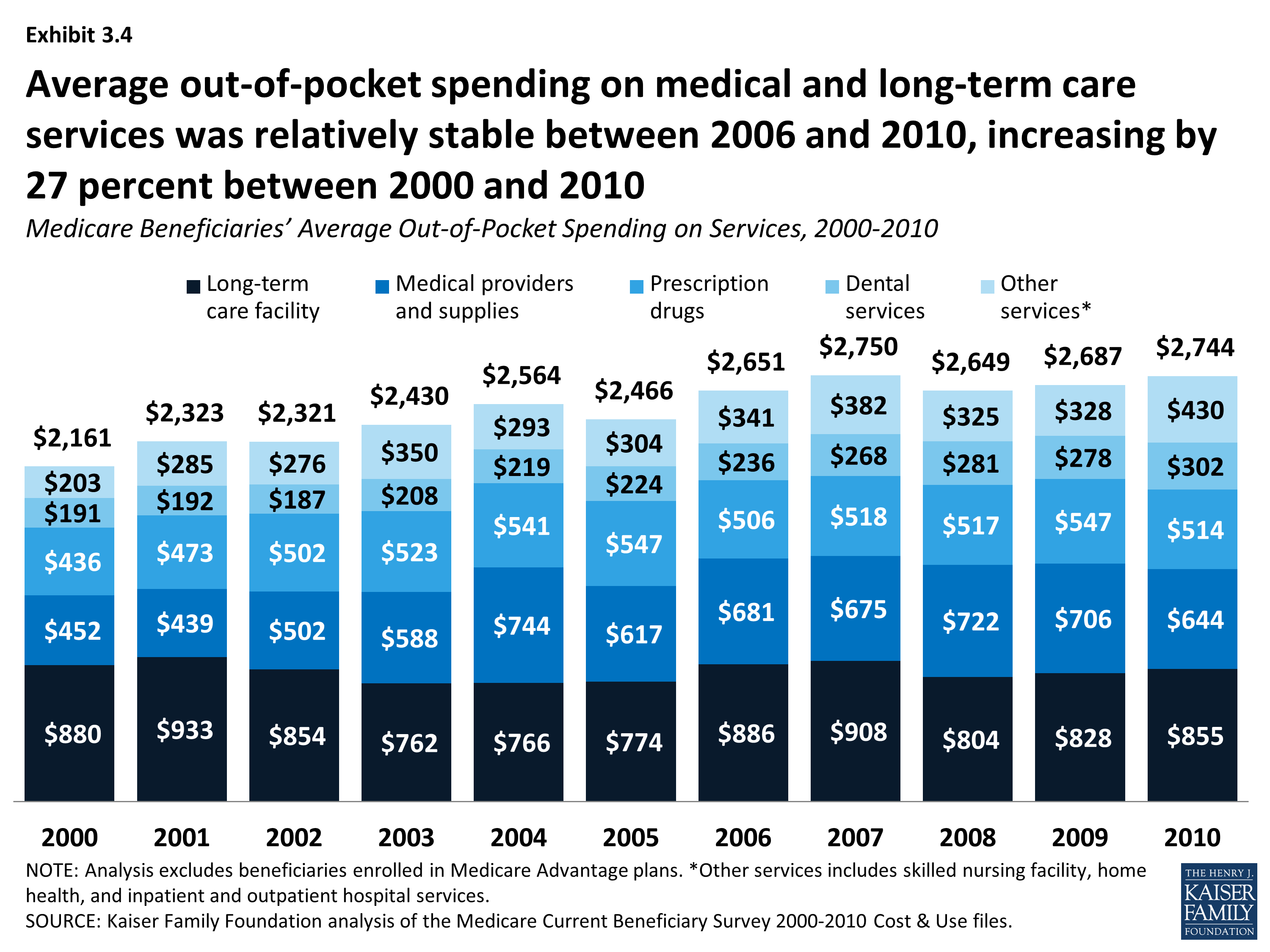

What you spend out of pocket may be totally different than what a family member or friend with Medicare pays. But, on average, people spend more than $5,000 out of pocket annually — or more than $400 per month — on their Medicare costs, according to the Kaiser Family Foundation (KFF).

How much are healthcare out of pocket costs?

Per the study, “PYMNTS’ research has found that 54% of Americans earning between $50,000 and $100,000 annually live paycheck to paycheck,” with 40% of those earning more than $100,000 also reporting living paycheck to paycheck. This is true even though research also found that nearly 54% of U.S. households have family medical policies.

How much is health insurance out of pocket cost?

Your deductible, copayments and coinsurance payments count toward the annual maximum out-of-pocket limit. For the 2020 plan year, the out-of-pocket limit for an ACA plan can’t be more than $8,150 for an individual and $16,300, as reported on Healthcare.gov. Many plans offer lower out-of-pocket limits.

How much did you pay out of pocket?

Your out-of-pocket maximum is the absolute most you will have to pay towards your medical costs for the duration of your health insurance policy. Once your out-of-pocket limit is met, your health insurance plan will cover 100% of all your eligible medical expenses. How Out-of-Pocket Maximums Work?

How much does Medicare take out of your paycheck?

Your Medicare costs

- Get help paying costs. Learn about programs that may help you save money on medical and drug costs.

- Part A costs. Learn about Medicare Part A (hospital insurance) monthly premium and Part A late enrollment penalty.

- Part B costs. ...

- Costs for Medicare health plans. ...

- Compare procedure costs. ...

- Ways to pay Part A & Part B premiums. ...

- Costs at a glance. ...

What do you pay out-of-pocket for Medicare?

Medicare also imposes penalties for signing up too late for Part B or Part D. All rates below are for 2021. This is the amount you will pay out of pocket before your coverage kicks in and Medicare starts paying for medical services. Part A: You will pay $1,484 for each benefit period.

Does Medicare cover 100% of costs?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

How much is deducted each month for Medicare?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Does Original Medicare have a maximum out-of-pocket?

Does Medicare have a maximum out-of-pocket limit? There is no limit to your potential medical bills under Original Medicare. Under current rules, there is no Medicare out of pocket maximum; if you have a chronic health condition or an unexpected health crisis, you could pay thousands in medical costs.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Does Medicare pay for everything?

Original Medicare (Parts A & B) covers many medical and hospital services. But it doesn't cover everything.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What will Medicare cost in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

What is the maximum out-of-pocket for Medicare in 2020?

Does Medicare have a maximum out-of-pocket limit? There is no limit to your potential medical bills under Original Medicare. Under current rules, there is no Medicare out of pocket maximum; if you have a chronic health condition or an unexpected health crisis, you could pay thousands in medical costs.

What happens when your Medicare runs out?

For days 21–100, Medicare pays all but a daily coinsurance for covered services. You pay a daily coinsurance. For days beyond 100, Medicare pays nothing. You pay the full cost for covered services.

What is Medicare out of pocket?

Original Medicare (Part A and Part B) is the federal health insurance program for people age 65 and older and individuals with certain disabilities. Although Original Medicare provides comprehensive coverage, it still leaves some out-of-pocket costs to recipients.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is coinsurance in Medicare?

Coinsurance is the percentage of costs you pay for health care expenses after your deductible is met. In most cases, your Medicare Part B coinsurance is 20 percent of the cost of Medicare-approved services. In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows:

How much is Medicare Part A coinsurance for 2021?

In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows: Days 1-60: $0 coinsurance for each benefit period. Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each lifetime reserve day after day 90 for each benefit period ...

What is the deductible for Medicare Part A in 2021?

In 2021, the deductible for Medicare Part A is $1,484 per benefit period , and the deductible for Medicare Part B is $203 per year.

How many Medigap plans are there?

Medicare Supplement Insurance provides full or partial coverage for some of the out-of-pocket expenses listed above. There are currently 10 standardized Medigap plans available in most states, and each includes a unique blend of basic benefits.

Is Plan F available for Medicare?

Important: Plan F and Plan C are not available to beneficiaries who became eligible for Medicare on or after January 1, 2020. All 10 standardized Medigap plans provide at least partial coverage for: Medicare Part A coinsurance and hospital costs. Medicare Part B coinsurance or copayment. First three pints of blood.

What is Medicare out of pocket?

Here's what you can expect to pay for Medicare out of pocket: Premiums. Deductibles and coinsurance.

How much does Medicare cost for a hospital stay?

Medicare Hospital Stays Costs. If you are hospitalized, Medicare Part A has a $1,408 deductible. If you end up spending more than 60 days in the hospital, it will cost you $352 per day for days 61 through 90 and $704 for up to 60 lifetime reserve days after that.

Why do Medicare beneficiaries pay lower premiums?

Medicare Part B payments are prevented by law from reducing Social Security payments, so some Social Security beneficiaries pay lower premiums because their Social Security payments have not increased enough to cover the current standard Medicare premiums.

How much is Medicare Part B deductible?

Medicare Deductibles and Coinsurance. Medicare Part B has a $198 deductible in 2020. After that, Medicare beneficiaries typically need to pay 20% of the cost of most doctor's services.

How many days can you go without prescriptions?

Premiums are higher for people who go 63 or more days without prescription drug coverage after becoming eligible for Medicare and for high-income Medicare beneficiaries. To get the best value for your money, you will need to continue to compare plans each year because the prices and covered medications change annually.

How long do you have to sign up for Medicare?

You can first sign up for Medicare during the seven-month initial enrollment period that begins three months before you turn 65. If you don't sign up for Medicare during this initial enrollment period, you could be charged a late enrollment penalty as long as you are enrolled in Medicare. Your Part B premiums will increase by 10% for each 12-month period you delayed Medicare coverage after becoming eligible for it. If you didn't sign up for Medicare because you receive group health insurance through your job or your spouse's job, you need to sign up for Medicare within eight months of leaving the job or the coverage ending to avoid the penalty.

Do Medicare beneficiaries pay for hospital insurance?

Most Medicare beneficiaries don't pay a premium for Medicare Part A hospital insurance. The premium cost for Medicare Part D prescription drug coverage varies depending on the plan you select. Most Medicare beneficiaries have their premiums deducted from their Social Security check.

How much does Medicare pay for a hospital stay?

Part A: No fee for hospital stays of 60 days or less. For 61 to 90 days, $341 per day. For 91 days or more, $682 per day or full cost of stay. Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once.

How much does Medicare pay for 91 days?

For 91 days or more, $682 per day or full cost of stay. Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once. Part B: Typically, 20 percent of the Medicare-approved cost of the service for most services.

How much will Medicare Advantage cost in 2021?

If you sign up for a Medicare Advantage plan that includes prescription drugs with a mid-priced premium, CMS predicts you’ll pay $4,339 in 2021. These are just estimates, of course, but they can help you choose the policy that’s best for your health care needs and financial situation.

How often does the Medicare tab swing?

And the tab can swing wildly each year, depending on the state of a beneficiary’s health, where he or she lives, and whether the government and insurers have instituted any price increases — or decreases. Individual plans can also tinker with the services and drugs they cover.

Does Medicaid pay out of pocket?

If you qualify for Medicaid, the federal-state health insurance program for people with low incomes and individuals with disabilities, it will pay some or all of your out-of-pocket expenses. Individuals on both Medicare and Medicaid are known as “dual eligibles.”.

Does Medicare have out of pocket costs?

Medicare’s out-of-pocket costs — premiums, deductibles, copays and coinsurance — can easily result in a large tab each year. If you’re struggling to meet those expenses, you might be eligible for federal and state assistance. If you qualify for Medicaid, the federal-state health insurance program for people with low incomes ...

Get help paying costs

Learn about programs that may help you save money on medical and drug costs.

Part A costs

Learn about Medicare Part A (hospital insurance) monthly premium and Part A late enrollment penalty.

Part B costs

How much Medicare Part B (medical insurance) costs, including Income Related Monthly Adjustment Amount (IRMAA) and late enrollment penalty.

Costs for Medicare health plans

Learn about what factors contribute to how much you pay out-of-pocket when you have a Medicare Advantage Plan (Part C).

Compare procedure costs

Compare national average prices for procedures done in both ambulatory surgical centers and hospital outpatient departments.

Ways to pay Part A & Part B premiums

Learn more about how you can pay for your Medicare Part A and/or Medicare Part B premiums. Find out what to do if your payment is late.

Costs at a glance

Medicare Part A, Part B, Part C, and Part D costs for monthly premiums, deductibles, penalties, copayments, and coinsurance.

General out-of-pocket costs

Most every insurance has the following out-of-pocket elements. Medicare also imposes penalties for signing up too late for Part B or Part D. All rates below are for 2021.

Provider-based expenses

Your out-of-pockets are directly affected by the healthcare provider you see. Make sure you take this into consideration before you schedule any appointments.

Hospital-based expenses

Staying overnight in a hospital does not necessarily mean you are admitted as an in -patient. You pay for inpatient hospital stays with a Part A deductible and a 20% Part B coinsurance for any physician services. When you are placed under observation, Part B provides your only coverage.

What do you need to know about Medicare?

Understanding Medicare's out-of-pocket costs. Don’t be frightened by the numbers. You have options. One of the first things you probably want to know when considering a Medicare plan is what it covers. That makes perfect sense, but it’s important to know what Medicare doesn’t cover, as well. Those numbers can add up.

How long did Medicare spend on cancer?

A Journal of the American Medical Association Oncology study published in 2016 looked at the out-of-pocket costs Medicare beneficiaries diagnosed with cancer between 2002 and 2012 spent.

What is a Part D premium?

Part D premium (prescription drug plan) Part D premiums, deductibles and copays vary by plan. See costs for our Medicare prescription drug plans. Medicare Supplement insurance. There is a monthly premium for these plans. Medicare Supplement plans help pay some of the healthcare costs that Original Medicare doesn't cover, like copayments, ...

How much is Part B premium 2020?

Part B premium1. The standard Part B monthly premium amount in 2020 is $144.60 or higher depending on your income.

When does the SNF benefit period end?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after 1 benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period.

How much is Part B deductible?

Part B deductible and coinsurance1. In 2020, the annual deductible for Part B coverage is $198 per year, after which you typically pay 20% of the Medicare-approved amount for most doctor services, outpatient therapy, and durable medical equipment (DME) Annual maximum out-of-pocket costs. There is no maximum out-of-pocket limit with Original ...

Do you have to pay out of pocket for a new pair of shoes?

Yep, you’ll be paying out-of-pocket for a new pair. Add to that out-of-pocket costs for plan copays, deductibles and monthly premiums and you might start feeling the pinch. And that’s if you’re generally healthy. An unexpected illness or injury requiring a hospital stay can send those numbers through the roof.

How much does Medicare typically cost?

Medicare protects people aged 65 and older and younger people with disabilities from financial hardship by providing health insurance. But it comes with out-of-pocket costs. How much Medicare costs depends on how each individual uses it and the choices they make about coverage.

How much does the average Medicare beneficiary spend out of pocket?

What you spend out of pocket may be totally different than what a family member or friend with Medicare pays. But, on average, people spend more than $5,000 out of pocket annually — or more than $400 per month — on their Medicare costs, according to the Kaiser Family Foundation (KFF).

What do you pay with Medicare Part A?

If you go to the hospital, after paying your Part A deductible, inpatient hospital care is covered under the following conditions:

What do you pay with Medicare Part B?

Unlike Part A, qualified Medicare enrollees must pay a monthly premium for Part B.

What is observation status, and how does it affect your Medicare costs?

A confusing and potentially costly scenario that some hospitalized patients encounter is what’s called observation status. Even though you’re at the hospital, you may sometimes still be considered an outpatient for the first day or two (or longer in extraordinary cases).

What do you pay for Medicare drug coverage (Part D)?

You’ll want to consider additional coverage for medications if you don’t already have coverage of equal value. You do this to avoid the Part D late enrollment penalty. You can buy a Medicare Part D plan — while keeping Parts A and B — or a Medicare Advantage plan instead.

Medigap: Covering your out-of-pocket costs

With original Medicare, there’s no annual out-of-pocket maximum. So if you need a lot of care, your out-of-pocket costs can add up. For that reason, about half of Medicare enrollees have supplemental coverage. Some get it through their employer, others have Medicaid, and many use Medicare supplement insurance known as Medigap.

What is out of network Medicare?

out-of-network. A benefit that may be provided by your Medicare Advantage plan. Generally, this benefit gives you the choice to get plan services from outside of the plan's network of health care providers. In some cases, your out-of-pocket costs may be higher for an out-of-network benefit. .

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium. Whether the plan pays any of your monthly.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). .

What is a medicaid?

Whether you have. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. and if the plan charges for it. The plan's yearly limit on your out-of-pocket costs for all medical services. Whether you have.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).