Full Answer

How much does Medicare pay for prescription drugs?

from Medicare to pay the prescription costs, premiums, deductibles, and coinsurance of Medicare prescription drug coverage. In 2019, prescription costs are no more than $3.40 for each generic/$8.50 for each brand-name covered drug for those enrolled in the program.

What are the costs of Medicare Part D prescription drug coverage?

Q: What are the costs of Medicare Part D prescription drug coverage? A: When you enroll in Medicare Part D (prescription drug plan) coverage, you will – depending on your plan – likely pay a monthly premium, an annual deductible, and coinsurance (a percentage of the cost of your prescription drugs) or copays.

How much does Medicare Part a cost?

Medicare costs at a glance. Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $437 each month. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240.

How do I estimate my Prescription Drug costs?

Estimate Your Drug Costs | AARP Medicare Plans Use our Drug Cost Estimator tool to help you estimate the cost of your prescription drugs based on drug type, dosage and frequency. Use our Drug Cost Estimator tool to help you estimate the cost of your prescription drugs based on drug type, dosage and frequency. Skip to main content

How much is the prescription part of Medicare?

The national base beneficiary premium for Part D plans is $33.37 per month in 2022, according to the Centers for Medicare & Medicaid Services, which calculates this number in part by using the national average monthly bid amount submitted by private insurers.

Are prescriptions cheaper on Medicare?

California law enables Medicare recipients to obtain their prescription drugs at a cost no higher than the Medi-Cal price for those drugs.

How much is Medicare Part D every month?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Why are my prescriptions so expensive with Medicare?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive.

Do I have to pay for Medicare Part D?

You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums. If you don't pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back.

Does Medicare Part B pay for prescriptions?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. covers a limited number of outpatient prescription drugs under certain conditions. A part of a hospital where you get outpatient services, like an emergency department, observation unit, surgery center, or pain clinic.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

Who has the cheapest Part D drug plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

What drugs are covered by Medicare Part B?

Drugs that are covered by Medicare Part B include the following.Certain Vaccines. ... Drugs That Are Used With Durable Medical Equipment. ... Certain Antigens. ... Injectable Osteoporosis Drugs. ... Erythropoiesis-Stimulating Agents. ... Oral Drugs for ESRD. ... Blood Clotting Factors. ... Immunosuppressive Drugs.More items...•

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How to lower prescription costs?

To lower your prescription drug costs, you can: Ask about generic drugs—your doctor can tell you if you can take a generic drug instead of a brand-name drug or a cheaper brand-name drug. Look into using mail-order pharmacies. Compare Medicare drug plans to find a plan with lower drug costs. Apply for.

How to contact Medicare for a new drug?

Or, you can contact. Medicare's Limited Income Newly Eligible Transition (NET) Program at 1-800-783-1307 for more information (TTY: 711).

What is Medicare copay?

This program helps pay for your Medicare drug coverage, such as plan premiums, deductibles, and costs when you fill your prescriptions, called copays or coinsurance.

Is Medicaid covered by Medicare?

Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. A monthly benefit paid by Social Security to people with limited income and resources who are disabled, blind, or age 65 or older.

Do you qualify for extra help if you have Medicare?

Some people automatically qualify for Extra Help. You'll get the Extra Help program if you have Medicare and get any of the following: A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is the maximum deductible for Medicare Part D in 2021?

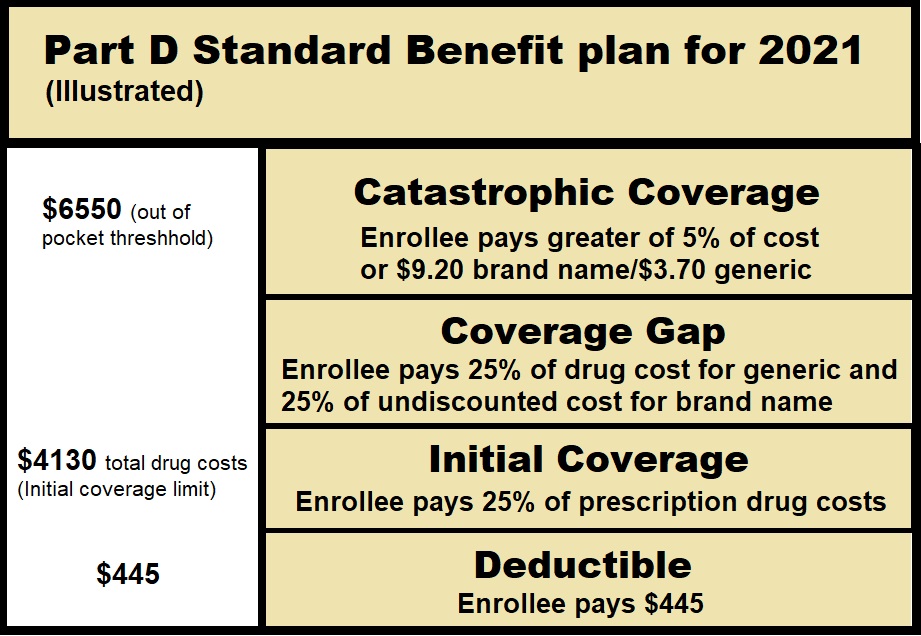

The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020. But not all plans have deductibles, and some have deductibles that are lower than the maximum allowed ( most plans do use this standard deductible amount though, so $445 in initial out-of-pocket costs is the norm for most enrollees in 2021).

How much does a PDP cost in 2021?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month. Premiums vary tremendously however, depending ...

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

What is coinsurance and copayment?

Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin. A copayment is usually a fixed dollar amount (such as $5) while coinsurance is most often a percentage of the cost (such as 20 percent). Plans might have different copayment or coinsurance amounts for each tier of drugs.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

What Determines Medicare Part D Premiums?

Medicare Part D premiums are the monthly fee you pay for coverage. Medicare Part D prescription drug plans are sold by private insurance companies that contract with Medicare.

What Is the Medicare Part D Deductible?

The Medicare Part D deductible is the amount of money you have to pay out of your own pocket for your prescriptions each year before your prescription drug plan starts paying its share.

Medicare Part D Copays and Coinsurance

Once you pay your Medicare Part D deductible, you will only pay a portion of the cost for your prescriptions for the rest of the year. These payments will be in the form of either a copayment or coinsurance.

Help Covering Medicare Part D Costs

If you have limited income and resources, a program called Extra Help may be able to help you with Medicare Part D prescription drug costs, including premiums, coinsurance and your deductible.