Medicare costs at a glance

- $1,556 deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $389 coinsurance per day of each benefit period

- Days 91 and beyond: $778 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

- Beyond lifetime reserve days: all costs

Full Answer

What is the average cost of Medicare coverage?

What is the average cost of Medicare Supplement Insurance (Medigap)? The average premium paid for a Medicare Supplement Insurance (Medigap) plan in 2019 was $125.93 per month. 3 It’s important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

What does Medicare really cost?

- Premiums: The monthly payment just to have the plan

- Deductible: The amount you must pay on your own before insurance starts to cover the costs

- Copay: A flat fee you pay for covered services

- Coinsurance: The percentage of costs you pay after reaching your deductible

How much does Medicare cost at age 65?

In 2021, the premium is either $259 or $471 each month ($274 or $499 each month in 2022), depending on how long you or your spouse worked and paid Medicare taxes. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

How to enroll in Medicare if you are turning 65?

- You have no other health insurance

- You have health insurance that you bought yourself (not provided by an employer)

- You have retiree benefits from a former employer (your own or your spouse’s)

- You have COBRA coverage that extends the insurance you or your spouse received from an employer while working

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How long does Medicare Part A last?

Medicare Part A is the inpatient benefit and is available to eligible recipients without a monthly premium as long as you paid 40 quarters of Medicare taxes while working.

How much is Medicare Part B 2020?

This deductible typically changes each year, and for 2020, the deductible is $1,048. Medicare Part B is the inpatient benefit, and it does require a monthly premium payment in order for benefits to apply.

Why is it important to discuss your needs with a qualified, licensed Medicare agent?

This is why it’s important to discuss your needs with a qualified, licensed Medicare agent in order to take advantage of the right benefits while avoiding overpayment for services you don’t need.

How much is the deductible for Part D?

The deductible for Part D coverage in 2020 is $435, and the standard base premium is $32.74 per month.

What is Part B insurance?

Recipients who opt into Part B coverage may also be responsible for additional charges for some services in the form of co-pays, so if you have part B coverage, you will want to discuss your plan with your provider to reduce the chances of facing out-of-pocket expenses.

Does Medicare cover out-of-pocket costs?

Medicare is a program designed to help seniors and other eligible Americans access quality healthcare at an affordable price; however, taking part in Medicare will include some out-of-pocket costs. While there are some state-sponsored healthcare and wellness programs available at no cost, including Medicaid and the Supplemental Nutrition Assistance ...

Does Medicare Advantage have the same benefits as Original Medicare?

Medicare Advantage plans provide the same Part A and Part B benefits found in Original Medicare, but they are offered through private insurers and may come with additional benefits and savings. Costs and coverage between plans can vary, so compare your options before enrolling.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

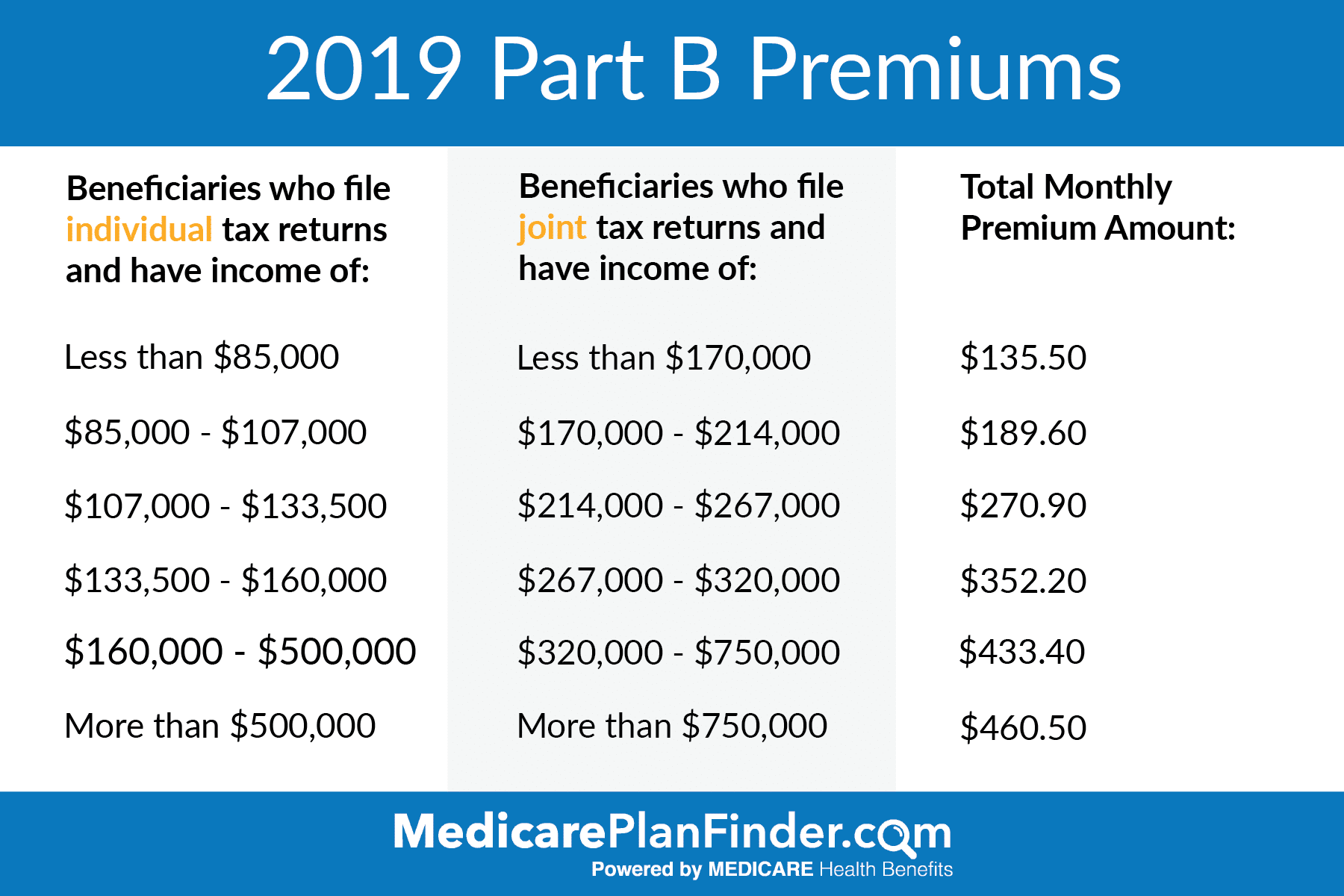

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.

What is Medicare Supplement Plan?

Medicare Supplement plans (also known as Medigap plans) are designed to work alongside Part A and Part B and to help pay out-of-pocket costs, which may include deductibles, copayments, and coinsurance, for example. Medicare Supplement insurance coverage for these expenses varies by plan type. If you enroll in a Medicare Supplement plan, you will ...

What are the benefits of Medicare Supplement?

All the standardized Medicare Supplement plans share some basic benefits. Aside from the first benefit listed below, not all plans cover these benefits at 100%. Basic benefits include: 1 Medicare Part A coinsurance and coverage for hospital services 2 Medicare Part B coinsurance or copayment 3 Blood transfusions (first three pints) 4 Hospice care coinsurance or copayment

How many states have Medicare Supplement Plans?

In 47 states, there are up to 10 standardized Medicare Supplement plans available. With the exception of Massachusetts, Minnesota and Wisconsin, which have their own standardized Medicare Supplement plan types, Medicare Supplement benefit plans are labeled with alphabetic letters for easy reference.

When is the best time to apply for Medicare Supplement?

Probably the best time to apply for a Medicare Supplement plan is the six-month period that begins the first month you are enrolled in Medicare Part B and you are age 65 or older.

Can you be turned down for Medicare Supplement Plan?

This time period is often referred to as Medicare Supplement Plan Open Enrollment, and you cannot be turned down for insurance coverage or charged a higher premium because of a health condition you have, although you might face a waiting period for coverage of your health condition.

Is Medicare Supplement Plan renewable?

Medicare Supplement plans are guaranteed renewable in most cases; generally as long as you continue to pay your premiums, you may continue your coverage from the Medicare Supplement plan year after year. You may also want to consider the long-range cost of your Medicare Supplement plan as well as the short-range, ...

Is Plan G the same as Plan M?

Plan G covers the same benefits as Plan M; however, Plan G also covers 100% of the Part A deductible and 100% of the Part B excess charge (the legally allowed amount above the Medicare approved fee). Because Plan G provides more coverage than Plan M, it is likely to cost more than Plan M. You can compare the coverage provided by ...

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

How much does Medicare Advantage cost?

The average premium for a Medicare Part C plan (also known as Medicare Advantage) was $35.55 per month in 2018. 1. Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live.

What is Part C insurance?

Part C plans may also include costs such as deductibles and coinsurance (or copayments). A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

What is Medicare Advantage?

The amount you are required to pay for each health care visit or service. Medicare Advantage plans typically include cost-sharing measures such as copayments and coinsurance, and the amounts of these costs can correlate with that of the premium. The type of plan.

Which state has the lowest Medicare premium?

A closer look at 2021 data also reveals: Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug (MAPD) plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

What is a Medicare Savings Account?

A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible.

What to look for when shopping for Medicare Advantage?

When you are shopping for a Medicare Advantage plan, you may consider features such as a plan’s range of benefits and possible network rules. But above all else, perhaps the biggest thing you might consider is the cost of a plan. When it comes to Original Medicare (Medicare Part A and Part B), the cost of premiums is standardized across the board.

How to save money on medicaid?

Saving money with Medicare Advantage 1 If you qualify for Medicaid, your Medicaid benefits can be used to help pay your Medicare Advantage premiums. 2 A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible. 3 If your Medicare Advantage plan includes a doctor and/or pharmacy network, you can save a considerable amount of money by staying within that network when receiving services. 4 Some Medicare Advantage plans may include extra health perks such as gym memberships. There is even the possibility of Medicare Advantage plans soon covering expenses like the cost of air conditioners, home-delivered meals and transportation.

How much does vision insurance cost?

Vision insurance can typically cost around $20 per month or less. 3. Hearing plans. Unlike dental and vision insurance, hearing insurance plans are not a common insurance product. Some hearing aid companies may offer extended warranties, but the warranties apply only to the hearing aid product itself.

Does Medicare Advantage cover dental?

While a Medicare Advantage plan by law must cover the same benefits as Medicare Part A and Medicare Part B , benefits like prescription drugs, dental, vision and hearing can be covered at varying degrees (or not at all).

Costs you may pay with Medicare

Medicare Part B and most Medicare Part C, Part D and Medigap plans charge monthly premiums. In some cases, you may also have to pay a premium for Part A. A premium is a fixed amount you pay for coverage to either Medicare or a private insurance company, or both.

What are my costs for Original Medicare (Parts A and B)?

With Medicare Part A, most people don't pay a premium, though you may if you or your spouse worked and paid Medicare taxes for less than 10 years. Medicare Part B has a monthly premium you pay directly to Medicare, and the amount you pay can vary based on your income level.

What are my costs with Medicare Advantage, Medicare Supplement (Medigap) or Part D plans?

Each Medicare Advantage (Part C) plan sets its own specific costs, but the types of costs you may pay include premiums, deductibles, copays and coinsurance. Not all plans will have deductibles, copays or coinsurance, so check each plan's cost-sharing rules carefully.

Need Help Finding a Plan?

Answer a few simple questions and get a personalized list of plans, ranked by what's important to you.

What if I need help paying Medicare costs?

If you have limited income and assets, you may qualify for help with your Medicare costs, including those that you pay for care you receive. There are several programs that help pay Medicare costs. Many people who could qualify never sign up, so be sure to apply if you think you might qualify. Don't hesitate to apply.

Cost-sharing considerations

It's easy to focus on just premiums when looking at how much a plan can cost. Premiums are regular monthly expenses that must fit into a budget, and most of us are keenly aware of our monthly expenses. But it's a better idea to look at the big picture—to look at all of your Medicare costs together—aka, premiums and all out-of-pocket costs.

Medicare late enrollment penalties

Missing your Initial Enrollment Period can be costly. Medicare Part A, Part B and Part D may charge premium penalties if you miss your initial enrollment dates, unless you qualify for a Medicare Special Enrollment Period.

What is the lowest Medicare premium for 2020?

Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

What are the factors that affect the cost of Medicare Supplement?

There may be plans available in your area that cost less than the average listed above for your age. Other factors such as gender, smoking status, health and where you live can also affect Medigap plan rates. A licensed insurance agent can help you compare Medicare Supplement Insurance plan costs in your area so that you can find a plan ...

Why does my Medigap premium increase?

As you age, your Medigap plan premiums will gradually increase each year. Medigap premiums can increase over time due to inflation and other factors , regardless of the pricing model your insurance company uses.

What is the factor that determines the premiums for Medicare Supplement Insurance?

Age is one factor that Medicare Supplement Insurance (Medigap) companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan. Medicare Supplement Insurance premiums tend to increase with age .

How does age affect Medicare premiums?

How Does Age Affect Medicare Supplement Insurance Premiums? 1 Community-rated Medigap plans#N#With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.#N#For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market. 2 Issue-age-rated Medigap plans#N#With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.#N#You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age. 3 Attained-age-rate Medigap plans#N#Attained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

How much is the 203 deductible?

The $203 annual deductible equates to around $17.00 per month. This means that a Plan G with a premium of no more than $17.00 per month more than a Plan F option could actually serve as a better value, provided you meet the entire Part B deductible.

When will Medicare plan F be available?

Important: Plan F is not available to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020. If you already have Medicare, you can still enroll in Plan F if the plan is available in your area.