What is the average cost of Medicare Advantage?

The average premium paid by a Medicare Advantage beneficiary in 2018 was $35.55 per month. 3 This includes all types of Medicare Advantage plans. From 2010 to 2017, the average premium paid by a PPO beneficiary in a plan that included prescription drug coverage was $55 for a local PPO, and $41 for a regional PPO. 4

How much does PPO insurance cost?

What is PPO insurance? Type of plan Average monthly premium for single cover ... Average monthly premium for family cover ... Average annual deductible Referral to see specialists PPO $111 $501 $1,204 No HMO $101 $440 $1,201 Yes HDHP $88 $404 $2,303 Varies

How many people have Medicare PPO plans?

In 2017, more than 6.2 million people were enrolled in a local or regional Medicare PPO plan, which represented more than a third of all Medicare Advantage plan holders. 2 What do Medicare PPO plans cover? By law, Medicare Advantage plans must provide at least the same basic coverage as Medicare Part A and Part B (also known as Original Medicare).

What are the out-of-pocket costs in a Medicare Advantage plan?

Your out-of-pocket costs in a Medicare Advantage Plan (Part C) depend on: Whether the plan charges a monthly Premium. Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium.

What's the average deductible for a Medicare Advantage plan?

Average Cost of Medicare Advantage Plans in Each StateStateMonthly PremiumPrescription Drug DeductibleCalifornia$48$377Colorado$49$343Connecticut$79$318Delaware$64$23946 more rows•Mar 21, 2022

What does PPO Medicare mean?

Preferred Provider OrganizationPreferred Provider Organization (PPO) | Medicare.

What is the average cost of a Medicare Part D plan?

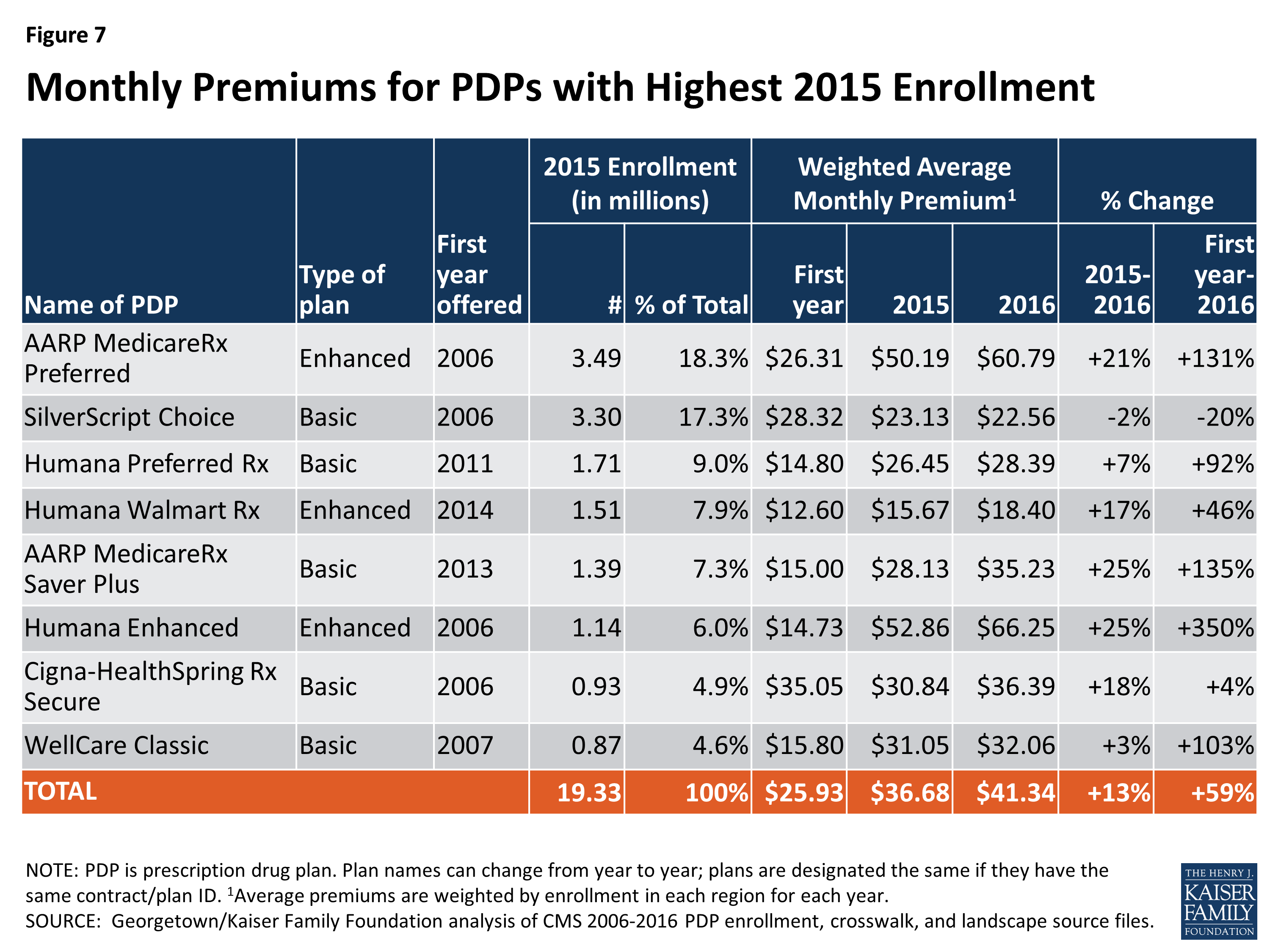

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Do doctors prefer HMO or PPO?

PPOs Usually Win on Choice and Flexibility If flexibility and choice are important to you, a PPO plan could be the better choice. Unlike most HMO health plans, you won't likely need to select a primary care physician, and you won't usually need a referral from that physician to see a specialist.

Is Medicare or PPO better?

Although Medicare Advantage PPO plans may offer more flexibility, your costs (such as the monthly premium) are generally higher under a PPO. You might need to take a more active role in care coordination in a PPO plan.

What are Medicare premiums for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Why would a person choose a PPO over an HMO?

Advantages of PPO plans A PPO plan can be a better choice compared with an HMO if you need flexibility in which health care providers you see. More flexibility to use providers both in-network and out-of-network. You can usually visit specialists without a referral, including out-of-network specialists.

What is the difference in a PPO and Advantage Plan?

There are differences between Medicare Advantage plans. The specific structure of the plan you choose dictates how much you pay for care and where you can seek treatment. HMO plans limit you to a specific network of providers, while PPO plans offer lower rates to beneficiaries who seek care from a preferred provider.

What is a PPO plan?

A type of health plan that contracts with medical providers, such as hospitals and doctors, to create a network of participating providers. You pay less if you use providers that belong to the plan's network.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

What are the benefits of a PPO?

Your PPO may offer additional benefits, such as vision, hearing, and/or dental care. Check with the plan directly to learn about coverage rules and restrictions for any added benefits.

Do PPOs charge higher premiums?

Plans may charge a higher premium if you also have Part D coverage. Plans may set their own deductibles, copayments, and other cost-sharing for services. PPOs typically set fixed copays for in-network services and may charge more if you see an out-of-network provider.

Do PPOs have the same benefits as Medicare?

Register. Medicare Preferred Provider Organizations (PPOs) must provide you with the same benefits as Original Medicare but may do so with different rules, restrictions, and costs. PPOs can also offer additional benefits. Below is a list of general cost and coverage rules for Medicare PPOs.

Do you have to select a primary care provider?

You are not required to select a primary care provider (PCP).

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium. Whether the plan pays any of your monthly.

What is out of network Medicare?

out-of-network. A benefit that may be provided by your Medicare Advantage plan. Generally, this benefit gives you the choice to get plan services from outside of the plan's network of health care providers. In some cases, your out-of-pocket costs may be higher for an out-of-network benefit. .

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). .

What is an ANOC?

The EOC gives you details about what the plan covers, how much you pay, and more. "Annual Notice of Change " (ANOC). The ANOC includes any changes in coverage, costs, or service area that will be effective in January. If you don't get these important documents, contact your plan.

What is a medicaid?

Whether you have. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. and if the plan charges for it. The plan's yearly limit on your out-of-pocket costs for all medical services. Whether you have.

How does preferred provider organization (PPO) insurance work?

You'll pay less for in-network providers, but you can use out-of-network doctors and facilities, too.

What does PPO insurance cover?

PPOs cover doctor's services, hospitalization, medical tests and radiology, outpatient services, and other health care expenses.

Why are PPOs more expensive than HMOs?

PPOs tend to have higher premiums than HMOs because you have the flexibility to use both in-network and out-of-network doctors and other providers.

What is the most common health insurance plan offered by employers?

PPOs are the most common type of health insurance plan offered by employers -- with 71% of the employers surveyed providing this type of plan to all or most of their workers, followed by high-deductible health plans (41%) and HMOs (28%), according to XpertHR's 2021 Employee Benefits Survey.

What is the coinsurance amount for out of network hospital?

The median coinsurance amount is 20% of eligible charges, according to the Mercer study. For out-of-network services, the median coinsurance amount is 40% .

What is the most common type of plan?

Employees often have a choice of several plans. PPOs continue to be the most common type of plan selected.

How much does a PPO cost in 2020?

The average total cost (for both the employer's and the employee's share) for a PPO in 2020 was $22,426 for family coverage and $7,880 for single coverage. That’s compared to $20,809 for family coverage and $7,284 for single coverage for HMOs, according to the Kaiser Family Foundation's 2020 Employer Health Benefits Survey.

How do Medicare PPOs work?

Medicare PPOs offer provider flexibility for people who want coverage for services from both in-network and out-of-network providers.

How do Medicare PPOs compare to original Medicare?

It’s important to consider all your healthcare needs when choosing between a Medicare Advantage plan or original Medicare. When you compare the two plans, you’ll want to consider some of the differences below.

Can I keep my doctor?

You can continue to visit your doctor with your PPO plan, as Medicare PPOs don’t require that you choose a specific primary care provider (PCP). However, if your doctor is out-of-network, you will pay more for their services.

Do I need a referral to see a specialist?

Unlike Medicare HMOs, Medicare PPOs don’t require a referral for specialist visits. In fact, if you seek services from a specialist in your plan’s network, you will save more money than if you visit a specialist out of the network.

What is a PPO plan?

Medicare PPO plans have a list of in-network providers that you can visit and pay less. If you choose a Medicare PPO and seek services from out-of-network providers, you’ll pay more.

How much is Medicare Part B coinsurance?

Medicare Part B charges a 20 percent coinsurance that you will out pay out-of-pocket after your deductible has been met. This amount can add up quickly with a Medicare PPO plan if you are using out-of-network providers.

How much is a PPO deductible?

Medicare PPO plans can charge a deductible amount for both the plan, as well as the prescription drug portion of the plan. Sometimes this amount is $0, but it depends entirely on the plan you choose.

What is the difference between a PPO and an HMO?

PPO vs. HMO. While PPO plans and Health Maintenance Organization (HMO) plans share many characteristics, PPO plans offer more flexibility. A Medicare Advantage HMO plan member usually must receive their healthcare from a list of providers in the plan’s network. In contrast, people with a PPO plan can choose someone from outside of their network, ...

What is not covered by Medicare Advantage?

What is not covered? A Medicare Advantage PPO plan is a type of Medicare Advantage plan offered by a private health insurance company. Preferred Provider Organization (PPO) plans usually have an in-network or group of healthcare providers and hospitals from which to choose. Choosing a health care provider that is in-network may cost less ...

How much does a PPO cost in 2021?

In 2021, the regular cost of a Medicare Part B is $148.50 per month. It may be higher depending on a person’s income.

What is a PPO plan?

They are provided by Medicare-approved, private health companies. A PPO plan is comprised of a group , called a network, of healthcare providers and hospitals from which a person can choose. These providers will be cheaper than using providers outside of the network. Most PPO plans are flexible, and a person can receive services from any healthcare ...

What to do if you are unsure if your insurance covers a particular service?

If a person is unsure if their plan covers a particular service, it is best to call the provider before receiving the treatment.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Who is Eligible for a Medicare PPO Plan?

In order to sign up for a Medicare PPO plan, you must first have signed up for Medicare Part A and Part B coverage.

How Much Does a Medicare Advantage PPO Plan Cost?

You can expect to pay the plan’s monthly premium in addition to your monthly Medicare Part B premium. Many Americans have access to a $0 premium PPO plan with drug coverage. You’re responsible for copayments and coinsurance for each service or drug received, after you have met your deductible. Most PPO plans require copays for services and treatments in network, and coinsurance for services out of network. You pay copays or coinsurance for medications. PPO plans pay for services you receive out of network, but your cost sharing amounts are higher.

What are the advantages of Medicare PPO?

The most significant advantage that a Medicare PPO plan offers is the flexibility to choose providers based upon your own preferences rather than being restricted to the plan’s in-network selections.

What is Medicare Advantage?

Among the Medicare Advantage plans there are several different types and options, all of which are offered by private insurance companies. Medicare Preferred Provider Organizations, or PPO plans, are among the most popular of these options. PPO plans allow beneficiaries the flexibility of using their in-network physicians ...

What is Medicare expert?

As a Medicare expert, he regularly consults beneficiaries on Medicare rules, regulations, and strategies. Once you are eligible for Medicare and enroll in both Parts A and Parts B, you have the option of remaining with that basic coverage or arranging for additional benefits via either a Medicare Advantage plan that is available in your state ...

How old do you have to be to get medicare?

Eligibility for Medicare is linked to being either a U.S. citizen or a legal resident of the United States for a minimum of five years and who have turned 65 years old. Disabled individuals who are under the age of 65 are also eligible for Medicare and can enroll in the program once they have been receiving either Social Security disability ...

What are special enrollment periods?

Special Enrollment Periods. There are special enrollment periods created for unique circumstances including:#N#Moving to a different service area while enrolled in another plan#N#Losing eligibility for a Special Needs plan#N#Losing eligibility for Medicare/Medicaid#N#Living in or recently leaving a nursing home 1 Moving to a different service area while enrolled in another plan 2 Losing eligibility for a Special Needs plan 3 Losing eligibility for Medicare/Medicaid 4 Living in or recently leaving a nursing home

What is the average cost of Medicare Advantage plans by state?

As you can see in the chart below, the average cost of a Medicare Part C plan can vary significantly from one state to another.

What is a Medicare Savings Account?

A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible.

Why do people choose Medicare Advantage?

Millions of people opt for a Medicare Advantage plan for a number of reasons, one of which may be the cost savings that some Medicare Advantage plans may offer. Review this detailed examination of Medicare Advantage costs to learn more about how you may be able to find the right plan for you.

What is Medicare Advantage?

The amount you are required to pay for each health care visit or service. Medicare Advantage plans typically include cost-sharing measures such as copayments and coinsurance, and the amounts of these costs can correlate with that of the premium. The type of plan.

What to look for when shopping for Medicare Advantage?

When you are shopping for a Medicare Advantage plan, you may consider features such as a plan’s range of benefits and possible network rules. But above all else, perhaps the biggest thing you might consider is the cost of a plan. When it comes to Original Medicare (Medicare Part A and Part B), the cost of premiums is standardized across the board.

How to save money on medicaid?

Saving money with Medicare Advantage 1 If you qualify for Medicaid, your Medicaid benefits can be used to help pay your Medicare Advantage premiums. 2 A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible. 3 If your Medicare Advantage plan includes a doctor and/or pharmacy network, you can save a considerable amount of money by staying within that network when receiving services. 4 Some Medicare Advantage plans may include extra health perks such as gym memberships. There is even the possibility of Medicare Advantage plans soon covering expenses like the cost of air conditioners, home-delivered meals and transportation.

Which state has the lowest Medicare premium?

A closer look at 2021 data also reveals: Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug (MAPD) plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.