultant in the United States is $65,406 a year.

What are Top 10 Highest Paying Cities for Medicare Consultant Jobs

We’ve identified 10 cities where the typical salary for a Medicare Consultant job is above the national average. Topping the list is San Francisco, CA, with Fremont, CA and San Jose, CA close behind in the second and third positions.

What are Top 5 Best Paying Related Medicare Consultant Jobs in the U.S

We found at least five jobs related to the Medicare Consultant job category that pay more per year than a typical Medicare Consultant salary. Top examples of these roles include: Medicare Set Aside Specialist, VP Medicare, and Medicare Compliance Officer.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is agent broker compensation?

Below is a link to a file containing the amounts that companies pay independent agents/brokers to sell their Medicare drug and health plans. Companies that contract with Medicare to provide health care coverage or prescription drugs typically use agents/brokers to sell their Medicare plans to Medicare beneficiaries.

Do brokers have to be licensed in the state they do business in?

Agents/brokers must be licensed in the State in which they do business, annually complete training and pass a test on their knowledge of Medicare and health and prescription drug plans, and follow all Medicare marketing rules.

How many hours a week do consultants work?

For work hours per week, enter “20.”. As a beginner consultant, you’re typically not working 40-hour weeks. You’ll spend just as much time winning projects as you do delivering them. For work weeks per year, enter “48” (or however many weeks you want to work, subtracting the number of weeks you want to take off).

How to calculate hourly rate?

The Hourly Method Formula For Setting Your Hourly Rate. Step 1. Open up Google and search for the average salary for your position. Write that number down. Example: “senior marketing manager average salary” = $98K. Step 2. Enter the average salary in a salary to hourly converter. For work hours per week, enter “20.”.

How much is $98,000 an hour?

Example: A salary of $98,000 equates to a monthly pay of $8167, weekly pay of $2042, and an hourly wage of $102. $102 = $100 per hour. This is your starting hourly fee. If you feel like it is too low, raise it.

Do consultants charge by the hour?

Consultants are notorious for undercharging — especially when they charge by the hour. Every time you successfully complete a project, increase your hourly rate by $25. Eventually, you’ll get to the point where charging by the hour is no longer the best method for you or your clients.

How to prevent hospital readmissions?

The most effective step to prevent hospital readmissions is to help patients understand what aspects of their care they can control. Click To Tweet. Encouraging patients to take ownership of their health can empower them to overcome some of the obstacles they face following their discharge to home.

Why is communication important in discharge?

Effective communication is essential to provide the best care for patients once they leave your healthcare facility.

What to do if client accepts your rates as is?

If a client accepts your rates as is, great! But, sometimes that doesn’t happen, and that’s okay. Guide the conversation into negotiation instead of turning down the project right away. And if you foresee further business with the client, try to be flexible.

What to say when you aren't willing to accept a client's rate?

If you aren’t willing to accept their rate or feel that the client wouldn’t be a good fit, it’s OK to say “no”. While you may be pitching the client, you are just as valuable to them as they are to you.

What happens if you set your rates too high?

However, if you set your rates too high, you may alienate yourself from the client and outprice yourself out of the project. Clients may perceive you as the high-end of the consulting or freelance market, and they may decide to settle for a less experienced but more affordable alternative.

What is retainer fee?

Working “on retainer” means you receive a monthly fee for working a certain number of hours or performing routine tasks. Retainer fees can be wonderful for your consulting business as it’s income that you can rely on and plan for (a rare commodity in the freelancing world).

Who is Nathan Chan?

Nathan Chan holds a Master of Business from Victoria University and is widely respected as one of the brightest minds of his generation. An expert at entrepreneurship, he started Foundr -- a global media and education company that reaches out to millions of people across the world. In the last seven years, Nathan has interviewed some of the most successful entrepreneurs of our time such as Richard Branson, Arianna Huffington, Mark Cuban, and Tim Ferriss. He currently leads the team at Foundr as their Chief Executive Officer.

Is rate negotiation a question mark?

The truth is, rate negotiations is one big question mark. It’s likely that both parties are unsure what to expect and how to proceed, and it shows extreme professionalism for you to lead with confidence and patience.